Where can you buy Ethereum ETFs? This guide discusses the best ways to invest in an Ethereum-backed exchange-traded fund, depending on the flavor you want to experience — spot, futures, or leveraged. It is important to note that doing so still constitutes a cryptocurrency investment, and you should be mindful of volatility and other risk factors associated with crypto investing.

KEY TAKEAWAYS

• Ethereum ETFs provide an easy way to gain exposure to ETH’s price without directly holding the cryptocurrency.

• Futures-based Ethereum ETFs allow investors to speculate on Ethereum’s future price, while spot ETFs offer direct tracking of ETH’s market price.

• Leveraged ETFs allow investors to amplify their gains or losses, making them high-risk options that require a thorough understanding.

• Before investing in Ethereum ETFs, you should consider the volatility of cryptocurrency, and the fees associated with each ETF product.

How do I invest in an Ethereum ETF?

An Ethereum ETF is a standard financial product, like any other exchange-traded fund, only with ETH as the underlying asset. Unlike BTC ETFs, which come in a number of different flavors, including Bitcoin futures, inverse price connections, Bitcoin options, or even companies holding BTC, Ethereum ETFs are more one-dimensional.

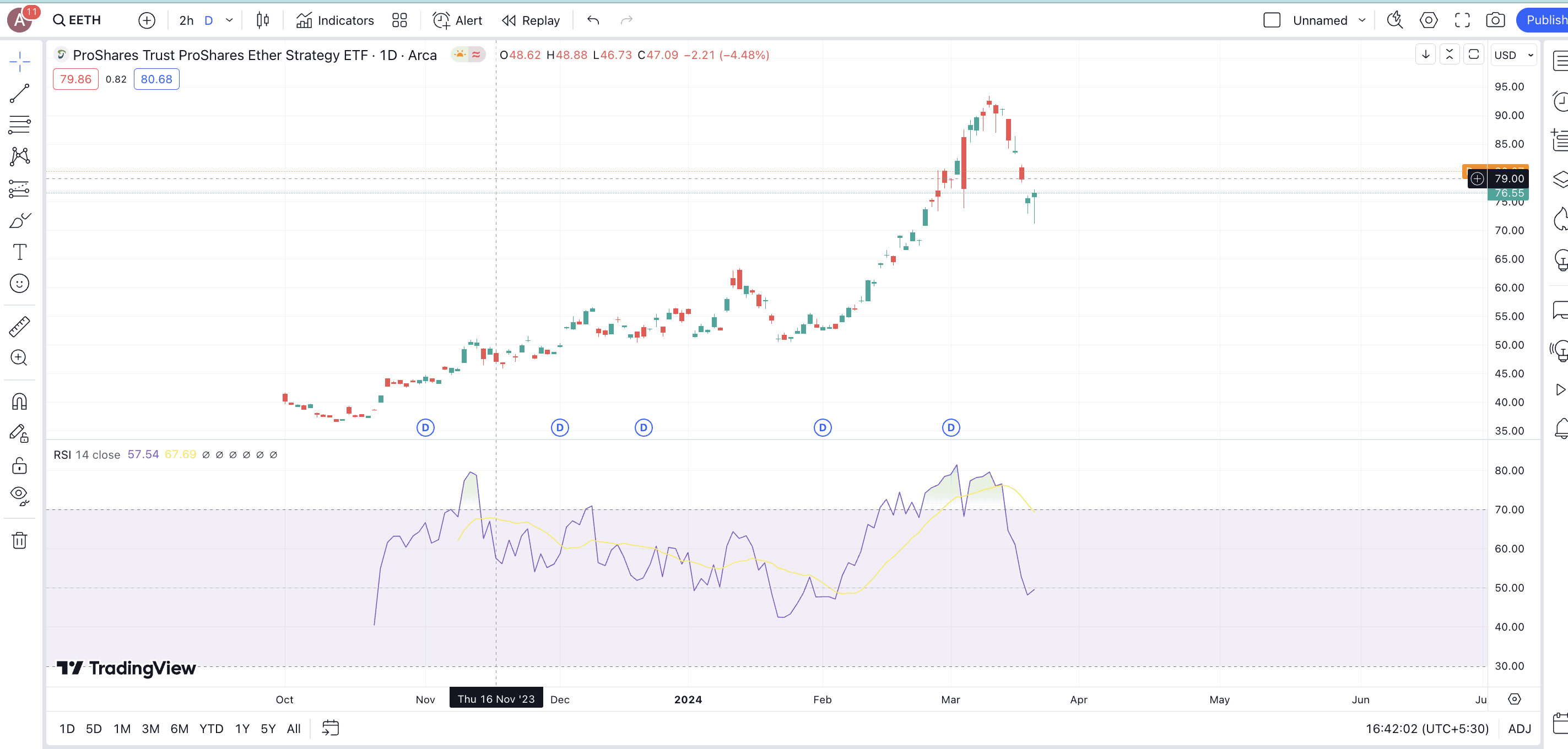

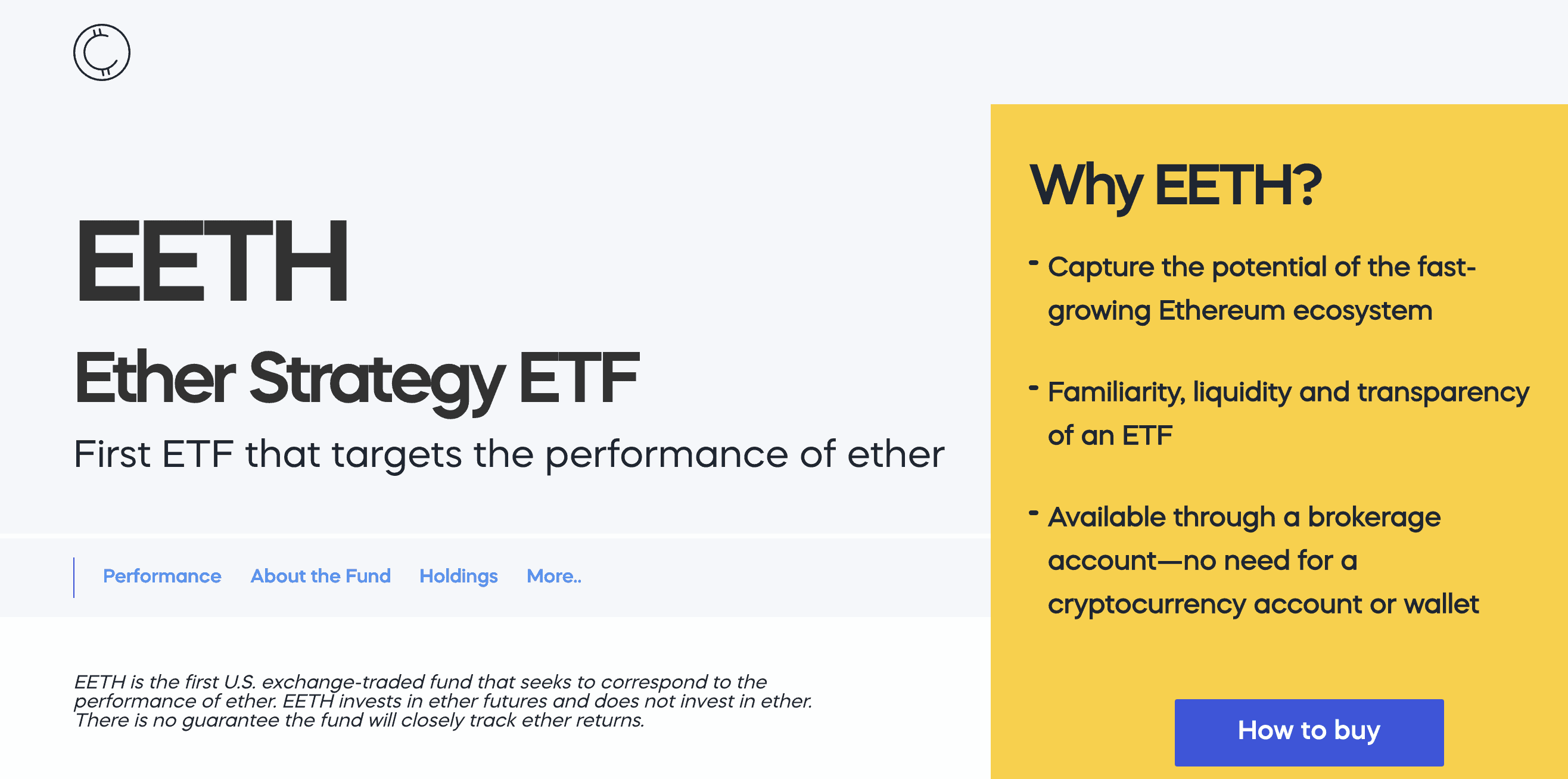

In 2025 in the U.S., you can invest in futures Ethereum ETFs or even an inverse Ethereum ETF product (ETH3S) provided by Gate.io. However, outside of the U.S., there are several spot exchange-traded funds or exchange-traded product picks available for investing. Here’s how to invest in Ethereum ETFs.

Investing in futures ETH ETFs

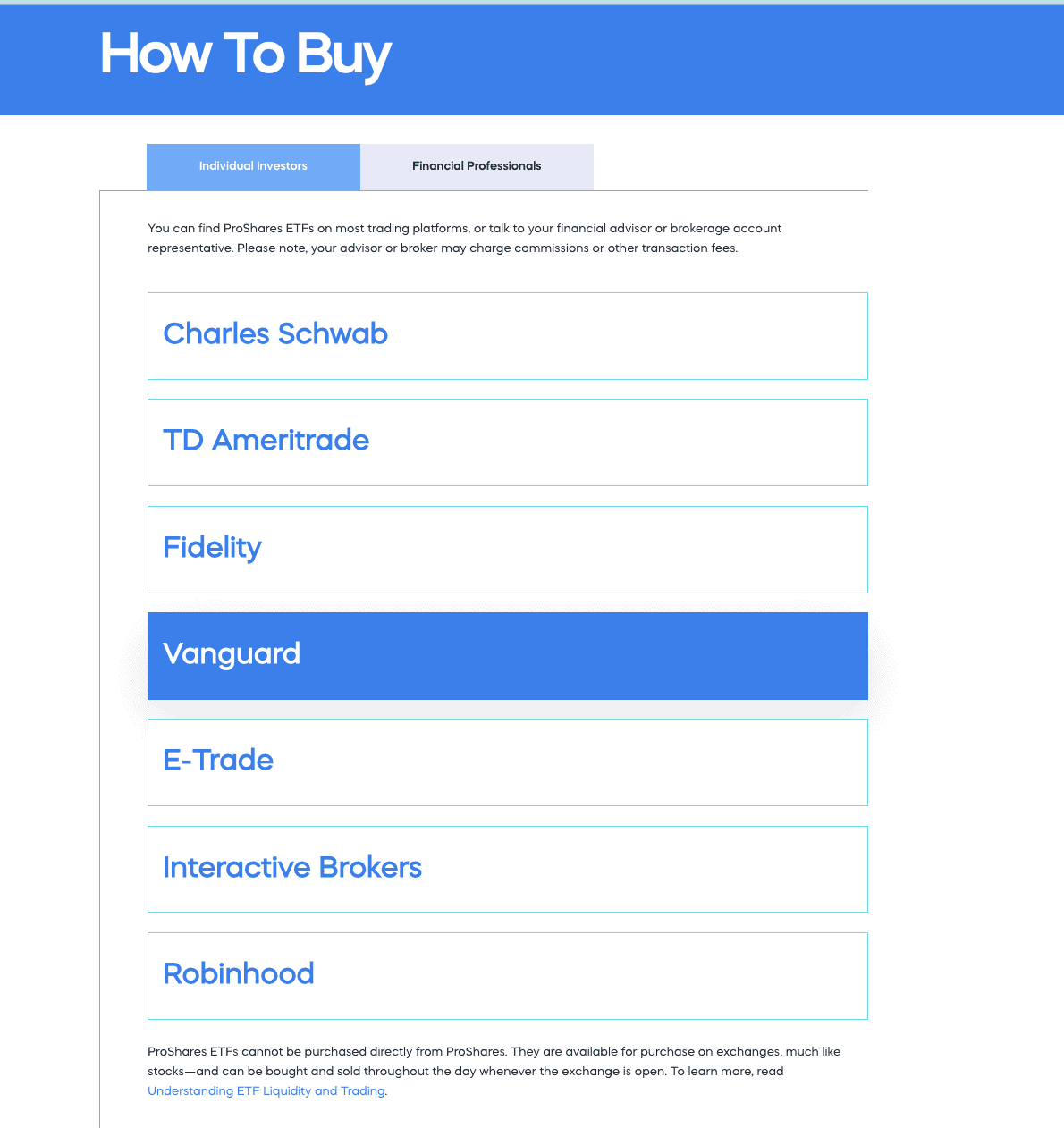

1: Head over to the official website, which, in this case, can be accessed by clicking this link.

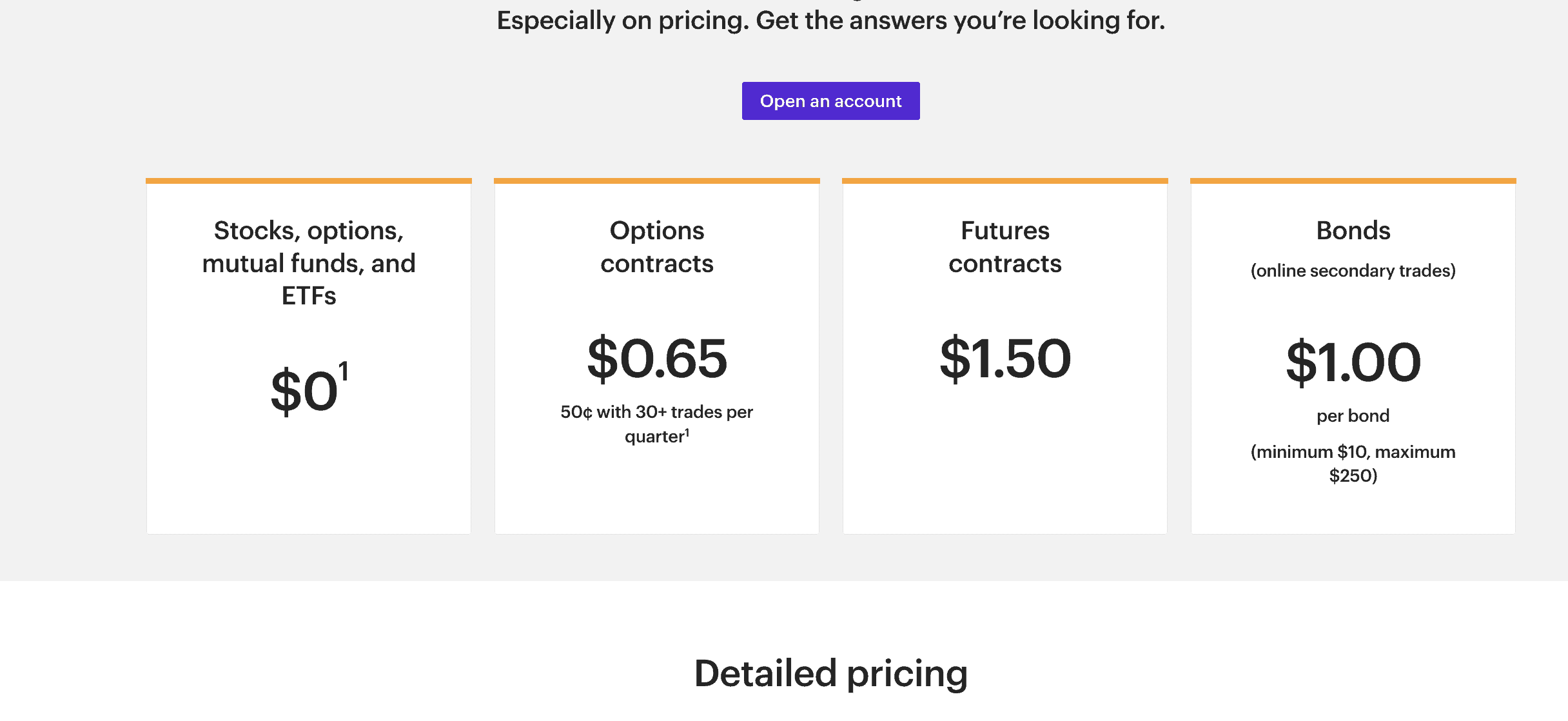

2: Once there, click on “How to buy” and choose from the listed brokerages.

3: For any brokerage firm you choose, you must create an account and get KYC-verified. Only then can you start trading or investing in an ETH ETF.

Futures ETH ETFs are trading globally, including in the U.S.

These ETFs have fund issuers invest in expiring Ethereum futures contracts, allowing investors to speculate on the future price of ETH.

The creation and redemption process of futures ETFs also takes into account the rollover costs — the additional overheads that need to be paid once the contracts expire.

Did you know? VanEck Ethereum Strategy ETF (EFUT) is the only Ethereum futures ETF structured as a C-Corp. This ETF invests in standardized, cash-settled ETH futures contracts traded on commodity exchanges registered with the Commodity Futures Trading Commission (CFTC), specifically on the Chicago Mercantile Exchange.

Investing in spot ETH ETFs

Here are the associated steps to purchase a spot ETH ETF:

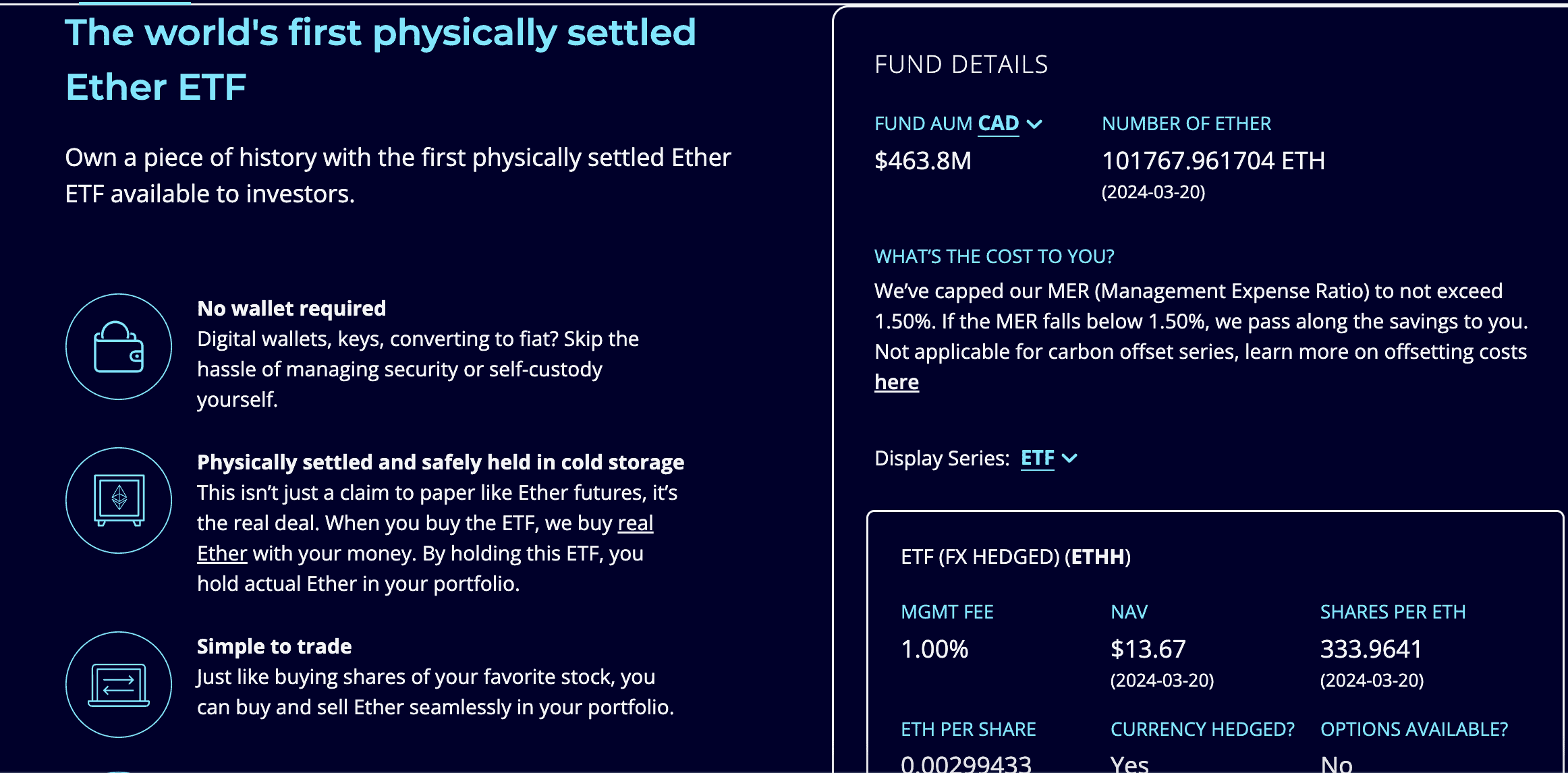

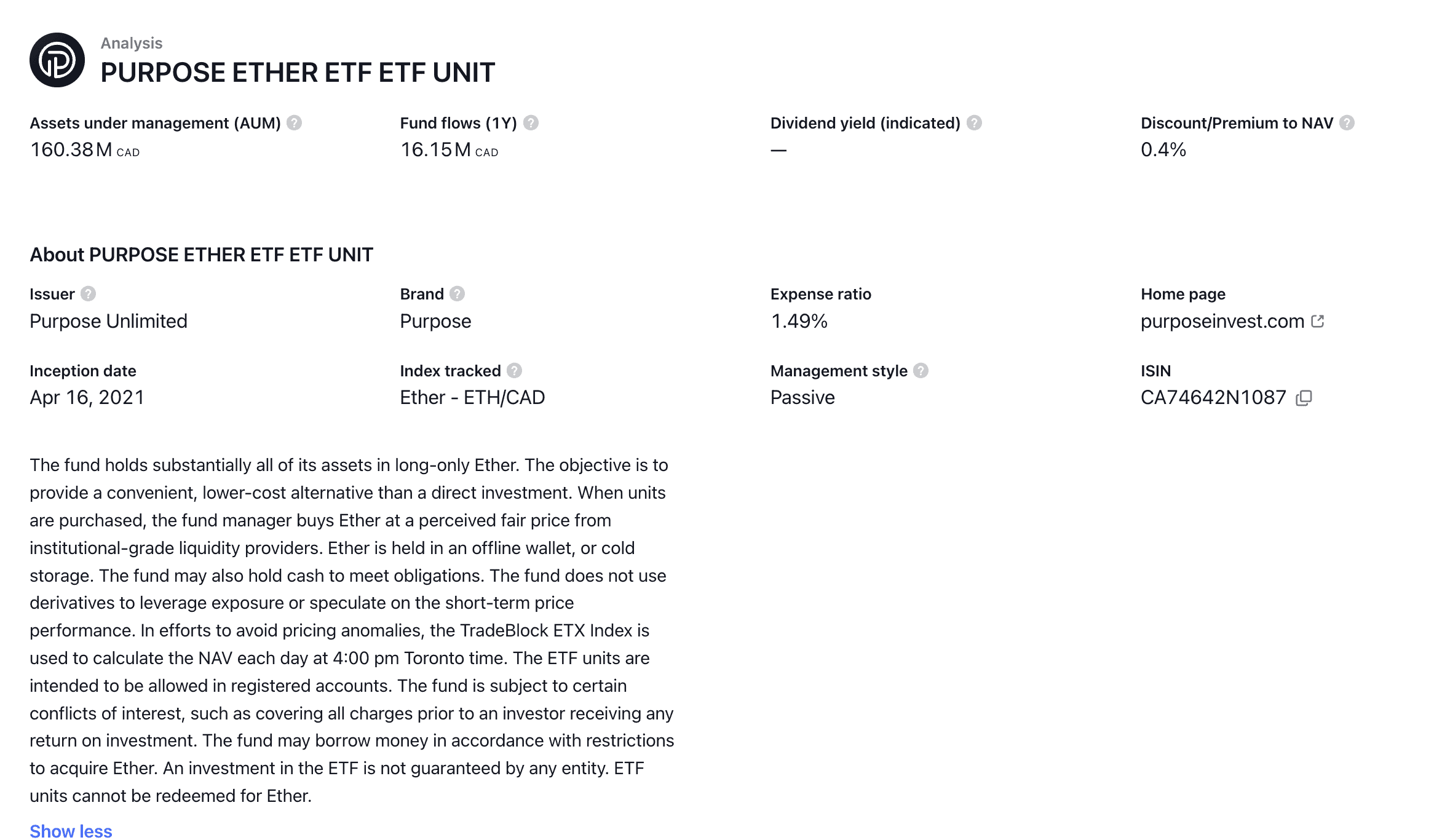

1: Choose the spot ETF you want to buy — ETHH, ETHX.B, ETHQ, etc.

2: Locate the brokerage firms that allow you to set up an RRSP, TFSA, or even a non-registered account to use for buying these spot ETFs.

3: You can onboard RBC Direct Investing, TD Direct Investing, Questrade, or Interactive Brokers to track and buy spot ETH ETFs.

Before making any purchase, it is advisable to check the asset’s accessibility and market risks.

Notably, Purpose Ethereum ETF has Coinbase as its ETF sub-custodian, helping with the creation and redemption process.

If you reside outside of the United States, you can invest in the likes of the Purpose Ethereum ETF and other spot trading options.

Spot Ethereum ETF prospects

In Q2 2024, the U.S. Securities and Exchange Commission (SEC) approved Ethereum ETFs. The first wave of ETFs began trading on July 23, 2023. However, the reaction to the ETH ETFs was not as strong as that seen by the Bitcoin Spot ETF approval earlier in the year.

Investing in leveraged ETH ETFs

While we have assessed some of the options above, some users will be looking to invest in Ethereum ETFs directly, say via an exchange. There are a few options where you can do so.

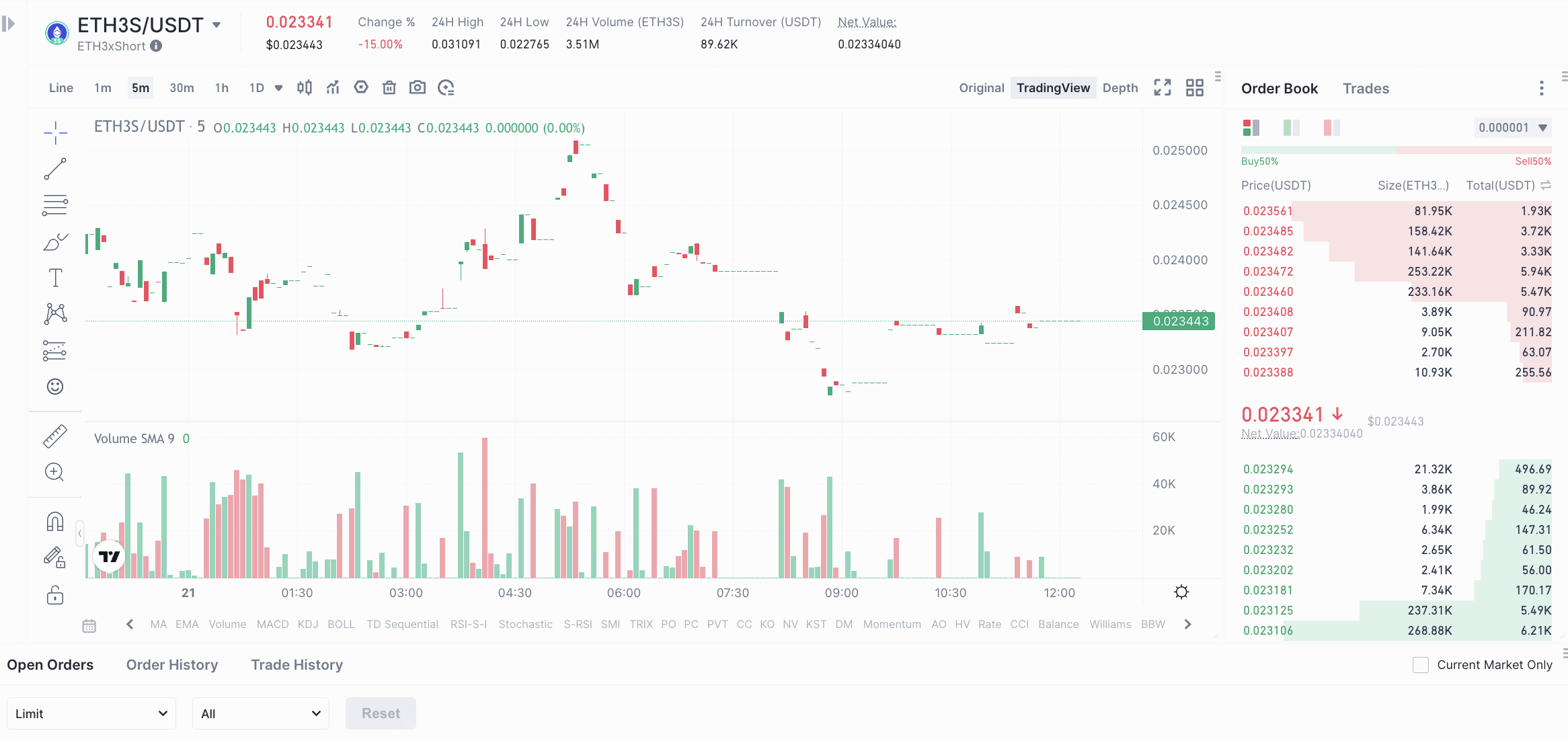

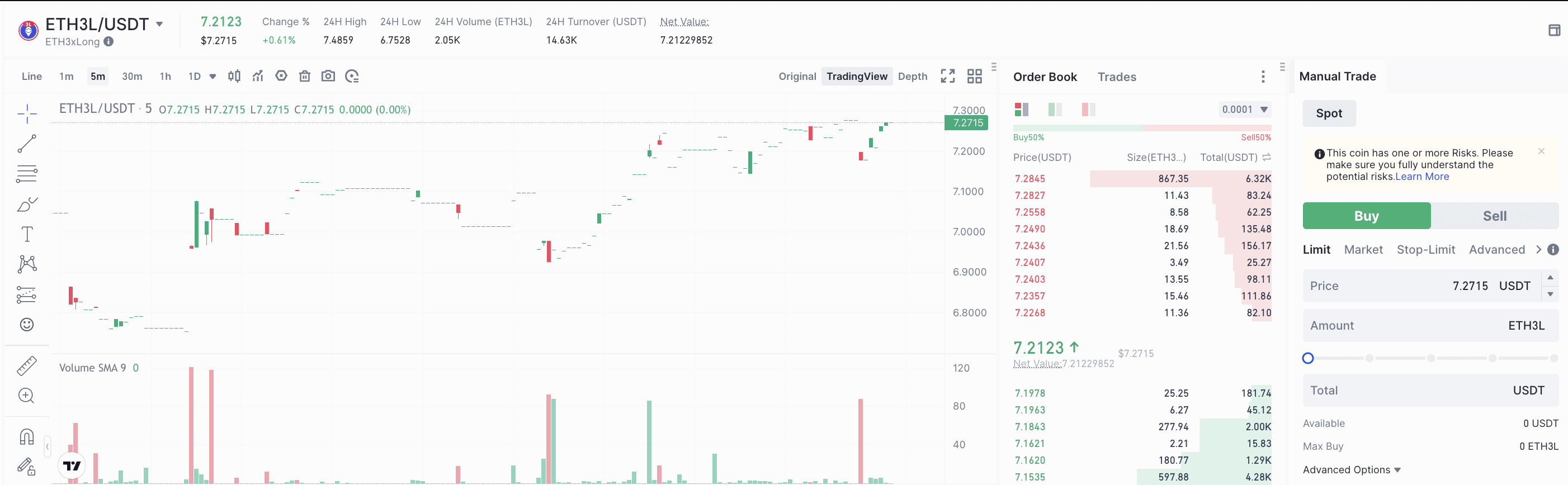

Unlike the Bitcoin Inverse ETFs, Ethereum has fewer leveraged ETH ETF picks. The only one that’s trading in 2024 is Gate.io’s ETH3S or the 3X Ethereum ETF. Also, it isn’t an ETF in the traditional sense but an inverse leveraged token, which stands for 3X short.

Here are the steps to invest in a leveraged ETF.

1: Open a Gate.io account.

2: Understand how the product works. For instance, if the price of ETH is correct by $10, your ETF portfolio will correct by $30 or in the same 1:3 ratio.

3: Fund your Gate.io account. You can choose direct crypto transfers, credit/debit cards, or even third-party services like Banxa. The funding methods might vary, depending on your geographical location.

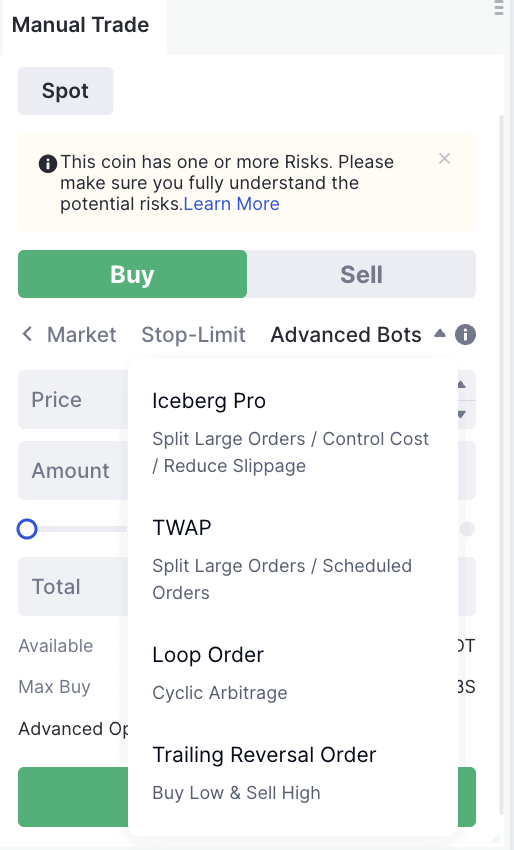

4: Choose the order type — Limit, Market, Stop-Limit, etc, to place the leveraged traded at the best possible price. With Gate.io, you can even utilize trading bots to navigate this Ethereum ETF for you.

A good thing about the ETH3S is that the leverage is adjusted to 3:1 at the end of the trading day. Gate.io also has an ETH3L ETF or token, which reacts positively to the ETH-specific price rise, unlike the ETH3S.

Which Ethereum ETF to choose?

Besides the mentioned ETF variants, several ETH ETPs also exist. However, these ETPs are often region-specific and require you to contact listed brokerage firms to obtain them.

For instance, ETC Group listed the ETC Group Ethereum Staking ETP on the Germany-specific Deutsche Börse XETRA. BeInCrypto connected with ETC Group’s Head of Product, Chanchal Samadder, to find out more. Samadder noted:

“We view this as a positive development. Staking offers investors the complete economic benefits of Ethereum and leads to improved outcomes. However, the approval of these products by the Securities and Exchange Commission (SEC) remains uncertain.

Drawing from our experience with launching our Staked ETH product, building a staking product is significantly more complex and introduces a range of new risks. If issuers lack deep familiarity with the technical aspects of the Ethereum protocol and do not have expertise in exchange-traded products (ETPs), it could potentially harm investor outcomes.”

Chanchal Samadder, Head of Product, EIC Group: BeInCrypto

Notably, if the staking component comes to the spot ETH ETFs in the U.S., it could make investing in Ethereum ETFs more lucrative.

Regulatory concerns regarding ETH ETF investing

Before you invest in ETH ETFs, it is advisable to track the regulatory waters associated with these products. In the U.S., the SEC tracks every move made by issuers who have already requested a spot ETH ETF.

Those eyeing Europe-specific ETH ETF and ETP picks should note that these are governed by the Markets in Financial Instruments Directive (MiFID) and the Undertakings for Collective Investment in Transferable Securities Regulations (UCITS).

The Ontario Securities Commission (OSC) handles the regulatory approval part for products related to the Canadian mainland. It is advisable to check the regulatory approval of any ETF or ETP before investing.

Why invest in ETH ETFs

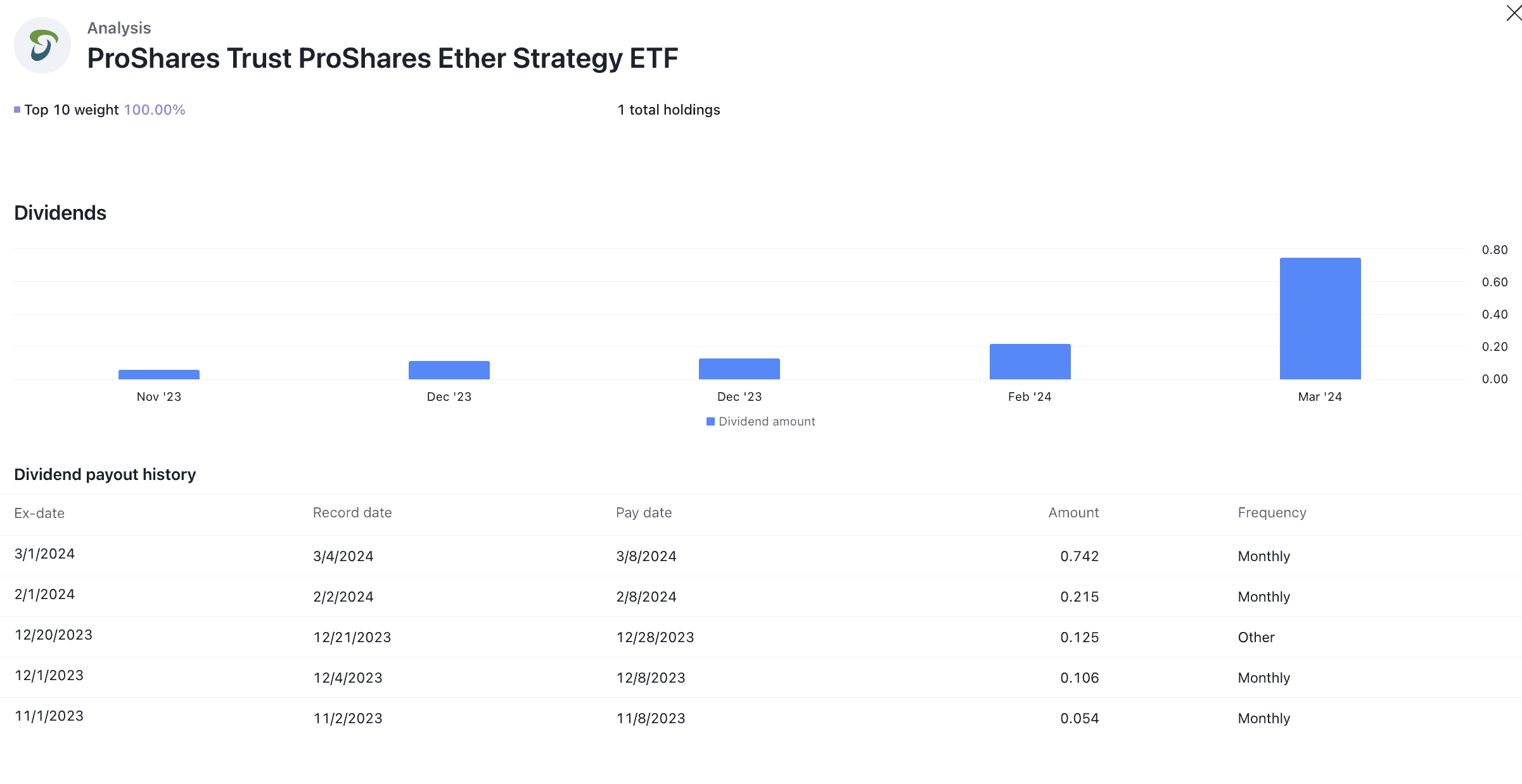

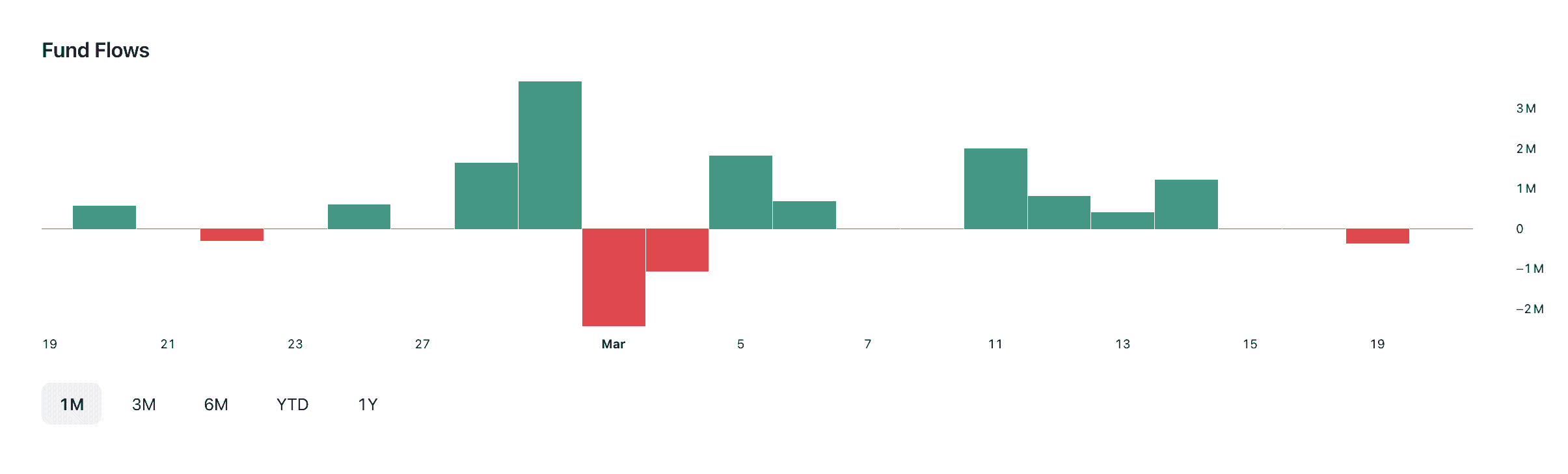

Firstly, ETH ETFs give investors exposure to Ethereum’s price in one way or another. This happens via regular TradFi firms and stock exchanges. Plus, ETH ETFs can also help generate passive income. For instance, the ProShares ETH Futures ETF offers dividends.

Plus, Ethereum, being a proof-of-stake (PoS) crypto now, has the staking element in play. Many prospective issuers didn’t consider this aspect in the first place. BeInCrypto reached out to Lark Davis, CEO of Wealth Mastery, for further expert insight:

“Ethereum ETF products are potentially even more bullish than Bitcoin. The reason is that Ethereum does so much more than Bitcoin. For example, if you want exposure to NFTs or stablecoins or gaming, buy Ethereum.

Plus, Ethereum ETF will likely have staking rewards basically as dividends for ETF holders. And to make it even more interesting Ethereum is deflationary. My guess is that these products were very popular with Wall Street.”

Lark Davis, Founder of Wealth Mastery: BeInCrypto

Refer to our data-backed Ethereum price prediction to further understand the lows and highs we can expect should such a sentiment-driven scenario surface.

Ethereum or Ethereum ETFs: Which to invest in?

For those who want to steer clear of exchanges and wallets and buy Ethereum ETFs, this guide has set out a number of options and. Overall, if you are looking for a long-term cryptocurrency investment, looking at Ethereum directly might make sense.

Whether you invest directly in ETH or into an associated ETF product, ensure you are aware of the risks and fees involved. Never invest anything you cannot afford to lose, and don’t get caught up in FOMO. Like with an investment, when you buy Ethereum ETFs, profits are never guaranteed. Crypto is a volatile arena, whether you are directly or indirectly exposed to the asset.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in Ethereum or ETH ETFs carries risk.