When Pi Network (Pi) launched in 2019, most people thought it was just an experiment. Mining on a phone? No exchange listings? Many believed it would never hold real value. But here we are; Pi Coin is the hottest topic in town, with exchanges listing it and speculation running wild. So, what’s next? This Pi price prediction (2025-2035) breaks down potential growth, trends, and what could shape the future value of Pi Coin.

KEY TAKEAWAYS

➤ Pi Coin’s price will depend on adoption, utility, and ecosystem growth.

➤ Market cycles will impact Pi’s price trends till 2035.

➤ Tokenomics changes can drive volatility or long-term price stability.

- What is the Pi Network (Pi) price forecast until 2035?

- Pi Network (Pi) price prediction 2025

- Pi Network (Pi) price forecast 2026

- Pi Network (Pi) price prediction 2027

- Pi Network (Pi) price prediction 2028

- Pi Network (Pi) price prediction 2029

- Pi Network (Pi) price forecast 2030

- Pi price predictions and the role of fundamentals

- Is holding Pi Network (PI) a wise call?

- Frequently asked questions

What is the Pi Network (Pi) price forecast until 2035?

Here is a quick table that summarizes our price expectations around PI, all the way up till 2035:

| Year | Minimum price of PI | Maximum price of PI |

| 2025 | $1 | $3.06 |

| 2026 | $1.75 | $3.86 |

| 2027 | $3.8 | $4.87 |

| 2028 | $3.5 | $4.3 |

| 2029 | $3.8 | $5.2 |

| 2030 | $5 | $7.2 |

| 2031 | $6.2 | $8.0 |

| 2032 | $8.5 | $12 |

| 2033 | $12 | $18 |

| 2034 | $18 | $25 |

| 2035 | $25 | $40 |

Do note that these prices are mostly speculative and rangebound. PI reaching these values, regardless of the year in question, isn’t guaranteed.

Pi Network (Pi) price prediction 2025

As Pi Coin was listed on exchanges only at the end of February 2025, it doesn’t actually make sense to chart the daily price pathways. Instead, we will be taking the hourly price action into consideration.

Considering Pi has already seen a post-listing surge to a level of close to $2.90, we can remain relatively optimistic regarding the current price action. At present (as of Mar. 18, 2025), the hourly chart shows that despite breaking out of the pennant formation, Pi coin has managed to drop yet again, currently sitting at $1.24. The previous support of $1.49 is currently acting as a strong resistance, and for Pi to move up, this line needs to be breached with high-to-decent volume.

If the bull market resumes, Pi might be able to breach past the previous highs charted by the PI/USDT pair, which makes us hopeful of a potential 2025 high of $3.06 or even $3.544, if market conditions hold.

On the downside, a breach under $1.1 can push the price of Pi coin even down to $1, as there aren’t many historical support levels in sight.

Pi Network (Pi) price forecast 2026

Provided PI moves as high as $3.06 (being a tad conservative) in 2025 — while keeping $1.5 as the tentative lowest point for the year — we can expect a stronger price move in 2026. But then, the broader crypto market will have to hold steady.

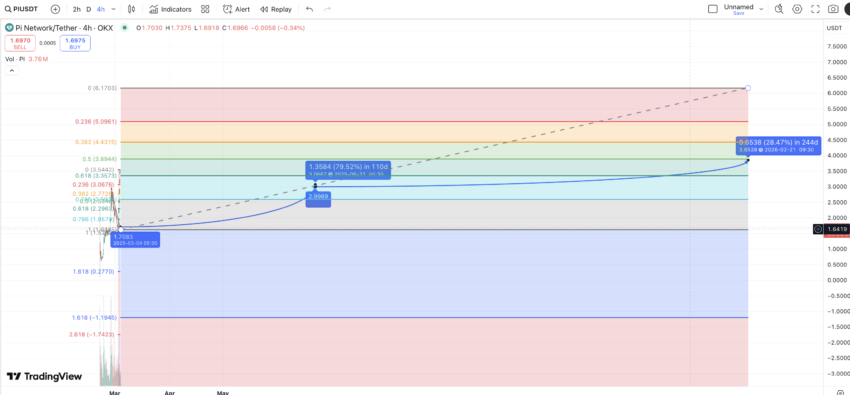

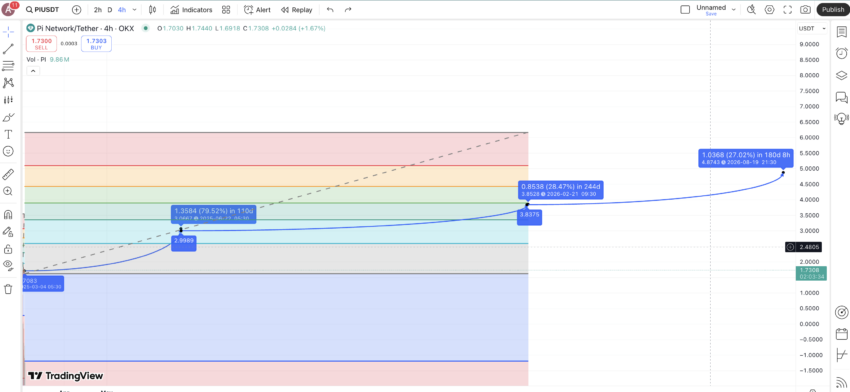

Do note that we shifted to the 4-hour chart in this case to locate the possible 2025 high at a farther point.

Based on the forecasted high of $3.06 in 2025, Pi coin might close in on a high of $3.86 by early-to-mid-2026. This conservative approach would be based on stable supply and demand, as most users will likely already have booked profits by then.

PI price forecast 2026: TradingView

The low could be anywhere between $1.75 (strong support) and $2.50 considering the presumed Pi Coin high of 2026 is expected to bring in new support levels for the coin.

Pi Network (Pi) price prediction 2027

The average percentage growth for the price of PI from 2025 to 2026 is 26.14%. Keeping that in mind and expecting the positive market conditions to continue till mid-2027, we can expect PI to go as high as $4.87. The low could still be around the $3 mark, depending on the new and continuing support levels in play.

Pi Network (Pi) price prediction 2028

By 2028, the crypto market could turn bearish, following the four-year cycle pattern seen in previous halving-based market trends.

Historically, bull markets peak within one to two years after Bitcoin’s halving (2024), followed by a downturn. If this trend continues, Pi Coin could see reduced demand and profit-taking, leading to a potential correction.

Pi’s price could dip toward $4.10-$4.30, with support levels between $3.50-$3.80 if selling pressure increases. However, if Pi Network enables microtransactions, peer-to-peer lending, or low-cost remittances, demand might stay intact, limiting the downside. Pi’s role as a digital currency within its ecosystem will determine its resilience in a bear market.

Pi Network (Pi) price prediction 2029

If 2028 plays out as a correction year, 2029 could see a slow recovery, as accumulation typically begins ahead of the next Bitcoin halving (2032). If Pi Coin maintains network growth, its price could gradually climb toward $5.00-$5.20, though growth might be measured rather than explosive.

The Pi ecosystem’s development will be critical. If Pi enables cross-border payments with minimal fees, introduces staking rewards for network validators, or supports merchant adoption, its price floor could strengthen. Otherwise, prices might hover between $3.80-$4.20 until broader market sentiment shifts positively.

Pi Network (Pi) price forecast 2030

By 2030, if the crypto cycle repeats, a new bull phase could emerge. Historically, post-halving years (e.g., 2017, 2021) have seen fresh inflows of capital. If Pi Coin continues expanding, its price could push toward $6.50-$7.20, with an optimistic high of $8.00 if institutional adoption grows.

A key factor will be real-world Pi Coin utility. If Pi enables merchant payments at scale, integrates with fintech applications for instant transactions, or introduces smart contract functionality for lending and borrowing, its demand could surge.

Conversely, if Pi fails to expand beyond a niche ecosystem, growth may cap around $5.80-$6.20.

Pi price predictions and the role of fundamentals

Price predictions are fun, but let’s be real; no chart or algorithm can predict how high Pi Coin will actually go without taking into account the fundamentals. Technical analysis gives us trends, but if Pi Coin is ever going to hit the big leagues, what really matters is adoption, real-world usage, and how well the ecosystem grows.

Now that Pi Network’s Open Mainnet is live, everything depends on what comes next. Can Pi attract developers to build decentralized apps (DApps)? Will businesses start accepting it as payment? The more integrations and real-world use cases Pi gets, the higher its potential price ceiling.

And let’s not forget the most important part: the users. A blockchain without active users is like a party with no guests. The more people transact, hold, and use Pi, the stronger its demand. More users mean more transactions, more utility, and ultimately, a higher price.

As of March 18, 2025, Pi Coin is trading at approximately $1.24, experiencing a 10% decline in the past 24 hours.

This decline is partly attributed to the raised concerns among traders about potential technical issues and delays, led by the recently concluded mainnet migration on March 14.

It is therefore critical to take note of all these factors, alongside the technicals, to get a truer picture of the Pi Network’s (PI) price in years to come.

If you’re looking to hold or trade the trending asset, check our step-by-step-guides covering how to buy Pi Coin, as well as how to sell Pi Coin. If you’re feeling like you missed out getting a slice of Pi before the hype and are looking for other ways to earn without investment, check our list of the top free mining coins in 2025. Remember, never invest due to FOMO.

Can tokenomics have a role to play?

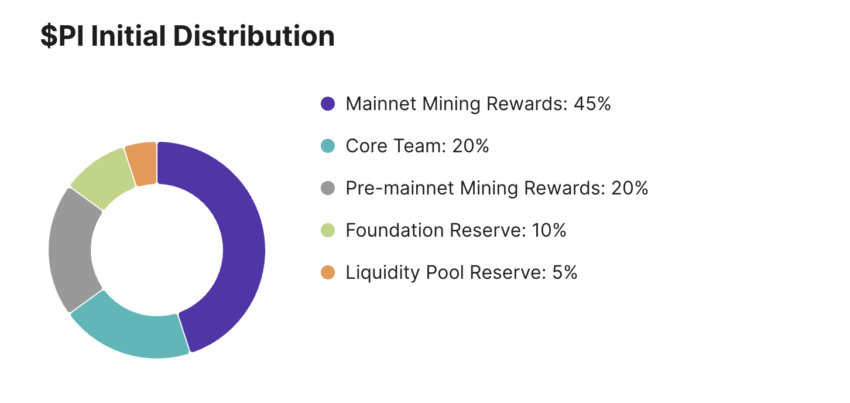

Pi Coin’s tokenomics are key to the network’s future price potential. It isn’t just about numbers; it’s about how supply and demand play out over time. Investors keeping an eye on Pi’s allocation model can get a better sense of where the price might be headed. Here’s a look at the current allocations.

Mining rewards (65% currently)

With 65% of Pi’s total supply allocated to mining, rewards have been the driving force behind network growth. More miners mean more engagement, but if Pi keeps entering circulation faster than demand grows, inflation could become a problem, pushing prices down.

Many projects have faced this issue — too much supply and not enough buyers. To remain sustainable, Pi may need to adjust mining rates over time or introduce staking to balance supply and demand. Otherwise, what fuels growth today could create instability down the line.

On the other hand, if Pi gradually reduces mining rewards — just like Bitcoin’s halving mechanism — it could help control supply, making each coin more valuable over time.

Core team allocation (20% currently)

Allocating a portion of tokens for the core team is standard practice in crypto. This keeps developers motivated and invested in the project’s long-term success. But here’s the catch: if there’s no vesting schedule in place, things can go south fast.

Without restrictions, team members could cash out large amounts all at once, flooding the market and triggering a price drop. This has happened before with other projects — major token unlock events often increase volatility and shake investor confidence.

Ecosystem growth fund (10% currently)

Not every ecosystem fund delivers what it promises. If funds meant for development, partnerships, and growth are mismanaged or lack transparency, investors start asking questions. This often leads to a decline in prices.

Fact check: On Mar. 14, 2025, Pi Network celebrated its sixth anniversary by launching several initiatives to expand its ecosystem. These include the Pi Domains Auction, allowing users to secure customized .pi domains for businesses and personal use, and the commencement of PiFest 2025, a global shopping event promoting local commerce and real-world adoption of Pi Coin.

Liquidity pool (5% currently)

Liquidity matters because it ensures smooth trading — low liquidity can lead to wild price swings, making investors nervous. A strong liquidity pool, on the other hand, keeps price movements stable and builds trust.

Here is Ben Zhou’s take on $PI:

Is holding Pi Network (PI) a wise call?

Holding Pi Coin depends on how well the ecosystem evolves. Now that Pi Network’s Open Mainnet is live, its future price hinges on adoption, exchange listings, and real-world use cases. If the described Pi Coin price prediction trends hold true, the asset could see steady growth.

For long-term holders, the question is whether Pi can cement itself as a reliable digital asset. If the network grows, holding could pay off. If adoption stalls, price stagnation is a risk.

Disclaimer: This price forecast is for informational purposes only and should not be considered investment advice. Always do your own research. Never invest more than you can afford to lose.

Frequently asked questions

Can Pi Coin become a top 10 cryptocurrency by market cap?

Can Pi Coin be used for real-world payments?

What risks should investors consider before holding Pi?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.