With the increasing demand for DeFi services, Terra Network has surpassed more than $22 billion in total value locked (TVL) as of early March.

Terra’s (LUNA) total value locked (TVL) has beaten out popular smart contracts-backed blockchain networks such as Binance Smart Chain, Fantom, Avalanche, and Solana.

The Terra Network managed to start the month of March with approximately $22.95 billion in TVL, according to Be[In]Crypto Research.

Inasmuch as Terra opened the first day of the second month of 2022 with a total value locked of $13.4 billion, the protocol managed to beat out competition from some of most patronized blockchain technologies in the space in March.

Terra’s Continues to Reach Millions of Decentralized Finance Enthusiasts

Since its 2018 launch, Terra has continued to help facilitate adoption of digital assets as DeFi becomes more attractive to users. Within the first few years of its launch, Terra hosts over 73 projects in its ecosystem, continuing to deploy DeFi protocols and DApps, as of March, helping shed light as to why it moved from having a $2.5 million TVL in mid-November of 2020 to $982.5 million by the end of Q1 2021 – a staggering $39,200% increase within a four-month period.

By Q4 2021, Terra’s TVL increased significantly by 248%, closing out June with an all-time high of $3.42 billion.

New projects to launch on Terra?

Back in October, Terra co-founder Do Kwon hinted at an approximate 160 new projects that will eventually be launching on the protocol.

“Now that Columbus-5 is live, more than 60 projects are preparing to launch in the next six to eight weeks, and more than 100 have recently announced plans for the end of the year or early 2022,” he said in his discussions about the platform’s prospects following Columbus-5’s successful network upgrade.

Columbus-5 saw to provide several new and updated features to Terra, specifically a change to the operating mechanics behind its native LUNA token.

Nexus Protocol to thank for Terra’s growth?

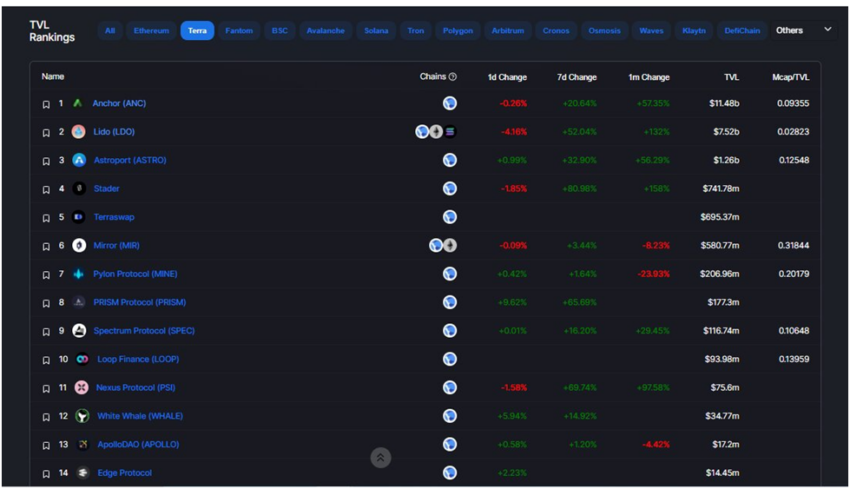

Aside from the network upgrade, Terra’s growth in 2022 has also been attributed in part to Nexus Protocol (PSI), Spectrum Protocol (SPEC), Stader, Astroport (ASTRO), Lido (LDO), and Anchor (ANC) – with the biggest one month gain coming from Stader, a 150% increase in TVL.

Looking at the below illustration, Nexus Protocol’s TVL spiked by more than 90 percent, with Lido Protocol surpassing Aave by more than 130% in March, while Anchor also increased by more than 57 percent.

The most exciting project that has driven Terra’s TVL across $22 billion came from the announcement of Terra’s stablecoin, TerraUSD (UST) being backed by a $1 billion Bitcoin reserve.

UST, unlike other stablecoins that are backed by the U.S. dollar (USD), is fixed to USD through a minting and burning process for its native token, LUNA. If the price of a stablecoin falls below $1 per coin, UST can immediately be swapped for LUNA, which can then be minted and subsequently sold for $1 USD – providing arbitrage gains for investors.

Ultimately, as the demand for UST increases, LUNA tokens will consistently burn, making it a deflationary asset, and increasing in price.

As for what’s happening on-chain, Do Kwon revealed that as of March, there are 73 total projects on-chain, with at least 87 more projects launching on-chain by end of 2022.

With the anticipated launches, it’s fair to assume that Terra’s TVL will continue to spike to new all-time highs throughout 2022.

What do you think about this subject? Write to us and tell us!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.