The Shiba Inu (SHIB) price shows signs of a potential bounce at a horizontal support area. However, the direction of the long-term trend is still unclear.

As a result, an initial upward movement may occur. However, it is still unclear how this fits with the long-term trend.

Shiba Inu Approaches Support of Long-Term Pattern

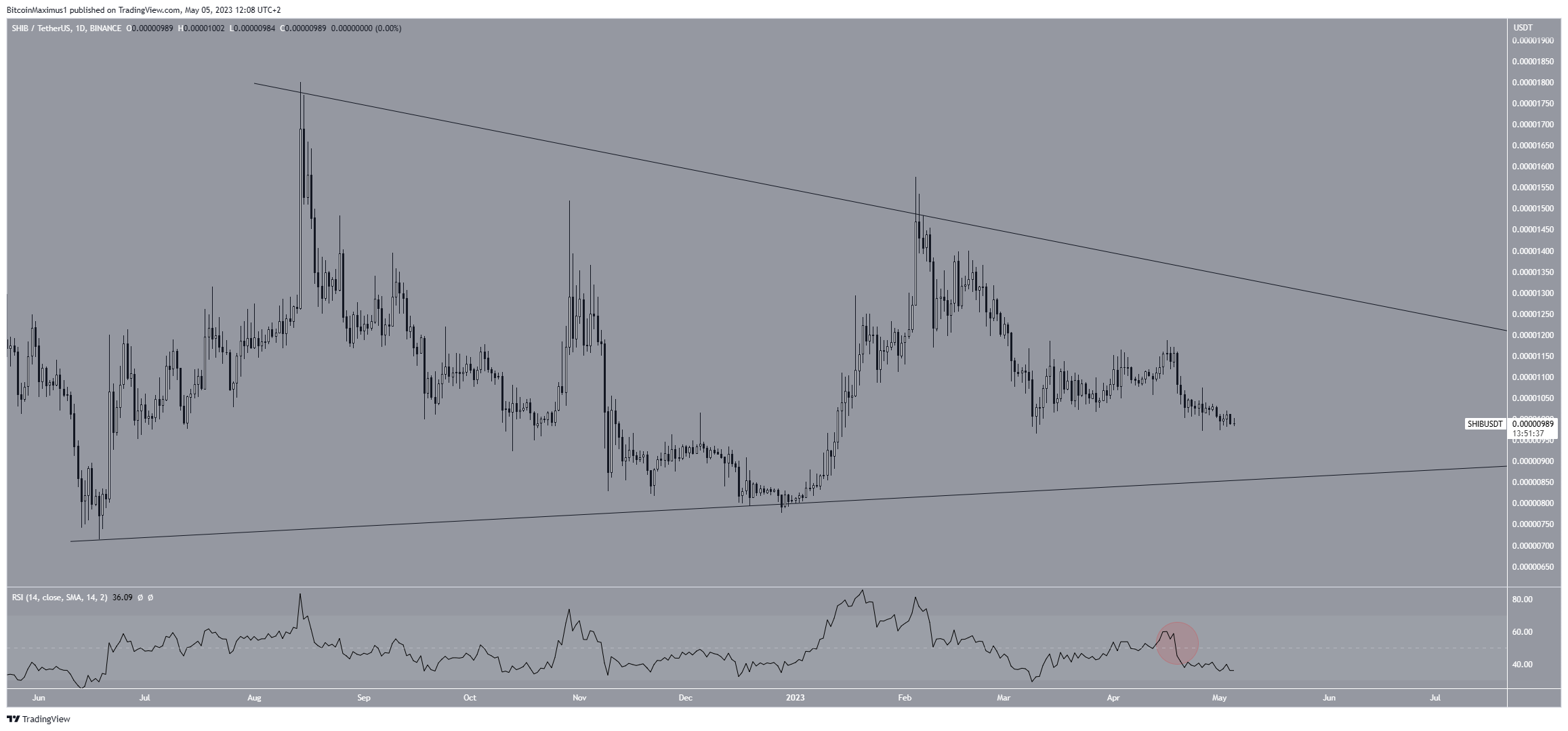

According to the analysis of the daily timeframe, the price of SHIB has been trading in a symmetrical triangle since June 2022.

This pattern is considered neutral, meaning there is an equal probability of an upward breakout or a downward breakdown.

Currently, the price is situated in the lower portion of the triangle and has been declining since encountering resistance on February 4th (red icon).

The daily Relative Strength Index (RSI) also indicates that the downward trend will likely continue. Traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and to decide whether to buy or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage.

Conversely, if the reading is below 50, the opposite is true. The RSI dropped below 50 (red circle) at the end of April and is now declining, indicating a bearish trend.

SHIB Price Prediction: Will Momentum Return?

The technical analysis from the short-term six-hour time frame shows that the price has fallen since breaking down from an ascending parallel channel on April 20.

This indicated that the previous upward movement is complete, and the structure is not valid anymore.

Since April 25, the price of Shiba has traded close to the $0.0000100 horizontal support area. This is the final support before the long-term triangle’s support line at $0.0000090.

Unlike the daily one, the six-hour RSI is bullish. The reason for this is the bullish divergence that has developed over the past week.

A bullish divergence occurs when a decrease in momentum does not accompany a decrease in price. It usually leads to significant upward movement.

In the case of the Shiba Inu coin, it could cause an increase toward the channel’s support line at $0.0000116. However, this will be in the confines of the long-term triangle, meaning that it will not affect the direction of the long-term trend.

However, a price breakdown below the $0.0000100 horizontal support area will invalidate this short-term bullish forecast. In that case, the meme coin could reach the triangle’s support line at $0.0000090.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.