The Ripple (XRP) price grazed the $0.55 mark on Friday after spending the better part of September rooted at the $0.50 territory. On-chain analysis examines the key indicators that could impact XRP prices in the coming weeks.

On-chain data shows the XRP profit-taking volume has shot up after the cryptocurrency’s price briefly broke above the $0.55 level. Can the whales soak up the selling pressure as the prevailing sentiment in the crypto market flips bullish?

XRP Profit-Taking Transfers Hit 3.5 Billion as Price Taps $0.55

After a month of relative stagnation, XRP’s price appears to be on the verge of a major breakout. But after briefly grazing $0.55 on September 29, a profit-taking frenzy quickly triggered a retracement below $0.53.

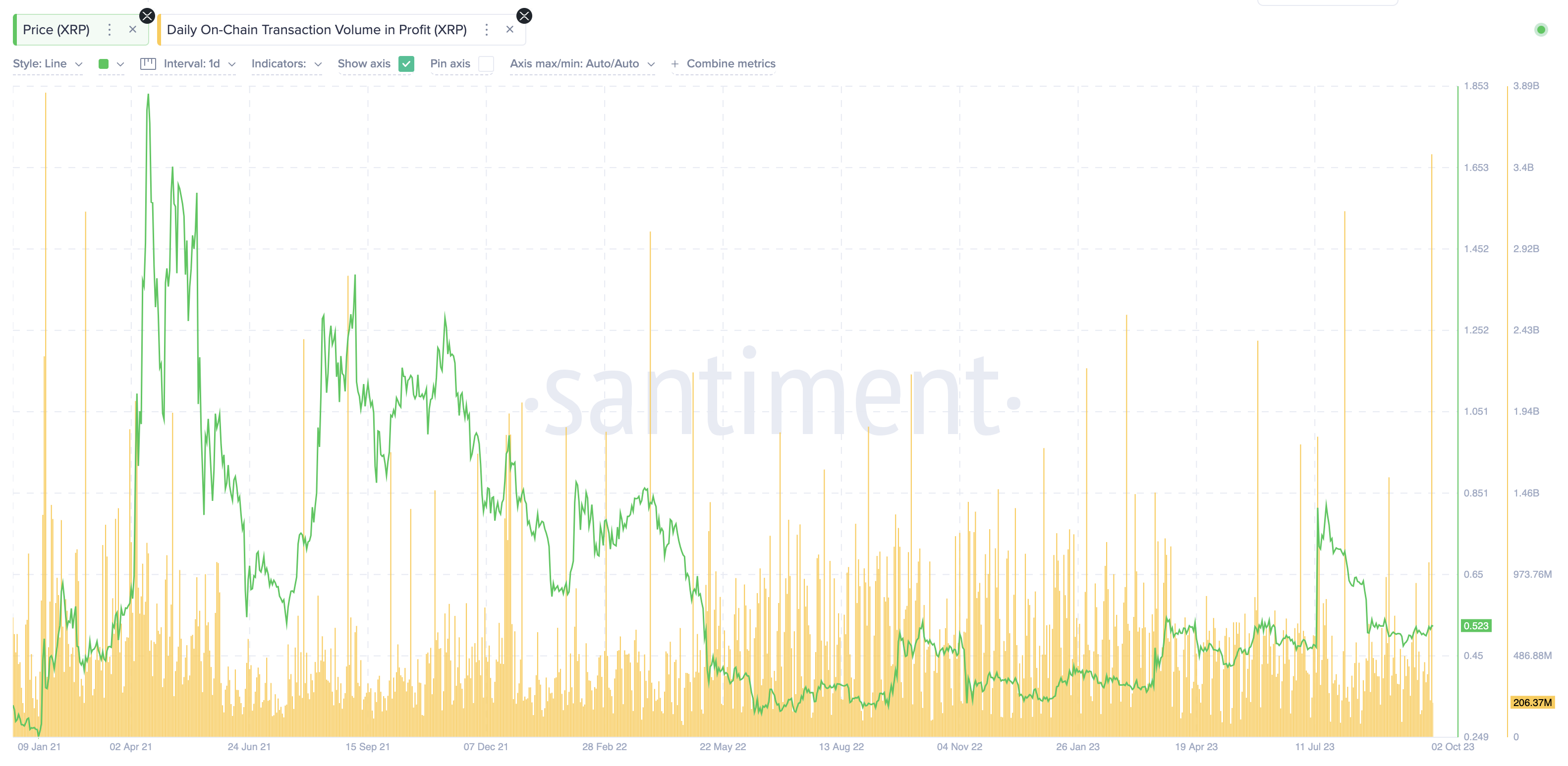

XRP Daily On-chain Transaction Volume in Profit charts show that 3.48 billion coins were traded at a profit on October 1.

According to data from the on-chain analytics firm Santiment, the Ripple-backed network has not witnessed this profit-taking level since February 2021.

As its name suggests, Daily On-chain Transaction Volume in Profit measures the volume of profit-taking transactions. The indicator compares the current XRP prices to the price at which each moving coin was last traded.

If the previous selling price for any coin was less than the XRP’s current market value, then that particular coin is deemed to have been moved at a profit. Conversely, if the last selling price exceeds the current market value, it is recorded as a “loss” volume.

This 3.48 billion XRP profit volume recorded on Sunday indicates that there’s an unusually high profit-harvesting in the XRP market.

Even when the monthly 1 billion XRP escrow movement is accounted for, 2.48 billion XRP moving at a profit remains a considerably high figure.

The high profit volume could suggest that investors fear a potential drop right now. Hence, they rushed to harvest some profits when the price exceeded the $0.55 level.

Notably, periods of comparable spikes in Daily On-chain Transaction Volume in Profit in September 2021 and March 2022 were followed by significant XRP price correction.

Read More: Crypto Portfolio Management: A Beginner’s Guide

Bullish Crypto Whales May Soak Up the Selling Pressure

Profit-taking on the XRP ledger network has reached record highs. However, a cohort of bullish crypto whales may have other ideas.

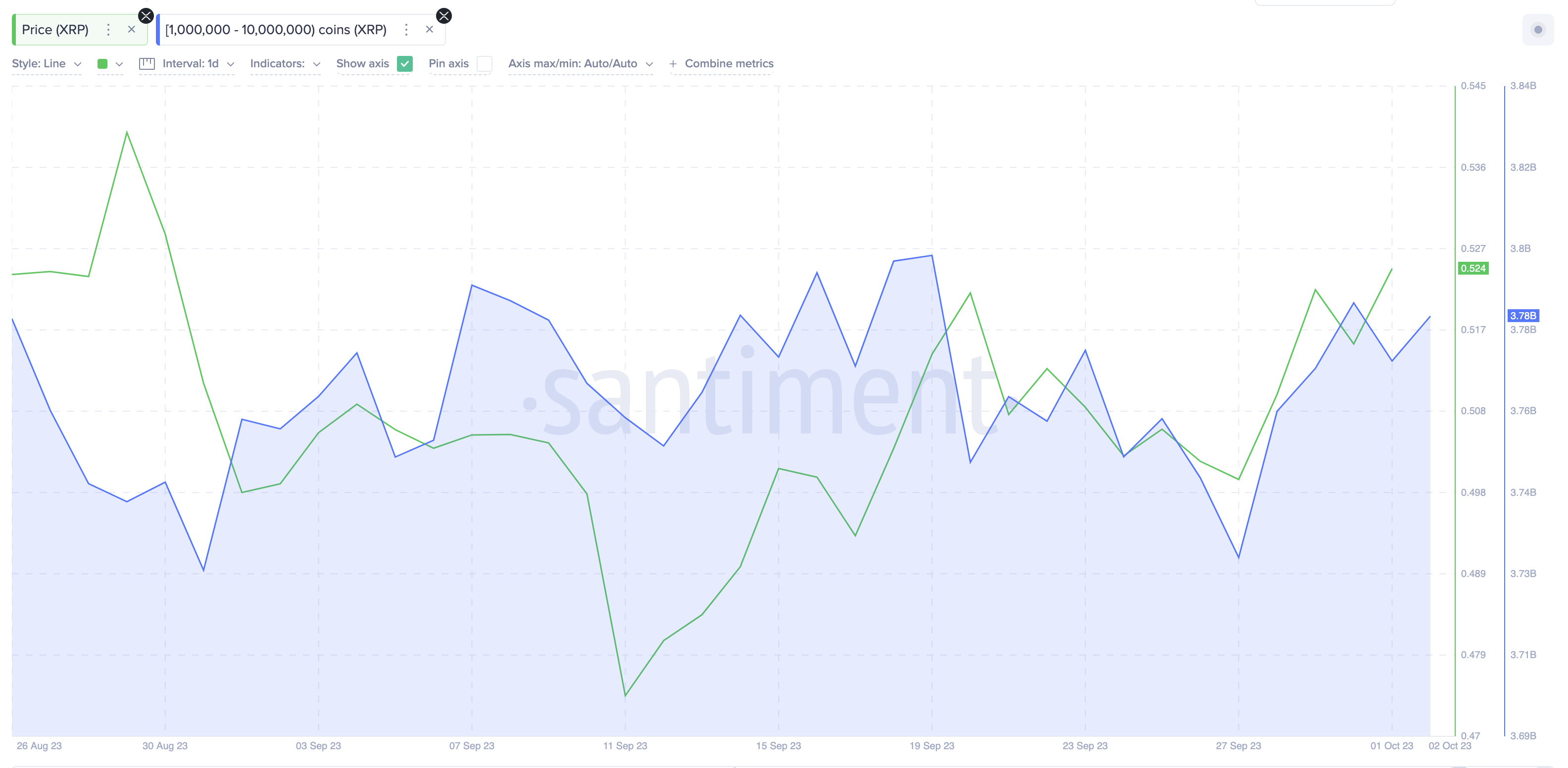

Pointedly, the whales holding 1 million to 10 million XRP had only 3.73 billion coins in their wallets as of September 27. But the chart below shows how that figure has now increased to 3.79 billion as of September 29.

This implies that while paper handholders booked profits, the whales aggressively accumulated 60 million coins in the last 5 days.

Valued at the current market price of $0.52, the 60 million coins recently acquired by the whales are worth approximately $31.2 million. This intense buying activity from XRP whale investors appears to have averted a major price correction.

Firstly, the large volume of the whales’ timely inflows soaked up the excess market supply. It could influence other strategic investors to take positive positions if they maintain this trend.

In conclusion, it remains to be seen if the prevailing bullish sentiment in the broader altcoin markets can convince XRP holders to suspend the profit-taking frenzy.

XRP Price Prediction: More Consolidation Before Major Breakout

Despite the 2-year high profit-taking frenzy, XRP price will likely consolidate above the $0.51 range if whales intensify their buying pressure.

The Market Value to Realized Value (MVRV) ratio, which assesses the net financial position of current XRP holders, also supports this prediction.

With prices currently sitting at close to $0.53, investors who bought XRP within the past month currently hold approximately 3% unclaimed profits. The current profit-taking run will likely abate when holders break even around the $0.51 range.

But if a major downswing sets in, the majority could look to avoid losses larger than 7%. The $0.49 area will be the next significant support level in that case.

Conversely, the bulls could regain control hold if the XRP price can reclaim $0.60. However, those looking to book profits at 10% will likely close their positions when the XRP price hits $0.55 once more.

If they sell early, it could slow down the XRP price breakout. But if the bulls can scale the $0.55 resistance level, the XRP price could promptly reclaim $0.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.