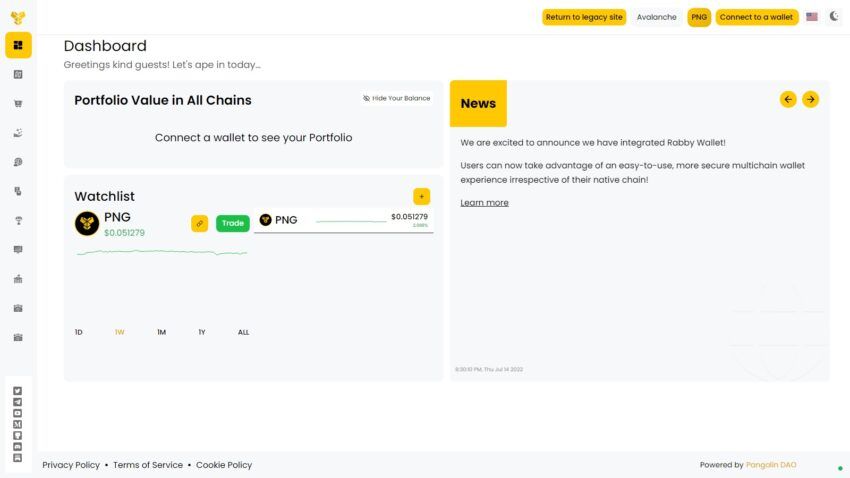

The Pangolin crypto exchange is an AMM running on Avalanche that supports fast and cheap trades. Here, we discuss the Pangolin exchange, the PNG token, its tokenomics, and everything else you need to know about the decentralized exchange in 2024.

KEY TAKEAWAYS

► Pangolin is a DEX on the Avalanche blockchain, offering fast and cheap trading by utilizing an AMM model similar to Uniswap.

► Pangolin differentiates itself with unique offerings such as Super Farms and limit orders, and it leverages Avalanche’s high transaction speeds and low fees.

► The PNG token, Pangolin’s governance token, is designed with a capped supply to support community-driven development, governance participation, liquidity mining, and staking rewards.

► Given its strategic advantages on the Avalanche network and a suite of innovative features, Pangolin is poised to grow and potentially become a significant player in the DeFi space.

What is the Pangolin Exchange?

Launched in Feb. 2021 by Ava Labs, Pangolin is an AMM-powered decentralized exchange (DEX) running on Avalanche. It employs the same AMM model as Uniswap. It has a native governance token, PNG, a community-distributed token capable of trading all tokens hosted on Ethereum and Avalanche.

Ultimately, the platform offers fast and cheap trades and community-driven development. It is committed to bringing users the best trading opportunities to find and maximize their profits. Additionally, it supports the Ethereum Virtual Machine (EVM) to allow Ethereum users to transact and swap tokens on the platform.

Pangolin benefits from several of the features Avalanche has over Ethereum, including faster and cheaper transactions. It can execute 4,500 transactions per second (TPS), while Ethereum can only process 15–30 TPS.

With Avalanche’s scalability, Pangolin is able to process much more transactions than other AMM DEXs on Ethereum. In addition, Avalanche’s reduced gas fees make trading on Pangolin cheaper than AMMs hosted on Ethereum.

How does the Pangolin crypto exchange work?

Pangolin is based on Avalanche, and it easily supports Ethereum tokens with improved and cheaper transaction processing but with faster finality, higher throughput, and support for the Ethereum network and token standards.

The AMM protocol works so that traders can execute trades against assets in the liquidity pools. However, users can also boost the liquidity pools by depositing funds.

To become a liquidity provider on Pangolin Exchange, you must provide two assets into the pools. When trades are executed, fees are attached, which are then used to reward traders who provide liquidity on the platform.

Besides providing liquidity, Pangolin allows users to swap, stake, farm, and bridge tokens from one network to another. Below are detailed steps on how to go about these.

Swap tokens

Swapping tokens on Pangolin is an easy way to trade one Avalanche token for another Ethereum token via automated liquidity pools.

Pool and farms

Pangolin offers one of the best DEX functions on Avalanche. The Super Farm feature offers liquidity mining. Typically, users can earn up to 115% APR by farming on liquidity pools.

Stake

Staking on Pangolin is straightforward and offers returns of around 24%. You’ll need an Avalanche or Ethereum-supporting wallet.

What makes Pangolin unique?

Pangolin is a gold-standard decentralized exchange for the Avalanche ecosystem. Essentially, it brings centralized exchange (CEX) functions to a decentralized exchange (DEX). Some of these features include limit orders, Super Farms, and other useful tools.

- Swaps: The protocol has a straightforward user interface with all details well laid out. It charges a 0.3% fee on each swap, which goes to liquidity providers, 0.25%; PNG stakers, 0.0425%; and then to Pangolin DAO’s swap fees wallet, 0.0075%.

- Limit orders: Similar to using a CEX, Pangolin users can set limit orders on their preferred tokens on the protocol. Limit orders can also be used as an arbitrage strategy to profit from market price fluctuations.

- Super Farms: Pangolin’s Super Farms is a unique concept that helps improve the liquidity of the overall protocol. Many of the Super Farms strategies involve various reward tokens. Examples of Pangolin partners offering tokens include Lost Worlds (LOST), Kalao (KLO), and Heroes Chained (HEC).

- Liquidity mining program: Pangolin’s liquidity mining program distributes PNG to pools with AVAX and PNG as base tokens. When the base token within a pool is not AVAX, the pool’s liquidity is determined by the base token’s equivalent value to AVAX.

- Bridges: Using the Avalanche Bridge (AB), users can swap ERC-20 tokens from Ethereum to Avalanche’s C-Chain and vice versa.

Benefits of Pangolin

Pangolin offers a number of benefits. These include:

Wide token selection

Since it’s compatible with all of Ethereum’s tools, the Pangolin crypto exchange offers users seamless access to new tokens. You can transfer stablecoins (USDT, USDC, etc.) and ETH from the ETH chain to Avalanche’s chain using the deposit features.

Multi-connection

The Pangolin built a platform that can be easily integrated with multiple wallets from different blockchains. For example, users can connect to MetaMask and explore various ERC-20 tokens.

Cheaper transactions

One of the most enticing elements of Pangolin is its cheap fee model. It reduces the expenditures on gas due to its underlying blockchain network. This means that you can execute trades on the Pangolin exchange at a much cheaper cost than Ethereum-based DEXs such as Uniswap and SushiSwap.

Pangolin is faster

Inheriting the features of Avalanche, Pangolin users’ transactions usually get processed within a few seconds. With faster trades, users can also reduce slippage and make more informed trading decisions.

Swift transactions increase users’ earning rates, as they can leverage many arbitrage trading opportunities.

What is the Pangolin token (PNG)?

PNG is the governance token of the Pangolin crypto exchange.

Tokenomics

Pangolin’s PNG is fully decentralized and distributed to the community. As set out in the token litepaper, the team, advisors, and other parties are not allocated any PNG tokens.

The token was initially scheduled to release 256 million tokens for the first four years and half of the previous release for every subsequent four-year cycle. However, the tokenomics was altered in September 2021, with the total maximum token supply reduced to 230 million.

The initial tokenomics allocated 95% of tokens for liquidity mining and the remaining 5% for Airdrops. Currently, around 83% of PNG goes to liquidity providers, and 13% is allocated to the treasury.

PNG token utility

Ultimately, PNG’s main application is to govern the Pangolin crypto exchange. Holding the token allows users to participate in Pangolin’s governance. As a decentralized protocol, proposals come from the community.

These proposals are then voted on. Likewise, the token provides basic functionalities, such as facilitating a community treasury, protocol fees, etc. PMG holders can also engage in staking and farming to earn rewards in pools.

To learn more about the PNG’s potential price performance, check out BeInCrypto’s PNG price prediction.

What is the future potential of Pangolin?

Due to its placement on the Avalanche blockchain, Pangolin offers fast and cost-effective trades. With unique features like Super Farms, limit orders, and wide token compatibility, it sets itself apart. from exchanges like Uniswap.

However, due to the growth of the Avalanche ecosystem, Pangolin is no longer the competitor of DEXs on Ethereum but the ones right at home on Avalanche. With continued development and integration of new features, Pangolin could expand its influence as a key player in Avalanche’s DeFi ecosystem.

Frequently asked questions

Is Pangolin an exchange?

How do you use the Pangolin exchange?

Is PNG crypto a good investment?

Where can I buy Pangolin crypto?

What is Pangolin DEX?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.