MATIC price edged closer to the $0.60 territory on Monday as markets reacted positively to Google Cloud becoming a node validator on the Polygon network. Key on-chain and derivatives market data provide insights into how MATIC price could fare in the coming weeks.

The Polygon team announced on September 29, that Google Cloud has become a decentralized node validator on the network. Early stakeholders’ reactions have provided key insights into imminent MATIC price movements.

The New Development Has Buoyed Crypto Whales’ Confidence in MATIC

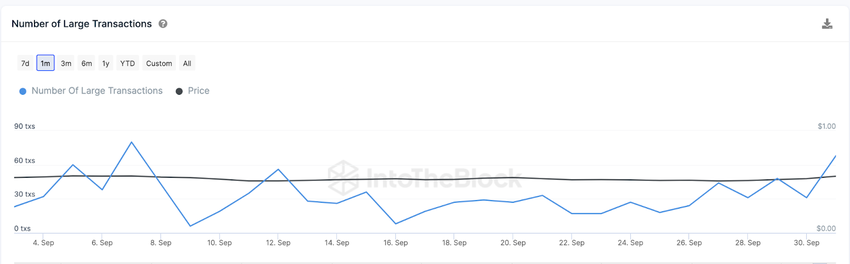

MATIC whale investors have increased their trading activity since Google Cloud was announced as an official node validator. On-chain data shows that the Polygon network recorded 68 Large Transactions on October 1, 2023.

Notably, this was the highest level of whale trading activity registered since September 7.

The Large Transactions metric aggregates the total number of confirmed trades that exceed $100,000 on a given day. Strategic investors often interpret an increase in Large transactions as a bullish signal.

Firstly, this is because large transactions boost market liquidity, which then allows traders to execute orders at favorable prices.

More importantly, the increased demand from the whales often leads to a price spike when market supply does not match up to it.

Speculative Traders are Also Piling on Bullish Bets

The recent news has undoubtedly boosted confidence in the MATIC spot markets. However, the latest data from the derivatives markets also shows that Polygon speculative traders investors have been piling on bullish bets.

Aggregate MATIC Open Interest stood at $86 billion at its lowest on September 28, according to the Coinalyze chart below. Within 24 hours of the news, that figure began to rise, hitting a 30-day peak of $116 million on October 1.

This means traders have added $30 million in capital inflows to the MATIC Futures market, anticipating that Google becoming a node validator will bode well for the Polygon ecosystem in the long term.

Open Interest is the total of all outstanding derivatives contracts for an asset across recognized Futures trading platforms. An uptick in Open Interest is a bullish signal indicating an influx of fresh capital inflows and new market participants.

If the Google Cloud partnership improves network demand as anticipated, the Polygon Open Interest could grow even further and accelerate the ongoing MATIC price rally.

Read More: 9 Best Crypto Demo Accounts For Trading

MATIC Price Prediction: Potential Breakout Toward $0.80

The critical data points analyzed above point towards a possible MATIC price breakout above the $0.80 range.

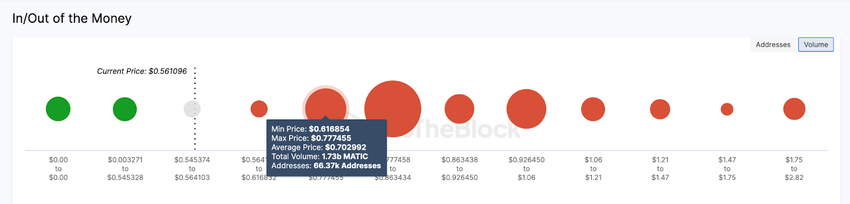

The Global In/Out of Money Around Price (GIOM) data, which depicts the purchase price distribution of current MATIC holders, also validates this bullish thesis.

It shows that if MATIC can scale the initial resistance at $0.70, the bulls could potentially push the price breakout toward $0.80.

As shown below, the 66,370 addresses bought 1.73 billion MATIC tokens at an average price of $0.70. If they sell early, they could mount a significant obstacle for the bulls.

But if the whales keep buying MATIC, the price rally could eventually surpass the $0.80 mark.

Conversely, the bears could regain control if the MATIC price wobbles below $0.70. However, as shown above, 3,770 addresses had bought 350.9 million Polygn tokens at the maximum price of $0.54.

Being the last line of defense, they will likely make spirited efforts to avert the bearish downswing.

But if the MATC loses that vital support level, the price could eventually drop below $0.50.