The Polygon Bridge is becoming an increasingly essential tool for Ethereum users because it permits the integration of different blockchain networks, providing support for Ethereum scalability. In this guide, we’ll take a look into what the Polygon Bridge is, how it works, and how you can use it.

What is the Polygon Bridge?

The Polygon Bridge is a trustless cross-chain transaction bridge between the Ethereum and Polygon networks. Ethereum users can leverage the Polygon Bridge to transfer their ERC tokens and non-fungible token (NFT) assets to the Polygon network via smart contracts. The Polygon Bridge is the only way users can access other tools and DApps on the Polygon ecosystem.

Interoperability is one of the most important requirements for a changing and ever-evolving blockchain ecosystem. Currently, there’s no single cost-effective, reliable, and secure data-sharing tool or process in the blockchain and crypto space. As a result, different blockchains can’t communicate with each other unless they utilize additional tools such as cross-chain bridges.

Polygon developers launched the Polygon Bridge to allow for easy asset transfer through cross-chain interoperability among different blockchains. The Polygon network is a protocol composed of different secured chains. Developers can build decentralized applications (DApps) or Ethereum-based solutions on Polygon as they allow for private network development and scalability. However, all sidechains still need to link to the Ethereum network. Besides, users need to transfer their assets to Polygon to interact with DApps on the network. And this is where the Polygon Bridge comes into play.

The Polygon Bridge boasts low gas fees, with users only incurring Polygon bridge fees. Additionally, there’s no third-party protocol involvement.

How does the Polygon Bridge Work?

The Polygon Bridge utilizes a dual-consensus mechanism that makes it decentralized and efficient. Its bridge architecture is designed to aid with arbitrary state transitions in its sidechain that are adaptable to the Ethereum Virtual Machine (EVM). As a result, cross-chain asset transfers can be accomplished instantly without any market liquidity limitations or third-party risks.

Polygon’s bridging mechanism doesn’t affect the circulating supply of the respective asset. Any token that leaves the Ethereum blockchain to the Polygon blockchain is locked up. The same amount of tokens is then minted on a 1:1 ratio as pegged tokens on the Polygon network. Likewise, when users bridge tokens back to the Ethereum network from Polygon, the pegged tokens are burned, and those on the Ethereum network are unlocked.

Currently, the Polygon network features two bridging options: the Proof-of-Stake (PoS) Bridge and the Plasma Bridge.

The PoS Bridge takes after the proof-of-stake consensus mechanism to secure its network and ensure deposits occur instantly. However, withdrawals can take a while, and it supports the transfer of most ERC tokens and ETH.

The Plasma Bridge, on the other hand, aids in the transfer of MATIC, Polygon’s native token, and specific ETH tokens such as ERC-20 and ERC-721. In addition, it provides increased security thanks to the utilization of the Ethereum Plasma scaling solution.

Both the PoS and Plasma Bridge options have their advantages and disadvantages. For instance, where PoS Bridge provides users with near-instant withdrawals — as it depends on external validators — the Plasma Bridge boasts enhanced security measures as it relies on the Ethereum network’s security.

The workaround Polygon 2.0

The Polygon Bridge utilizes a dual-consensus mechanism that makes it decentralized and efficient. With the recent upgrade to Polygon 2.0, the native MATIC token is being transitioned to POL, enhancing the staking, security, and governance features of the network. This transition ensures backward compatibility and seamless asset transfers between Ethereum and Polygon.

How to use the Polygon Bridge

You can easily bridge tokens using either the PoS Bridge option or the Plasma Bridge option. Most users, however, prefer the PoS bridging option as it’s compatible with many ERC tokens and is much more convenient. We will look at how to bridge tokens using the PoS bridging option for the purposes of this guide.

For starters, you will need a compatible crypto wallet, such as MetaMask. If you don’t already have one set up, you can download the MetaMask crypto wallet, set it up, and follow the below bridging steps.

Step 1:

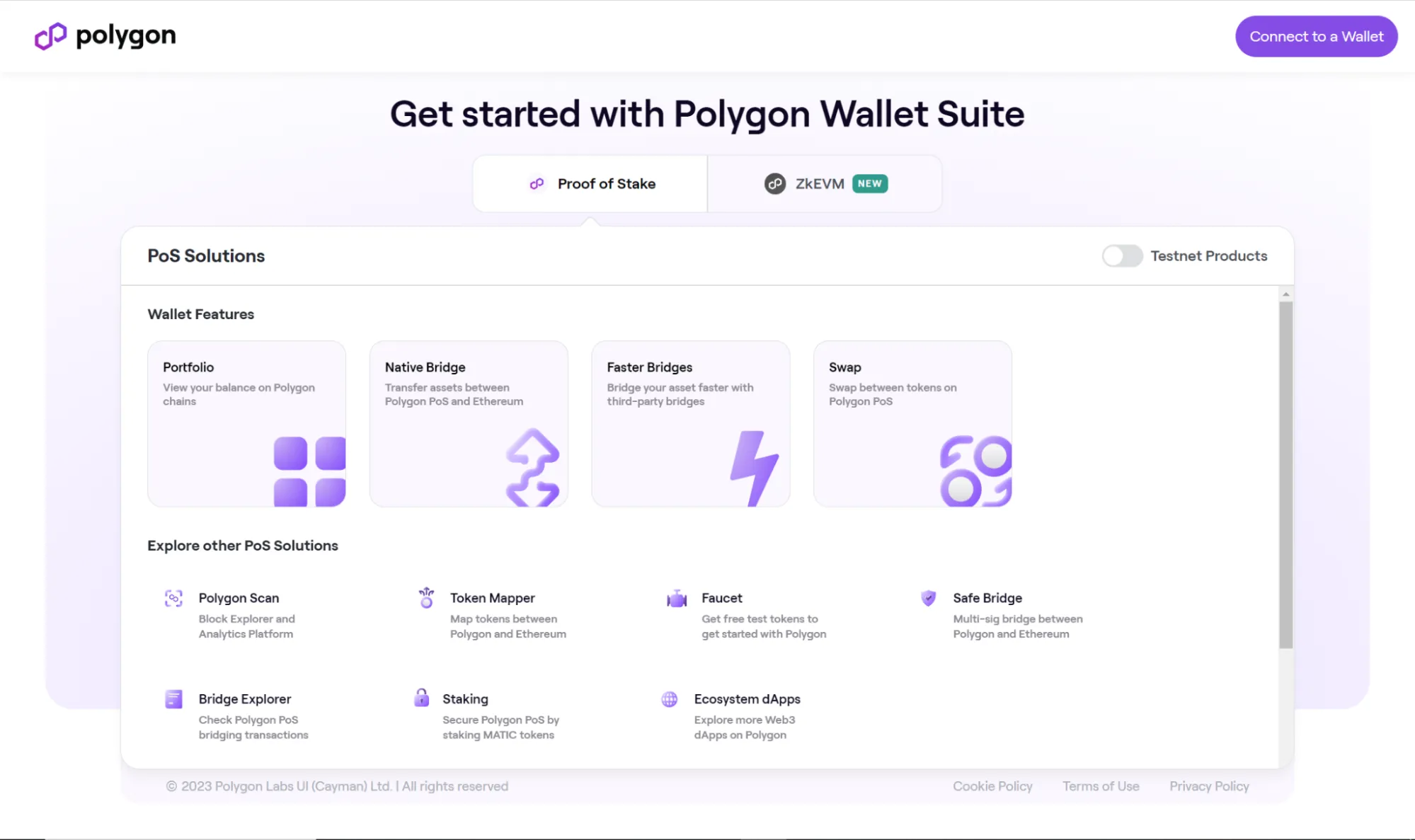

Visit the Polygon Bridge Web Wallet. Then, click “Connect to Wallet.”

Step 2:

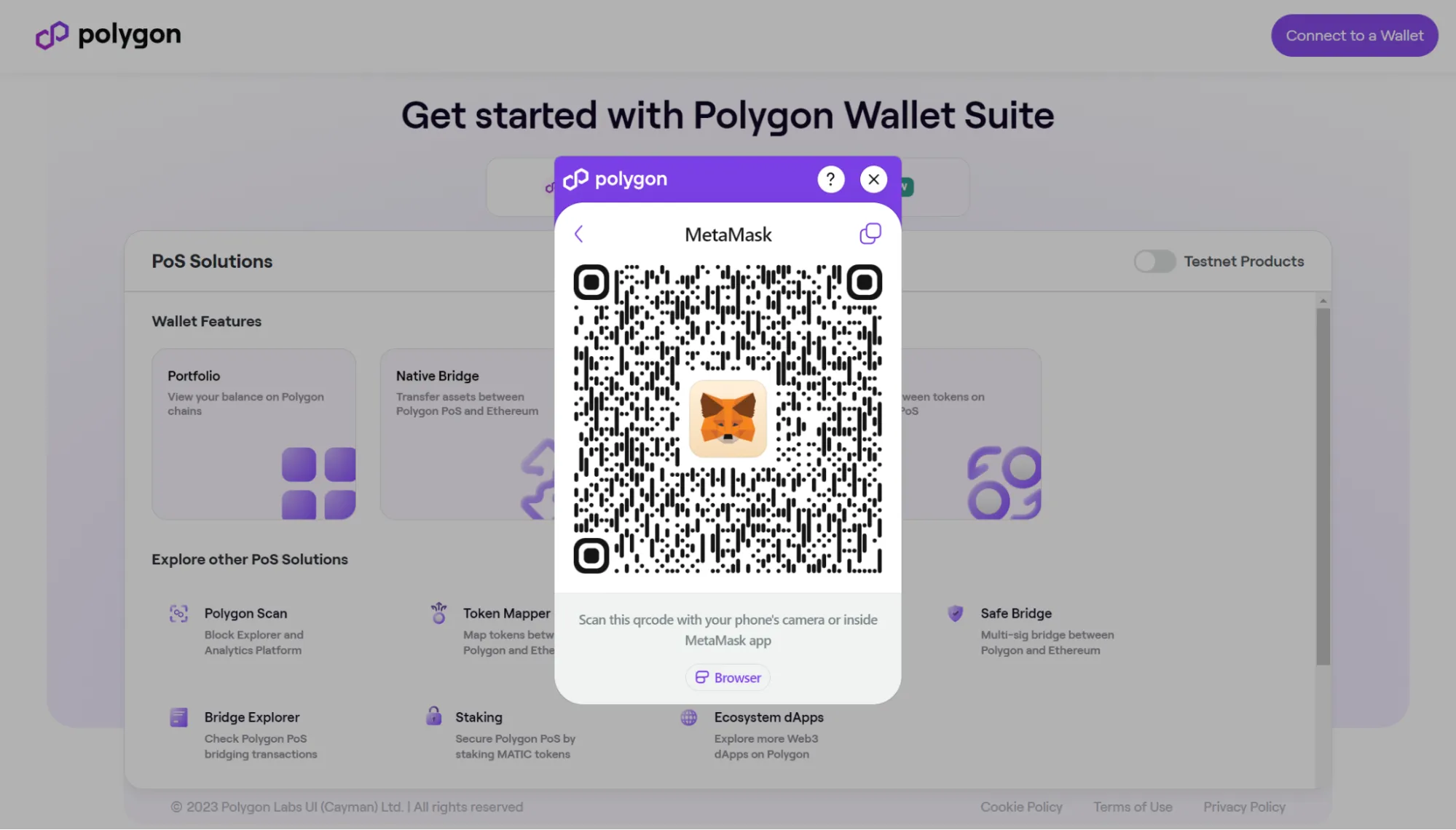

Choose the MetaMask wallet.

Step 3:

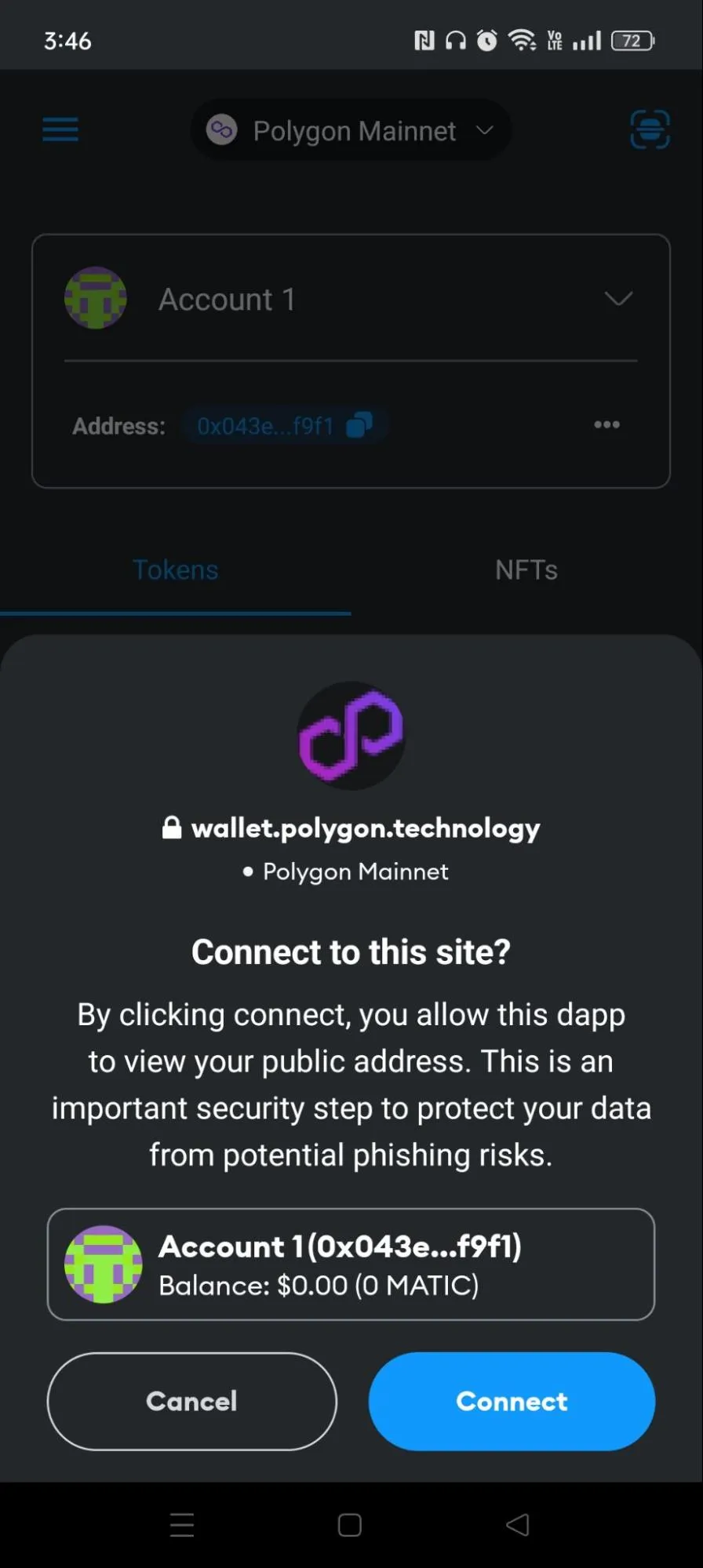

Go to your MetaMask wallet on your smartphone and click on the scan icon at the top right. Scan the QR code on the Polygon Web Wallet page as shown below.

Step 4:

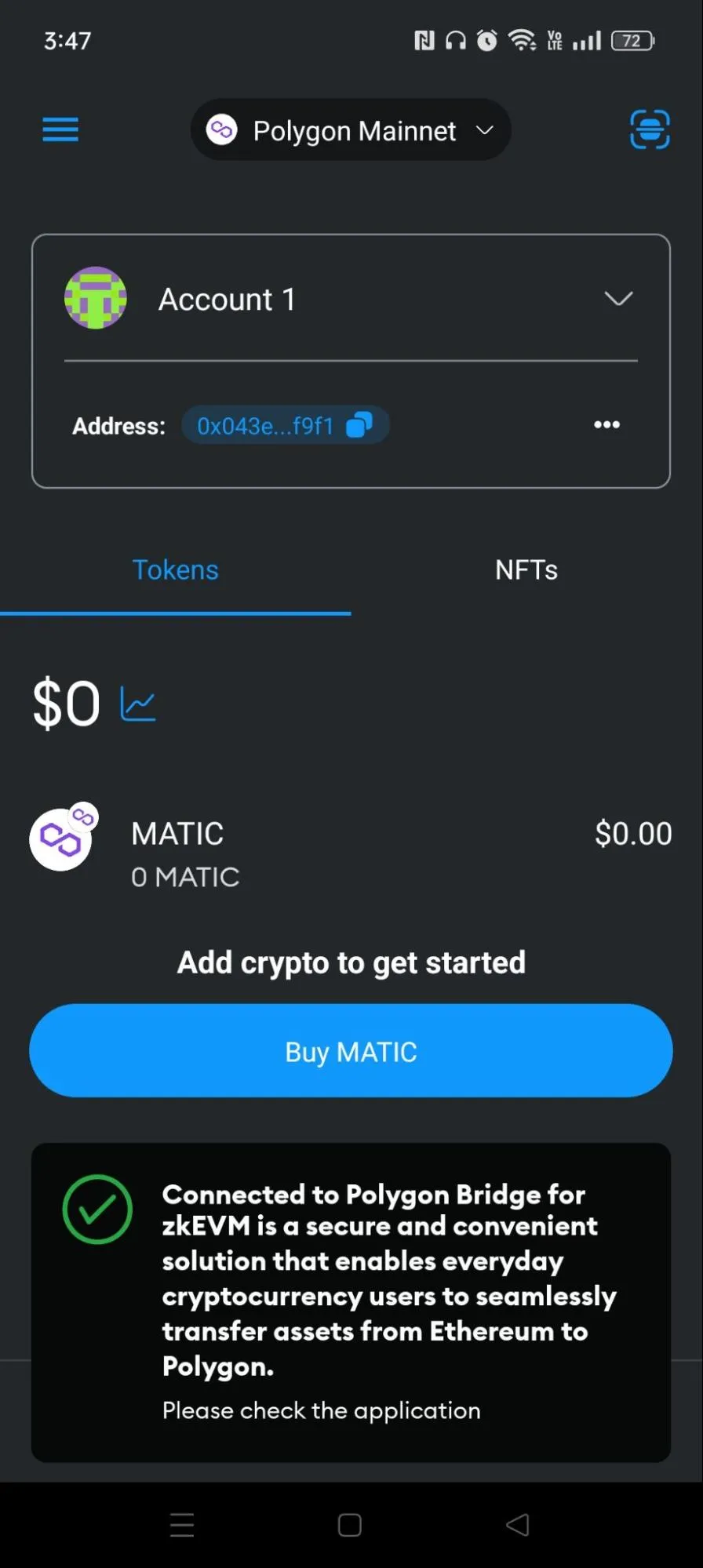

On your MetaMask wallet, click on ‘Connect’ as shown below. Once successfully connected, a pop-up will appear confirming the connection on your app.

Step 5:

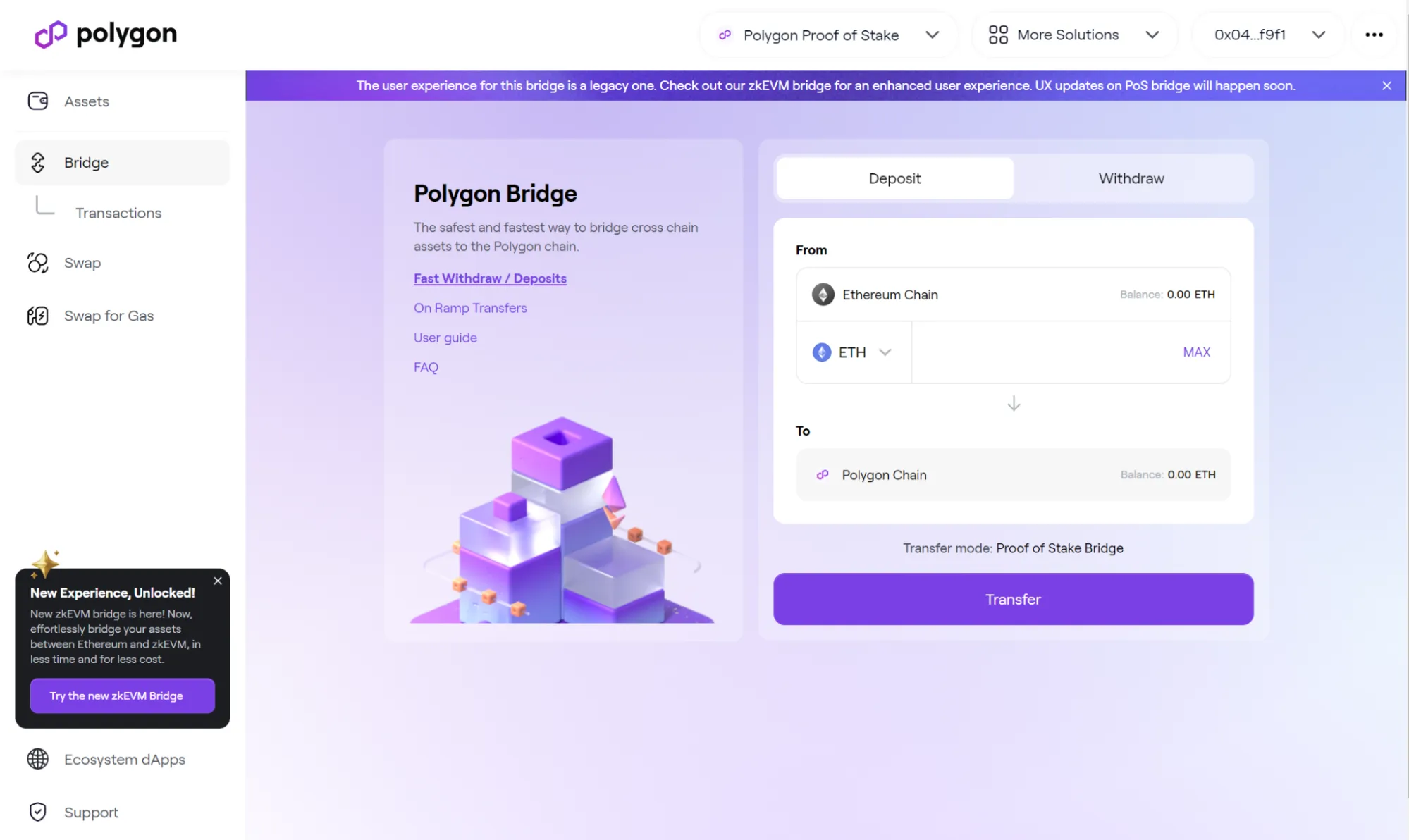

You will automatically be redirected to the Polygon Bridge page. If not, you can click on ‘Bridge’ on the left menu bar. Next, you can proceed to send your tokens from ETH from the Ethereum network to the Polygon blockchain. To do this, click on the token you want to bridge. For this guide, we’ll click on ETH and enter the amount of ETH you wish to bridge, and then click ‘Transfer.’

As usual, ensure you have enough tokens in your wallet before carrying out the transfer.

Step 6:

Once you click on ‘Transfer,’ Polygon Bridge will display some important notes regarding the transfer. Read through them and click on ‘Continue.’ Next, you will see the breakdown of the token amount, gas fees, and estimated transaction costs. If you are okay with everything, click on ‘Continue.’

Step 7:

Next, you must approve the transaction and sign the transfer in your crypto wallet. Check your MetaMask wallet to confirm the details are accurate, and click ‘Confirm.’

Step 8:

Once you confirm the transfer, wait for the tokens to land in your Polygon wallet. Please note that the transfer might take anywhere from a few seconds to a couple of minutes, depending on how busy the network is. You can also check on the status of the transaction by clicking on ‘View on Polygonscan’ on your MetaMask wallet.

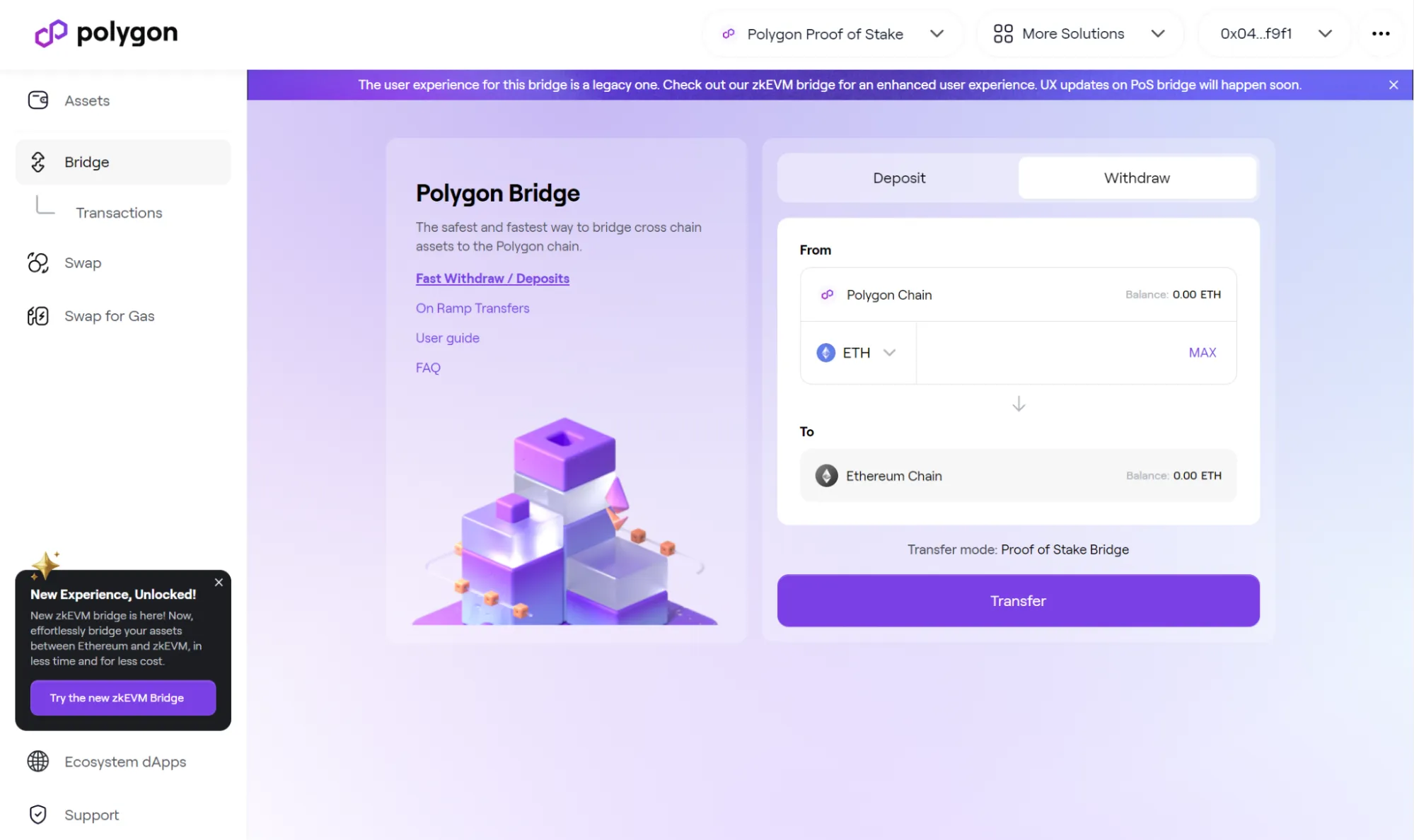

Additionally, if you wish to withdraw your Polygon token from Ethereum, all you will need to do is switch to the ‘Withdraw’ tab. The blockchains will automatically switch places, and you can proceed to complete the transfer.

Interested in the zkEVM bridge? Follow these steps:

- Visit the Polygon Bridge Web Wallet: Click ‘Connect to Wallet’ and select MetaMask.

- Choose the zkEVM Bridge: This new bridge offers an improved user experience and supports fast finality for transactions.

- Initiate the Transfer: Select the token to bridge, enter the amount, and follow the prompts to complete the transaction. The zkEVM Bridge eliminates the need for token mapping, streamlining the process.

3 Best Polygon bridges

zkEVM aside, it is time to discuss the best Polygon bridges!

To enhance your experience with cross-chain transactions, here are the three best Polygon bridges:

- Polygon PoS Bridge: The Proof-of-Stake (PoS) Bridge is widely used for transferring tokens, such as ERC-20 and ERC-721, from Ethereum to Polygon. It offers lower gas fees and fast transaction times, making it a preferred choice for many users looking to bridge assets.

- Polygon Plasma Bridge: This bridge uses the Plasma scaling solution to provide increased security. It supports specific ETH tokens and MATIC, Polygon’s native token. It is ideal for users to prioritize security in their bridging assets.

- AnySwap Bridge: A popular option for those looking for blockchain interoperability, the AnySwap Bridge supports a wide range of tokens and provides a seamless way to move assets between Ethereum and Polygon. Its ease of use and extensive support make it a top choice for cross-chain transactions.

Troubleshooting common issues

There can still be issues despite you relying on the best Polygon bridge. Here are a few that you can expect and the ways around them:

Stuck Transactions

If you encounter stuck transactions when bridging assets:

- Check Transaction Status: Use Polygonscan to monitor the status of your transaction.

- Increase Gas Fees: In some cases, increasing the gas fee can help push through a stuck transaction.

- Retry the Transaction: If a transaction fails, wait for a confirmation and then attempt the transaction again.

Connectivity Problems

Connectivity issues with your cryptocurrency wallet can disrupt the bridging process:

- Ensure Wallet Connectivity: Ensure your wallet, such as MetaMask, is properly connected to the Polygon network.

- Clear Browser Cache: Sometimes, clearing your browser cache can resolve connectivity problems.

- Update Wallet Software: Ensure your wallet software is up to date to avoid compatibility issues when transferring tokens.

Support and Resources

Here is how you can troubleshoot:

- Polygon Support: Visit the Polygon support page for comprehensive guides and FAQs on bridging assets.

- Community Forums: Engage with the community on forums and social media platforms for troubleshooting advice on blockchain interoperability.

- Technical Support: Contact Polygon’s technical support team for assistance with complex issues related to layer 2 solutions.

Tips for reducing Gas fees

Bridges can be hard on your pocket. Here are the steps to make the charges more affordable as reducing gas fees when transferring tokens from Ethereum to Polygon can significantly impact your overall costs. Here are some best practices:

- Use Layer 2 Solutions: Utilize layer 2 solutions like the Polygon PoS Bridge, which typically have lower fees compared to the main Ethereum network.

- Optimize Transactions: Combine multiple small transactions into a single larger one to save on fees when using your cryptocurrency wallet.

- Check Gas Prices: Use tools to monitor gas prices and choose the optimal time to execute cross-chain transactions.

Timing Your Transactions Timing is crucial when aiming to reduce gas fees:

- Avoid Peak Hours: Conduct transactions during off-peak hours when the network is less congested to benefit from lower fees.

- Use Gas Fee Trackers: Employ gas fee tracking tools to find the best times to perform cross-chain transactions.

The Polygon Bridge is key to furthering interoperability

The utilization of both the proof-of-stake and Plasma bridging options in the Polygon ecosystem helps to guarantee better cross-chain interoperability between blockchains. Using the Polygon Bridge to transfer assets across different blockchains has multiple benefits. For instance, users who want an alternative way of exploring DApps or DeFi platforms on the Polygon network can use the bridges to do so. The low transaction costs also make it an attractive tool to use.

With cross-chain interoperability as an essential aspect of Polygon, the leading blockchain network is well-positioned to contribute to the growth of the web3 ecosystem.

Frequently asked questions

What is the Polygon Bridge?

What is the best bridge for Polygon?

Is there a BSC to Polygon Bridge?

How long does the Polygon Bridge take?

Can I Use the Polygon Bridge to Transfer NFTs from Ethereum to Polygon?

What Should I Do If My Transaction Gets Stuck While Using the Polygon Bridge?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.