The collapse of major crypto firms last year awakened investors to the harsh reality of crypto custody. Not only did customers lose access to their crypto on exchanges when they failed, but US investors also became responsible for complying with tax laws overseen by the Internal Revenue Service (IRS) even though they didn’t own keys to their crypto.

Just a few weeks ago, the United States Treasury Department proposed new laws for catching crypto tax cheats and making it easier for obedient citizens to file returns.

Under the draft tax laws, crypto exchanges must report gross transaction proceeds. Later, they would need to report the cost basis or how much customers paid for assets they later sold.

Interested in creating your own markets? Read our primer on decentralized exchanges here.

The difference between the investor’s cost basis and the price they sold the assets for would constitute taxable income.

Despite their best efforts, investors keeping crypto in non-custodial wallets have historically faced nightmares trying to track gains that span multiple decentralized finance (DeFi) applications. The fact that service providers help track transactions is not always useful since different providers can present wildly different results, says tax expert Clinton Donnelly.

Only Code Knows Your Identity

But first, a primer on why DeFi transactions are so hard to track.

A core feature of decentralized finance is the ability to transact without intermediaries. Hayden Adams, the developer of decentralized exchange (DEX) Uniswap, and Michael Egorov, the creator of stablecoin DEX Curve Finance, allow crypto investors to make their own markets for exchanging crypto assets.

Read our step-by-step guide on how to set up and manage your own crypto wallet.

In other words, these platforms deploy special code that allows users to exchange crypto assets peer-to-peer. They create markets largely independent of rules imposed by regulators like the US Securities and Exchange Commission (SEC), although this could change.

Until the recent crypto collapses, Uncle Sam was content to let DeFi enthusiasts amuse themselves. Unrestricted, investors could experiment with products whose yields dwarfed returns banks pay savers.

A keystone feature of this type of investing is pseudonymity. Most decentralized platforms only need investors to connect software that allows them to spend assets using a private key divorced from personally identifiable information.

Read about the decentralized finance revolution here.

Sometimes, DeFi investors are exposed when their wallet addresses are linked with their profiles on other platforms like X (formerly Twitter). While their real identities are still mostly safe from prying eyes, it often takes stolen data from a platform like X to link an address to a real-world entity.

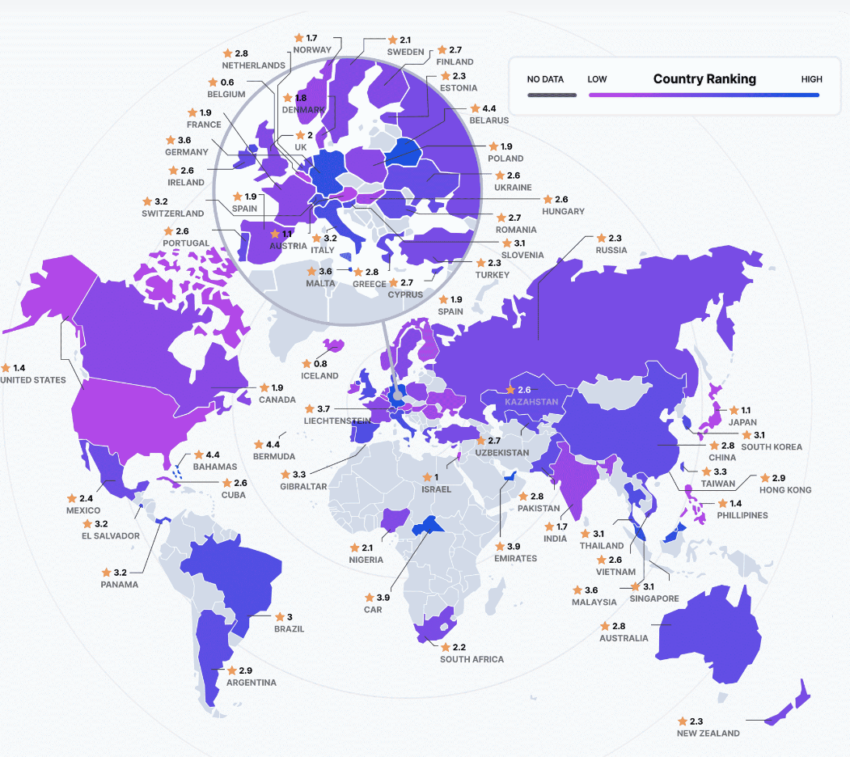

The pseudonymity of crypto transactions has given regulators sleepless nights. Last year, the US sanctioned Tornado Cash, a decentralized application that obscures the identity of depositors. Later, US tax authorities partnered with an artificial intelligence firm to track tax fraud on blockchains.

Regulators Could Force Data Collection for Crypto Tax Defaults

Danny Chong, the CEO of Tranchess, a DeFi yield platform, recently told BeInCrypto that DeFi needs regulations to shape its future. But is the surrender of private information the price we have to pay?

The 2023 US Crypto-Asset National Security Enhancement Act mandates DeFi protocol investors to collect customer information. It would also give the Treasury additional powers to prosecute money laundering conducted outside the traditional financial system.

International anti-money laundering bodies like the Financial Action Task Force (FATF) recommend anti-money laundering rules that European Union regulators saw fit to include in their crypto legislation, the Markets in Crypto-Assets (MiCA) bill. Effective 2024, MiCA mandates exchanges to record both transaction parties, regardless of amount.

Ethereum Upgrades Will Lead to Greater Scalability

Upgrades to Ethereum transaction blocks will accommodate cheaper transaction blocks. In the interim, several zero-knowledge projects will improve the scalability of Ethereum. Self-custodial wallet providers like MetaMask and Ledger have also experienced hacks and have been accused of undermining the ethos of crypto.

Learn how to safeguard crypto in non-custodial wallets here.

Moreover, it remains to be seen whether companies like Recap would need to change their approach when new US laws come into effect. In September last year, the IRS issued a John Doe summons to New York-based M.Y. Safra Bank clients who may have failed to pay taxes on crypto transactions.

Got something to say about how to leverage self-custody for anonymous crypto tax payments or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.