Despite stiff competition among crypto trading platforms, the Seychelles-based MEXC makes a name for itself courtesy of low trading fees and a specific focus on educating the crypto community. In addition to the key MEXC trading tools, this centralized exchange caters to spot, margin, and derivatives traders with its extensive suite of products. In this detailed MEXC review, we explore everything there is to this global exchange, evaluating and discussing its performance across key parameters.

MEXC

- MEXC

- MEXC review: Overall assessment

- What is MEXC?

- Where is MEXC available?

- How to sign up for MEXC in 2025?

- Welcome offer/bonus

- MEXC deposit and withdrawal methods and limits

- Payment methods supported

- How does MEXC compare to others?

- MEXC review: Features and tools

- Is MEXC a safe exchange?

- Does MEXC have good customer support?

- How have we tested MEXC?

- Regulatory compliance and safety

- Invest responsibly

- Is MEXC the right exchange for you?

- Frequently asked questions

MEXC review: Overall assessment

Before we delve deep into MEXC, let us first cover some of the critical elements.

- MEXC maintains a CoinMarketCap Trust Score of 6.1, having declared its proof-of-reserves status in 2024

- This exchange is packed with resources for experienced crypto traders — spot, futures trading options, MEXC margin trading support, quantitative trading features, and more.

- MEXC supports over 1600 coins and 2000+ trading pairs, making it a stand-out performer in the choice of cryptocurrencies.

- KYC verification isn’t compulsory for all MEXC users.

Here is our BeInCrypto graded assessment table:

| Criteria | Supported cryptocurrencies | Supported fiat currencies | Fees | Features | User experience | Customer support | Security (past breaches) | Our overall score |

| Score | 5/5 | 4/5 | 5/5 | 5/5 | 4.5/5 | 4/5 | 4/5 | 4.6 |

What is MEXC?

MEXC is a reputed cryptocurrency exchange founded by John Chen. Currently, the exchange serves 170+ nations and has a user base of over 10 million. While this MEXC review will mention the hits and misses associated with the exchange, what stands out is the highly competitive trading fees and support for almost every popular cryptocurrency there is.

John Chen, CEO of MEXC: Twitter

The exchange came to the fore in 2018 and started offering leverage ETFs to its users, along with spot and derivatives products. The exchange itself is capable of handling over 1.4 million transactions each second, making it one of the fastest around.

Did you know? MEXC was recognized and awarded as the “Best Crypto Exchange Asia” in 2021 during the Crypto Expo event in Dubai.

Currently, MEXC only offers spot and futures trading options to its users, depending on which crypto supports what.

Crypto trading on MEXC

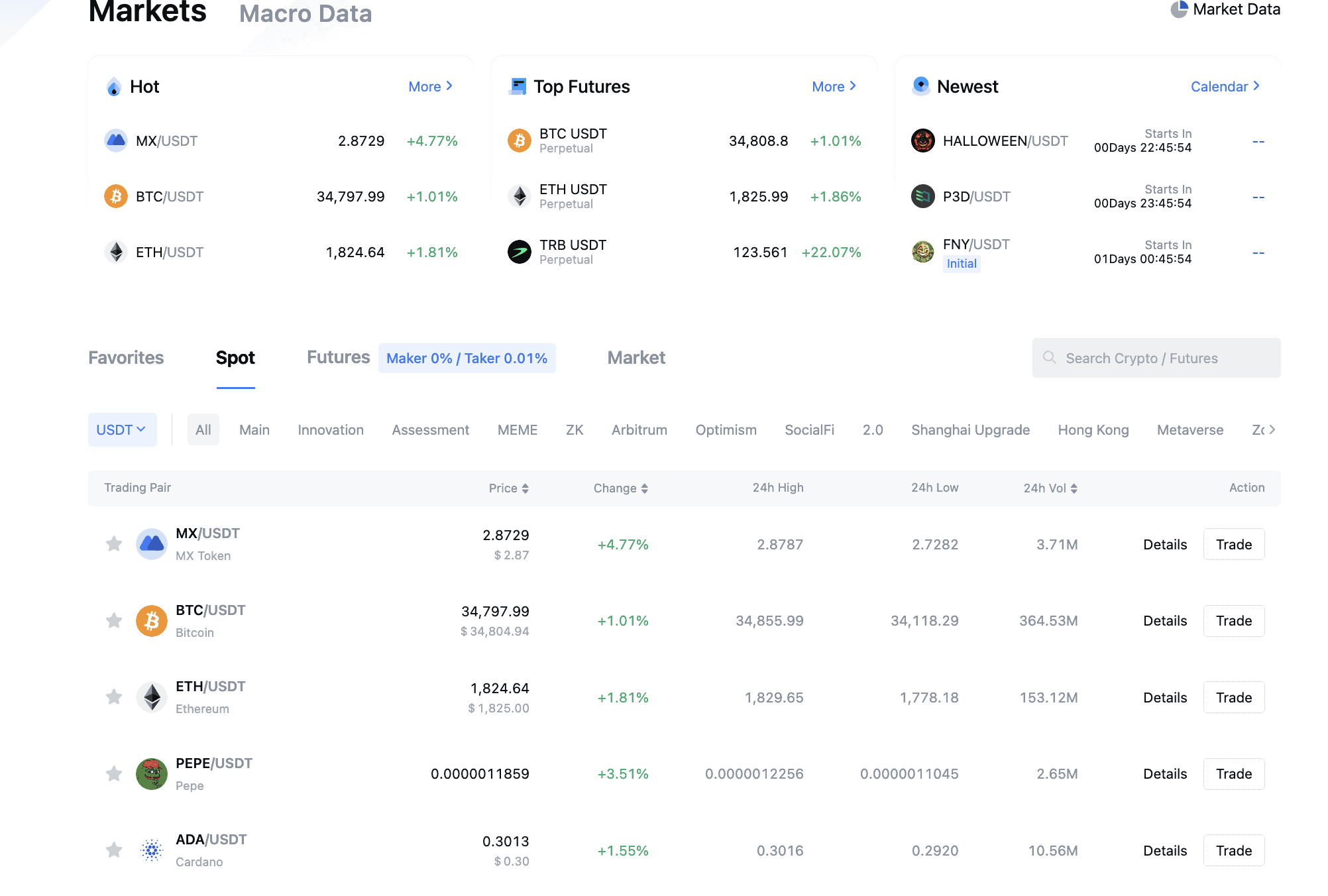

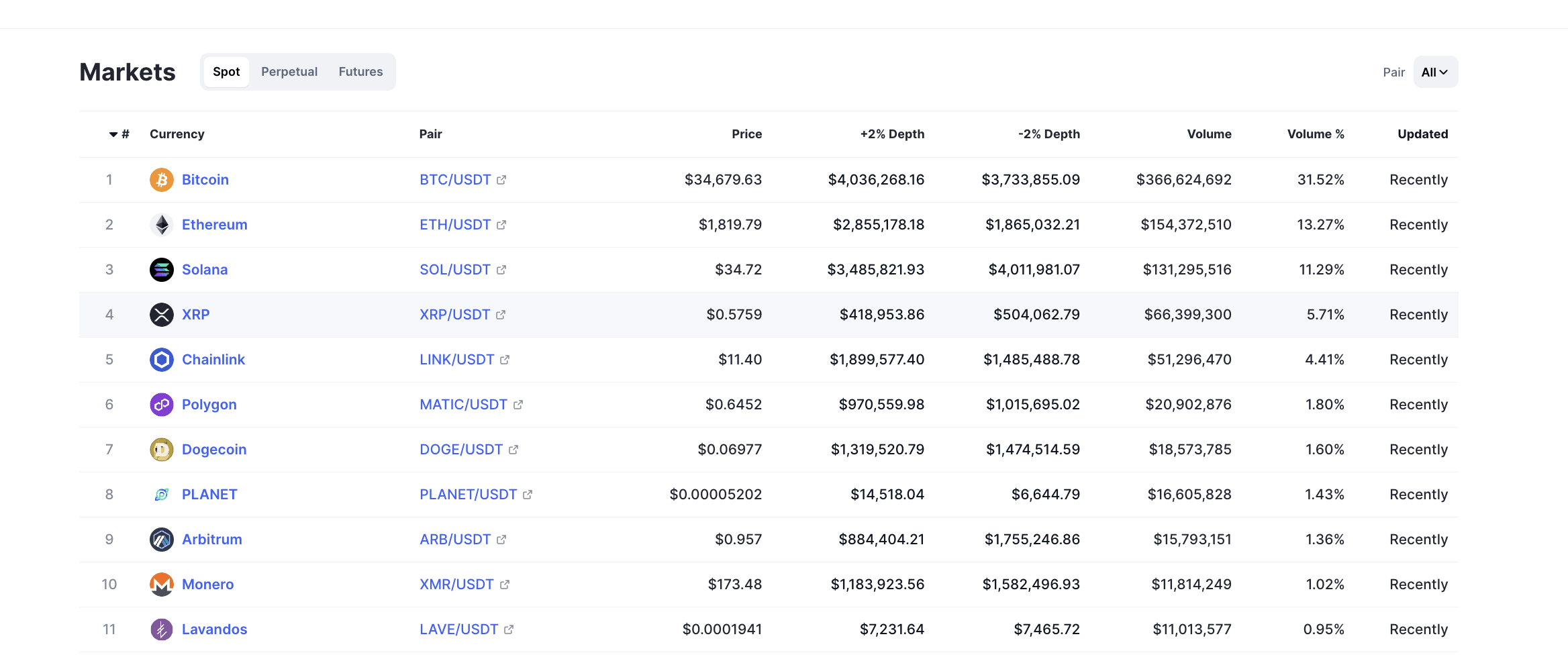

MEXC’s web interface shows that it currently supports over 1800+ coins. Per CoinMarketCap’s data, the most active spot trading pairs include BTC/USDT, ETH/USDT, SOL/USDT, and XRP/USDT. Notably, MEXC also supports perpetual contracts for specific assets, with BTC/USDT and ETH/USDT being the volume leaders.

MEXC’s web interface further segregates the diverse range of crypto into categories like ZK tokens, Arbitrum-native tokens, meme coins, top futures pairs, hot pairs, and more.

MEXC’s native token

MEXC also has a native token, MX, and the MX/USDT pair is one of the website’s more active assets. Holding MX tokens comes with many benefits, including price appreciation, rebates and discounts on specific trading scenarios, free airdrops, and other perks.

Keen to know more about centralized exchange tokens (CETS) and the roles they play within web3? Check out our complete guide.

Where is MEXC available?

As mentioned earlier, MEXC is currently operational in more than 170 countries. Some of the more popular nations include Australia, Brazil, South Korea, India, Dubai, the U.K., and more. Also, MEXC has operational limitations across several countries, including the following:

- North Korea

- Cuba

- Sudan

- Iran

- Canada

- United States

- Singapore

How to sign up for MEXC in 2025?

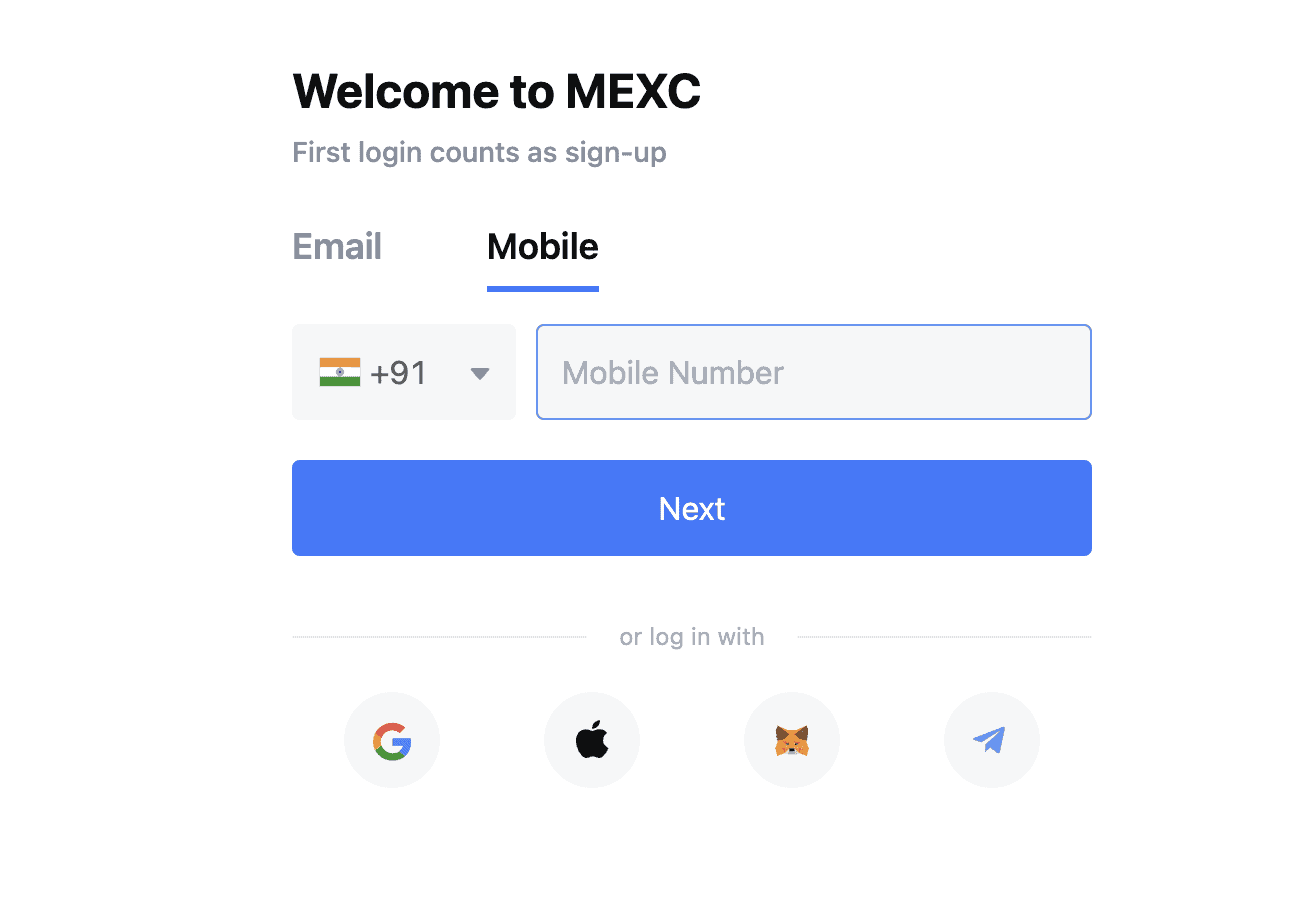

Signing up for MEXC requires you to log in with your email ID or phone, fill in the first password — more like setting it, complete a puzzle, and enter the code sent to your ID or phone.

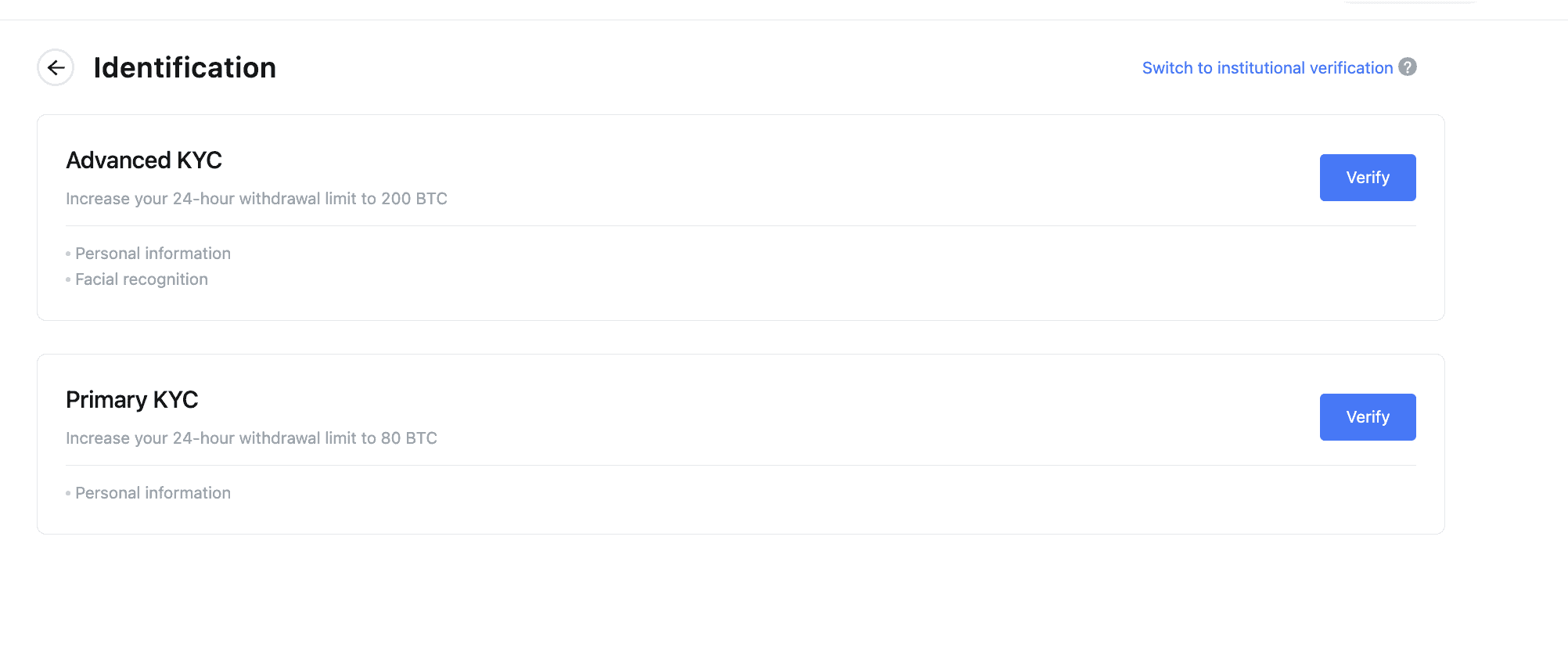

This is the basic sign-up process that lets you withdraw up to 30 BTC each day. However, you can complete the next verification level by setting up the primary KYC.

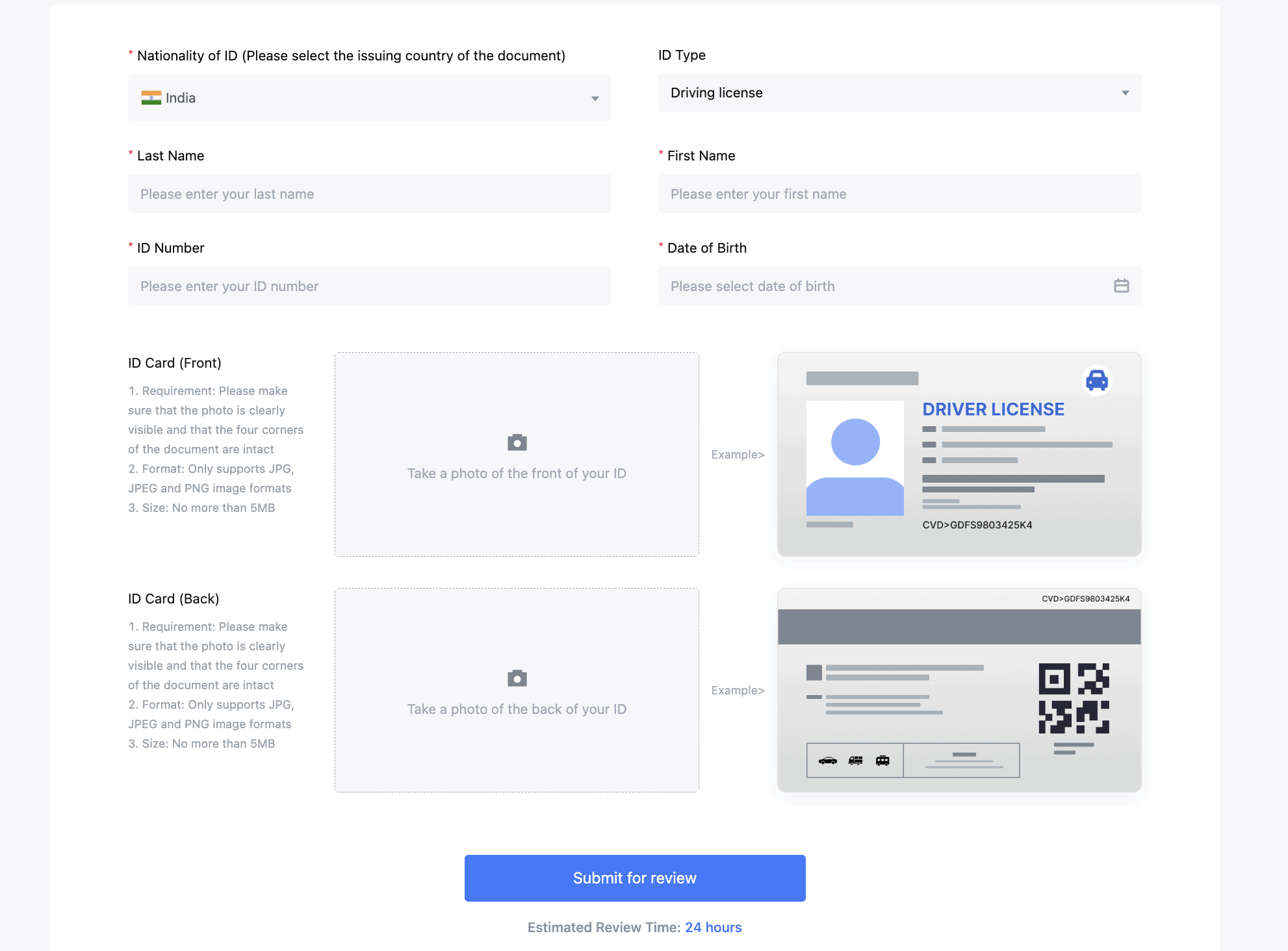

For primary KYC, the basic credentials, date of birth, and ID proof need to be submitted. MEXC might take up to 24 hours to verify this information. You can even opt for advanced KYC verification to further enhance the withdrawal limits.

Do note that advanced KYC verification requires some additional personal information and even facial recognition. You can even choose Business KYC if you plan on opening an institutional account.

Welcome offer/bonus

Once you have followed the sign-up flow and have successfully verified it, you are eligible for 1000 USDT worth of futures trading bonuses. However, the rewards aren’t credited at once and are segregated as deposit, trading, and community rewards.

Here are the details to grab each reward option and add more funds to your trading corpus.

MEXC deposit and withdrawal methods and limits

Imagine you have signed up and are waiting to make your first trade. To do that, you need to understand the nitty-gritty of the MEXC deposit and withdrawal methods, including the modes, limits, and underlying fees.

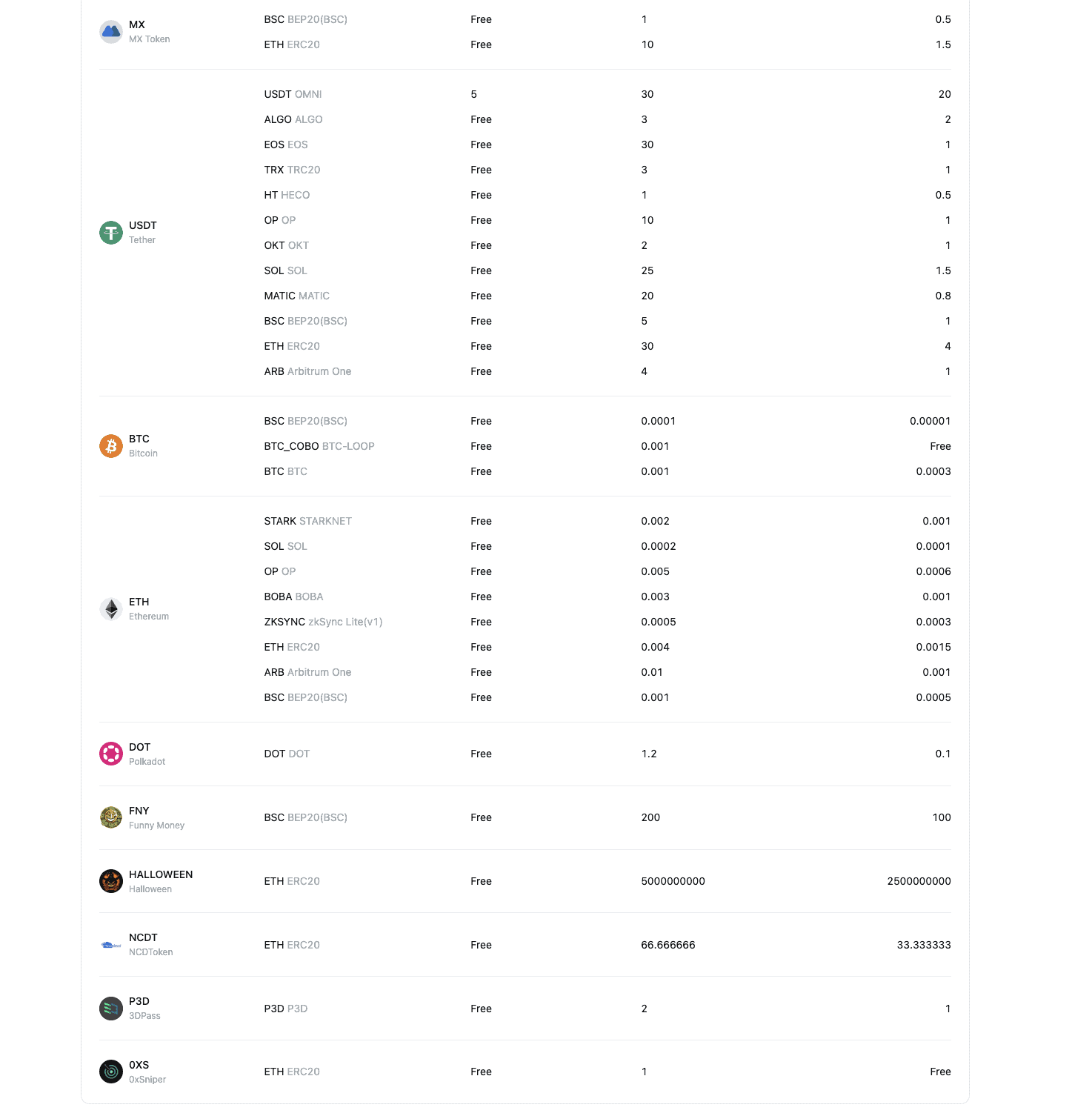

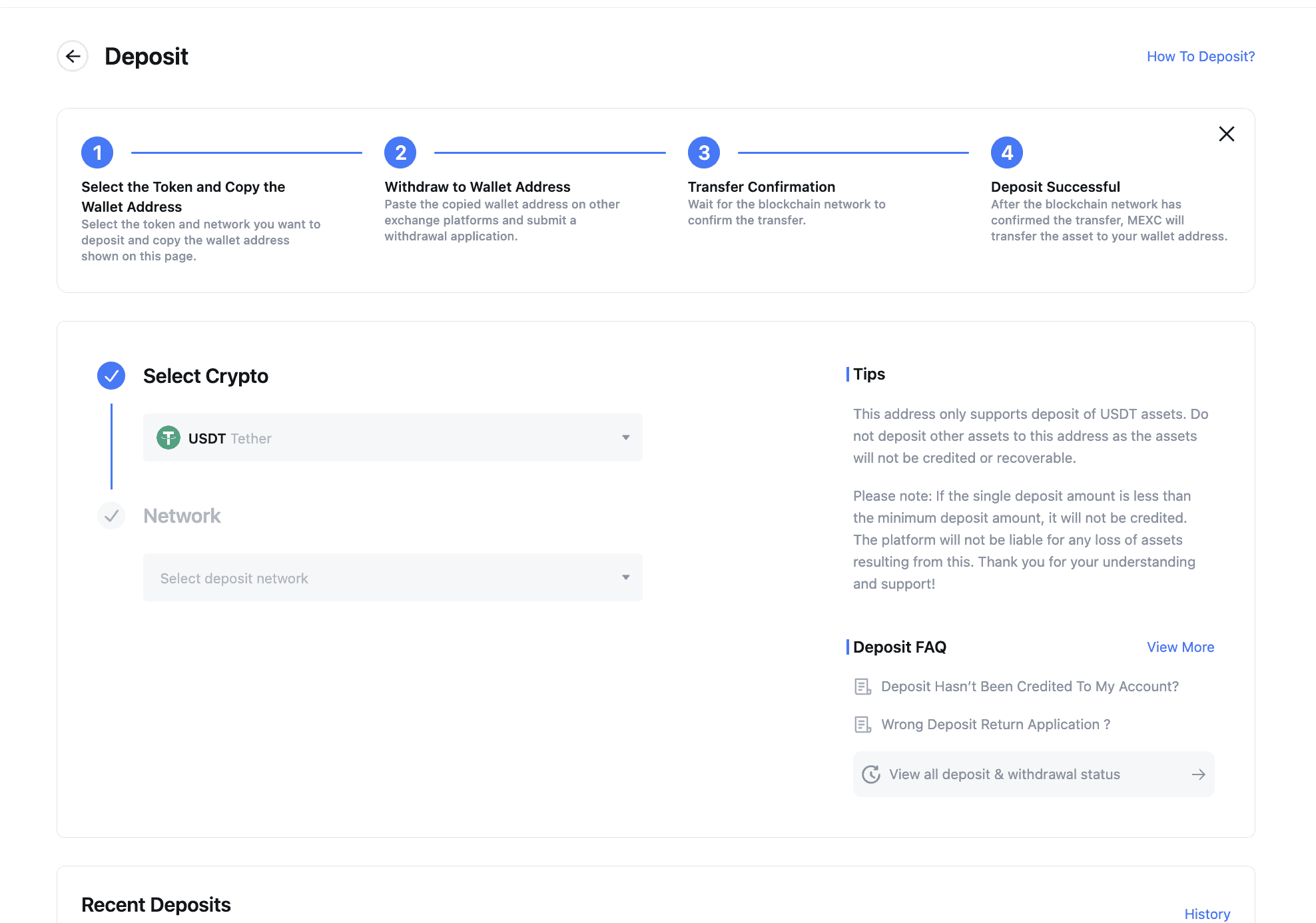

For starters, MEXC facilitates free and instant crypto deposits. Regarding the limits, you can deposit any amount you wish, barring a few cryptocurrencies. For withdrawals, the minimum amount varies depending on the cryptos you wish to trade. The withdrawal fee depends on the network you use to move your crypto around.

MEXC allows you to deposit funds to its spot, futures, or fiat wallet, depending on the trades you want to execute. Finally, the maximum withdrawal limits at MEXC depend on the type of verification you choose. An unverified user can withdraw up to 30 BTC daily, whereas Primary and Advanced KYC allow you to move 80 BTC and 200 BTC, respectively.

Payment methods supported

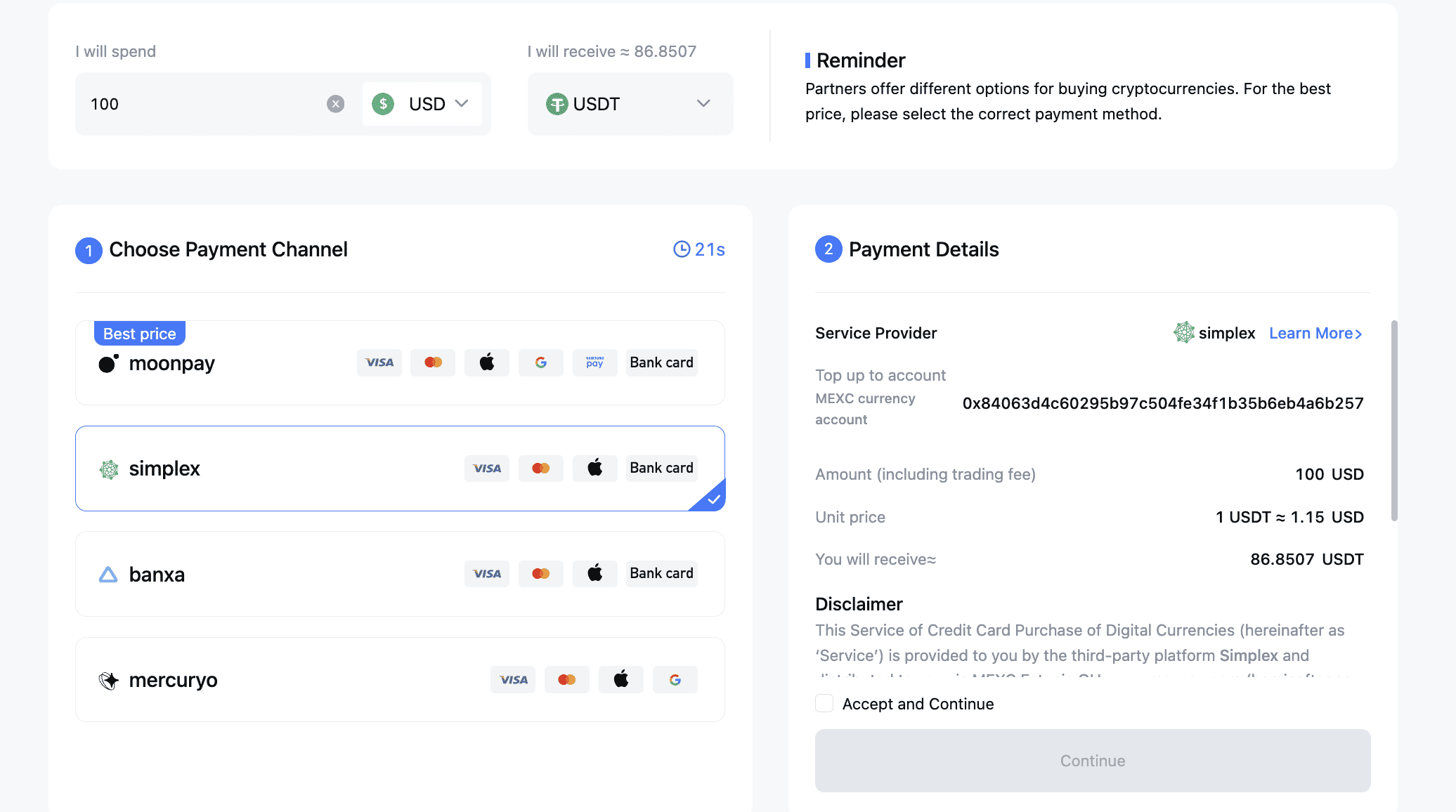

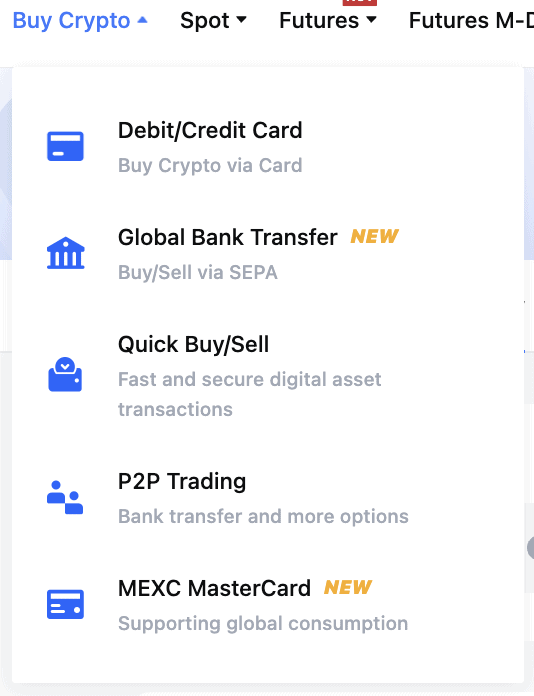

MEXC isn’t only about crypto deposit and withdrawal methods. You can also purchase cryptocurrencies directly using specific payment methods. Depending on the type of fiat you wish to use to make purchases, MEXC supports debit/credit cards and third-party payments to purchase cryptos directly.

If you wish to buy and sell cryptocurrencies via P2P, even bank transfers, including SEPA transfers, are allowed.

How does MEXC compare to others?

A critical aspect of the MEXC review has to be how it compares against other crypto trading platforms.

MEXC vs. Kraken

While Kraken is a market leader in offering trading options and handling security implementations like Pro, MEXC offers more cryptocurrencies to choose from. Plus, MEXC seems to have a wider reach, courtesy of the 170+ country spread.

MEXC vs. Binance

In terms of crypto trading options, Binance is a force to reckon with. With over 1500 trading pairs, Binance offers a huge choice to traders. Yet, MEXC, with its 2000+ trading pair catalog, makes for an even more aggressive platform.

Besides the key differences, MEXC also offers perks like zero trading fees for spot markets, low trading fees for the futures markets, native token-specific fee discounts, and more. But then, MEXC doesn’t offer forex trading, commodities, leverage ETFs, or crypto CFDs as of now. For that kind of diversified trading suite, you might want to consider platforms like Forex.com, and more.

MEXC review: Features and tools

The quality of any trading platform depends on how widespread its trading and other features are. Let us now take a closer look at MEXC’s set of offerings.

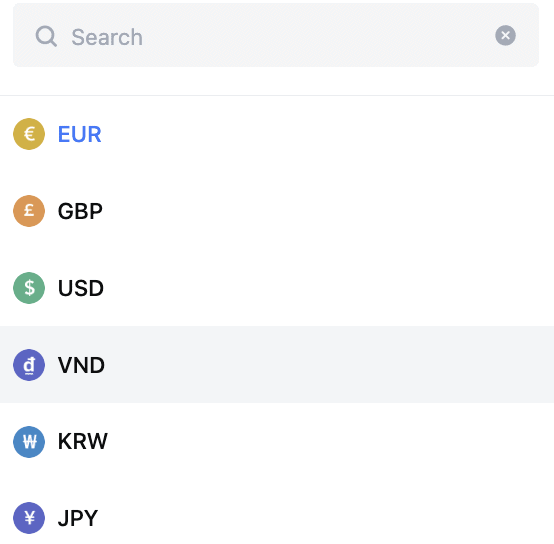

Quick crypto buying interface

As mentioned previously, MEXC allows you to quickly buy and sell crypto via Express orders, P2P avenues, or third-party service providers. You can rely on cards, global SEPA bank transfers, and other payment options. MEXC even supports various fiat currencies for buying and selling crypto. These include EUR, GBP, USD, KRW, JPY, and many more.

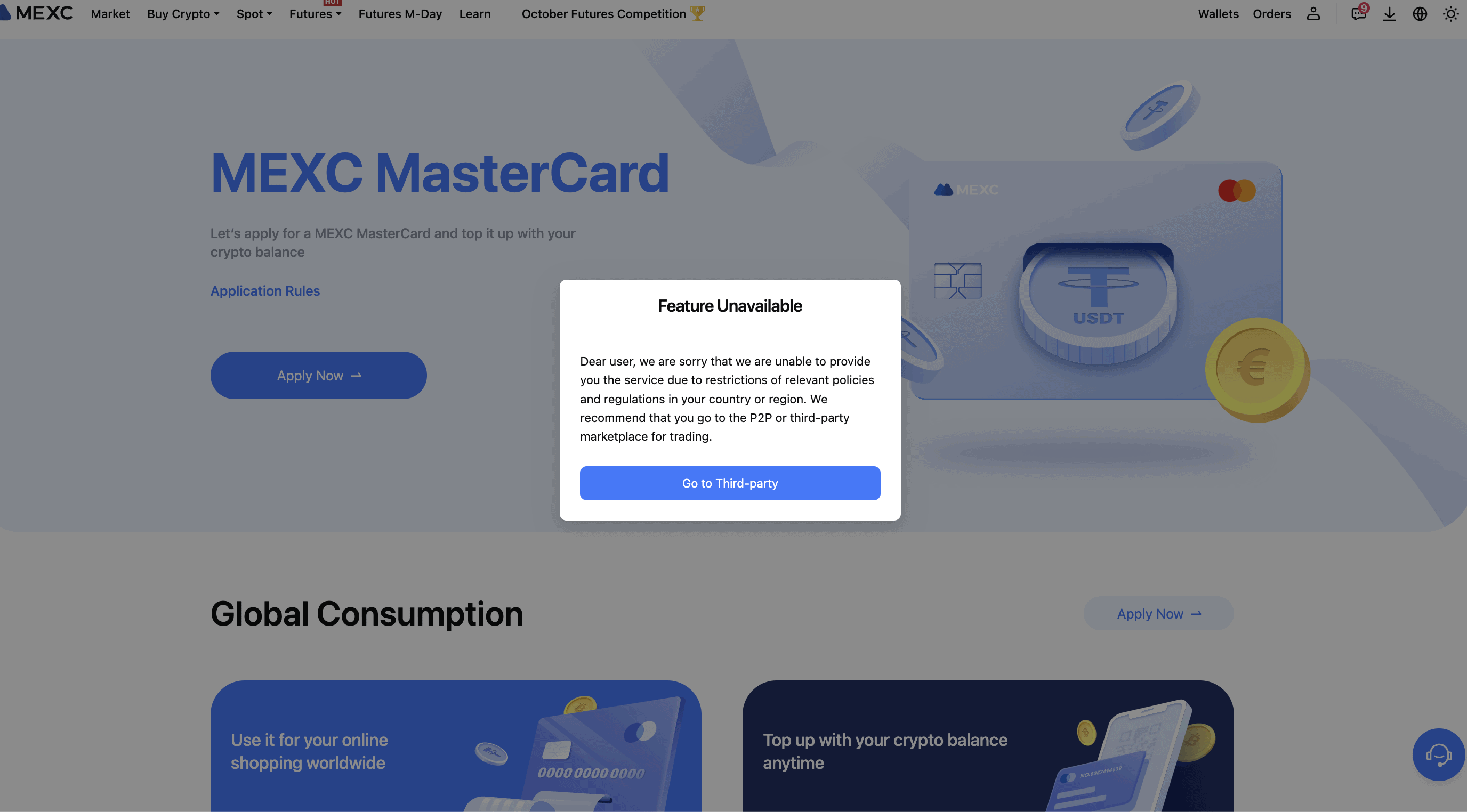

MEXC Mastercard

Like other exchanges that offer debit card-like facilities, MEXC also has a Mastercard functionality, allowing users to top up their crypto balance and use their decentralized assets to shop across the globe. Note that the availability of this feature is location-dependent, as specific regions may have restrictions imposed.

A widespread trading suite

MEXC allows you to indulge in spot trading courtesy of a packed trading-specific MEXC user interface. For spot trades, you can place limit, market, and stop-limit orders, depending on the levels you want to use.

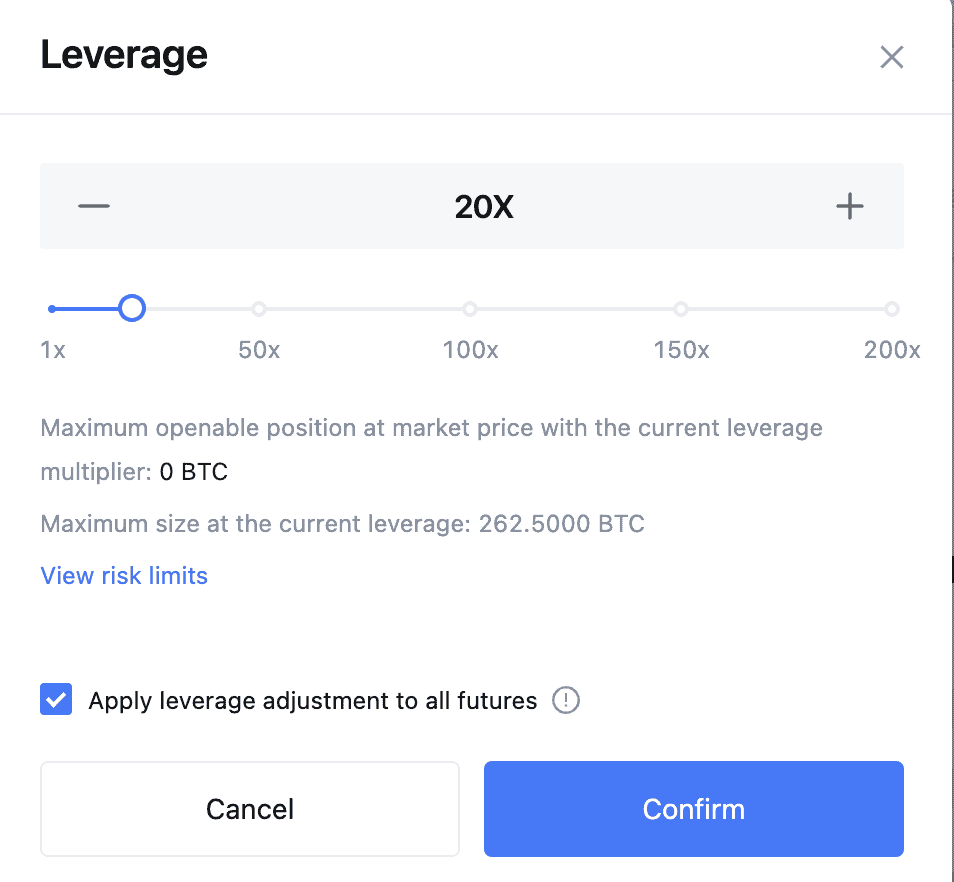

However, MEXC has a more extensive futures trading suite, allowing traders to explore low fees and leverage up to 200x for specific crypto pairs. MEXC allows futures and perpetual contracts settlement in either USDT or the crypto you wish to trade.

MEXC also offers diverse futures trading events, including monthly competitions, a futures leaderboard, and other traits to make the futures trading sector more rewarding for users.

MX Zone

By now, we know that MEXC’s native token, MX, is a tradable asset. However, the MEXC trading platform has a dedicated section called the MX Zone to showcase the MX token’s additional utilities.

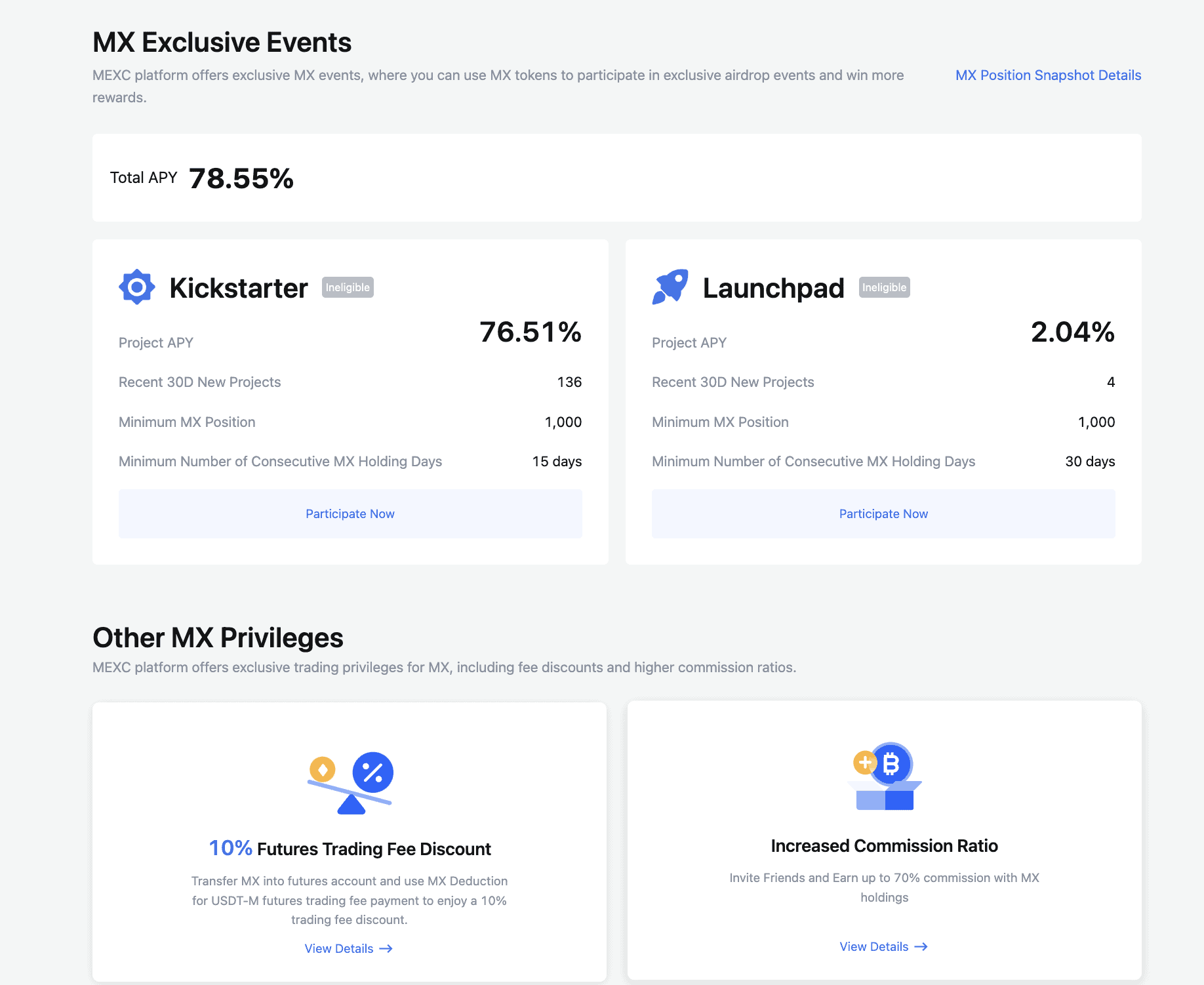

With MX tokens, you can access several privileges, including MEXC’s Kickstarter campaigns with decent APY access, plus the MEXC launchpad, where early projects are listed.

MEXC Learn

The MEXC trading platform is one of the better ecosystems that further crypto’s educational vigil. The platform features a dedicated “Learn” section, boasting market insights, beginner guides, and more.

MEXC mobile app

MEXC comes with a diverse collection of apps for mobile and desktop access. The mobile and desktop apps ensure a seamless trading experience, access to advanced trading charts, and other benefits. The MEXC mobile app(s) also employ stringent security measures.

Besides the mentioned features, MEXC offers a bird’s eye view of the crypto market, with coins, futures trading instruments, new listings, and more seamlessly categorized. Plus, the social following and multi-channel community support also stand out.

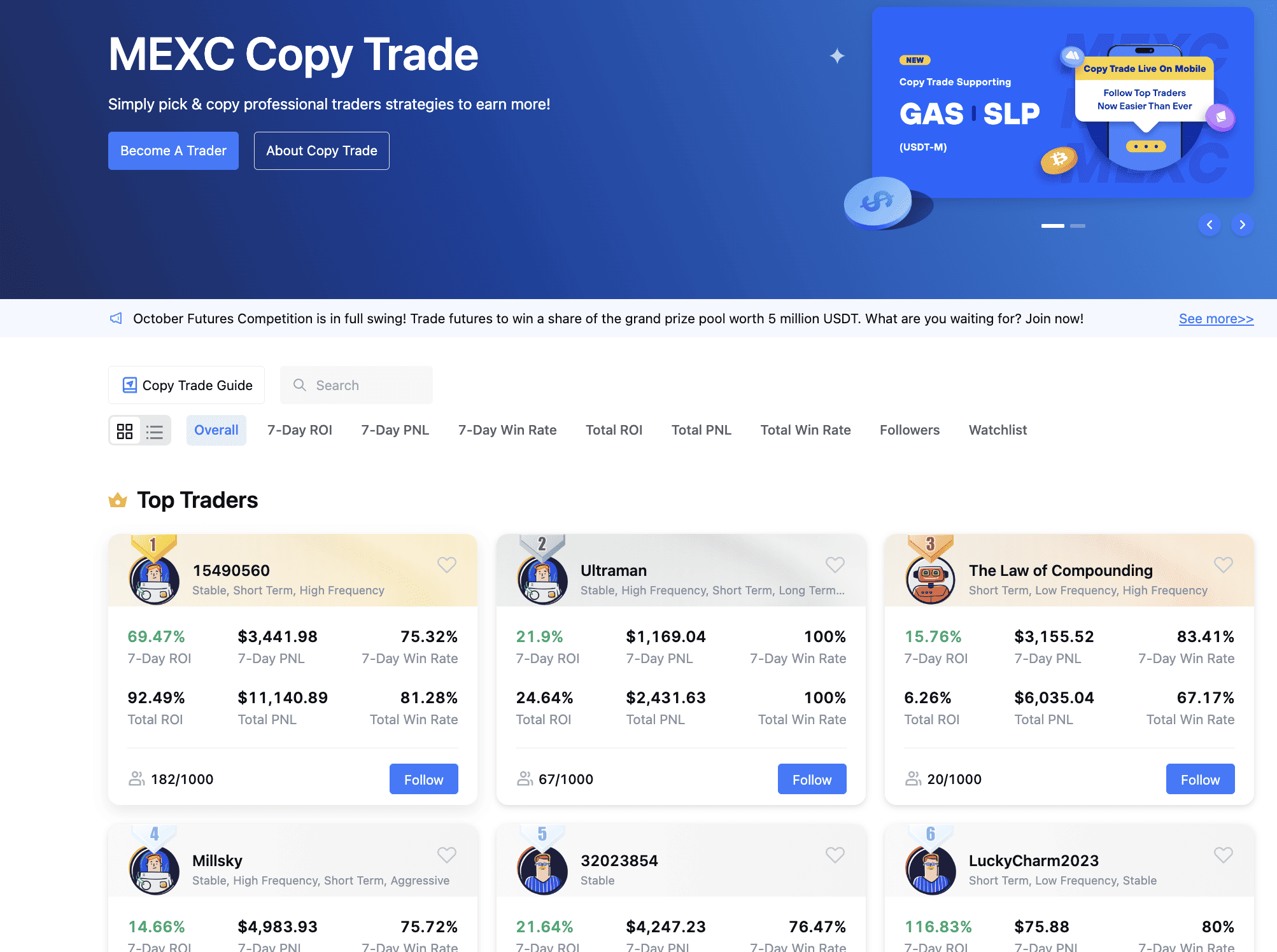

Copy trading on MEXC

One of MEXC’s more exclusive features is its extensive copy trading functionality. This way, you can pick and copy the trades of professional MEXC trades, increasing your chances of making profits. You can pick traders and trades to copy based on a seven-day ROI, total PNL, followers, and other metrics.

Demo trading on MEXC

Not many global exchanges offer demo trading functionality. MEXC, however, allows you to simulate futures trading using made-up funds. This way, you can quickly learn everything there is about crypto futures, perpetual contracts, MEXC leverage trading, and other related components.

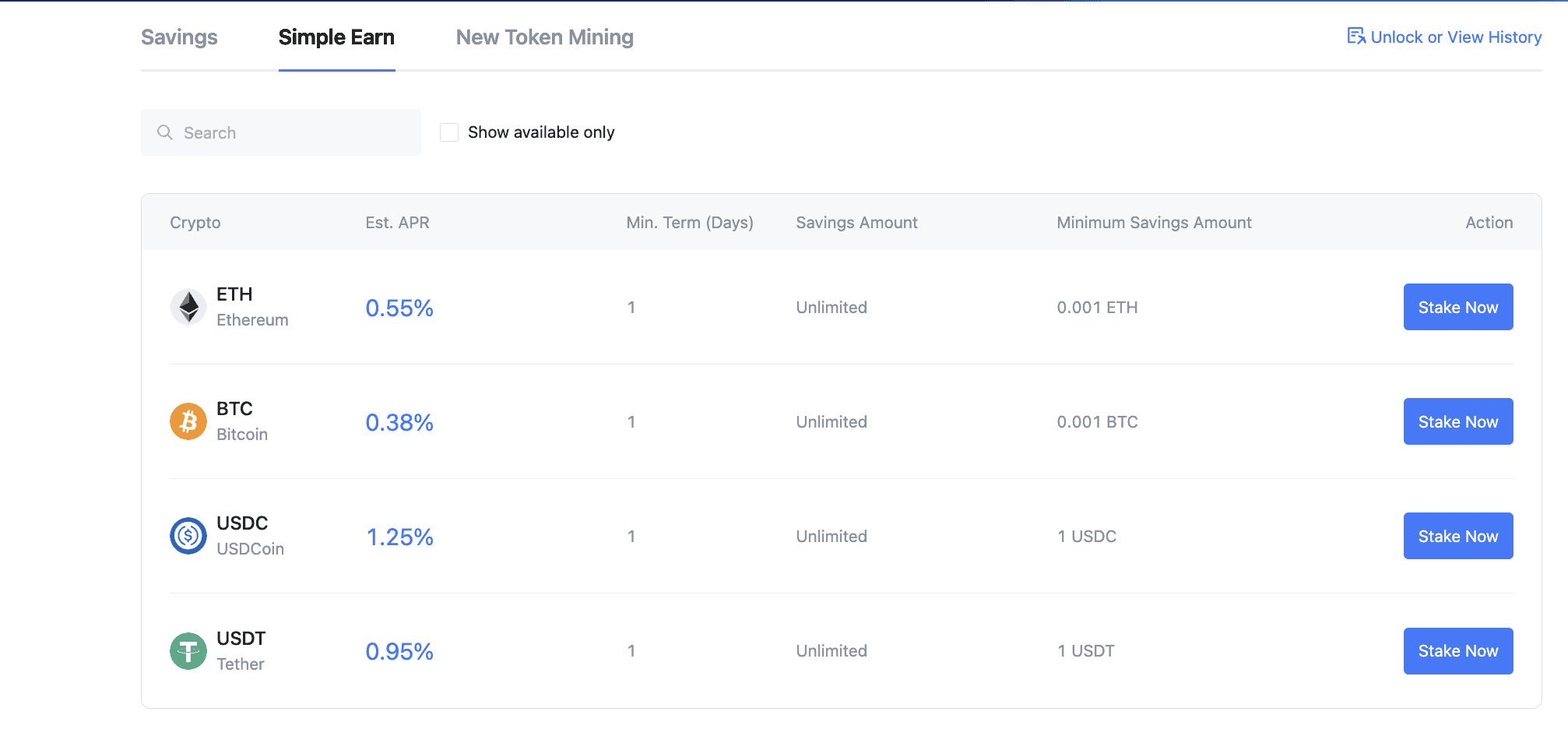

Staking on MEXC

MEXC also brings forth a passive earning option called MEXC Earn. The first component of MEXC Earn is “Simple Earn,” where you can stake popular cryptocurrencies like USDT, BTC, and more to earn APR up to 1.25%. Then there is the Savings plan that stands for more aggressive crypto staking with an APR potential of up to 8.80%.

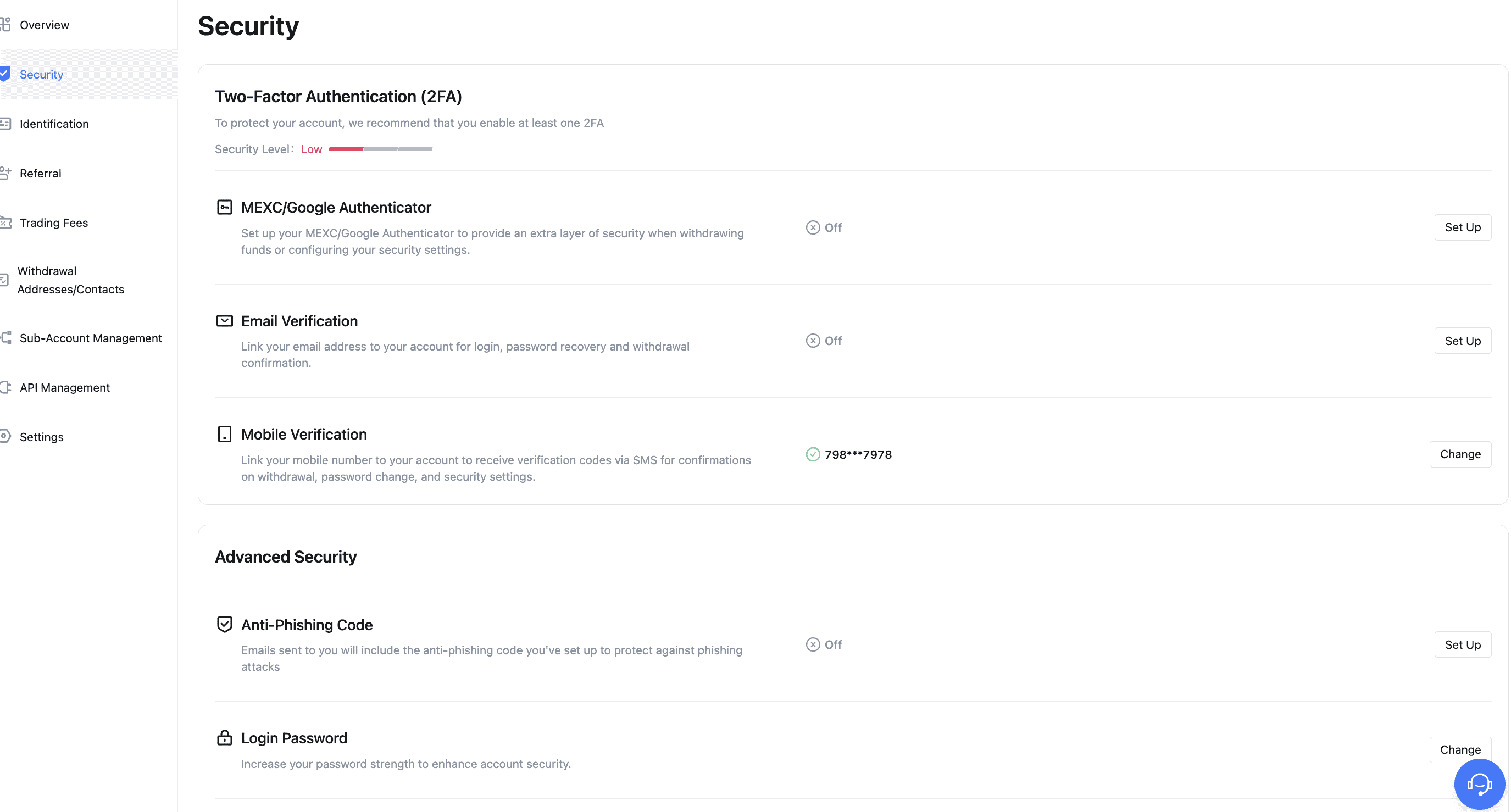

Is MEXC a safe exchange?

MEXC takes customer safety and data security very seriously. Some of the crucial elements of MEXC’s security posture include the following:

- Two-factor authentication involving web, desktop, and mobile interfaces

- Email verification and Google authentication

- Anti-phishing coverage

- Third-party account authorization

- Advanced encryption protocols

And more.

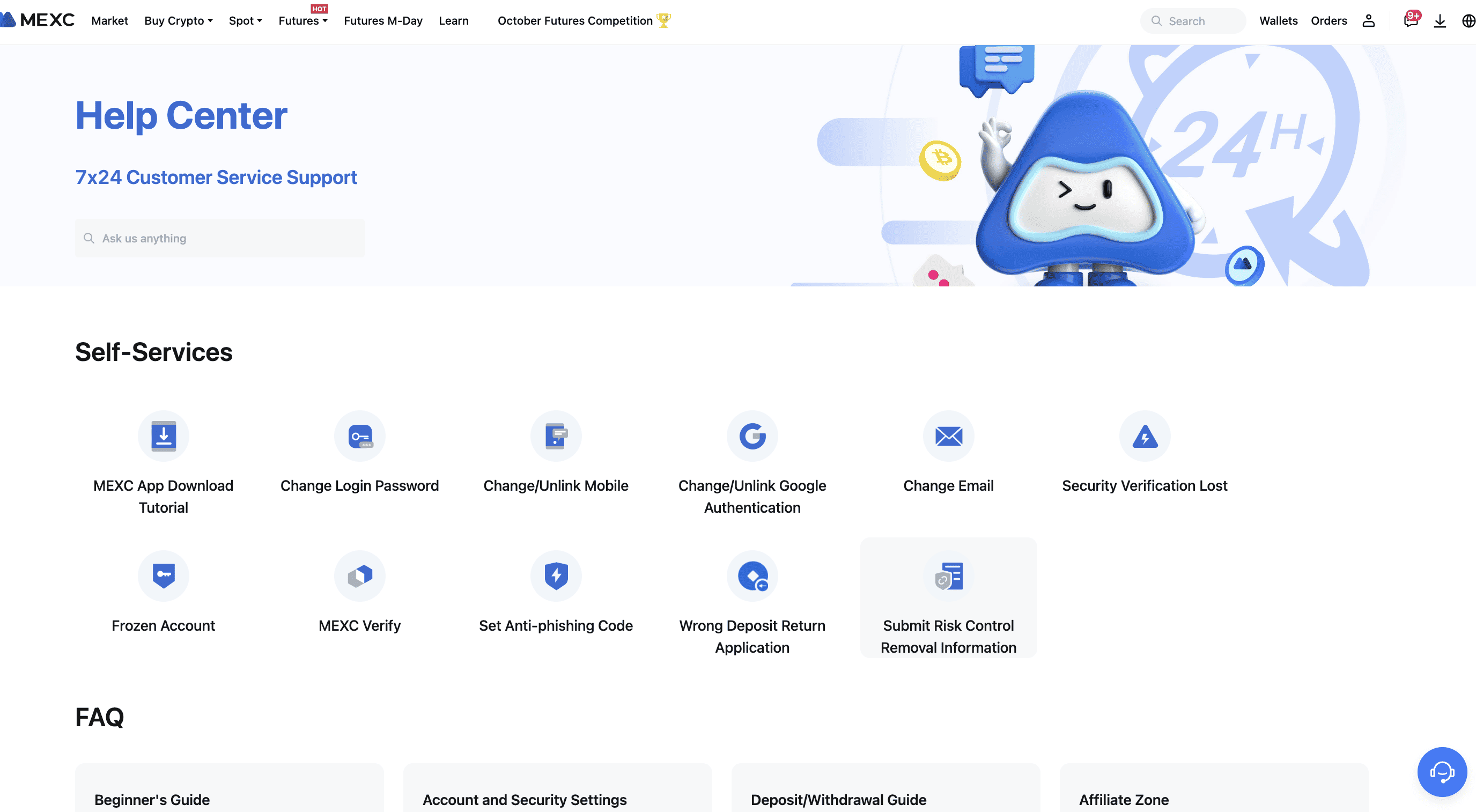

Does MEXC have good customer support?

MEXC has a pretty solid user support setup. The customer service section directly takes you to the email correspondence with [email protected]. The responses are prompt and well within the 24-hour timeline.

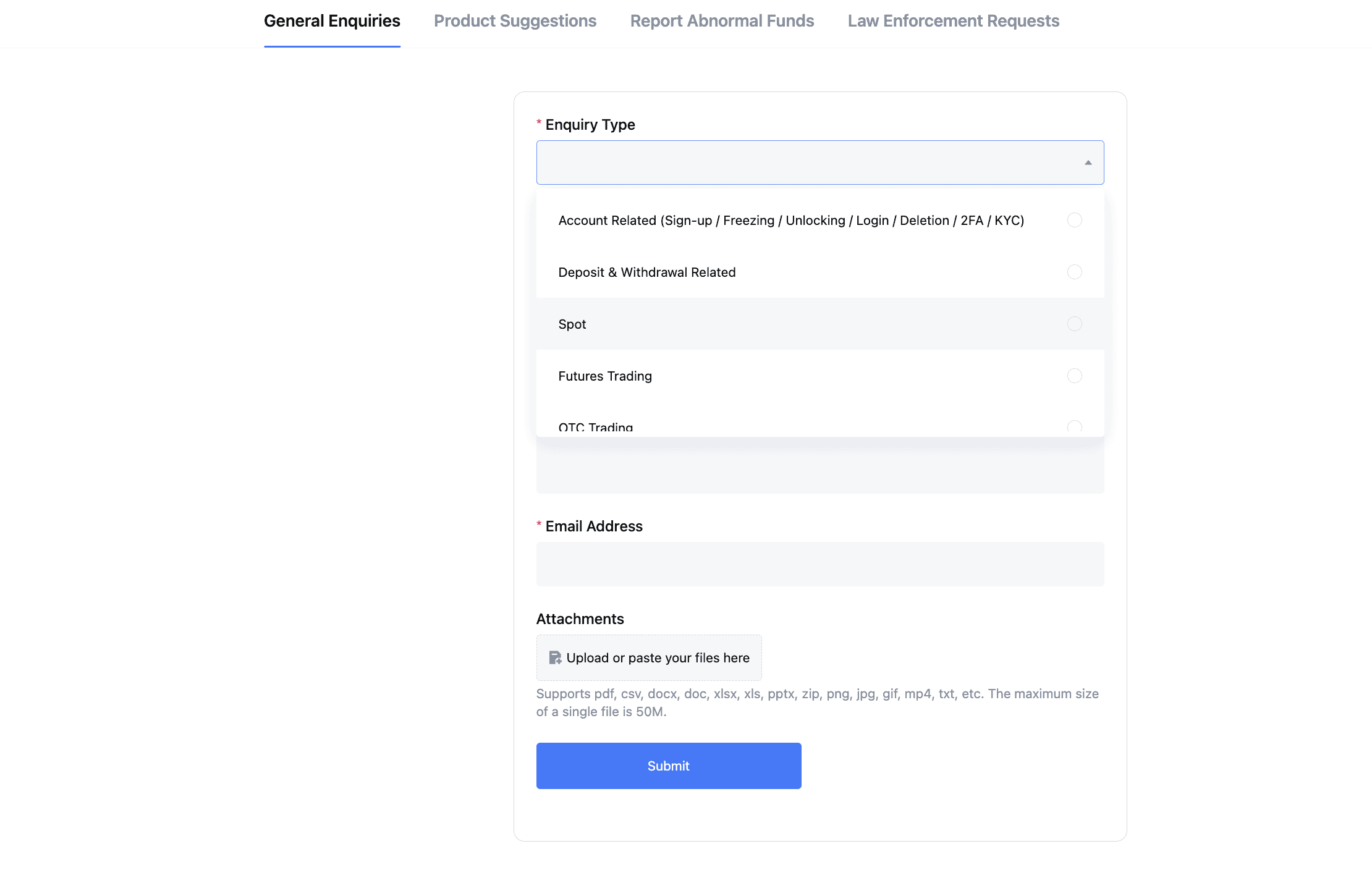

Then, there is the 24×7 help center, with self-service sections, detailed FAQs, and more. Besides that, there is live chat assistance with real individuals answering your questions. Also, MEXC has a “Submit a request” section where you can enquire about account-related info, report funds, give suggestions, and even post requests concerning enforcement.

For the tickets we raised, we highlighted an issue related to delayed deposits. We reached the team via email and even via live chat. The ticket was acknowledged within an hour, and the representative asked us to wait for 12 hours, as network congestion might have caused the delay.

The response was prompt, and the issue was resolved in under two hours.

How have we tested MEXC?

We tested MEXC for several months across numerous parameters, including response time, asset liquidity, ease of trading, quality of copy trading services, quality of MEXC margin trading, and MEXC leverage trading and deposit and withdrawal methods. The comprehensive analysis allowed us to evaluate every segment in detail, resulting in the following list of pros and cons:

Pros

- A massive selection of cryptocurrencies to choose from

- Competitive fees

- Staking opportunities in sight

- Offers a wide selection of derivative products

- Stacked with educational resources

- Offers multilingual support

Cons

- KYC policies aren’t stringent

- Not available to the U.S. users

Regulatory compliance and safety

Although MEXC doesn’t serve U.S. customers due to unclear regulatory compliance, the platform adheres to international KYC and AML standards. Notably, MEXC has ties with third-party processors like Banxa, Simplex, and others. This shows that MEXC aligns with third-party requirements across multiple regions.

Invest responsibly

Despite MEXC or any other crypto exchange offering a wide range of trading tools and services, you should not get carried away by the breadth of these offerings. Always invest responsibly and with a solid plan in place. Always do your own research, and never invest more than what you can comfortably afford to lose.

Is MEXC the right exchange for you?

Over time, MEXC has established itself as a credible player in the crypto space. It is loaded with features for users who want to learn the ropes of futures and derivatives trading, all while offering classic trading tools, including access to spot markets and passive earning options. With a simple user interface and easy-to-navigate Earn ecosystem, MEXC is the perfect platform for both beginners and advanced traders.

Frequently asked questions

MEXC is a CEX that offers access to over 1800 cryptocurrencies. Unlike any other basic and beginner-friendly trading exchange, which only offers spot trading facilities, MEXC margin trading and MEXC leverage trading make the exchange suitable for intermediates and not just the newbies. Plus, you get access to launchpads, educational tools, staking services, and more on MEXC.

MEXC was established 2018 as a centralized exchange utilizing high-performance mega-transaction matching technology. A team of professionals with extensive experience in the financial sector and blockchain technology operates it.

MEXC offers solid user support, providing a customer service section for direct assistance. Their responses are prompt, usually within a 24-hour timeframe. This ensures users receive timely help with their inquiries.

The MEXC trading platform is meant to trade cryptocurrencies across the spot markets or the derivatives space. You can even use MEXC to buy and sell crypto quickly. And if you are holding any crypto asset, you can stake it to earn passive income on MEXC.

The spot trading fee rates on the MEXC platform are 0% for makers and 0.1% for takers. However, the fee structure changes a bit for futures trading. For perpetual contracts and derivatives trading using leverage, the maker fee at MEXC is still zero. The taker trading fee for market orders is 0.01%, which can be further lowered if you hold the native MX tokens.

Countries like Sudan, Cuba, North Korea, Canada, the United States, and more do not allow MEXC to operate or extend services to its users. These restrictions are due to unclear regulatory concerns. Also, markets like India, Australia, and more have opened their arms to this Seychelles-based crypto trading platform.

Yes, you can deposit funds into MEXC’s spot or other exchange wallets. To do so, you need to deposit USDT or any other crypto into your MEXC address. It is worth noting that MEXC even offers deposit rewards, allowing you to maximize trading opportunities.

MEXC is a relatively safe application for a host of reasons. Firstly, the moment you log in, you need to set the two-factor authentication for secure logins. Besides that, MEXC employs advanced security protocols, biometric security, and other guardrails to make the mobile and desktop app more secure. Besides that, MEXC even resorts to regular audits and has stringent password-setting standards to make the process more secure.

MEXC is owned by MEXC Global. The trading platform was co-founded by John Chen and Jocelyn Chang. As of June 2024, MEXC services over 170 nations and has a user base well in excess of 10 million.