Litecoin (LTC) price briefly reclaimed the $75 territory last week sparking hopes of a bullish price breakout. With miners and crypto whales’ transactional activity gradually returning to pre-halving levels, here’s how LTC price could react.

Litecoin price action in recent weeks has been underwhelming compared to other mega-caps like Bitcoin (BTC) and Solana (SOL) that have claimed new yearly peaks. On-chain data reveals that key stakeholders within the LTC network are now positioned for a similar price breakout.

Litecoin Miners Have Recouped Coins Offloaded After Halving

Similar to 2015 and 2019, Litecoin price entered a prolonged correction phase after the latest halving event on Aug. 2. In a bid to front-run the losses, Litecoin miners entered a selling frenzy, offloading 500,000 LTC between Aug. 3 and Sept. 5. However, as the crypto market flipped bullish in late October, confidence grew among LTC miners as they began to accumulate their block rewards again.

After weeks of rapid accumulation, Litecoin miners reserves crossed 2.6 million LTC on Nov. 7. This milestone is quite notable as it brought the miners’ current balances above the 2.55 million LTC they held at completion of the halving event on Aug. 3.

Miners Reserves metric tracks the number of coins deposited in wallets controlled by recognized crypto miners and mining pools. Strategic investors often interpret it as a bullish signal when miners accumulate their block rewards during a market rally. It is a clear indication that the miners are looking to hold out for more gains rather than sell at the current prices.

Read More: Litecoin vs. Bitcoin: What Are the Major Differences?

Litecoin has Attracted Increased Demand from Crypto Whales

The Litecoin miners’ prolonged accumulation wave appears to have spread bullish sentiment across the ecosystem. According to IntoTheBlock, crypto whales have increased their demand for LTC significantly in recent weeks.

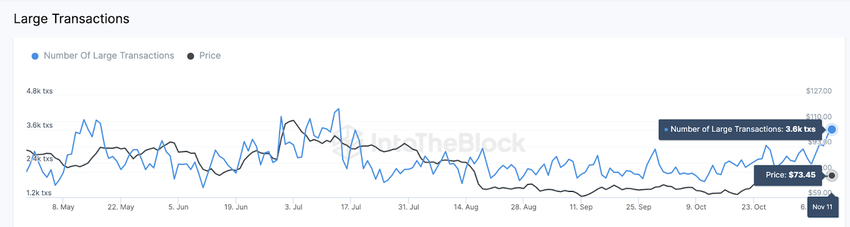

The chart below illustrates how the number of LTC Whale Transactions has consistently increased over the last 30 days. On Nov. 11, it hit a four-month peak of 3,600 large transactions.

The whale transaction metric presents a daily aggregate of the number of trades that exceed $100,000 in value. Typically, a steady increase in whale transactions as observed above is often taken as a bullish signal.

It indicates a growing interest among large institutional investors. And crucially, this coincidence with miners’ recent accumulation wave means that major stakeholders in the Litecoin ecosystem are positioned for an impending bullish price action. It’s only a matter of time before strategic retail traders take on an optimistic disposition as well.

If this thesis holds, the Litecoin price could experience a significant price breakout in the weeks ahead.

Read More: Top 11 Crypto Communities To Join in 2023

LTC Price Prediction: Breaking $80 Resistance Could Catalyze Bigger Gains

Drawing inferences from the aforementioned on-chain data points, Litecoin looks well-positioned for an imminent price breakout.

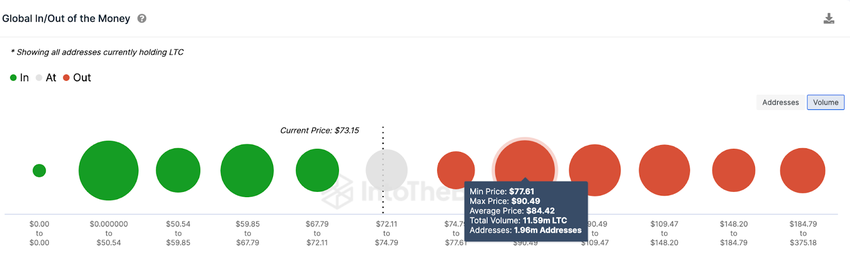

The Global In/Out of the Money (GIOM) data, which groups the current Litecoin investors according to their entry prices, also confirms this bullish LTC price prediction.

It however, shows that the bulls must break the initial resistance at $78 to be confident of reclaiming $80. As depicted below, 1.96 million wallets had bought 11.95 million LTC at the average price of $77.81. If those investors exit early, they could trigger an instant LTC price correction.

But if the bulls can scale that sell wall, the Litecoin price will likely reclaim $80 as predicted.

Still, the bears could negate the optimistic prediction if Litecoin price dips below $65. But, in that case, the 406,590 holders that bought 4.84 million LTC at the minimum price of $67 could offer initial support. If those investors HODL firmly, Litecoin price will likely avoid a larger downswing.

Read More: 11 Best Sites To Instantly Swap Crypto for the Lowest Fees