Anyone familiar with the cryptocurrency market knows how volatile the space can be. Crypto prices fluctuate so much that similar patterns would likely cause a mass panic if they happened on the stock market. Nonetheless, this provides a fertile space for scalp trading. Find out if this trading strategy is right for you in this comprehensive scalp trading guide for 2025.

KEY TAKEAWAYS

► Scalp trading involves making multiple trades throughout the day to capitalize on small, frequent price changes in cryptocurrencies, optimizing for small profits that accumulate over time.

► Successful scalp trading relies on technical analysis using tools like candlesticks and moving averages, while fundamental analysis plays a minimal role due to the rapid pace of trading.

► Using demo accounts is a good idea for beginners to practice scalp trading without financial risk, allowing them to learn market analysis and trading techniques in real market conditions.

What is scalp trading?

Scalp trading is a trading strategy that involves buying and selling to profit from small price changes. It’s all about taking advantage of cryptos’ daily price movements. Such a strategy requires multiple trades during the day to gain small profits, adding up over time. Scalping crypto is perfectly legal.

Scalp traders must be dedicated and cool-headed to achieve a sustainable scalp trading performance. One should aim for a minimum of 1.0 GtPR — Gain-to-Pain Ratio.

Above 2.0 GtPR is considered excellent, while above 3.0 is exceptional. For example, if a trader has a net return of $7 and two losing trades of $2 and $1, the GPR would be 7/3, or 2.33.

Calculate your GtPR by simply dividing the cumulative total of all monthly RORs (Rate Of Return) by the absolute value of cumulative negative monthly RORs.

Both cryptocurrency and forex markets are ideally suited for scalp trading because they involve assets that generate such minuscule price moves. A good crypto scalper will have to react to price moves measured in minutes or even seconds to reap gains consistently.

Therefore, scalp trading revolves around three critical elements:

- Consistency

- Speed

- Chart reading skills

With these three skills honed, scalpers have to choose currency pairs that exhibit higher volatility for the tiny price moves to be profitable.

Unlike day trading popularized by Dave Portnoy, leveraging relatively minor price differentials between token pairs poses low risks and immediate rewards.

How profitable is scalp trading?

The profitability of scalp trading largely depends on individual skills. Scalp trading can be somewhat compared to “penny pinching” in the sense that it involves making many small, incremental gains that add up over time. While every scalper develops their own unique strategy over time, the practice still relies on the foundations of financial ventures:

- Technical analysis (TA) – This needs to be conducted in real-time. This asset assessment takes into account its current volume, past prices, and market activity. It depends on reading charts, indicators, and trading patterns to figure out which way the price will go. One of the most common tools it uses is the Japanese Candlesticks chart, price support and resistance levels, moving averages, Relative Strength Index (RSI), Fibonacci retracements, and Bollinger Bands.

- Fundamental analysis (FA) – Although still important for scalp trading, it reserves minimal attention given the reaction time needed. This metric deals with an asset’s value proposition within the wider economic context. For example, does it make sense to invest in GameStop (GME) if it uses a similar business model that had previously failed other brick-and-mortar retail chains?

With these core tools in hand, scalp traders respond to market movements, usually within 5-minute (M5) intervals. Otherwise, one would have little time for a proper TA. When the time frame is under M5, this is called intuitive scalping, which relies on a trader’s accrued experience instead.

As you can see from the candlestick chart above, the intervals for profits range from 5 to 30 minutes. The accuracy of these educated predictions and how long an open position is held determines the rewards.

Accordingly, for this high-frequency trading strategy to be profitable, it requires great focus and discipline. With that in mind, either commit to it as your primary trading strategy, or you risk underperforming below 1.0 GtPR.

Is crypto scalping better than day trading?

The main difference between day trading (also called swing trading) and crypto scalping is the time frame. Although both are intra-day trading — occurring within a single day — many retail traders abhor going to sleep on opened positions. If you fall into this category, scalping trading would be a better option for you.

However, if you don’t like to be glued to the screen for half a day, opening and closing dozens or hundreds of positions, then day trading is for you.

On the other hand, you may get addicted to closing positions whenever it becomes even slightly profitable. After all, the dopamine hit from successful trades is a powerful behavior modifier that may turn against you. This was confirmed by the FCA study conducted on 517 self-described investors.

A worrying 38% of participants indicated they don’t have a rational reason for engaging in trades. Instead, the emotional thrill of trading and social signaling took priority. Obviously, the worst scenario for traders is the merger of over-confidence with the lack of skills.

The key is to practice scalping without risk to ensure that your investment decisions are based on rational factors rather than emotions. This is the purpose of demo accounts on various crypto exchanges and market trackers.

Top demo accounts for scalp trading

If you want a safe space where you can feel free to make mistakes and learn, crypto demo accounts are the way to go. Here are our top demo accounts for practicing scalp trading.

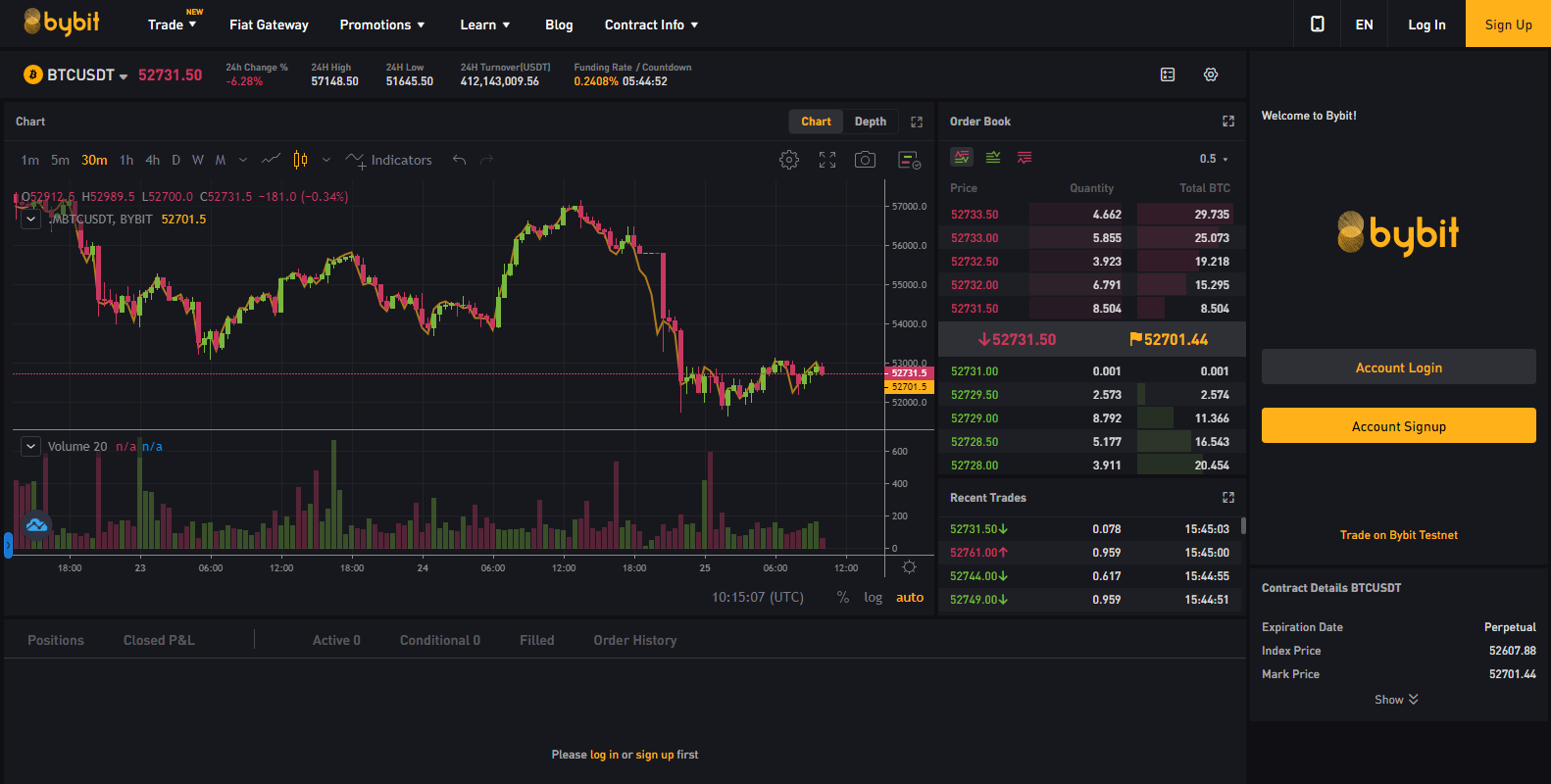

1. ByBit

This trading platform specializes in leveraging, allowing up to 100x leverage on crypto derivatives. Its modern and user-friendly design is complemented by a powerful set of indicators and charts for scalpers to train with.

With ByBit, you can set up a testnet, making it easy to start training your high-frequency craft. A testnet is the ideal solution for learning to read charts and indicators because it shows actual crypto prices instead of a simulation.

This is invaluable because there is no better way to react to price movements than reading real market data. However, setting up your testnet properly will take some time.

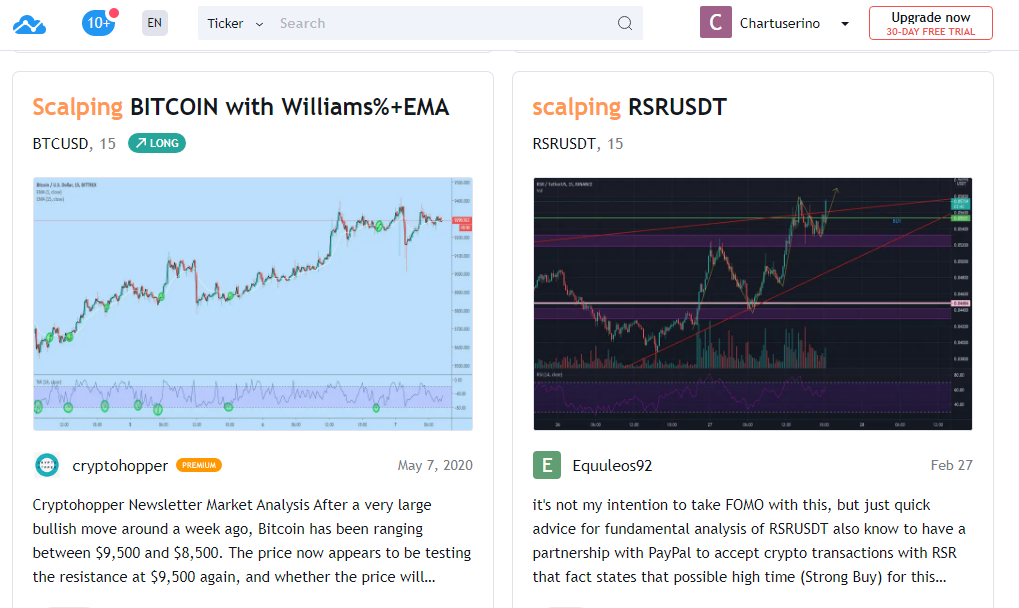

2. TradingView

TradingView has become the staple for market analysis in the crypto space. Even with a free account, it offers unmatched customizability and ease of use.

It is entirely cloud-based, so you can access it from any device and web browser. Its demo account gives you a sophisticated set of indicators and charts, but it takes some time to take advantage of all of its numerous options.

TradingView has a social network with frequent blog posts giving traders valuable insight and new trading strategies. If there is a relevant altcoin to be considered, TradingView has it with over 100 supported cryptocurrencies. Most importantly, it feeds you real market data for practice trading.

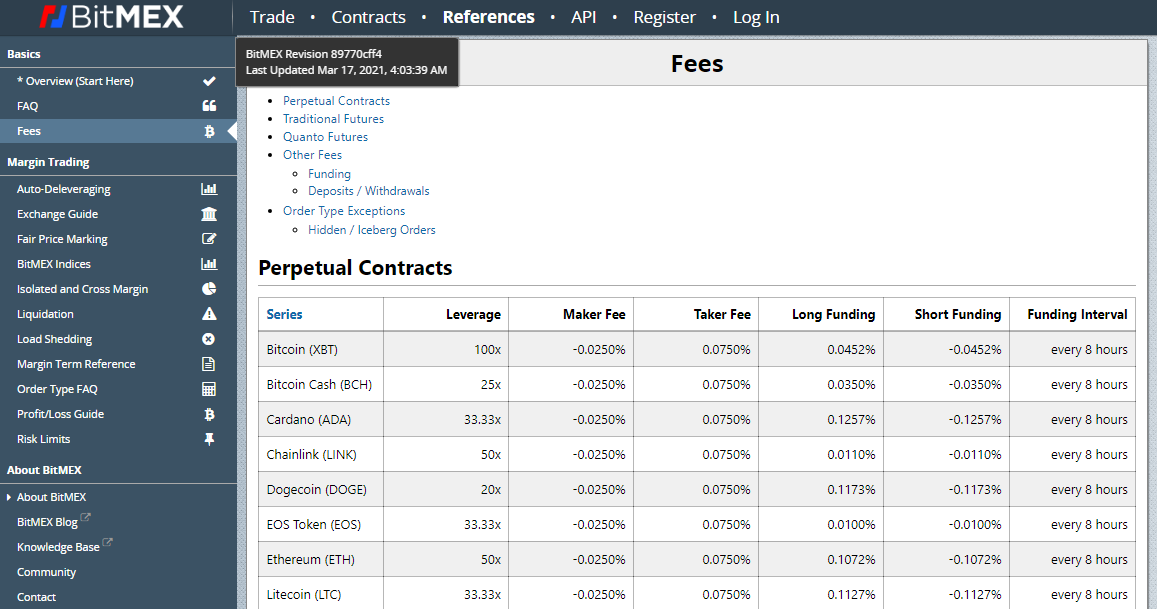

3. BitMEX

BitMEX, founded in 2014, is one of the world’s largest P2P trading platforms. Although it may seem a bit old-school, it is still in wide use. Like ByBit, setting up a testnet platform is somewhat complicated.

Alongside Bitcoin, it supports seven major altcoins. The platform’s order types are extensive and perfectly suited for scalp trading. The order types are fill or kill, good till cancel, immediate or cancel, trailing stop orders, stop limit, take profit, limit, and hidden order.

Likewise, the platform has a comprehensive set of tools to chart your way toward margin gains, allowing you to easily change time periods and graph types and add market indicators.

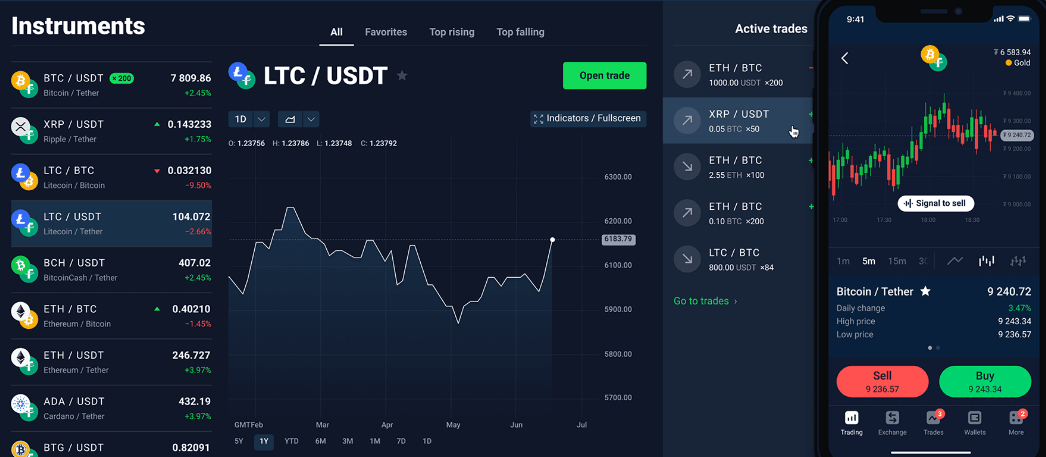

4. StormGain

With a rare offering of up to 200x leverage for Bitcoin futures and others, Stormgain is another good option for learning scalp trading. Its demo account faithfully mimics real account experience, including live customizable price charts, crypto pairs, indicators, patterns, trend lines, and wallet balances.

If you have multiple monitors, the modern and sleek StormGain interface is great for setting up specific price indicators on full screen.

Demo accounts for scalp trading compared

| Platform | Available countries | Crypto | Platform |

|---|---|---|---|

| Bybit | 160+ | 1,500+ | Android and iOS |

| TradingView | 50+ | N/A | Mobile, Windows, MAC, and Linux |

| BitMex | 100+ | 100+ | Android and iOS |

| StormGain | 100+ | 80+ | Android and iOS |

The platforms with the best demo accounts for scalp trading were chosen based on a multitude of factors. The most notable features are availability or supported countries, ease of use, platform features, and cryptocurrencies and platforms supported.

Best crypto scalp trading strategies

As previously noted, each crypto scalper ends up developing their own trading style and strategy in order to best align with their lifestyle and level of experience. Bitcoin’s volatility, in particular, presents an excellent opportunity to pair with a number of currencies.

Here are some of the most popular scalping strategies.

Don’t forget can also search for “scalping” on the TradingView platform. There are always new, interesting tweaks to proven formulas.

1. Bid-ask spread method

Self-explanatory, bid-ask is the difference between the trader’s bid price (buying) and their opposing ask price (selling). Any time there is a substantial difference between the two, you can jump in and reap gains.

In most cases, using bid-ask spreads is commonplace when there are more buyers than sellers. If you are familiar with the law of supply and demand, you know this causes the price to fluctuate. Such a wide bid-ask spread then offers crypto scalpers the opportunity to sell.

In a similar fashion but in the opposite direction, a narrow bid-ask spread occurs when the bids are close to the asks. This scenario reflects high liquidity in the market

2. Range trading

We’ve already encountered the terms “support” and “resistance” in this guide. The former represents a low price level, indicating a buying opportunity. In turn, resistance represents a high price level, indicating that one should sell. In other words, support marks a market entry, while resistance marks a market exit.

Range trading focuses on monitoring the price movements between the two levels. If price frequency goes against either support or resistance, this indicates a breaking point should occur soon.

This is commonly called a breakout. When it happens, a scalper will use a stop-loss order to make profits. This is why candlestick charts are so widely used for scalp trading. They track both support and resistance levels (S/R), which should be used in conjunction with moving averages.

3. Automated trading

High-frequency trading is a lot like factory work — fast, intense, and exhausting. For this reason alone, scalping bots have been developed to detect a variety of patterns in order to open and close positions in a timely manner. There are thousands of scalping bots on the market.

Note that due to the high demand for effective trading bots, the market is crawling with scams. The obvious problem is that a new bot has to be thoroughly tested across numerous market conditions and users. In the meantime, the scammer counts on people’s greed to sell defunct software products.

To avoid scams, make sure to buy a scalping bot that has been thoroughly vetted by multiple independent sources.

Pros and cons of scalping crypto

Many traders will espouse the wonders of trading. However, there are a few things that you want to keep in mind before you decide to start. Here are the advantages and disadvantages of scalp trading.

Pros:

- Can be automated, relieving the scalper of major downsides — emotional highs and lows and exorbitant time investment which negatively affects social and family life.

- Very short positions don’t pose a big risk if you miss the shot, thus representing a low-risk strategy trading.

- Consistency repays in profits. Set a daily goal, a $30 daily profit to start with, and work toward achieving that threshold.

Cons:

- Lack of confidence results in missed trading shots, which accumulate losses.

- Requires a significant expenditure on trading fees, as scalping inherently relies on hundreds of trades.

- You may be mostly trading against the best scalping bots, not people. This puts you at a disadvantage unless you too invest heavily into buying a scalping bot service.

- Profits are not guaranteed. Scalp trading is risky, and you can lose money.

The key to scalping: Education and training

The key to becoming a successful crypto scalper relies on education and training. For both, a demo account becomes a necessity. Invest at least 30 hours in virtual scalping trading before committing with real funds.

Because unassisted scalping requires an intimate understanding of dozens of chart types, patterns, and indicators, it must become second nature to react quickly to the market’s price moves. Remember, practice makes perfect.

This article is for informational purposes only and should not be considered investment advice. Scalp trading is high risk.

Frequently asked questions

What is scalp trading?

How do you scalp trade?

What are the risks of scalp trading?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.