Digitization of finance has introduced a new level of personal freedom. Bossless and independent of residency, day trading options have spiked in popularity during pandemic-induced lockdowns.

As sports bars, gatherings, and casinos closed, day trading has become a favorite pastime for millions. If you want to make it more than a side hustle, however, you should learn how to start day trading properly.

- The ups and downs of stock market trading

- What exactly is day trading?

- Tools and skills needed for day trading

- Money involved with day trading options

- How much can day traders make?

- Overview of the most commonly used day trading terms

- Decide your commitment level after practicing with a demo account

- Frequently asked questions

The ups and downs of stock market trading

The Financial Crisis of 2007–2008 and the ensuing bank bailouts significantly diminished public trust in the centralized financial system. As depicted in the film “The Big Short,” where Christian Bale portrays Dr. Michael Burry, this crisis was a singular event not expected to recur. The real game-changer for young people entering the stock market came with the introduction of Robinhood’s zero-fee trading app, which made stock market trading more accessible.

After the GameSpot (GME) scandal in which Robinhood intercepted retail trading of the stock, apparently on behalf of the Citadel hedge fund, its reputation has been shattered. Nonetheless, Fidelity, TD Ameritrade, and a wide variety of crypto trading apps are more than happy to pick up the slack.

What exactly is day trading?

Instead of investing for the long haul, as a diversified portfolio for retirement or some other purpose, day traders engage in speculative trading based on market trends and technical analysis (TA). In other words, day trading is opening a position on an asset or a stock and closing it on the same day.

Let’s take one of the world’s most popular blue-chip stocks as an example of day trading — Tesla (TSLA). For a while, its value had grown so high that Elon Musk had been christened as the world’s wealthiest person, back in 2021.

Tesla’s drop was not that surprising, especially since it has been considered an overvalued high-growth stock. Moreover, there was no specific news about the company at this time to cause the stock plunge. Therefore, an informed trader would have expected the drop and keep an eye on the stock as:

- Growth stocks are influenced by fears of inflation

- Growth stocks are also influenced by rising bond yields

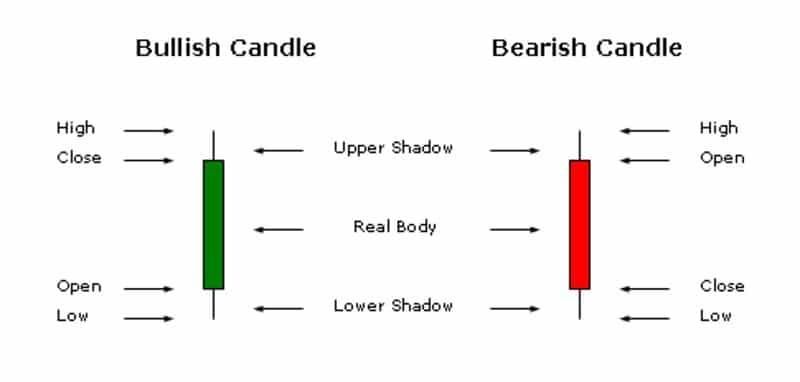

A day trader analyzes the Japanese candlestick chart for price support and resistance levels, capitalizing on the fluctuations between each candlestick to profit, like buying low and selling high in the transition from March 8 to 9, a technique often referred to as “buying the dip.” Day trading involves managing risk by interpreting charts, price movements, and indicators to exploit market volatility.

Greater volatility means more opportunities for day trading, a principle particularly true for penny stocks and cryptocurrencies. However, any asset can exhibit volatility in response to news, whether good or bad.

Tools and skills needed for day trading

Before risking day trading with real money on the real market, it is essential for you to first master these skills and knowledge.

- An in-depth understanding of day trading lingo, and fundamental and technical analysis.

- Selecting a day trading strategy practicing it with a free demo account. You will find that most trading platforms offer such accounts with virtual funds. More importantly, real market data is fed to the charts in order to commit simulated trades more effectively.

- Achieving a respectable profit returns ratio on a demo account means that at least 70% of your trades of the month were profitable.

- A charting platform such as TradingView also serves as a stock scanner and screener. Scanners feed real-time data into the platform, allowing you to act in a timely manner. Screeners seek the stocks that fit your search criteria for volatility, producing lists of stocks you can start trading with.

Fortunately, much of the educational material is free to learn all the relevant terminology, how to read dozens of price indicators and patterns. You can start your day trading for beginners’ journey with this guide on how to read charts.

When you find the right stocks, those that have a relatively high volume, your day trading option should be more successful because there is a greater chance for price breakouts. Such stocks are also called “stocks in play”.

Money involved with day trading options

Most trading apps offer transactions with little to no commissions, but you must still invest in fractional or penny stocks to profit from trading. Starting with at least $100 is advisable. With penny stocks valued under $5 per share, $100 allows you to purchase about 20 shares.

If you’re day trading with $1,000, you can acquire 200 to 500 shares. To earn a net daily profit of $100 from a $1,000 budget, you’d need the stock to increase by 20 cents per share. Ultimately, the potential for daily profits in trading scales with your investment and the experience gained from practicing with demo accounts. Additionally, be aware of the different types of trading accounts available.

- Margin account: Offers a limited number of trades for a specific time period. Usually, 3 trades within a 5-day period if your account holds less than $25,000.

Additionally, a margin account gives you 2x buying power (if below $25k) and 4x buying power (if over $25k). Such leverage on borrowed funds enables you to buy more shares than your cash reserve allows for, but it also increases the risk of losing more money than you have in reserve. - Cash account: Low-risk account with which you can trade as many times you want, as long as it is topped up with funds. Be careful, though, not to trade with funds that have not yet been settled. This may get you suspended.

Experienced scalpers and day traders prefer the margin account, as they can make small trades to yield larger gains. Furthermore, take note that FINRA instituted some restrictions on margin trading accounts in 2001, following the dot-com bubble burst. One of them is the pattern day trader rule (PTD).

Your account receives a Pattern Day Trader (PDT) designation if you execute four trades within five business days. As a PDT, you must maintain a minimum balance of $25,000 in your account to continue day trading, which in turn grants you leverage up to four times your buying power.

However, if your balance falls below $25,000, you’ll be restricted to making up to three trades within five days. It’s important to note that FINRA, a US-based federal agency, enforces these regulations. For traders looking to bypass the PDT rules, one option is to open an account with an offshore brokerage, such as TradeZero.

How much can day traders make?

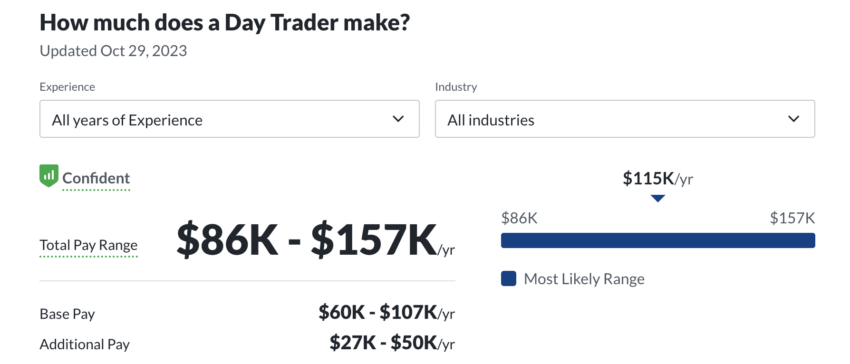

According to Glassdoor, the earnings of a day trader can vary significantly, with the total annual compensation ranging from $86,000 to $157,000.

This data reflects the potential for high rewards in day trading, acknowledging that earnings can fluctuate widely based on individual performance, market conditions, and the level of expertise. Comparatively, an average computer programmer makes about $70k per year.

In the U.S, such salaries should further be impacted by migration and machine learning. Achieving financial independence through day trading can be a rewarding endeavor over time. Yet, the success of this path hinges on the level of dedication you bring to your trading activities.

Aside from daily discipline, your success will depend on:

- Your initial investment – if you start with just $1000, it will take much longer to reach your desired lifestyle than if you start with $10,000. For margin trading, $25k is the bare minimum.

- The types of markets you engage with — stocks, futures, forex, cryptocurrencies…each have their own advantages and drawbacks.

- Patience – if you don’t achieve results in a month’s time, it doesn’t necessarily mean you are a bad day trader. Rather, you should further educate yourself and tweak your trading strategy.

In short, you should not view day trading as a hobby or a side gig. Top day traders tend to make money from leveraging tiny price movements in indexes that have mid to high volatility.

Likewise, liquid stocks. These are the stocks that resist price drops if they are quickly sold. For example, the previously mentioned Tesla (TSLA) is a liquid stock, just as Apple (AAPL), which has tighter bid/ask spreads.

Overview of the most commonly used day trading terms

You have already seen some of these terms trading for dummies guide throughout this day. Let’s take a closer look at those that make the core of day trading:

- Bid: The price a buyer sets for buying an asset

- Ask: The price a seller sets for selling an asset

- Spread: The price differential between bid and ask — this is where you make your money!

- Candlesticks: A chart consisting of candlesticks, each one denoting price’s high, low, open, and close within a timeframe

- Bearish: Asset’s downward trend, colored red on candlestick charts

- Bullish: Asset’s upward trend, colored green on candlestick charts

- Trend: Direction of the asset’s price moves, which can go up (bullish) or down (bearish)

- Cover: Buyback of shares that were sold short

- Short-selling: A trading strategy that counts on the stock to decline. The seller opens the position by borrowing for the purpose of buying them after they reach a low point.

- Resistance: A price threshold at which sellers overpower buyers. For example, Bitcoin had numerous price resistances during the last six months, all broken after institutional buyers showed up to break them.

- Support: The opposite of price resistance — buyers overwhelm sellers, making it difficult for the asset’s price to drop.

- Breakout: When an asset moves outside of defined support and resistance levels

- Scalping: Exploiting minor changes in prices within short time periods

There are dozens of more terms to explore, but behind each exploration hides a new trading strategy to explore.

Decide your commitment level after practicing with a demo account

Day trading is a complex endeavor that requires exploring and experiencing a variety of strategies before fully committing to it. It’s crucial first to learn the appropriate terminologies and understand the technical analysis tools. This practice is an effective way to assess your skills, discipline, and patience. Aiming for a minimum ratio of lost versus won trades of around 4:6 out of 10 works is a good benchmark.

While day trading can be a highly rewarding experience, it’s important to be aware of its potential to generate addictive behavior. This tendency is particularly noticeable among young investors, as highlighted in a study by the British Financial Conduct Authority (FCA).

Frequently asked questions

What is day trading?

What are the risks of day trading?

How can I become a successful day trader?

Can anyone become a day trader, or is it reserved for financial experts?

What are the best day trading strategies for beginners?

What are risk management strategies for day trading as a beginner?

What is a typical mistake made by beginners in day trading?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.