The Chainlink (LINK) price started 2024 with a sharp decrease that revisited an important Fib support level.

Despite the drop, LINK regained its footing today, retracing a significant portion of the decrease.

Chainlink Struggles to Maintain Increase

The LINK price was one of the first gainers of the crypto market cycle, beginning a significant upward movement in October after breaking out from a descending resistance trend line. The increase led to a new 2023 high of $17.67 in the final week of December.

The LINK price has fallen since. The downward movement accelerated last week, leading to a low of $12.20.

Nevertheless, LINK regained its footing and is creating a long lower wick, though there are four more days until the weekly close.

The RSI is a momentum indicator traders use to evaluate whether a market is overbought or oversold and whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage. Readings below 50 indicate the opposite.

The weekly RSI gives a mixed reading since while the indicator is falling, it is still above 50.

Read More: How to Buy Chainlink With a Credit Card

What Do the Analysts Say?

Cryptocurrency traders and analysts on X are decisively bullish on the future LINK trend.

The CryptoBull believes the LINK price movement was a fractal of Ethereum (ETH) in 2020. Therefore, he suggests the price will increase above $250.

DavidOnCrypto believes that yesterday’s decrease was not the beginning of a new downward trend. He tweeted:

Look at that “Scam wick” just to liquidate leverage longs. & boom! It’s back in the Ascending Triangle.

1w closure in it will keep Asc Triangle intact.

I will update again after weekly closure. It has no choice than to break the $16s res this Q1.

Finally, Commander suggests the price will increase to its range high.

Read More: What is Chainlink (LINK)?

LINK Price Prediction: Is This the Local Bottom?

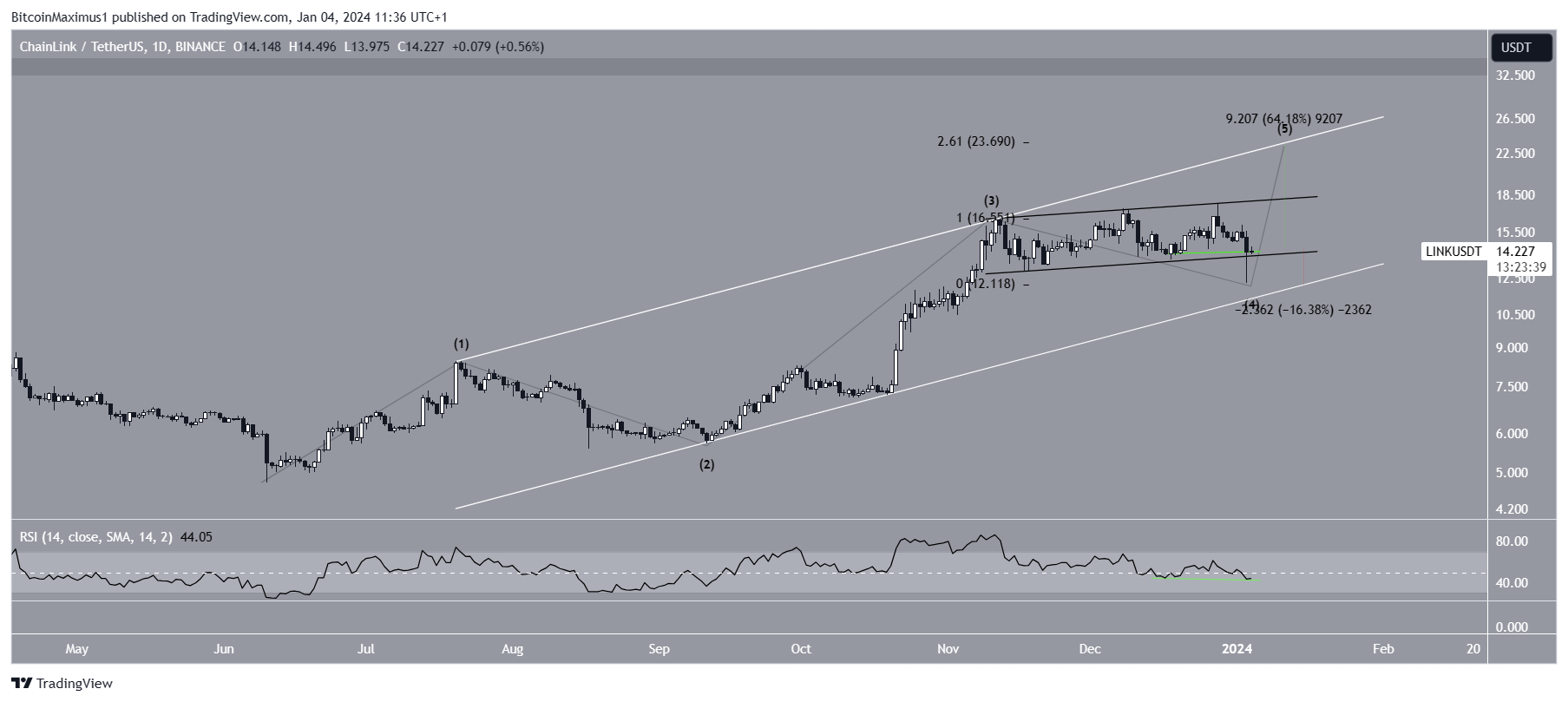

The technical analysis of the daily time frame suggests that the price has reached a local bottom because of the price action and wave count.

Technical analysts use the Elliott Wave theory to identify recurring long-term price patterns and investor sentiment, aiding in trend direction determination.

The current analysis suggests that LINK has initiated the fifth and final wave (black) in an upward movement that started in June. Wave four was contained inside an ascending parallel channel (black). Its bottom nearly reached the support trend line of a long-term ascending parallel channel.

Wave four concluded on January 3, assuming correct counting, and wave five commenced. The hidden bullish divergence in the daily RSI supports this.

In the event of a breakout from the channel, the probable target for LINK’s upward movement is $23.60, representing a 65% increase from the current price.

This target is determined by the 2.61 external retracement of wave four and the resistance trend line of the long-term channel.

Despite the bullish LINK price prediction, a daily close below the channel’s support trend line can trigger a 16% LINK price decrease to the long-term channel’s support trend line at $12.50.

For BeInCrypto‘s latest crypto market analysis, click here