Solana (SOL) price raced to a 4% price increase on Thursday, August 24, after Shopify added support for USDC Via Solana Pay. Derivatives market data analysis shows investors are taking bullish positions on SOL’s future price performance.

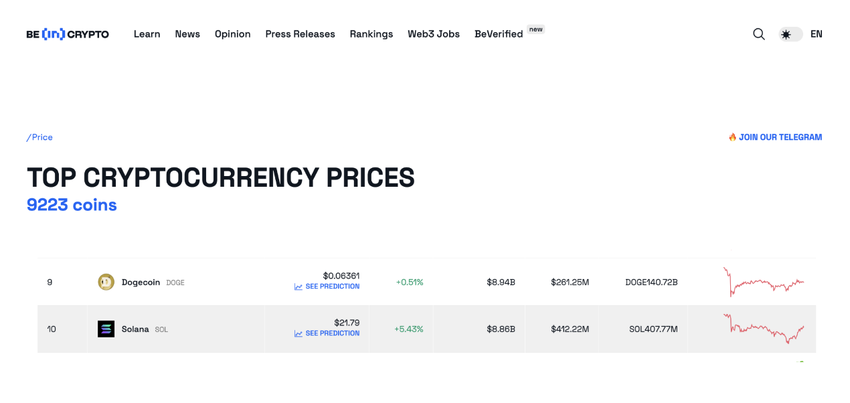

Will the Shopify Integration drive Solana valuation to take Dogecoin’s (DOGE) ninth spot in the top 10 crypto rankings? On August 23, e-commerce giant Shopify announced the integration of the USDC payment method via Solana (SOL) Pay.

Shopify reportedly has 4.2 million registered online stores and 2.1 million daily active customers. Hence, crypto enthusiasts anticipate that this landmark integration could prop up SOL price and deepen crypto adoption globally.

How Will Shopify Payment Integration Impact Solana (SOL) Price?

Within 12 hours of the announcement, crypto traders piled on SOL, triggering a nearly 4% price bounce. This has driven Solana’s market capitalization toward the $9 billion milestone, just behind Dogecoin (DOGE).

Market capitalization is a financial metric that represents the total valuation of a cryptocurrency’s circulating supply. Crypto market capitalization is derived by multiplying the token’s current price by its total circulating supply.

The Shopify integration has significantly boosted Solana’s estimated market valuation. As shown above, SOL’s market cap is now closing in on Dogecoin, hovering around $8.9 billion at press time.

Going by early reactions from crypto traders in the Futures markets, it’s only a matter of time before SOL flips DOGE.

Solana Short traders are Feeling the Pinch

The Shopify announcement saw SOL price increase 3.5% from $21.27 to $22 on Thursday morning. The positive market swing saw Solana short sellers scamper to close their positions.

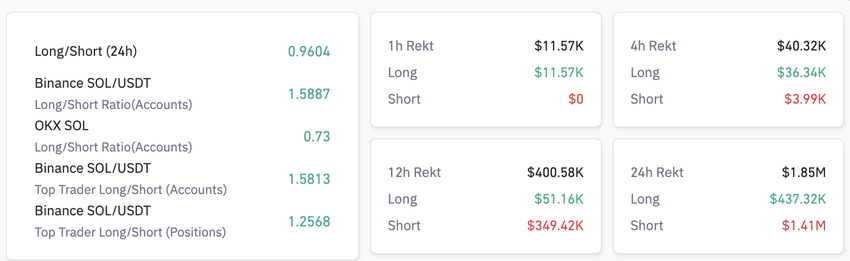

The chart below shows that Short traders have suffered liquidations of over $1.4 million between August 23 and mid-day on August 24.

Short Traders borrow and sell assets (like stocks or cryptocurrencies), expecting the asset’s price to decrease. They aim to buy back the assets at a lower price and return them to the lender, pocketing the price difference as profit.

A Short Liquidation event is triggered when the asset’s price rises rapidly, resulting in losses that exceed the value of collateral or ‘margin’ put up by the short trader.

The chart above means investors who took Short/Negative positions on Solana price have assumed more than $1.85 million in losses within the last 24 hours. Such large liquidations within a short period raise the risk of a Short squeeze.

Check Out the Best Upcoming Airdrops in 2023

To avoid further losses, the Solana short traders could try to buy more SOL tokens to cover their positions. This can increase buying pressure, leading to an even more rapid SOL price increase.

If a Short Squeeze sets in, Solana’s price valuation will likely overtake Dogecoin’s market cap in the coming weeks.

Investors are Bringing Fresh Funds into The Solana Ecosystem

Furthermore, crypto investors have started piling fresh funds into Solana Futures Markets to front-run the potential upsides from the Shopify collaboration.

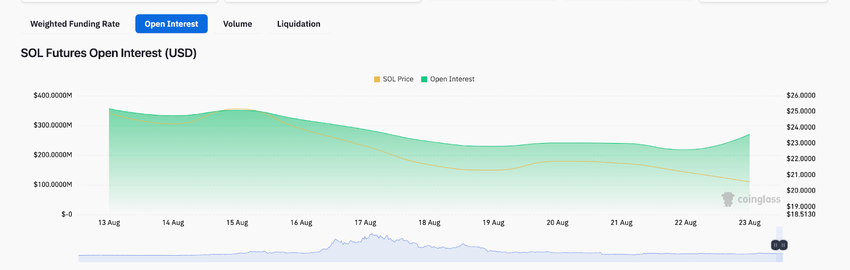

The chart below shows that, after nearly a week on the back foot, SOL’s Open Interest climbed 24% to hit $270 million on August 23.

Open Interest sums up the total value of active derivative contracts for an asset. An uptick in Open interest is a bullish signal, indicating significant capital inflows.

Notably, the timing of this 24% boost in the Solana Futures market suggests that most investors are reacting positively to the Shopify integration.

If the uptrend in Open Interest is sustained, the bullish pressure could see the Shopify Integration drive up Solana’s price in the spot markets in the coming days.

Interested in AI Trading? 9 Best AI Crypto Trading Bots to Maximize Your Profits