As technology has advanced, the world has grown much smaller. As a result, you probably have loved ones in other countries, do business in other nations, or perhaps like to vacation all over the globe. So, you need a reliable way to send money across borders. Crypto is the best method for cross-border money transfers, offering faster and cheaper services than banks. So, in what ways can you transfer money with crypto? This guide details the three top methods.

BeInCrypto Trading Community in Telegram: read news & reviews on the best crypto platforms, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

- What are the best ways to use crypto for cross-border money transfers?

- Nexo Card

- Coinbase Card

- Binance Card

- Kraken exchange

- Bybit exchange

- ZenGo Wallet

- Ledger Wallet

- Trezor Wallet

- Hassles with cross-border money transfers

- Crypto cross-border money transfer methods compared

- Crypto offers an effective solution for reliable cross-border payments

- Frequently asked questions

What are the best ways to use crypto for cross-border money transfers?

Crypto debit or credit cards

There are some great benefits to using crypto cross-border payments rather than traditional fiat for foreign exchange. Primarily, Visa and Mastercard crypto debit and credit cards are accepted anywhere Visa and Mastercard are accepted. Secondly, when you withdraw, they instantly convert to EUR if you open an account in Europe.

Nexo Card

– No monthly, annual, or inactivity fees

– No FX fees for up to €20,000 per month

– Up to €10,000 in monthly ATM withdrawals

– Up to 10 free withdrawals per month

- Physical and virtual

- Cashback rewards

- Accepted wherever Mastercard is accepted

- Only available for EEA residents

- Only works on credit

1. Sign up to Nexo using the link below, complete KYC and download the mobile app.

2. In the Nexo app go to the Card tab.

3. Swipe left and tap on the Order Nexo Card button.

4. Follow the on-screen instructions and wait up to 2 weeks for your physical card to arrive. Virtual card will be issued immediately.

Coinbase Card

The Coinbase Card is a Visa debit card that is accepted anywhere Visa is accepted. It works offline, online, and globally. You can use the card to make everyday purchases at your favorite stores or to withdraw cash from your Coinbase account at ATMs. The Coinbase Card can be used to spend funds from any of your Coinbase balances.

There are no transaction fees for spending with the Coinbase Card. You can spend US Dollars (USD), USDC, or any supported crypto on Coinbase using your Coinbase Card and there will be no transaction fees. Coinbase does include a spread in the price to buy or sell cryptocurrencies.

- Connects to your Coinbase account

- Accepted anywhere Visa is accepted

- Spending limit

- One card per user

1. Sign up for Coinbase Card through Coinbase.com or the Coinbase mobile app using the link below.

2. Go to the Pay tab

3. Click Apply now under Coinbase Card

4. Follow the directions to sign up.

Binance Card

The Binance Debit Card is a cryptocurrency debit card that allows you to easily convert your crypto assets into fiat currency. Because the Binance Card is issued by Visa, it can be used anywhere Visa is accepted. It also functions similarly to a traditional debit card, allowing you to make purchases and withdraw cash from ATMs.

-Amount per contactless transaction: 50 EUR (across Europe)

-Accumulated amount of contactless payments: 150 EUR

-When you reach the accumulated contactless payment limit, you need to make a chip & pin transaction to reset it, and you will be able to use contactless payment again.

-Transaction fees up to 0.9%.

- Up to 8% cashback

- Card for refugees

- Low ATM and virtual card spending limit

- Not available in U.S.

1. Visit the Binance Visa Card website directly using the button below.

2. Click Finance and select Binance Visa Card from the navigation bar at the top.

3. Click Card at the bottom of Binance.com.

4. You must complete KYC requirements and live in an area where Binance Card is available to order a Binance Card.

5. Sign in to your Binance account and click Get Started on the Binance Card page.

6. Follow the instructions.

Crypto exchanges

There is a great benefit to using exchanges rather than banks for international payments. Exchanges that accept fiat make it easy to convert cryptocurrency into cash. Furthermore, you can open an account on an exchange and purchase crypto using a card. You can send crypto from anywhere to an account on an exchange and, in some cases, can even withdraw to any account.

Kraken exchange

Kraken services a multitude of countries, so it is widely accessible. The platform also supports hundreds of cryptocurrencies. Kraken Pro members may receive more favorable fees.

1. In order to withdraw cryptocurrencies from your Kraken account, you must first add and confirm the withdrawal address.

2. Sign in to your Kraken account and navigate to Funding.

3. Click the Withdraw button.

4. Search for the currency you wish to withdraw and then click on it.

5. Select a previously added address or click the Add Address button.

6. Enter the amount you would like to withdraw.

- Crypto deposits are available instantly

- Available in many countries

- Can not transfer between Kraken accounts

- Limited fiat support

Bybit exchange

Bybit is a global exchange. The platform supports a multitude of cryptocurrencies. It can also process up to 100,000 transactions per minute.

1. Before submitting a withdrawal request, please ensure you have linked your withdrawal wallet address to your Bybit account.

2. Select chain type: ERC-20 or TRC-20

3. Click on Wallet Address and select the address of your receiving wallet

4. Enter the amount you want to withdraw, or click the “All” button to make a complete withdrawal

- High withdrawal limits

- Available in multiple countries

- Wallet recovery options

- Unregulated

Crypto wallets

Using crypto wallets to send cryptocurrency is a great way to remain sufficiently decentralized. You can instantly send crypto to any other wallet anywhere in the world. Peer-to-peer transactions are always cheaper. Furthermore, some wallets allow you to purchase crypto directly within the app.

ZenGo Wallet

ZenGo wallet is relatively safe for new users. It supports a multitude of cryptocurrencies. ZenGo is suited for crypto beginners who need to send payments.

1. To send crypto assets from your ZenGo wallet, you can either swipe right on an asset in the Home screen or you can tap an asset and tap the Send button.

2. Enter the amount you want to send in your preferred currency.

- Simple to use

- Supports multiple cryptocurrencies and blockchains

- Custodial

Ledger Wallet

Ledger is a very reliable and secure wallet. You can send crypto from the app, all while securing your assets. You can also use Bluetooth with the hardware wallet.

1. Click the Send button on the left panel or at the top of an account page.

2. Type or use the drop-down list to select the Account to debit.

3. Enter the recipient address.

4. Enter the amount to send.

5. Choose the Network fees from the drop-down list and click on Continue.

- Customer support

- Secure wallet

- Available in multiple countries

- Not open source

- May be difficult for beginners

Trezor Wallet

Trezor is very secure and safe. It has a solid reputation and built-in systems that prevent brute force attacks.

1. Making payments in Trezor Suite.

2. Enter the destination address and the amount.

3. Setting transaction fees.

4. Labeling.

5. Confirm the transaction on your Trezor device.

- Very secure

- Available in many countries

- Supports multiple cryptocurrencies

- Not available on IOS

Hassles with cross-border money transfers

Making payments to other countries is a nightmare with traditional systems. This is the case for tradesmen, businesses, and banks alike. Cost, security, time, liquidity, and transparency are all problems that affect cross-border transactions.

Global remittances may take days to settle. Not only do banks have to have relationships with each other to facilitate transfers, but they have to resolve their ledgers with each other. Not to mention that nations have to have swap lines to access liquidity for each other’s currencies.

Because this financial system has such a wide surface area, there is a lot of room for fraud, so naturally, anti-money laundering measures must be imposed. This system takes time and has a high overhead. Thankfully, crypto cross-border money transfers solve all of this.

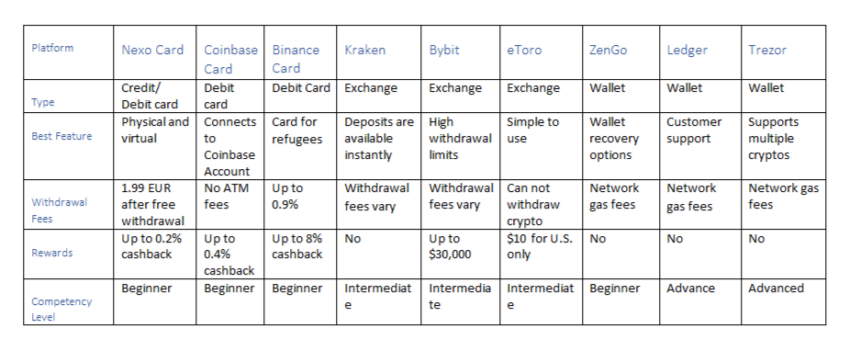

Crypto cross-border money transfer methods compared

Crypto offers an effective solution for reliable cross-border payments

The global monetary system is convoluted. In today’s era of crypto, it makes less sense to use it for money transfers between individuals. Blockchain networks can guarantee faster and more reliable payments. The safeties — or lack thereof — guaranteed by central banks are slowly moving over to decentralized finance. Crypto cross-border money transfers are only the beginning.

Frequently asked questions

What is a cross border money transfer?

What is the problem with cross border money payments?

How do I transfer money internationally through crypto?

How do crypto cross border payments work?

What is the best crypto for international transfer?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.