PayPal Gearing Up for the Big Rollout

While no official announcement has come from PayPal themselves, the sources did give some details regarding the development. First, the buying and selling of cryptocurrency will be done directly, not only from PayPal but from Venmo as well. As for token storage, built-in wallet functionality will be added, according to the sources. When this announcement was first made, many assumed that Bitcoin, being the most popular cryptocurrency in the world, would be the first asset to be added. While this has not been confirmed by the sources, it was revealed that PayPal would be working with external cryptocurrency agencies. The purpose of this is reported to source liquidity for the trading activities that will be taking place. Ahead of the rollout, it seems that PayPal is recruiting staff. Several positions have been listed on the official PayPal job board, and these seem to point to upcoming projects involving blockchain and cryptocurrency. One of the first job listings that caught the attention of the cryptocurrency industry is Technical Lead – Crypto Engineer, though this has since been removed. According to the published details, the job requires the development and maintenance of cryptocurrency-related products and features that are targeted towards availability. Another interesting listing is for a blockchain engineer that will work with the PayPal research group.

The group in question is newly formed within the Strategic Technology Enablement team. It was established to explore opinions and expertise regarding emerging blockchain technology and its possible uses within PayPal. Some of the stated skill requirements for application include C++, asymmetric cryptography, and cryptographic libraries.

According to the published details, the job requires the development and maintenance of cryptocurrency-related products and features that are targeted towards availability. Another interesting listing is for a blockchain engineer that will work with the PayPal research group.

The group in question is newly formed within the Strategic Technology Enablement team. It was established to explore opinions and expertise regarding emerging blockchain technology and its possible uses within PayPal. Some of the stated skill requirements for application include C++, asymmetric cryptography, and cryptographic libraries.

PayPal’s Previously Anti-Crypto Stance

While this new development from PayPal is one of the biggest steps towards adoption in a while, the company’s management hasn’t always been very open to cryptocurrency. Their founding CEO Bill Harris, in particular, has been critical of digital tokens. In a 2018 article for Vox, he declared Bitcoin as the greatest scam in history.It’s a colossal pump-and-dump scheme, the likes of which the world has never seen.In his piece, he called cryptocurrencies ‘pump and dump’ schemes and claimed that they swindled those who invested in them. He argued that Bitcoin holds no value at all and fails to qualify as a means of payment, a store of value, or even a valid concept in itself. He pointed to the often volatile price of Bitcoin as the reason why it was useless as a store of value or a currency. Furthermore, Harris said that cryptocurrencies are only as valuable as people decide and are inferior to fiat currencies. Another point he posed in his article was the use of cryptocurrency for crime, referencing Silk Road and the rise of crypto-jacking. He then called on the Securities and Exchange Commission to ‘protect’ investors from what he called fraudulent schemes. This is not the only controversy that PayPal has endured in the last few years. In 2010, PayPal famously closed down the account of the WikiLeaks organization. The organization is known for leaking classified documents from several government agencies.

When this took place, PayPal claimed that the reason was that WikiLeaks violated its Acceptable Use Policy. The policy has a clause which states that the account cannot be used for any activities that encourage, promote, facilitate, or instruct others to engage in illegal activity. PayPal did not specify what illegal activity caused the Wikileaks account suspension, but the decision remained.PayPal bans WikiLeaks after US government pressure http://is.gd/ibbwG Support us: http://wikileaks.ch/support.html

— WikiLeaks (@wikileaks) December 4, 2010

PayPal Vs Pornhub

One of PayPal’s most infamous account closures was that of Pornhub, a popular pornographic website. It was announced in 2019 that the company would no longer support payments on the website. This was significant because many performers received payments using this method and would have their income affected.Pornhub management spoke out and said that they were devastated by the decision. According to them, hundreds of thousands of performers would be affected. They followed up by directing performers to set up new payment methods and offered support for those with pending PayPal payments. The reason given by PayPal for the ban was that certain transactions had been carried out by Pornhub without prior notice given. The ban, they said, was to prevent these actions from repeating themselves. Pornhub stated that PayPal’s decision hindered their efforts to stop discrimination towards sex workers.URGENT: PayPal has stopped all Pornhub model payouts.

— Pornhub Model Help & Updates (@PornhubHelp) November 14, 2019

If you had PayPal as your payout method please change to direct deposit/SEPA, or payment by check in your settings. Read more here https://t.co/LQAKeMsHIu

PayPal’s Initial Foray into Cryptocurrency

Despite the criticism leveled by its former CEO, PayPal has been involved in the cryptocurrency industry for a while. Specifically, the company has been in partnership with Coinbase, a leading cryptocurrency exchange, for years. In 2016, it was announced that Coinbase would begin accepting PayPal for the sales of Bitcoin. As a result of this partnership, users who sold Bitcoin would be able to receive their USD into their PayPal wallets directly. In 2018, this was taken a step further by enabling Coinbase users to directly withdraw their wallet balances to their PayPal accounts. These transfers were instantaneous and had no fees attached.This option was, at the time, only available for U.S. customers, but this was soon to change. By 2019, the ability to withdraw directly into PayPal accounts was extended to EU and European Free Trade Association members.Starting today, all Coinbase customers in the U.S. can instantly withdraw Coinbase cash balances to PayPal for no fee.

— Coinbase (@coinbase) December 14, 2018

It's Day 5 of 12 Days of Coinbase. Learn more here: https://t.co/tfYVzgJjxc pic.twitter.com/EFHn8LFPTs

Cryptocurrency Community Reacts

This development is a very significant one and elicited many responses from the cryptocurrency industry. While some are excited about the news, others are critical of PayPal entering the cryptocurrency sector. Jimmy Song, a prominent cryptocurrency educator, and developer, said on Twitter that PayPal had come ‘full circle’ from banning WikiLeaks accounts in 2010 (and inadvertently leading to increased use of Bitcoin) to supporting cryptocurrency.Not everyone feels this way, including Kraken co-founder Jesse Powell, who responded by claiming that while this move aids Bitcoin adoption, PayPal is still a ‘centralized choke point.’ He went on to reveal the issues he has had with PayPal and other institutions in the past. This includes PayPal locking up his funds for a month and almost bankrupting him as well as two different banks closing his business’ accounts without adequate notice.PayPal is going allow people to buy #Bitcoin.

— Jimmy Song (송재준) (@jimmysong) June 23, 2020

Paypal is the company that froze the Wikileaks account and put #Bitcoin on the map back in 2010.

It only took a decade for this to come full circle.https://t.co/m6fHfndeer

Nick Szabo, a computer scientist and cryptographer, pointed out to Powell that his exchange has the same power over users’ funds. He then warned users not to keep more funds than they needed on Kraken as they would have to comply with any government orders to close accounts and relinquish funds. Another user pointed out that PayPal seizing digital funds in the future is a legitimate possibility. It cannot be denied, however, that this is a major shift in the financial sector. Max Keiser, the host of The Keiser Report, noted that PayPal has been forced to embrace Bitcoin because it is so popular, and not doing so would give a leg-up to its competitors.Paypal locked up all the money I had for 6 months, almost lost my business/apartment. BofA killed @Krakenfx's payroll account on 30 days notice. Chase killed it on 5 days notice, by mail, which arrived after the account was closed. Found out when employee checks bounced.

— Jesse Powell (@jespow) January 9, 2019

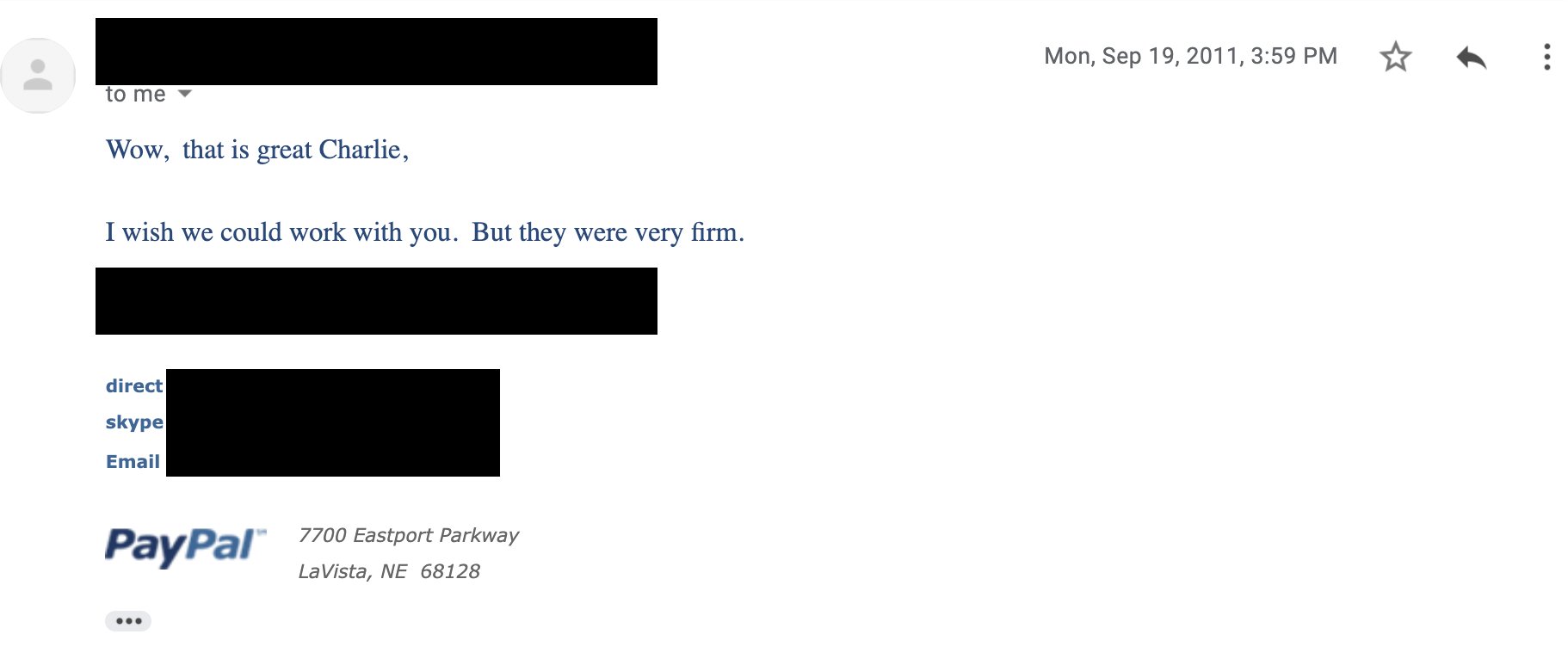

Others took to calling them out on their change of stance. Charlie Shrem, who was involved with the Silk Road in the early 2010s, posted a screenshot of an email between him and a PayPal employee in 2011 where his request for Bitcoin integration was denied.#Bitcoin’s built-in game theory strikes again.

— Max Keiser (@maxkeiser) June 22, 2020

Paypal, seeing $SQ making a killing with BTC, is forced to take on BTC or suffer huge competitive consequences.

Global Hash War is coming!

Mark Yusko, the CEO of Morgan Creek, posted a quote from their former CEO berating Bitcoin with the hashtag ‘#Ifcantbeatemjoinem.’ Others found it ironic that PayPal is integrating Bitcoin when their poor service was one of the reasons for Bitcoin’s spike in popularity.

A now-viral tweet from 2011 shows Neeraj Agrawal, a communications manager at Coincenter, complaining to PayPal about his funds being held. He declared that he should have conducted his transaction in Bitcoin instead. Impressively, PayPal support responded to him on June 22, 2020 — nine years later!

Mark Yusko, the CEO of Morgan Creek, posted a quote from their former CEO berating Bitcoin with the hashtag ‘#Ifcantbeatemjoinem.’ Others found it ironic that PayPal is integrating Bitcoin when their poor service was one of the reasons for Bitcoin’s spike in popularity.

A now-viral tweet from 2011 shows Neeraj Agrawal, a communications manager at Coincenter, complaining to PayPal about his funds being held. He declared that he should have conducted his transaction in Bitcoin instead. Impressively, PayPal support responded to him on June 22, 2020 — nine years later!

It has also been suggested that this new service is unnecessary because Venmo already allows for similar Bitcoin transactions. Another point brought up by the crypto community is that there isn’t even enough Bitcoin in existence for every person who currently uses PayPal to have 0.05 BTC.Give me my goddamn money @paypal. I should have conducted this transaction in bitcoin.

— Neeraj K. Agrawal (@NeerajKA) November 11, 2011

Industry Leaders React

Besides posts across social media, executives within the industry have also given official statements on the issue. One of the most pressing issues is the effect that this will have on the value of Bitcoin. Alex Svanevik, Data Scientist and CEO at Nansen, a blockchain analytics platform, believes that the impact will be positive:Anything that gives hundreds of millions of people the opportunity to directly buy Bitcoin is a positive for the space. If nothing else, the value in marketing terms for Bitcoin is significant.Jason Yanowitz, Co-Founder of BlockWorks Group, believes that the expansion of the industry is a good thing. More people could trigger future bull runs, he claims. He explained this with a quote from Paul Tudor Jones,

Paul Tudor Jones said it best: “Bull markets are built on an ever-expanding universe of buyers.” Well, the universe of Bitcoin buyers just drastically increased.The issue of the impending transaction fees is a different matter, though. He added,

The fees will most likely be the same as Coinbase, or slightly marked up. Coinbase and PayPal have a relationship dating back to 2016. I would have to assume PayPal will integrate with Coinbase for this.

Svanevik believes that the impending fees will be ‘atrocious’. Even more, he believes that PayPal might integrate the fees into the exchange rate to give off the impression that the transactions are feeless. Yanowitz disagrees, believing that the fees will be the same as Coinbase or only slightly marked up. Fees aside, the mainstream adoption of Bitcoin also poses the question of whether it can truly remain decentralized.

Pedro Febrero, Analyst at Quantum Economics, led by Mati Greenspan, believes so. According to him, more people within the industry will aid decentralization. The key is to increase access as much as possible, stating,

Svanevik believes that the impending fees will be ‘atrocious’. Even more, he believes that PayPal might integrate the fees into the exchange rate to give off the impression that the transactions are feeless. Yanowitz disagrees, believing that the fees will be the same as Coinbase or only slightly marked up. Fees aside, the mainstream adoption of Bitcoin also poses the question of whether it can truly remain decentralized.

Pedro Febrero, Analyst at Quantum Economics, led by Mati Greenspan, believes so. According to him, more people within the industry will aid decentralization. The key is to increase access as much as possible, stating,

Decentralization means more players in the space. Therefore, the fact more people have access to btc, that’s a good thing at the end of the dayAs for the price, he feels that people will buy up Bitcoin for a perceived cheap price in the short term. When asked about the impact of this move, he added,

I expect speculators to try to grab some (perceived) cheap btc, in the expectation more people buy the commodity once it appears on venmo. However, if not many folk jump into the hype train through venmo, we could see the reverse effect, and price dumping. I’m assigning a higher probability to the former than the later.Yanowitz predicts that in the short term, this will not affect Bitcoin’s price. However, in the long term, it will. This is given due to PayPal having such a mammoth user base and being such a mainstream platform:

Short term, this will not impact Bitcoin’s price. Long term, absolutely. We thought it was big when Robinhood rolled out Bitcoin, but Robinhood only has 13M users. Venmo has 50M users and $100B in annual payments volume. PayPal has 300M users and $700B in annual payments volume. More buyers means a higher price when there’s an asset with a fixed supply.

What Does This Mean for Bitcoin Moving Forward?

The idea of Bitcoin and what it can do will likely change following this move by PayPal. A lot of the institutional support given to the cryptocurrency in the past has been with the view to market it as an investment tool. Depending on how it plays out, payment platforms offering Bitcoin support may shine a light on its use case for cross-border finance, and not just as a long-term investment. PayPal and Venmo, while under the same parent company, serve distinctly different functions. PayPal is primarily concerned with remittances and eCommerce, while Venmo is popular for domestic payments. We could see the use of Bitcoin explored in all three areas moving forward. Finally, there is a possibility that Bitcoin will not be the only digital asset to be adopted. Bitcoin is the most prominent cryptocurrency, so its adoption is considered a given. However, many other assets could make an appearance such as Ethereum, zCash, and Litecoin.

YouTuber, Ivan on Tech, suggested that PayPal’s adoption could lead to a massive rally once the dust settles. He says that now is not the time to be docile about the price of Bitcoin. Instead, it is important to watch the market more closely than ever.

While most of the conversation is centered around what PayPal can do for Bitcoin, it is worth exploring what Bitcoin will be doing for PayPal. When Cash App first introduced Bitcoin purchases in 2020, it led to a wave of new signups, and soon, the platform was growing faster than Venmo, another payment app owned by PayPal. In many ways, PayPal isn’t doing the cryptocurrency industry a favor as much as it is getting with the times.

This new move by PayPal will likely have implications on Bitcoin and cryptocurrency as a whole in the years to come. This might mean short-term price rallies or long-term adoption. Either way, it is indicative of a changing financial landscape into one that includes cryptocurrencies and digital assets.

YouTuber, Ivan on Tech, suggested that PayPal’s adoption could lead to a massive rally once the dust settles. He says that now is not the time to be docile about the price of Bitcoin. Instead, it is important to watch the market more closely than ever.

While most of the conversation is centered around what PayPal can do for Bitcoin, it is worth exploring what Bitcoin will be doing for PayPal. When Cash App first introduced Bitcoin purchases in 2020, it led to a wave of new signups, and soon, the platform was growing faster than Venmo, another payment app owned by PayPal. In many ways, PayPal isn’t doing the cryptocurrency industry a favor as much as it is getting with the times.

This new move by PayPal will likely have implications on Bitcoin and cryptocurrency as a whole in the years to come. This might mean short-term price rallies or long-term adoption. Either way, it is indicative of a changing financial landscape into one that includes cryptocurrencies and digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.