Shiba Inu (SHIB) price made multiple unsuccessful attempts at the critical $0.000008 price resistance level last week. Critical on-chain data analysis suggests that SHIB’s price could be at risk for a major correction. Can the bulls hold firm?

Prominent cryptocurrencies in the memecoins sector endured mixed fortunes last week. While coins like PEPE and FLOKI delivered double-digit gains, SHIB’s price has relatively stagnated below $0.000008. Is Shiba Inu at risk of a major downswing this week?

Shiba Inu Long-term Investors are Folding

One key indicator of a potential price correction is the perceived drop in confidence among Shiba Inu long-term holders. Between June 17 and July 3, SHIB’s price gained 15%.

But, importantly, Mean Coin Age has decreased by 35% during that period, according to Santiment‘s on-chain data.

Mean Coin Age gauges the level of confidence among long-term investors by calculating the average number of days that coins in circulation have spent in their current wallet addresses.

When it drops during a price rally, as seen above, it indicates that long-term investors are booking profits. If they continue to exit their positions, SHIB’s price will likely drop further in the coming days.

After Nearly Two Weeks in an Uptrend, SHIB Now Appears Overbought

After entering 15% price gains over the past two weeks, SHIB appears to be overvalued. Pointedly, the Network Value to Transaction Volume (NVT) ratio has been on the rise since mid-June. From June 22 to July 3, SHIB witnessed a 385% rise in the NVT ratio.

The NVT ratio evaluates the underlying economic activity on a blockchain network relative to the token price. When it rises, it signals that the token is overvalued and could be at risk of some retracement.

If this historical trading pattern holds true, the SHIB bears could seize control in the coming days.

Read More: Best Upcoming Airdrops in 2023

SHIB Price Prediction: Bears Could Push for $0.000006

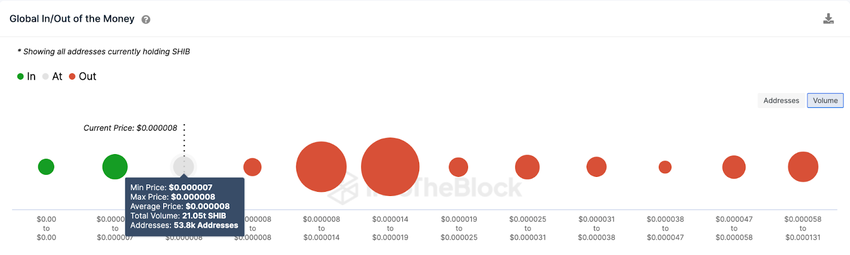

According to IntoTheBlock’s Global In/Out of the Money Around Price distribution data, Shiba Inu will likely make a downswing toward $0.000006.

But currently, the 53,800 investors that bought a total of 21.05 trillion SHIB tokens at the minimum price of $0.000007 will likely offer some support.

If that critical support level folds as expected, then Shiba Inu’s price could backtrack toward $0.000006.

Still, the Shiba Inu bulls can overcome the bearish narrative if SHIB breaks above $0.0000085. But as seen above, some of the 14,950 addresses that bought 31.32 trillion SHIB tokens at the minimum of $0.000008 could trigger a pullback.

But if the bulls push that resistance aside, the Shiba Inu could head toward 0.000014.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits