Despite shrouding identities, most cryptos still allow public addresses and transactions to be tracked. This isn’t the case with Zcash, a decentralized crypto that comes with an optimal layer of anonymity. When you use Zcash, you can choose not to reveal the amount transacted or even the public address. But will this additional layer of anonymity work in favor of ZEC — Zcash’s native coin? This Zcash price prediction uses fundamentals, on-chain metrics, and technical analysis to form an in-depth ZEC price prediction model.

- Zcash price forecasts using fundamental analysis

- Zcash tokenomics: can that impact the future price?

- Zcash (ZEC) price prediction using the market cap, trading volume, and trading markets (2022-23 insights)

- On-chain metrics and social growth involving Zcash (2022 insights)

- Zcash price prediction using technical analysis

- Zcash (ZEC) price prediction 2023

- Zcash (ZEC) price prediction 2024

- Zcash (ZEC) price prediction 2025

- Zcash (ZEC) price prediction 2030

- Zcash (ZEC’s) long-term price prediction until the year 2035

- How accurate is the Zcash price prediction?

- Frequently asked questions

Want to get ZEC price prediction weekly? Join BeInCrypto Trading Community on Telegram: read ZEC price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

Zcash price forecasts using fundamental analysis

In a world where pseudonymity is gold, there’s some serious value in anonymity. Zcash allows users to choose between transparent (pseudonymous) and shielded (anonymous) transactions. The network uses famed zero-knowledge proofs, a secure form of cryptography that establishes credibility without revealing identity.

Price forecasts for Zcash look optimistic for the following reasons:

- It is a secure blockchain where the network is safeguarded by PoW consensus.

- With exchanges like Paxful coming down heavily on the PoS giants like Ethereum, PoW might still go the distance. This is speculative, though.

- Miners helping with the network security get the rewards, and some part goes to the ecosystem for further development.

- It uses Bitcoin’s original codebase and is open-source.

- Anonymity is achieved using zero-knowledge proofs.

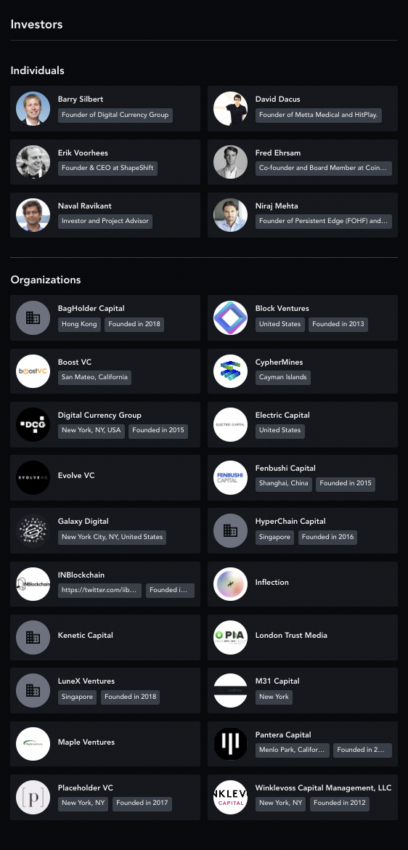

- Zcash has a lot of trusted organizations and individuals invested in it.

Did you know? Ethereum founder Vitalik Buterin is one of the advisors at Zcash.

However, in late September 2022, at the Mainnet 2022 summit, Vitalik mentioned that he expects Zcash to migrate to the PoS ecosystem. The price of Zcash might see some volatility if that happens.

Overall, Zcash looks like a project that can stand the test of time, especially due to its Bitcoin-like schema.

Zcash tokenomics: can that impact the future price?

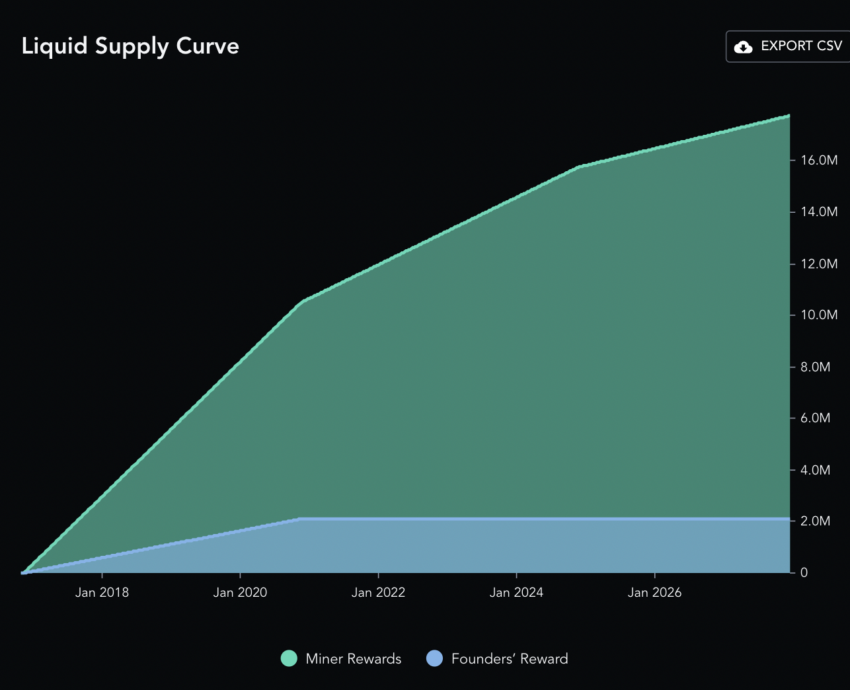

Like Bitcoin, Zcash boasts a mineable and scarce token model. The capped supply of 21 million tokens stands out, and even Zcash follows a four-year reward-halving structure. Currently, close to 16 million ZEC tokens are in circulation, with the next halving event due in 2024. The halving event might happen towards the year’s end, as in 2020, the same happened on November 18.

Also, the 20% Founder’s reward concept was eliminated during Zcash’s Canopy upgrade. Now, a part of the mining rewards goes to the ECC (Electric Coin Company, previously known as the Zcash company), its founders, and the Zcash Foundation — with a focus on ecosystem development.

Here is what the token supply curve looked like initially.

Do note that the miner rewards are still there.

Finally, unlike some of the other popular whale-driven crypto assets in play, top 100 Zcash (ZEC) holders do not even hold 40% of the circulating supply.

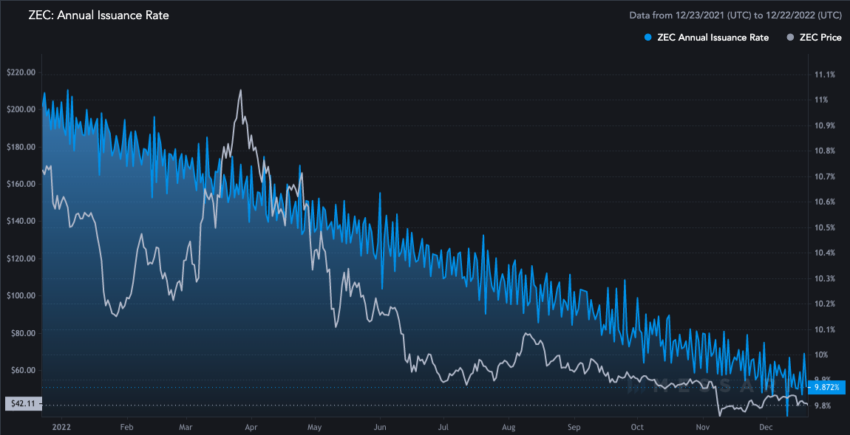

Inference: The token issuance at Zcash is disinflationary — meaning that inflation is gradually reducing. Also, once the scarcity kicks in with all Zcash tokens being mined, we can expect the increased demand to kick in — helping drive the prices further.

Zcash (ZEC) price prediction using the market cap, trading volume, and trading markets (2022-23 insights)

Let us now check the volatility of Zcash, comparing its peak market cap and trading volume to the December 2022 levels. We shall take the trading volume to market cap ratio for calculating the turnover ratio.

Zcash’s market capitalization was the highest on Nov. 26, 2021.

At the peak:

Market cap: $3.88 billion

Trading volume: $1.32 billion

Turn-over ratio: 0.34

As of 19 December 2022)

Market cap: $694.07 million

Trading volume: $45.95 million

Turn-over ratio: 0.066

Therefore, Zcash was way more volatile in the 2022 cryptocurrency market, which makes the Zcash price forecasts a bit topsy turvy going ahead. That is exactly why the prices haven’t surged in 2024 as of yet.

Also, ZEC is one of the more actively traded tokens worldwide and has a decent spread of spot trading markets, per 2022 data. Coinbase’s ZEC-USD is the most popular, followed by Binance’s ZEC-USDT pair.

The liquidity score across ZEC markets is quite good, showing that the volatility hadn’t impacted trading activities. Yet, we shall delve deeper into the technical analysis to know more.

On-chain metrics and social growth involving Zcash (2022 insights)

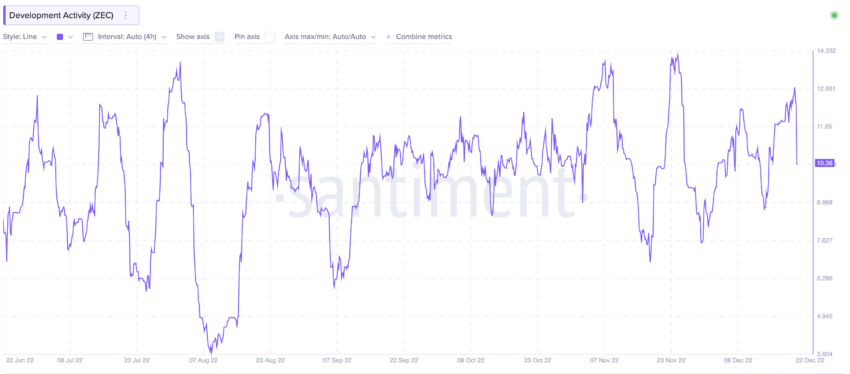

Development activity at Zcash’s counter has been steady since early November 2022. This means network adoption is growing, people are mining, and rewards are being offered.

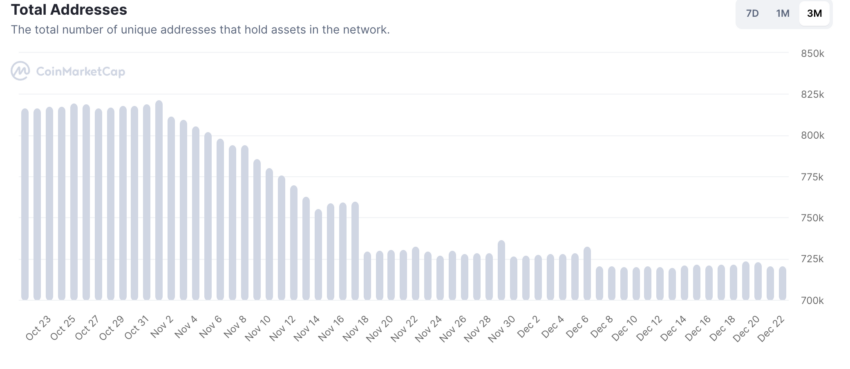

However, one deterrent remains. The total address count holding ZEC has dipped since the October 2022 highs. Accumulation needs to pick up for the prices to show strength.

The social volume is pretty tepid as of November 2022. However, the social chatter for Zcash peaked towards the end of July.

The corresponding price action shows that Zcash responds positively to social chatter.

Most metrics were muted in 2022, a reason why even the price action was tepid throughout.

Zcash price prediction using technical analysis

Looking at the raw chart pattern for ZEC, a pattern becomes clear. We will return to this shortly.

First, here are the things we know about the price of ZEC:

- Zcash’s all-time high price is $5,941.80, which it reached on Oct. 29, 2016. This was long before leading exchanges listed ZEC.

- Binance’s ZEC-USDT chart has ZEC’s high at $372.30 around May 10, 2021.

- According to the chart, the minimum price of Zcash (ZEC) was $17.5 back in March 2020.

Now, we can circle back to the price chart. The trend is clear. A peak, followed by a low, then a set of higher highs to a peak, and then a set of lower highs — mirroring the previous pattern. Let us mark the points and look for price change patterns.

Price change (high to low)

Notice that Pattern 1 and Pattern 2 look like mirror images. According to the foldback pattern rule, price action often traces the historical path. We will use this assumption to predict the future price of ZEC.

Also, notice that even pattern 0, albeit a half-cooked pattern, has a mirror-like similarity to pattern 1. Hence, for ZEC, the foldback pattern might be right.

Now let us mark the highs and lows of pattern 1 and pattern 2:

Now let us focus on pattern 1 and the available data for pattern 2 and find the distance and price changes from the highs to lows and vice versa. Data set 1 is as follows:

A to M = 28 days and -76.95%; B to N = 140 days and -54.59%; C to O = 4 days and -47.23%; D to O1 = 42 days and -76.95%; C1 to O1 = 154 days and 71.77%; B1 to N1 = 56 days and 62.63%

To find the next high that has M1 as the low, we need to find the average of the data provided above:

Distance: 72 days (Max 154 days)

Percentage change: -53% (Max drop 76.95%)

Therefore, the next high, or A1, should be 72 days from M1, and the drop from A1 to M1 should be -53%. We can now plot these points and see where we land.

If we consider M1 as the current low, the next high should be at $74.70 in late January 2023.

Price change (low to high)

Now, let us locate the points from the lows to the highs to see where the low in 2023 can surface for the price of ZEC.

Do note that we have marked the transition point from pattern 0 to pattern 1 as X (a low after A0 and before A). This gives an extra point to work with. Here we can form data set 2:

X to A = 77 days and 198.22% price change; M to B = 140 days and 517.44%; N to C = 49 days and 296.59%; O to D = 70 days and 261.8%; O1 to D = 70 days and 346.22%; N1 to C1 = 63 days and 274.13%; M1 to B1 = 238 days and 552.37%

Now the average comes out to be:

Distance: 101 days (max days 238)

Percentage change: 350%

So the low after A1 might be at a distance of 101 days, and from A1 should be at a 350% higher level than that point. Taking the bearish crypto market into account, the price of ZEC can drop to as low as $16 in 2023. However, there is strong resistance at $17.50, where the drop might stop.

Do note that in 2023, ZCash followed by price prediction for the lows and took support at $19. For more details on our 2023 price analysis, read along:

Zcash (ZEC) price prediction 2023

Outlook: Moderately bullish

Our price predictions for 2023 and the corresponding calculations put the maximum price of ZEC at $74.70 and the minimum price at $17.50. That’s a 76.56% drop.

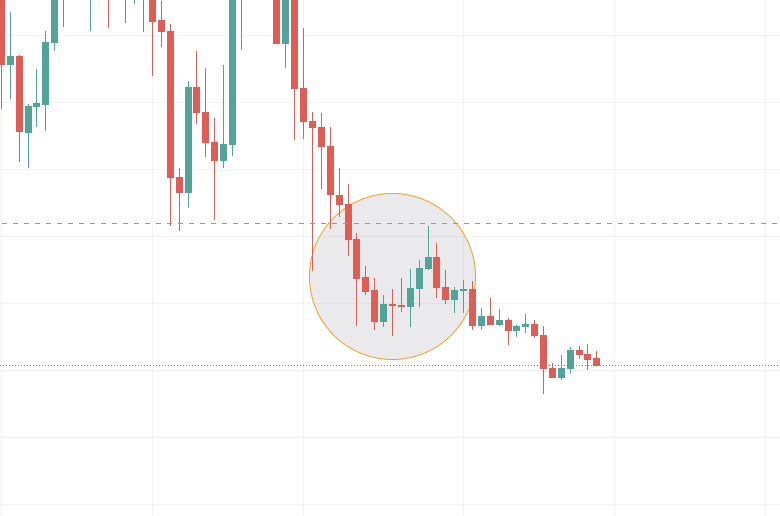

If we look at the short-term (daily chart) of ZEC, the price action doesn’t look all that optimistic.

Firstly, notice a rough inverted flag and pole pattern being broken. ZEC is currently trading at $41.10. We can expect an immediate correction if it corrects further and drops below $38.09. The RSI also shows a bearish divergence pattern, with the price making higher lows and the RSI forming lower lows.

Therefore, the high of $74.70 might take some time to form. Also, the prediction will require a recalibration if the previous low of M1 at $33.5 is breached and ZEC makes a new low. Notably, weak market conditions ensured that in 2023, ZEC could only go as high as $34, making the previous level of $41.10 the highest.

Zcash (ZEC) price prediction 2024

Outlook: Bullish

With the having expected to happen months after BTC halving, we are expecting ZEC to resume the 2023 path in 2024. Here is what we expect:

We shall update the piece should something unexpected happen. For now, the price predictions for 2024 place the high at $74.70 and the minimum price of Zcash at $17.50.

Projected ROI from the current level: 157%

Zcash (ZEC) price prediction 2025

Outlook: Bullish

If ZEC follows the pattern, then the low of $17.50 might kickstart a new higher-high trend for Zcash. This makes sense as, by the end of 2023, we may have seen the end of the current bear market.

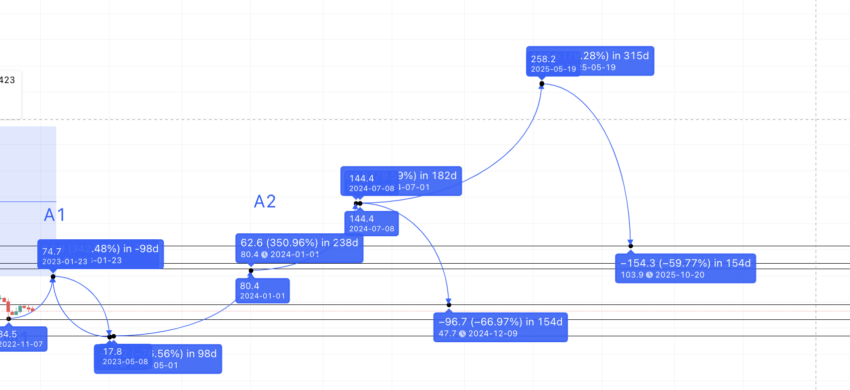

Let’s take the average low-to-high calculations (from data set 2) into consideration. The next high, preferably in 2024, should surface at $80.40. Now let’s use the high-to-high calculations using pattern 1 and the reverse pattern 2 to get the maximum points.

Data set 3 is as follows:

A to B = 175 days and 39.4% price change; B to C = 189 and 84.78% price change; C to D = 91 days and 95.85% price change; C1 to D = 196 days and 23% price change; B1 to C1 = 119 days and 42.04% price change; A1 to B1 = 315 days and 190.34% price change.

The average distance and price change figures come out to be: 180 days (max 315 days) and 79.23%

Therefore, if we plot the next high from 2024’s A2, the point surfaces at $144.4, also in 2024. The low that year can be at a strong support level of $47.7, which also coincides with the low N from pattern 1. Plus, it also adheres to our data set 1 calculation, which returned a maximum drop percentage of 76.95%.

The next high, per table 3 data, can be $259. And while the high can show up by the end of 2024, a more practical assumption would be to put the high after 315 days and, therefore, in 2025, according to Table 3. The low for 2025 can be $103.60 as it coincides with a strong support line.

Here is what the Zcash price prediction for 2025 looks like on the chart:

Projected ROI from the current level: 793%

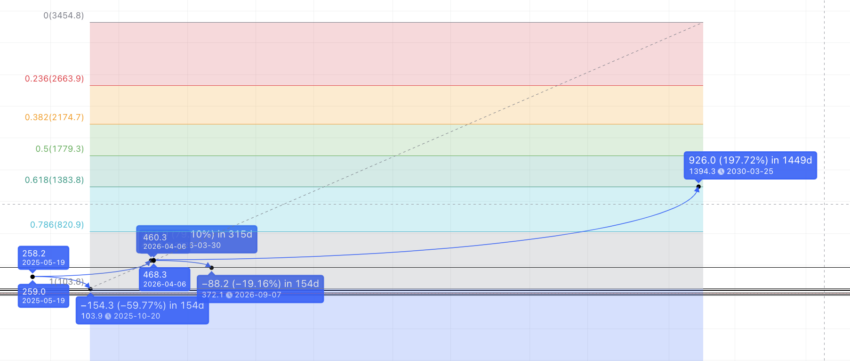

Zcash (ZEC) price prediction 2030

Outlook: Very Bullish

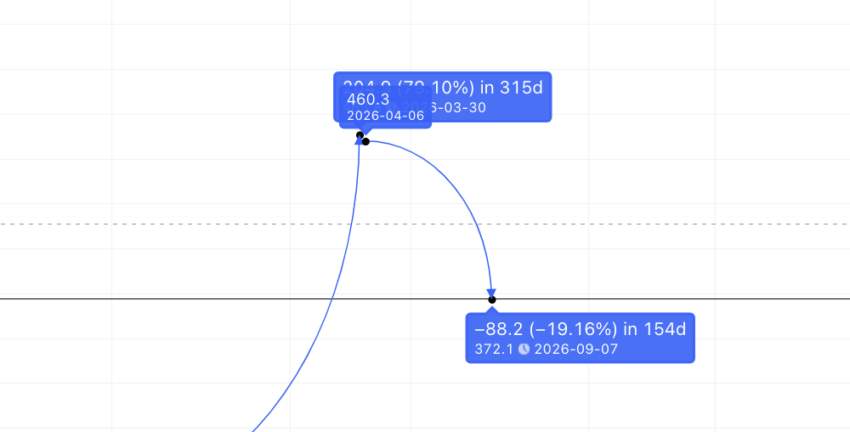

If the price forecasts for ZEC hold till 2025, we can use the 79.23% high and a max time of 315 days to get the Zcash price predictions for 2026.

Let’s check out the future price forecasts for 2026:

The forecast puts Zcash (ZEC) price prediction for 2026 at a high of $463.80. By 2026, Zcash has a chance of breaking the Binance chart high of $372.30. The low could be at $372.30, as that resistance would surely make a great support line.

If we use the 2025 low and 2026 high, we can draw Fibonacci levels to trace the future price path:

That way, the ZEC price prediction for 2030 puts the high at $1,394.30. Do note we have used the same growth slope as in 2025-26. The low can be at $1021.40, which also coincides with the 78.6% of Fib retracement level.

Projected ROI from the current level: 4707%

Zcash (ZEC’s) long-term price prediction until the year 2035

Outlook: Bullish

Here is a table with price forecasts until 2035. Do note that between 2032 and 2034, the Zcash price forecasts put the lows of the year higher than the previous year’s high. This might be a bullish sign and justifies the significant price rise during those years. Also, it’s wise to take the average price of Zcash into consideration. This will provide a more realistic figure than maximum and minimum prices.

You can easily convert your ZEC to USD

| Year | | Maximum price of ZEC | | Minimum price of ZEC |

| 2023 | $74.70 | $17.50 |

| 2025 | $259 | $103.60 |

| 2026 | $463.80 | $372.30 |

| 2027 | $579.75 | $452.20 |

| 2028 | $753.67 | $467.27 |

| 2029 | $1130.50 | $700.60 |

| 2030 | $1,394.30 | $1021.40 |

| 2031 | $1742.87 | $1080.57 |

| 2032 | $2614.31 | $1960.73 |

| 2033 | $3398.60 | $2650.44 |

| 2034 | $4588.11 | $3578.64 |

| 2035 | $5735.15 | $4473.41 |

How accurate is the Zcash price prediction?

This Zcash price prediction model uses fundamentals, technical analysis, and even on-chain metrics to form a practical price forecast. Zcash, a PoW blockchain with zero knowledge proofs as its underlying technology, does look like a promising investment option. With the Zcash blockchain offering a strong anonymity use case, it certainly offers user benefits. Also, the technical analysis puts the ROI till 2035 in pretty good stead for the ZEC coin.

Frequently asked questions

Does Zcash have a future?

What will Zcash be worth in 2030?

Can Zcash reach $1?

Is Zcash a good investment?

Which is better, bitcoin or Zcash?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.