The Solana (SOL) price has increased since June 10 and reclaimed a critical resistance level on June 29.

While it previously seemed that the SOL price was headed for a new yearly low, the recent price action suggests that the upward movement will continue in the near future.

Solana Price Recovers, Reclaims Crucial Support

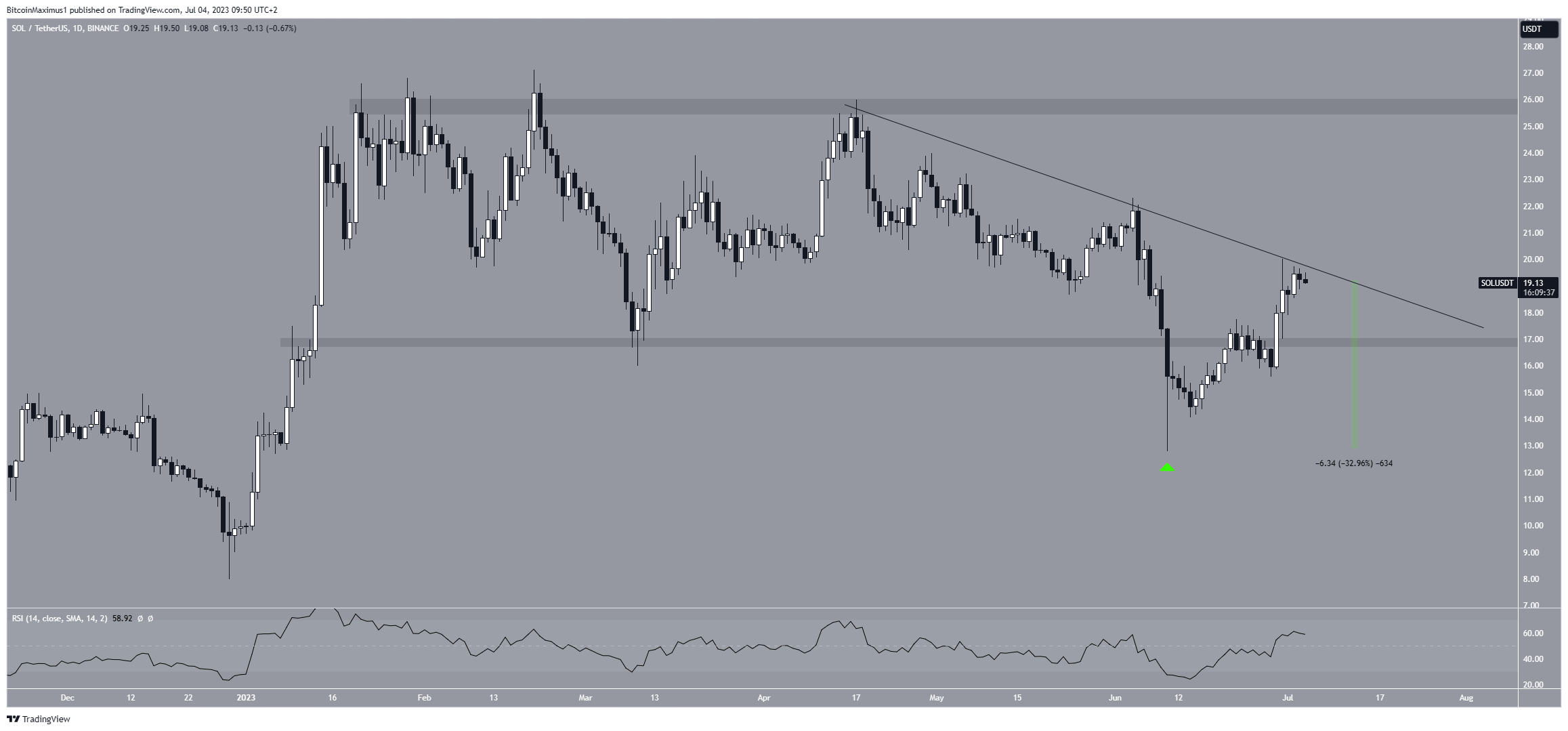

The daily time frame technical analysis of SOL shows a 33% recovery that started on June 10. The rally was preceded by a very long lower wick, which is considered a sign of buying pressure (green icon).

The significance of this increase lies in the fact that the price reclaimed the $17 horizontal area. After the previous breakdown, the area was expected to provide resistance. However, after an initial rejection on June 20 (red icon), the SOL price moved above the area and reached a high of $20 on June 30.

Read More: 9 Best Crypto Demo Accounts For Trading

The SOL price now trades slightly below a descending resistance line that has been in place since April 17.

A breakout above it can further accelerate the rate of increase and ultimately confirm that a bullish reversal has begun.

The daily Relative Strength Index (RSI) yields a bullish signal. The RSI is a momentum indicator used by traders to assess whether a market is overbought or oversold.

Readings above 50 and an upward trend indicate a bullish advantage, whereas readings below 50 suggest the opposite. The RSI has moved above 50 and increasing, a decisive sign of a bullish trend.

SOL Price Prediction: When Does Wave Count Predict Bottom?

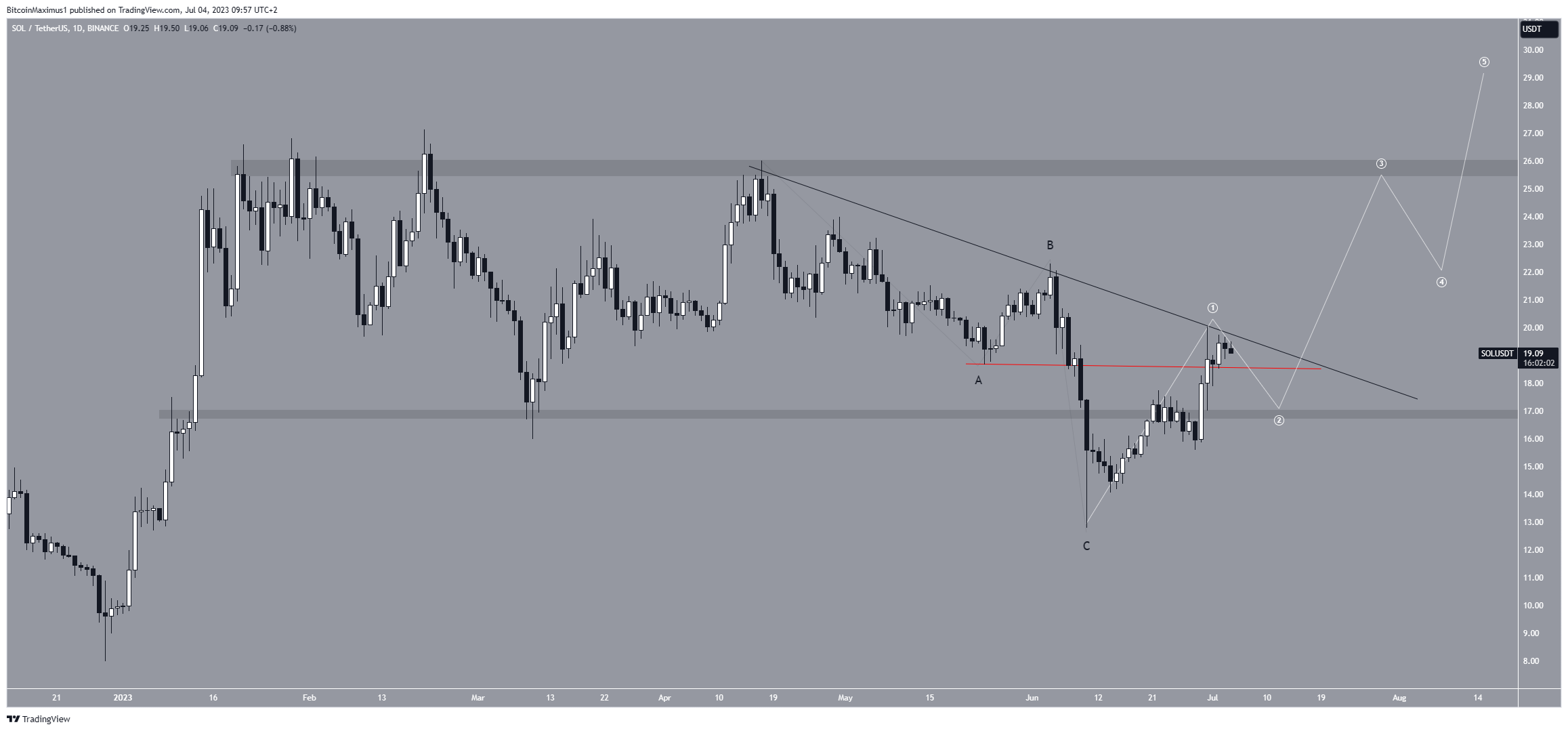

Remaining within the daily time frame, the analysis of wave patterns is bullish. Technical analysts employ the Elliott Wave theory, which examines long-term price patterns and investor psychology to determine the trend direction. The wave count suggests that the SOL price will break out from the resistance line and continue its increase to the next resistance level at $26.

Based on the wave count, the SOL price has seemingly completed an A-B-C corrective structure (black) since April 15. The correction is confirmed by the overlap between the low of wave A and the current high (red line).

So, if the count is correct, the SOL price began an upward movement on June 10 (white) and will eventually break out from the resistance line. It will likely reach the next resistance at $26 if it does.

Despite this bullish SOL price prediction, falling between the $17 support area again will mean the trend is still bearish.

In that case, the SOL price could decrease to $10.

Read More: Best Crypto Sign-Up Bonuses in 2023

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.