The Solana Foundation has rejected the U.S. Security and Exchange Commission’s (SEC) classification of its SOL token as a security. Polygon Labs also shared this sentiment, stating that they developed and deployed MATIC outside the U.S.

On June 10, the Solana Foundation expressed willingness to cooperate with regulators to provide further clarity for the emerging industry. On the other hand, Polygon Labs noted that it did not target the U.S. market with the MATIC coin.

Solana Willing to Work With Regulators

Earlier this week, the SEC took legal action against crypto exchanges, Binance and Coinbase, accusing them of violating federal securities law and facilitating the trades of crypto security assets like SOL.

In response, the Solana Foundation disagreed with the SEC but would welcome “welcome the continued engagement of policymakers as constructive partners on regulation to achieve legal clarity on these issues for the thousands of entrepreneurs across the U.S. building in the digital assets space.”

More From BeInCrypto: 6 Best Copy Trading Platforms in 2023

The statement resonated with several members of its community, who agreed that the regulator wrongly classified it. The Foundation added:

“The Solana builder community is the strongest in the industry and continues to build exceptional projects and products. The Solana Foundation remains committed to those building for the long-haul to continue to create the best blockchain for a decentralized future.”

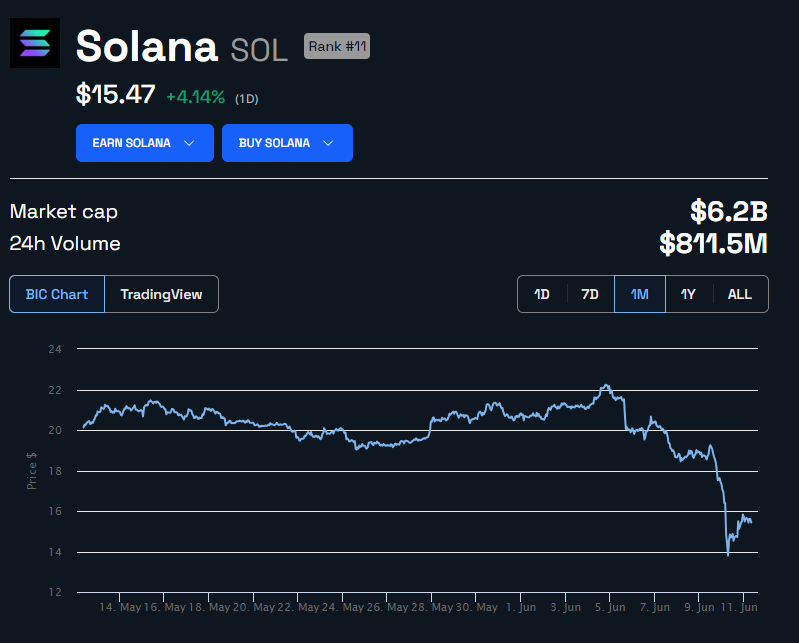

Meanwhile, the new conviction has helped SOL rally by more than 4% in the last 24 hours to $15.47 as of press time, according to BeInCrypto data. However, its price is down more than 20% on the seven days metric after Robinhood delisted it and several whales dumped it.

Polygon Labs Said it Did Not Target US Market

On the other hand, Polygon Labs stated that while it made sure MATIC was available to a broad group of persons, it ensured that the digital asset did not target the U.S. The team acknowledges the non-US market as the world’s largest and expresses gratitude to global stakeholders, including regulators and policymakers, for their contributions.

“We are proud of the history of the Polygon network – developed outside the US, deployed outside the US, and focused to this day on the global community that supports the network.”

The Polygon growth team further highlighted the importance of MATIC within its ecosystem. It wrote:

“MATIC was a necessary part of the Polygon technology from Day 1, ensuring that the network would be secure – and remains so to this day.”

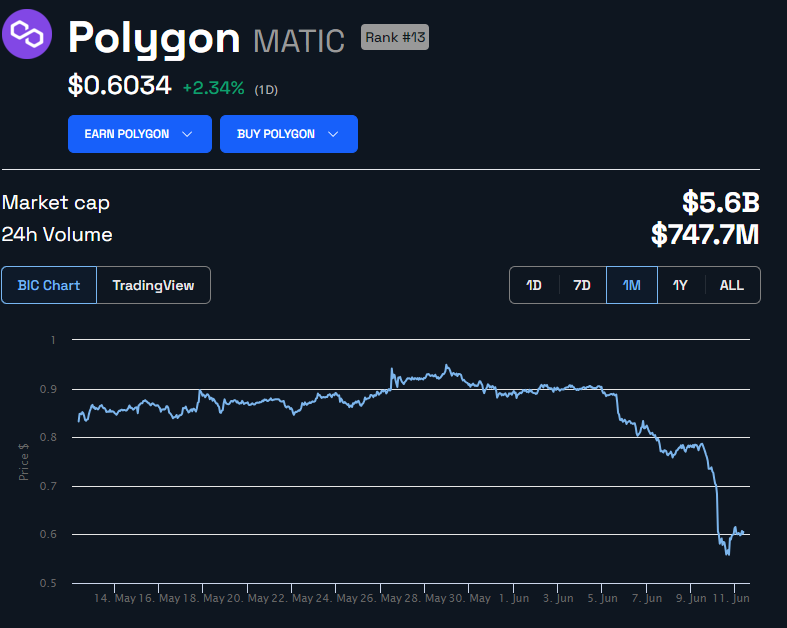

Polygon’s MATIC was one of the numerous digital assets labeled as securities by the U.S. SEC. The crypto coin rose by over 3% in the last 24 hours to $0.6048 at the time of writing, according to BeInCrypto data.

Read More: 13 Best No KYC Crypto Exchanges in 2023

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.