The user of an Ethereum wallet that previously earned a 1,000x return on Pepe (PEPE) recorded 375x gains from PEPE 2.0.

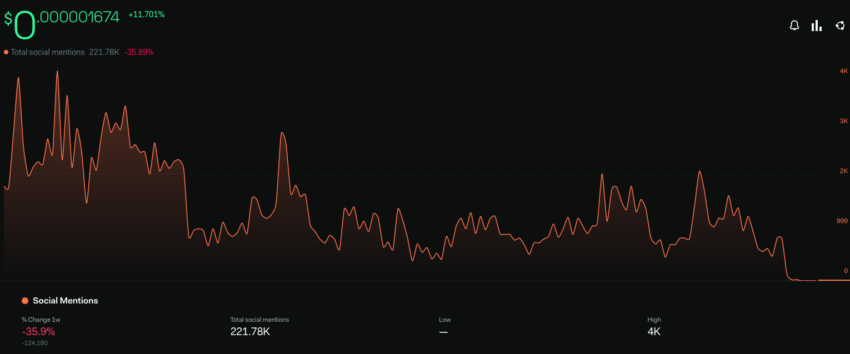

It is unclear how the investor is making returns, as the hype around the PEPE-related tokens has not been evident on social media recently.

PEPE Gains Are No Joke

The wallet user may be a PEPE insider or using a unique strategy to multiply PEPE 2.0 profits to 375x. They currently hold about $120,544 in PEPE 2.0 and $5,800 in PEPEC, with the remainder of their $248,100 in ERC-20 assets spread across Ethereum, PulseChain, Arbitrum, BNB Chain, and Polygon.

The investor previously made 99 ETH from 0.1 ETH through their PEPE 1.0 investment strategy, and executed most of their early PEPE trades on decentralized exchange Uniswap V3.

The last transaction was made on Friday morning on Uniswap V2, according to Etherscan.

New Legislation Cuts Down Market Manipulation

Meme coin prices generally follow a hype cycle field by social media influencers. The coin’s creators initially listed PEPE on decentralized exchanges after its April 14 launch. The coin’s mentions on social platforms has fallen from a peak of 4,000 to 684 in the past seven days.

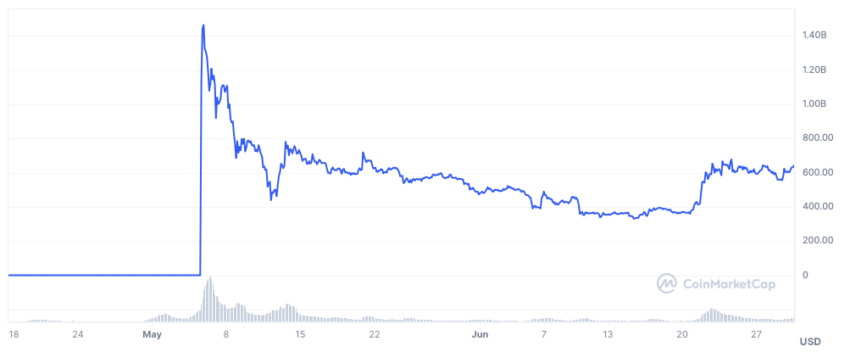

Within two weeks of release, the coin had amassed a market cap of $326 million, roughly 0.03% of the total crypto market cap. Binance fueled further excitement when it listed PEPE and released an investment guide.

One investor earned 340,000x return on $27 he invested in PEPE’s initial coin offering, bagging $1 million. Another trader earned $7 million from a $260 investment in May this year.

However, meme coins can be manipulated to enrich insiders. South Korea’s Virtual Asset User Protection bill penalizes market manipulation and unfair practices. Europe’s new Markets in Crypto-Assets legislation compels influencers to disclose any compensation they receive from projects they promote.

Large holders of new tokens at their peak may not find the liquidity they need to cash out.

Presently, there are 125,772 PEPE holders, with the coin having a market cap of about $635,000,000.

Got something to say about the 1,000x PEPE investor or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.