The Solana (SOL) price has fallen since November 16, when it reached its yearly high of $68.20.

Despite the decrease, SOL still trades above a critical horizontal support area. Is the trend still bullish?

Solana Increase Takes Price Above $50

The SOL price has increased considerably since the start of the year. In July, Solana broke out from a descending resistance trend line that had been in place since the all-time high.

After validating the line as support (green icon) in September, the SOL price accelerated its rate of increase, leading to a new yearly high of $68.20 last week.

During the increase, SOL also broke out from two key resistance areas.

With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward, but if the reading is below 50, the opposite is true. The weekly RSI is increasing but is in overbought territory.

What Are Analysts Saying?

Cryptocurrency traders and analysts on X have a bearish outlook for the short-term trend.

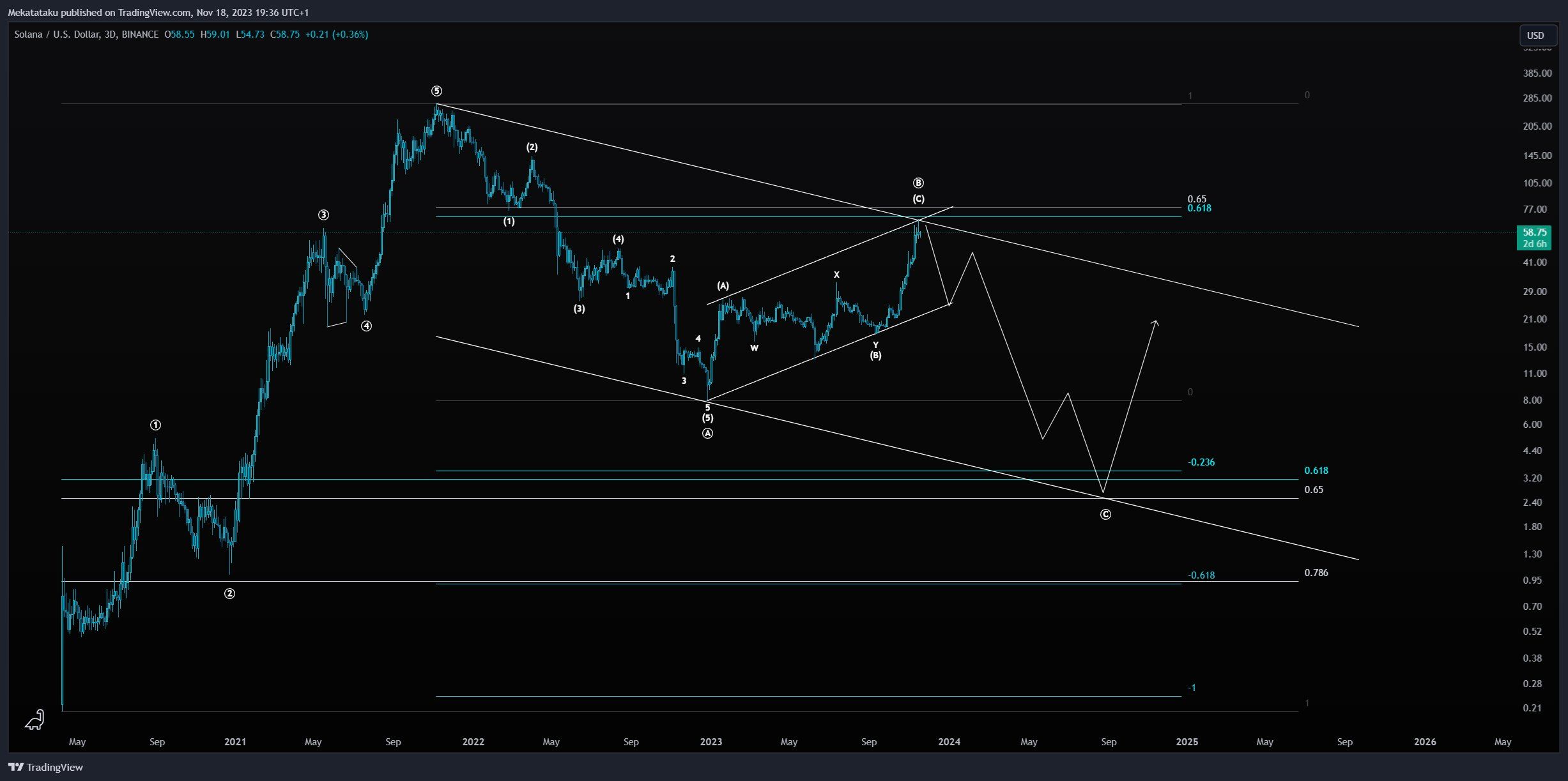

Technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction by studying recurring long-term price patterns and investor psychology.

Metakaku tweeted a bearish count that suggests the SOL price will reach a top soon and begin a downward movement. He stated that:

“Upside target has been fully realized on SOL, leaving us with the potential of a completed correction on the macro. If this is the case, the expectation is for price to reject here and go for a new low as shown on the third chart. This isn’t me having a bearish bias against SOL, it’s Elliott Wave applied in it’s most basic form, and the subwaves of this are close to perfect. Simply take it as a word of caution for bulls.”

Sherlock tweeted a bearish head and shoulders pattern, stating that its breakdown will likely trigger a sharper downward movement.

Read More: 9 Best Crypto Demo Accounts For Trading

SOL Price Prediction: Will Price Increase Again?

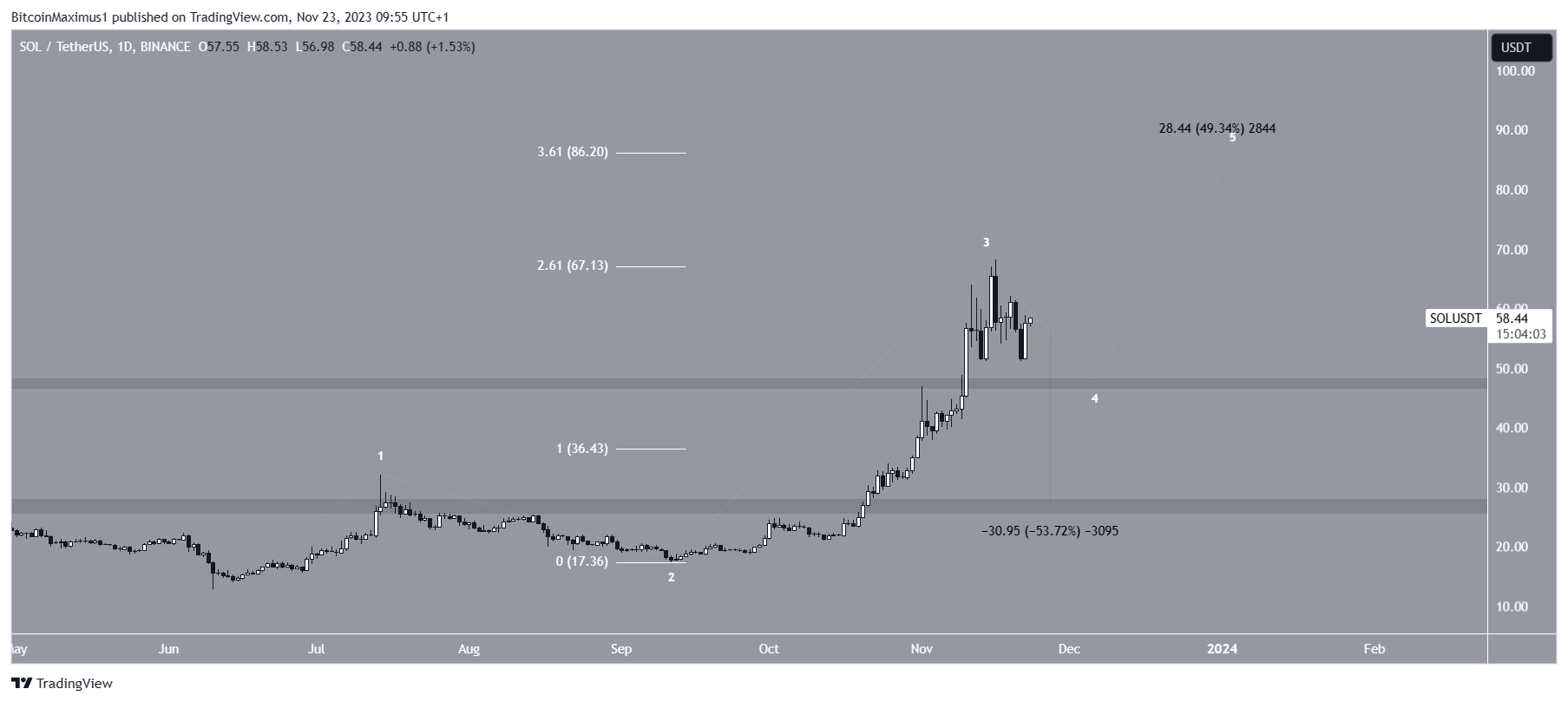

A closer look at the daily time frame wave count reveals a positive outlook.

Starting in June, SOL seems to have begun a five-wave upward movement (white). In it, wave three extended, having 2.61 times the length of wave one.

If the count is correct, SOL is now in wave four, which is corrective. It is unclear if wave four has ended or if the price will correct further. If it does, it could return to the long-term $48 support area before bouncing again.

The count suggests that the trend is still bullish, and the SOL price will increase again.

The bullish count will be confirmed by a SOL upward movement above the yearly high of $68.4, which could trigger a 50% increase to the next resistance at $86.20.

Despite this bullish SOL price prediction, a close below the $48 horizontal support area can trigger a 50% drop to the next closest support at $28.

Read more: What Is Solana (SOL)?

For BeInCrypto’s latest crypto market analysis, click here.