In a fresh move exemplifying the global reach of the United States regulatory enforcement, the Securities and Exchange Commission (SEC) is again crossing international borders, this time to South Korea.

US District Judge Jed Rakoff has ruled that the SEC may enlist the South Korean government’s aid in its investigation into Terraform Labs and its co-founder Do Kwon.

The SEC Wants Terraform Labs’ Do Kwon

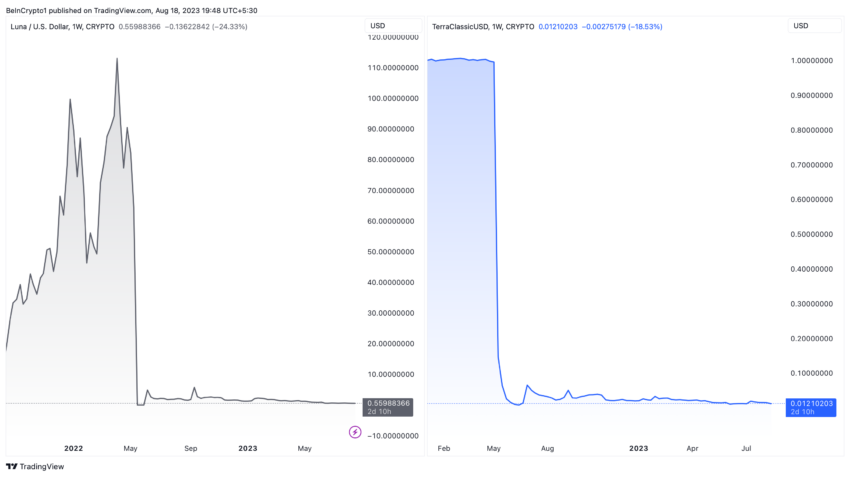

Do Kwon, former CEO of Terraform Labs, is serving a four-month sentence in Montenegro for traveling on a fake passport. Additionally, he faces criminal charges in both the United States and South Korea, along with an SEC lawsuit. Kwon and Terraform assert their innocence despite obliterating at least $40 billion in an illegal crypto scheme.

Remarkably, they did not oppose the SEC’s request for foreign assistance. Instead, they included their own demands for evidence to bolster their defense.

This recent action pivots on the SEC’s intent to question Daniel Shin, Terraform Labs co-founder, and to scrutinize documents from payments company Chai Corp., of which Shin is CEO.

The companies, initially sharing office space and staff, diverged in 2020. As Kwon assumed Terraform’s leadership, Shin retained his position at Chai.

The crux of the SEC’s allegation revolves around Kwon’s purported deception. Falsely professing that Chai leveraged Terraform’s blockchain and its TerraKRW stablecoin to process millions of South Korean retail transactions. The SEC contends that Kwon and Terraform manipulated records of Chai transactions on their blockchain.

According to court filings, the SEC is intently pursuing testimony and documentation concerning Chai’s payment processing procedures. Moreover, its engagement with Terraform’s blockchain and stablecoin, intercompany communications, and disclosures to Chai’s investors regarding the companies’ association.

Read more: What’s the Difference between Security and Utility Tokens?

The unfolding drama between the SEC and Kwon, framed by a 1970 treaty guiding international evidence requests, highlights the increasingly complex and expansive landscape of global financial regulation.

As crypto companies navigate these intricate waters, the SEC’s latest move signals its readiness to extend its jurisdictional bounds relentlessly in the quest for accountability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.