The Synthetix (SNX) price has increased considerably this week, reaching a nearly 600-day high of $4.95.

The upward movement caused a breakout from a key horizontal resistance area. Will this increase continue?

Synthetix Ends Token Inflation

Synthetix has entered a new phase with the passage and implementation of SIP 2043, marking the end of SNX token inflation. This pivotal decision was driven by the diminishing effectiveness of inflation as a staking incentive. It reflects the protocol’s commitment to a more sustainable economic model.

SNX inflation was initiated in 2019 to boost staking and adjusted in 2022 for dynamic targeting. It led to a unique distribution approach across all healthy stakers. However, it confused users and raised concerns about the inflationary model and staking complexity.

The rationale behind SIP 2043 is changing staking incentives, prompting Synthetix to abandon inflation in favor of strategies like buybacks and burns using trading fees. As of the publication date, the protocol’s Perps generated over 28.5 million in trading fees, showcasing the viability of the new approach.

Post-inflation, the staking process has been streamlined, eliminating the need for weekly claims and introducing a novel reward structure benefiting both stakers and non-stakers.

For stakers, the new era brings a free loan against SNX collateral, automated fee burns, and a buyback and burn strategy, reducing SNX supply. Additionally, Non-staking token holders also benefit from decreased SNX supply through the Andromeda Release’s fees.

This paradigm shift ushers in a more efficient era for Synthetix, where sustainable trading fees replace the necessity for inflationary incentives, shaping a robust and user-friendly protocol for the future.

What Do the Analysts Say?

Cryptocurrency traders and analysts on X believe the SNX price trend is strong.

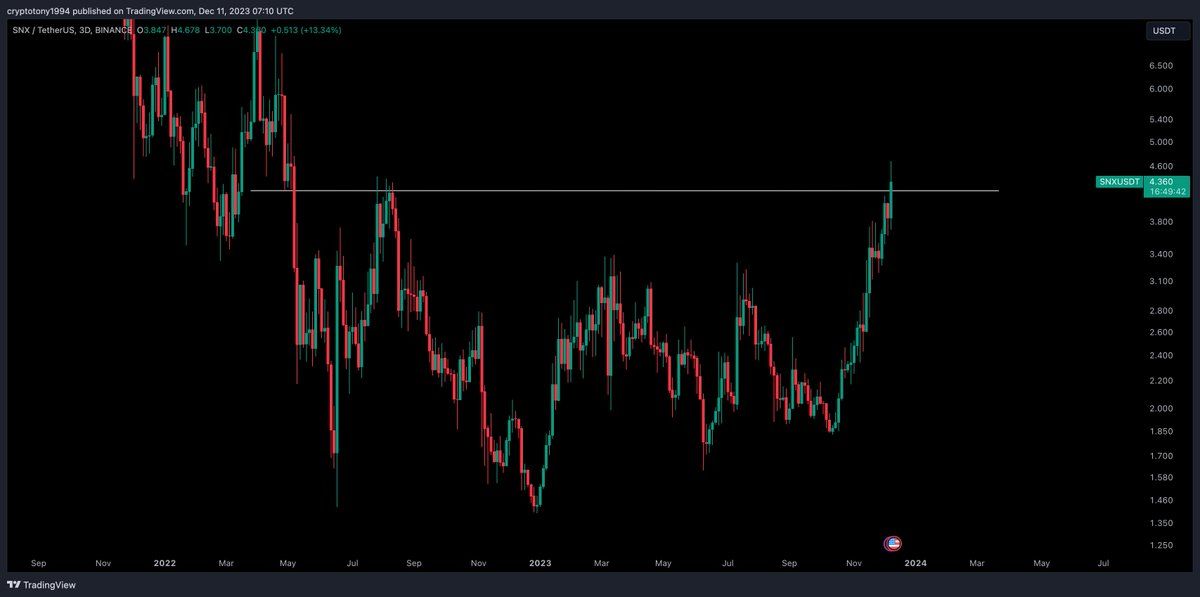

Crypto Tony is bullish but on one condition. He stated that:

Setting up for a good run here if we can close this daily candle above the range high at $4.22

BS_Joe Biden noted that the SNX price posted considerable gains against Bitcoin. Finally, ColdBloodShill and CryptoFaibik both believe that the price has shown strength due to its positive long-term movement.

SNX Price Prediction: Can Price Reach $10?

The weekly time frame technical analysis gives a bullish outlook. This is because of the price action and the Relative Strength Index (RSI).

The price action shows that the SNX price broke out from a long-term descending resistance trend line and a long-term horizontal resistance area at $3.20, both bullish signs. As a result, the altcoin reached a nearly 600-day high of $4.95 today.

Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset. Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

Read More: Best Crypto Sign-Up Bonuses in 2023

Additionally, the weekly RSI is increasing and is above 50. Additionally, it crossed into overbought territory (green icon). The previous time it occurred, this cross led to the upward movement becoming parabolic.

Therefore, if the upward movement continues, SNX can increase by another 60% and reach the next resistance at $7.

Despite this bullish SNX price prediction, a sudden rejection can lead to a 30% drop to the closest horizontal support area at $3.20. This will not invalidate the bullish trend. That will only be done with a weekly close below the $3.20 support area, likely triggering a significant decrease.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.