In the ever-evolving landscape of cryptocurrency, decentralized exchanges (DEXs) have emerged as a promising alternative to centralized exchanges (CEXs). Among these DEXs, peer-to-peer (P2P) DEXs have gained attention due to their unique approach to trading digital assets. In this guide, we explore what a P2P DEX is, its unique advantages, and how it executes crypto trades.

Understanding the basics of P2P DEXs

A P2P DEX, as the name suggests, is a decentralized exchange that allows one user to trade cryptocurrencies directly with another user.

Unlike centralized exchanges, where trades are facilitated by a central authority that controls the funds and matches orders, P2P DEXs completely remove the need for a third-party intermediary. That means users can transact with one another securely and maintain full control of their funds throughout the trading process.

AMM DEX vs. P2P DEX

Decentralized exchanges have become a popular way to trade crypto in recent years. However, it’s important to note that there are two main types of decentralized exchanges: automated market maker (AMM) DEXs and peer-to-peer (P2P) DEXs.

They differ significantly in two ways: how assets are exchanged and how slippage is determined.

Mechanism of exchanging assets

AMM DEXs, such as Uniswap and SushiSwap, utilize liquidity pools and mathematical formulas to determine the price of assets. These pools are funded by liquidity providers who deposit equal values of two different cryptocurrencies, enabling users to trade against the pool. The price is dynamically adjusted based on the supply and demand within the pool, leading to a constant price curve.

On the other hand, P2P DEXs facilitate direct trades between users without the need for a liquidity pool or centrally controlled smart contracts. Users can create their orders and specify the price they are willing to buy or sell. Thus allowing for more flexibility in negotiating prices. The P2P approach gives users more control over their trades, while AMM DEXs rely on predefined algorithms to determine prices.

Slippage

AMM DEXs generally benefit from higher liquidity due to the continuous funding from liquidity providers. As a result, users can execute trades with minimal slippage, even for large orders. However, the price slippage may increase for larger orders due to the limited liquidity in the pool.

In contrast, the liquidity of P2P DEXs relies solely on the trading activities of users. This can vary significantly depending on the platform’s popularity and demand for specific trading pairs. As a result, P2P DEXs might face higher slippage for larger orders, as finding matching orders at the desired price may be challenging. This potential slippage is an important consideration for traders seeking to execute substantial transactions.

The advantages of P2P DEXs

P2P DEXs offer several advantages that make them an attractive option for many cryptocurrency traders compared to CEXs and AMM DEXs.

Enhanced security

One of the primary advantages of P2P DEXs is enhanced security. Since users retain control of their private keys and funds, the risk of hacks or thefts associated with centralized exchanges or AMM DEX liquidity pools is significantly reduced. This truly decentralized nature ensures that users are not vulnerable to security breaches that arise from a single point of failure.

Data privacy

Many P2P DEXs allow traders to engage in transactions without revealing their identity or sharing personal information. Users can trade directly from their wallets, eliminating the need for Know Your Customer (KYC) procedures typically imposed by centralized exchanges. This anonymity safeguards users’ privacy and prevents potential data breaches.

No third-party control

Traditional exchanges often hold users’ funds in centralized wallets, giving the exchange provider full control over user assets. This has led to numerous issues, such as large-scale thefts from hackers, misuse of funds, and exit scams.

In contrast, P2P DEXs utilize non-custodial wallets where users hold their own assets. For trading, atomic swap technology is a specialized type of smart contract that enables direct trades between users. Atomic swaps eliminate the need for a central authority to control funds, reducing the risk of asset mismanagement or loss.

How P2P DEXs work

To understand how P2P DEXs work, let’s take a closer look at the underlying mechanisms involved.

Order matching

In a P2P DEX, trades are executed through order matching on order books. This is similar to how centralized exchanges function — except P2P DEXs don’t use a middleman.

When a user places an order to buy or sell a specific cryptocurrency on a P2P DEX, one of two things occur:

- The user creates a limit order that is filled if another user decides to accept the order. OR;

- The user creates a market order with an existing order.

Once a match is found, the trade executes via an atomic swap.

Atomic swaps

Atomic swap technology is a crucial part of P2P DEXs. An atomic swap is a trustless and decentralized method for exchanging cryptocurrencies between two parties without the need for an intermediary. This trading technology is powered by Hashed Timelock Contracts (HTLCs). HTLCs execute the atomic swaps based on agreed-upon criteria.

Atomic swaps are CALLED “atomic” because either the trade successfully executes and both parties receive their orders — or nothing happens, and funds are returned to their original owners.

One advantage of atomic swaps is that they allow users to directly swap cryptocurrencies based on the same blockchain or cryptocurrencies based on two different blockchains. For example, two users can trade native BTC and native ETH across their respective blockchains via atomic swaps. This solution doesn’t require a centralized liquidity pool or wrapped/proxy token.

User reputation systems

P2P DEXs often implement user reputation systems to build trust and mitigate the risk of fraudulent activities. Traders receive reputation scores based on their trading history, successful transactions, and adherence to the platform’s rules. Reputation systems help users make informed decisions when choosing their trading partners.

What are examples of P2P DEXs?

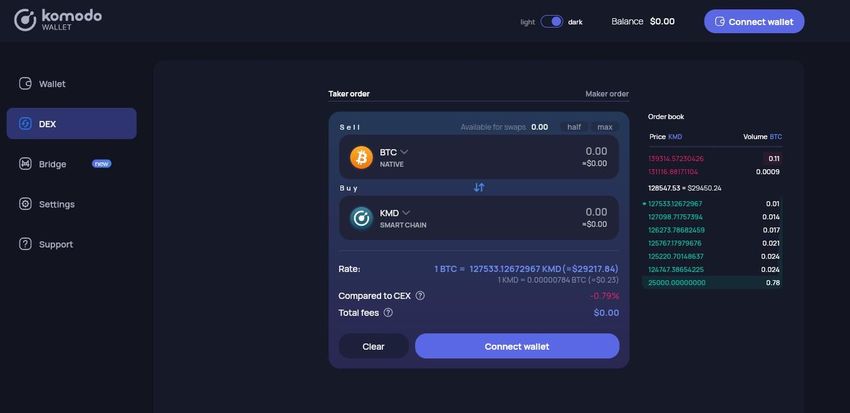

An excellent example of a P2P DEX is the Komodo Wallet. The Komodo Platform’s flagship decentralized application is a multi-chain non-custodial wallet, DEX, and bridge all rolled into one application. It offers the widest cross-chain trading support of any decentralized exchange on the market, including both P2P DEXs and AMM DEXs.

With Komodo Wallet, users can both HODL crypto assets and trade directly from their wallets. Users maintain full control of their funds, while the platform ensures that the trades are executed securely.

Another DEX to watch out for is Decred’s decentralized exchange, a non-custodial solution for cross-chain exchange based on atomic swap technology. The peer-to-peer exchange offers no trading fees, complete privacy, and the ability to always stay in control of your assets.

Decred’s DEX was voted in and built by the community, prioritizing security and decentralization in the process. The DEX matches trading parties and facilitates price discovery and the communication of swap details.

Dfyn, another decentralized exchange, was the first to introduce on-chain limit orders, combining the power of an RFQ matching engine with a concentrated liquidity AMM. Orders on the DEX are directed to the most efficient path by utilizing smart order routing. Dfyn signal is a multi-chain compatible smart trade-finding engine capable of finding the best trade for the user by comparing different token paths & different protocols with minimal slippage.

Are P2P DEXs the future?

Overall, P2P DEXs provide a promising alternative to both centralized exchanges and AMM DEXs, offering enhanced security, data privacy, and user control over funds. As the blockchain industry continues to move towards decentralized technologies, P2P DEXs are likely to play a significant role in shaping the future of cryptocurrency trading.

Frequently asked questions

What is peer-to-peer (P2P)?

What are the differences between P2P and AMM?

How do P2P networks ensure security and privacy?

Do P2P DEXs have limitations compared to CEXs?

About the author

Kadan Stadelmann is a blockchain developer, operations security expert, and chief technology officer of Komodo, an open-source technology provider that offers all-in-one blockchain solutions for developers and businesses. Komodo works closely with organizations that want to launch their own custom decentralized exchanges, DeFi platforms, and independent blockchains.

Kadan strongly identifies with Komodo’s open-source vision and ideology. His dedication to the Komodo project is founded on an unwavering desire to make the world a better place. In addition to cryptography, blockchain technology, and development, Kadan is interested in literature, mathematics, astrophysics, and traveling.