Understanding the right crypto trading strategies is important for trading effectively, with many methods at your disposal to master. Basic knowledge of candlestick patterns and indicators is a valuable starting point. However, more is needed to guarantee sustained success in the trading world. Here are our prime crypto trading strategies to try out in 2025.

KEY TAKEAWAYS

► There are multiple crypto trading strategies available, each with unique strengths and risks based on risk tolerance and personal goals.

► Effective trading involves using strategies like DCA, FA, and RSI to mitigate risk, but none guarantee success in the volatile crypto market.

► While leverage trading can amplify gains, it also magnifies risks significantly, making it suitable only for experienced traders.

► Success in crypto trading requires ongoing education, practice, and adjustment of strategies, as there are no shortcuts to consistent profits.

The top crypto trading strategies of 2025

The following table provides a brief summary of each strategy. Each method carries its own strengths and risks, so you should select the method that suits you best.

| Strategy | Description | Difficulty |

|---|---|---|

| Dollar-Cost Averaging (DCA) | Regularly buying fixed amounts of an asset over time to offset volatility and avoid timing the market. | Easy |

| Crypto Fundamental Analysis (FA) | Analyzes the intrinsic value of a crypto asset by evaluating factors like project team, tokenomics, market cap, and demand. | Medium |

| RSI Divergences | Identifies overbought or oversold conditions and divergences to anticipate potential price shifts in ongoing trends. | Medium |

| Crypto Breakout Trading | Borrowing funds to trade larger positions than one’s capital potentially amplifies both gains and losses significantly, making it high-risk. | Hard |

| Crypto Leverage Trading | Borrowing funds to trade larger positions than one’s capital allows and potentially amplifies both gains and losses significantly. | Hard |

| Trading Signals | Following expert traders’ buy/sell signals, often through paid services or Telegram groups, to make informed trades based on market analysis and technical indicators. | Easy |

1. Dollar-cost averaging

Dollar-cost averaging (DCA) is the practice of performing regular, usually smaller, purchases of an asset over time. It is usually a form of accumulating and “HODLing” (a popular misspelling of “holding”).

There are a few different ways to look at this, but let’s start with a situation where you want to buy $1,000 worth of Bitcoin and hodl it for several years as you believe it will continue to appreciate.

You could buy $1,000 today at whatever price you believe it has a long way to go up anyway. You could also try to “time the market,” and wait for a significant dip, assuming you believe one is coming.

These are fair options but rely greatly on uncertainty, chance, and faith. An alternative to this is DCA. In this scenario, you take that same $1,000 and buy, for example, $100 a month for 10 months.

By doing this, you can significantly offset volatility in the market. This means that while you probably didn’t buy at the best lows on average, you also likely didn’t buy all the highs either.

The idea is that when applied to a market that is in a long-term uptrend, as Bitcoin is believed to be, you will generally do much better than blindly making a one-time purchase or trying to buy the bottoms.

Any long-term investor who just regularly takes a percentage of their paycheck (that they can afford to lose), and purchases Bitcoin, or any other appreciating asset, with it is enacting a simple form of this crypto trading strategy.

Timing the market

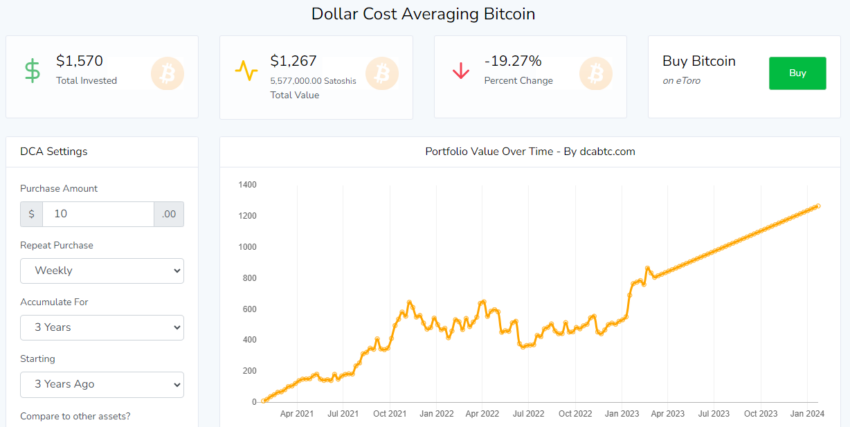

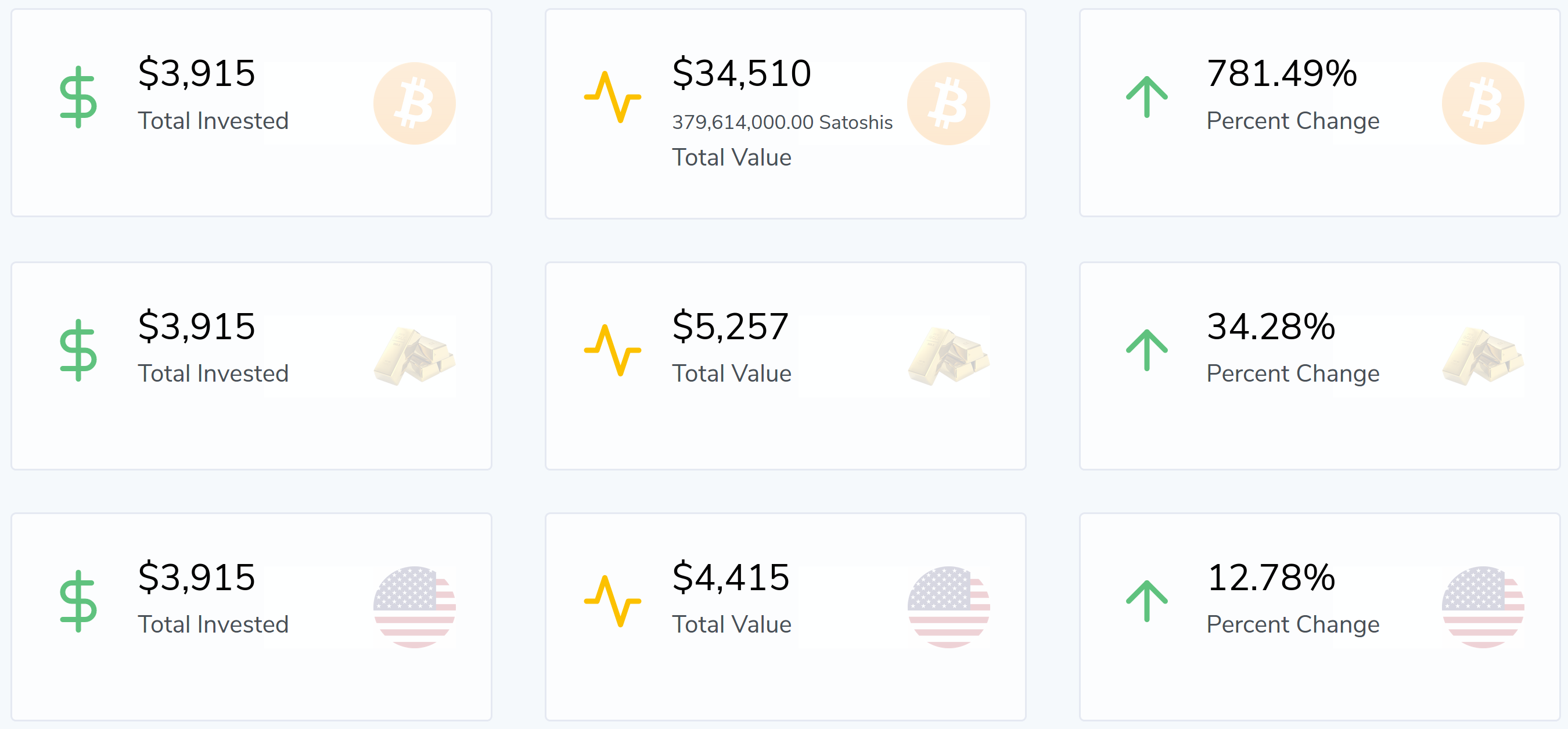

By using a Bitcoin DCA calculator, you can see how much you could have made by DCAing over time. Say, a $15 purchase weekly over the last five years:

You can even compare it to other assets, like gold and the stock market. In the case of day trading Bitcoin, the gains that have been possible absolutely dwarf these other investments.

There is a more advanced version of DCA that combines it with other strategies, including the ones below. In this version, you can still make regular purchases, but only when certain conditions are met.

Unlike trying to time the bottom mentioned above, you may simply set limit orders for certain favorable price levels.

This can give you a higher degree of control over when you buy. But of course, you will want to be sure you understand how to read the market first. Otherwise, you could actually underperform compared to the more “hands-off” approach.

2. Crypto fundamental analysis

Fundamental analysis (FA) has traditionally been used to look for the intrinsic value of the company behind a stock. This would help determine if the current stock price was above or below this value and buy or sell accordingly.

This meant looking at the company’s financial numbers, like sales, profit margins, etc. What does the company make? Is there a market for it? How much competition?

Analyzing cryptocurrencies can be a bit different, but there are parallels. Some coins have companies behind them, offer utilities, and are structured at least similarly to legacy stocks. Others are closer to commodities like gold or fiat currencies.

The first step to performing useful FA is determining what kind of asset you’re dealing with. To this end, there should be some pretty solid and clear documentation available, presumably from either a team website or a community repository.

Read the whitepaper, see what people are saying, and ask yourself if you understand what kind of asset this is and if there is a real demand for it.

If there is a team behind the project, who are they? They ideally should be transparent about their credentials and history. If they can show other successful projects they have worked on, all the better. When you cannot determine the names and faces behind a project, this could potentially be a huge red flag.

If you give this team your money and they just disappear, how would you find them? You wouldn’t even know who it is you are looking for. This is why it is very important to learn at least a bit about the major players on a team before investing in anything.

Tokenomics

You’ll also want to explore the asset’s tokenomics. This is getting a little deeper into the nuts and bolts of what the asset actually looks like. You should see how the network is structured, how the ecosystem has different players interacting with each other, and what types of rewards or incentives are there for participating.

This is also when you want to be looking at some hard numbers. Generally speaking, there won’t be “earnings reports” like there are for a traditional company. Even if there are, they may not be as relevant to the project’s validity as they are with stocks.

However, looking at the current price, circulating supply, market capitalization, and trading volume can be important before jumping in. Let’s look at these now.

Current price

The current price is pretty straightforward; it is what the asset trades for currently. While this can vary slightly from exchange to exchange, checking a website like CoinMarketCap will give an average across various exchanges. This is also a great place to check out these other metrics.

Circulating supply

- Circulating supply is how many coins can actively be traded, though there can be some contention around this. If a team were to create a project that has a total supply of 100,000,000 coins, all generated at inception, then you could say the maximum supply is 100,000,000. However, what if 40% are stored away by the team to be released over the coming years? Well, then, there is really only a circulating supply of 60,000,000 coins being traded. Awareness of this distinction is key, as sometimes these numbers are thrown around haphazardly.

- One more important thing to learn related to this subject is how the asset is created and whether there is a hard cap on the supply now or in the future. Bitcoin, for example, will only ever have 21,000,000 coins created. The schedule for the creation of new coins is fixed every four years. This puts a very specific type of growth in control of the supply, which proponents feel is positive. Other projects have completely open-ended supply caps, meaning that new coins can be created indefinitely. While this is not necessarily a negative, some worry that this is too similar to how fiat currency currently works.

- It’s not that one supply model is better than another. The important takeaway here is that you should be aware of which type of scenario you are dealing with, as it varies from asset to asset. For example, if a token has a low circulating supply and a high fully diluted valuation, the price could drop when the new tokens are released. Part of why this is also important is that it plays into how the market capitalization is calculated.

Market capitalization

- The market cap is simply the current price multiplied by the total supply. So, a 100,000,000 supply trading at $0.05 is a $5,000,000 market cap. You should always look at the size of the market cap in light of the price and supply because often traders want “cheap” coins because they see this as room for growth, and it can be. However, if a coin is cheap because there are a lot of them, then there may not be as much upside possible as you think.

- It’s better to look at the market cap, as smaller market caps really do have more room for growth, but this is still assuming there is an increasing demand for this asset. One other way to help gauge demand is daily trading volume. This will usually be an average across exchanges but will show if people are actually engaging with this currency versus just a handful of people holding and promoting it.

- If you feel that a project has massive potential and great talent but still has a small market cap, then you may be onto something. Just watch out for the pump-and-dump scams out there, which generally push coins with little intrinsic value. This is basically your risk-reward ratio, meaning that smaller projects are unproven and may not make it but offer huge potential upside for returns. On the other hand, a larger market cap plausibly means there is already a lot more interest, but it has already seen some impressive gains, and there may be a little less room for growth.

3. RSI divergences

The Relative Strength Index (RSI) is an indicator that charts buy and sell-side momentum in the market. It helps determine whether an asset is overbought or oversold. The RSI looks at recent price action (default is the 14 previous candles) and normalizes the price movements on a scale of 0 to 100.

Generally, when the value is low (below 30), the market is seen as “oversold,” and when it is high (above 70), it is considered “overbought.”

While this could point to an imminent price shift, it is important to note that the RSI can stay on the high or low end for some time before a real shift in momentum comes, so it can be hard to time your crypto trading strategies correctly using the RSI alone.

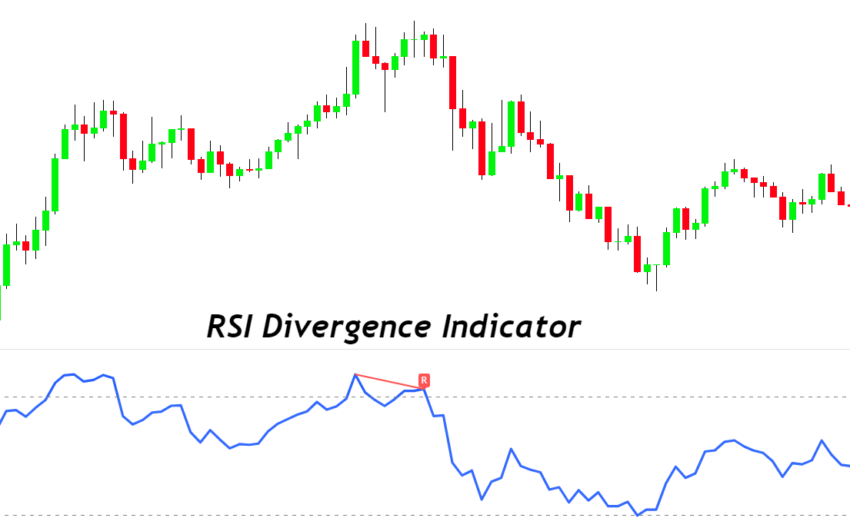

RSI divergences give us a little bit more information. In a strong ongoing trend, the RSI trendline should roughly match the direction of the price action’s trendline. The price goes up, RSI goes up, and vice versa. However, when a trend is losing momentum, divergences can occur between the price and the RSI trendlines.

How to use RSI?

The RSI can be an early warning that pressure has shifted, and the price is about to start moving because of it. To correctly spot this, first, identify if your trend is to the upside or downside.

If the trend is sideways, this crypto trading strategy is generally less effective. Sideway action doesn’t have a lot of clear momentum to begin with. If the trend is to the upside, make your trendline along with the highs of the price action and RSI values, and if it is to the downside, use the low points.

See above; the trendlines basically match. They don’t have to be exactly the same angle, but the closer they are the more confidence you can have that momentum is solid and this trend will continue for now. Still, you are looking for both to be hitting higher highs in this case. Now, let’s look at a divergence.

Notice how the lows are moving in clearly different directions in the above chart. The price action was still hitting lower lows, but the RSI was starting to hit higher lows.

This is what you are looking for. It wasn’t very long before dropping prices leveled off and began to rise, but this shift would have been harder to spot if you were only paying attention to the value of the RSI and not the ongoing trend.

4. Crypto breakout trading

A breakout trading cryptocurrency strategy is based on the ideas of support, resistance, and channels. Various metrics can form areas of support and resistance, and these act as places where price action tends to get stuck or turn around.

Support is when the price drops but doesn’t drop past a certain price level over time. Resistance is when the price rises but does not rise past a certain price over a period of time. What creates these lines? A variety of things.

Historical price action, psychological levels, trendlines, moving averages, Fibonacci retracement, and extension levels, to name common ones. We won’t be getting into all of these things here, so we’ll keep it simple and we’ll talk about channels and wedges.

We discussed trend lines earlier and how they can define a rising or declining trend in price action. As these trends go on longer, traders become increasingly confident that these lines represent meaningful resistance levels.

Channel

Often, trends begin to emerge on both the highs and lows in price action, and if these are parallel, it is referred to as a “channel” or “flag.”

Wedge

If the lines are more converging, this is called a “wedge.”

You are looking for one of these patterns to break. The price can stay inside ranges like this for a variable time. Still, when a significant break occurs with sufficient volume, action will likely have some notable momentum behind it and continue for some time. See where this ongoing trend finally broke out of its channel pattern and how the Price responded.

Wedges are similar, but again, the price range will be tightening, not parallel. Because they keep getting into smaller and smaller ranges, you can usually place an upper limit on when this break must occur.

Usually, they break before reaching the extreme of this area, but as they approach it each time the price tests the trendlines, the chance of a breakout becomes higher.

Whether a channel or wedge, be aware of false breakouts. Again, there are no guarantees, so occasionally, there can be a spike or dip in the price that looks like it is about to break the trend.

This is why volume is important, because if the movement came from a fairly small trade volume then it is unlikely to hold for long, and it is plausible that the price will revert into its channel yet again.

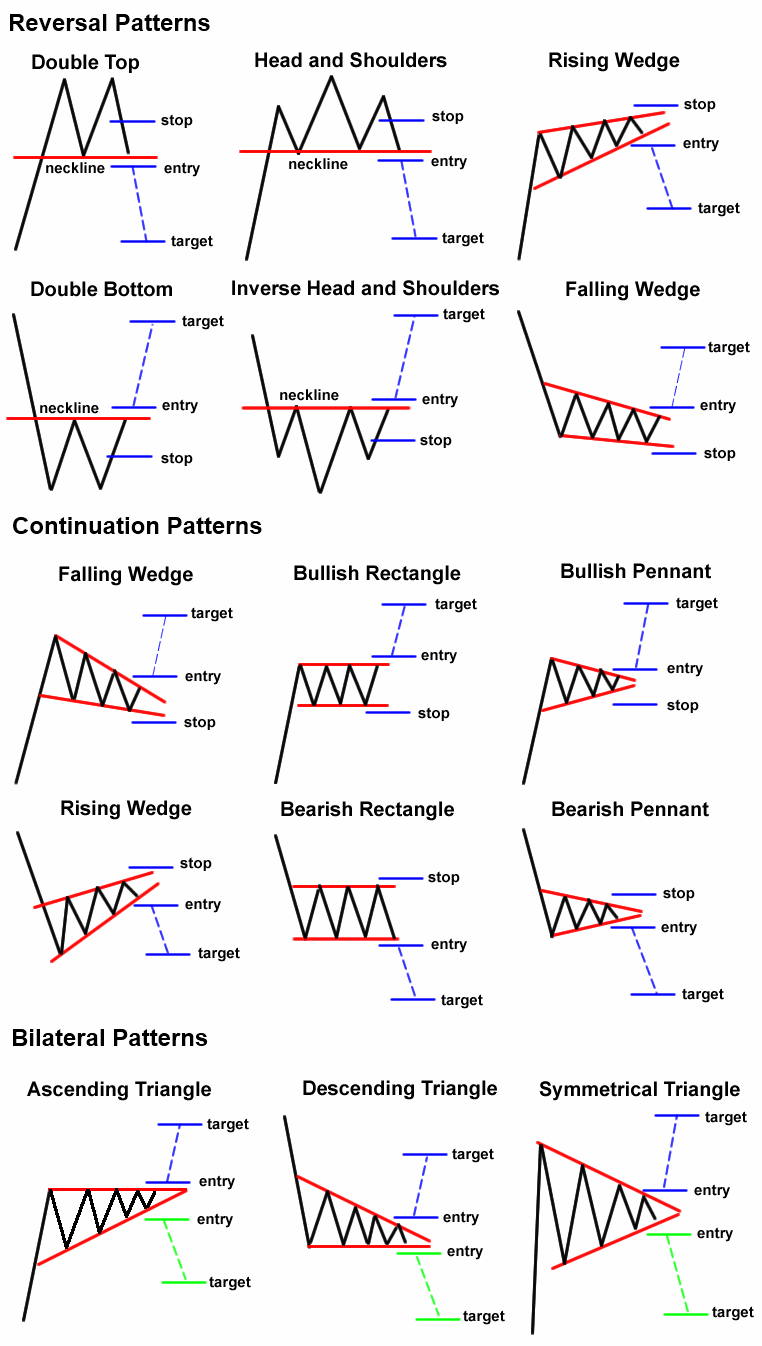

Other chart patterns

As mentioned, there are many chart patterns besides just channels and flags, and this handy infographic covers the most common ones:

You may be wondering how to know if the price will break up or down. This can be tricky, of course, and there isn’t one predominant opinion. As you can see in the above image, wedges, for example, can be seen as continuation or reversal patterns.

It can depend on whether they are rising or falling, as well as the predominant trend in the market, but even so, the way they break out is never a guarantee.

How to use chart patterns

Often, traders use price points slightly outside of a given channel to place entries and exit into their “long” and “short” trades. Long trades are what many people think of when they think of trading, which is buying an asset in the hopes of selling it for a higher price later.

It is the type of trade almost all traders begin with as it is a bit more straightforward and obvious what is going on.

This is one of the breakout crypto trading strategies that still works well, as it can help traders identify a good place to get in or out near the beginning of a pump or a dump. However, short trades work in reverse. When you short something, it means you believe it will go down.

Managing risk

You can earn money with this shorting cryptocurrency strategy (as opposed to just cutting losses) if you borrow the asset from your exchange with an agreement to return it, sell it at its current value, re-purchase it after the price drop, and then return the originally borrowed amount and pocket the difference.

This can be a bit riskier, but many exchanges allow for it, and it is the way people can actually make impressive profits even when an asset tanks. However, most traders short assets using put options as a safer method than borrowing.

Be aware there are usually very specific time parameters for short trades, so you can’t just wait indefinitely to return the asset in the hopes it will finally drop.

Furthermore, when you go long, your risk is limited, as any asset can only ever drop to $0, destroying your capital, but that’s it. Shorting has theoretically infinite risk, as prices can always rise, and you will still be obligated to pay back the exchange.

This is why having specific “stop losses,” in your strategy is absolutely essential. If shorting sounds scary, know that you don’t have to expose yourself to infinite risk, but that’s what you are facing if you don’t have proper parameters set up.

5. Crypto leverage trading

Leverage trading stands to bring the biggest gains but also comes with the biggest risks. Leverage trading is basically the practice of creating larger positions than you actually have capital for by borrowing money or assets from the exchange.

Shorting, which we just discussed, is a form of leverage trading because it involves borrowing, but leverage is often applied to longing, too.

Say you want to purchase $1000 worth of Bitcoin because you believe the market is about to go up, but you really only have $100 to spend. If your exchange allows for leverage, you can put up your $100 as collateral, and the exchange will put up the additional $900.

When you exit the trade, you must give back that $900, but any profits you get to keep. So if Bitcoin went up 10%, for example, your $100 worth of Bitcoin would be worth $110, but a 10x leveraged position with $1000 worth would now be worth $1100.

You would then pay back $900 to the exchange plus fees, and you would have nearly doubled your investment. Of course, this ability to multiply gains also multiplies risks.

Shorting with leverage

Now, let’s say you were in a 10x leveraged position. When a 10% drop comes, your $1000 position is now only worth $900. The exchange needs that $900 back to break even, so it will exit the trade immediately and take its money back, and you’ll be left with nothing.

Keep in mind that an exchange will never let you lose its money in a position, and if you ever find an exchange that does, it won’t be open for very long.

Shorting on leverage is pretty much the ultimate risk. Just imagine the issues outlined with shorting above and add a multiplier to it, and you can imagine how fast you can lose money.

Limitations

An exchange knows that you can’t pay back trillions of dollars if you make a bad trade, so there will be limits. Usually, you will be required to have some type of collateral reserve (on top of the collateral you put in the trade) that gets taken if your position goes bad.

Again, the exchange will end the trade when this limit is met, but this is how people can lose large stores of collateral in literally seconds if market conditions go perfectly against their predictions and positions. Generally speaking, in cryptocurrency, this is called getting “rekt.”

If you are interested in leverage trading, you’ll need to find an exchange that allows it. Some notable leverage trading platforms include Binance and Kraken.

Depending on the exchange and asset, you can find anywhere from 3X to 200X leverage options, so the possibility of making amazing gains is on the table.

Note that not all of these exchanges are available in most countries and that certain conditions will usually need to be met to open a leverage account, usually a mix of identity verification and funding a minimum reserve collateral pool.

6. Trading signals

Cryptocurrency trading signals can be based on several factors — news regarding a coin, technical analysis, and the current market climate. With one of these factors, a trader could procure substantial returns.

Telegram signals are trading crypto signals from expert traders to buy or sell a particular cryptocurrency at a specific price or time.

The best crypto signals groups are popular because they give investors and traders the opportunity to benefit from proven track records and trading experience. They remove the risk of making bad trades and losing a majority of their capital, which can be prominent in cryptocurrencies.

As always, they don’t remove all risks when trading cryptocurrencies. Traders must ensure that trades are effectively managed and conduct proper risk management practices.

In our BeInCrypto Telegram Trading Group, we offer everything from a free crypto trading course, trading signals, and help from experienced traders.

Benefits of signals

The most significant benefit of signals is that they provide valuable trading data to their members, allowing investors to manage their assets more effectively.

With signals, you learn how to use stop losses, how to set targets, and the appropriate points to exit and enter a trade to maximize your profits. They provide more in-depth information than what you could get on the Internet or via analyses on social media.

The signals will also help you know what to buy, how to invest, and how to take profits successfully. As for your earnings, however, it isn’t easy to estimate as there are varying factors.

Cryptocurrencies can be extremely volatile, so it’s worth doing your due diligence and ensuring that the signal provider you’re choosing has a long track record of success, strong social proof and reviews, and a thriving, supportive community.

Holistically, the signal group in the crypto space – both short-term and long-term is always up for question since they vary significantly. Regardless, one important thing that you’ll need to make money is the right knowledge – something signal operators offer.

Navigating crypto Telegram signals

Telegram’s choice as the haven for crypto trading is primarily due to the density of the cryptocurrency trading community on the platform. It’s proven to be one of the best mediums for broadcasting messages to a large audience.

Usually, the most accurate crypto signal providers will charge a fee before allowing you to join their channel. Of course, given their expertise and the profitability of their trades, it’s natural that they’ll charge for VIP access to their strategies.

Some Telegram signal groups provide free signals and training. They’re attractive because they allow you to save funds, but you might not get the level of accuracy that a paid signal provider gives.

What is cryptocurrency trading?

Trading is the act of buying and selling any financial instrument for a profit. Some of these financial instruments may include stocks, fiat currencies (also known as forex), ETFs, commodities (e.g. precious metals), and, most relevant to us — cryptocurrencies.

You have often heard the term trader. Well, a trader is someone who trades or someone who buys and sells something to make a profit. Trading is a popular concept and is a form of speculation that can pop up in many sectors of our lives.

Maybe you have traded collectible cards as an adolescent or even action figures. While in the past you may not have traded to earn a profit, in a highly financialized world, you will learn that even your hobbies can earn you profit, and thus make you a trader.

As a child, you probably did not trade just any cards or toys. Some toys and cards were worth more than others and required more items in exchange for one. By doing so, you executed your first trading strategies.

Crypto trading strategies are slightly different, but the concept is the same. Having a strategy can earn you more than not having one.

Optimize your crypto trading strategy

By now, you should understand the basics of these strategies. Remember, they don’t guarantee success but can improve your chances of profit. Proceed cautiously and continuously evaluate your approach. To practice risk-free, use “dummy” accounts on some exchanges to trade fake cryptocurrency with real market data. Success in trading requires constant learning and assessment; there are no shortcuts.

Frequently asked questions

What is dollar cost averaging?

What is RSI?

What is leverage trading?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.