Litecoin (LTC) is a decentralized crypto network and one of the earliest altcoins. The LTC crypto was designed to provide a more efficient alternative to Bitcoin for everyday transactions. This Litecoin guide covers everything you need to know about the network, including its history, functionality, and unique features. Here’s what to know.

Methodology

We chose the top exchanges to buy Litecoin after a six-month long testing process. We considered fees, reputation, security, and more. The exchanges that made the final cut are BingX, Bitget, BYDFI, and Kraken. Here’s an insight into why each is recommended.

BingX

BingX supports over 700 cryptocurrencies and is one of the top exchanges in the world. It has extensive support for users across the world, supporting more than 100 countries, 20 languages, and 70 fiat currencies. Its features are:

- Social trading

- Spot and derivatives

- P2P trading

- Educational resources

Bitget

Bitget is a popular crypto exchange that supports more than 500 altcoins, including Litecoin. It was founded in 2018 in Seychelles. The exchange has a Bitget Protection Fund and publishes a proof of reserves. Top features include:

- Spot, derivative, futures, and margin trading

- Copy trading and trading bots

- Tutorials and guides

- Educational resources

Kraken

Kraken is a crypto exchange based in San Francisco. It was founded in 2011 by Jesse Powell and has since become one of the most reputable exchanges. The company has licenses in the U.S. and regularly publishes a proof of reserves. Top features include:

- Spot, futures, and margin trading

- NFT marketplace

- Staking and earn products

- Advanced trading with Kraken Pro

BYDFI

BYDFI is a global cryptocurrency exchange that was founded in 2020. It is also a social trading app that serves more than half a million users in 150 countries across the world. Top features include:

- Copy trading and trading bots

- Spot, derivatives, and leverage tokens

- Demo/paper trading

- Available on Android, iOS, Windows and Mac

To learn more about BeInCrypto’s Verification process, follow this link.

Where to buy Litecoin (LTC)

Before we dive into this Litecoin guide, here are a few BeInCrypto recommended exchanges where you can pick up LTC safely and securely in 2025

BingX

BingX is a global crypto exchange that is famously known for its association with the Chelsea Football Club and two UFC champions. The exchange allows users buy and trade spot and derivatives. It is popular for its social trading features which allow users to copy each others trades. You can also utilize trading bots on the platform.

• Access derivatives trading and spot trading in more than 700 markets.

• Utilize the wealth management features which allows you to earn crypto from your idle assets.

• Access the trades of professional traders or use trading bots to maximize earning potential.

• Take advantage of the Rewards Hub to earn crypto for completing tasks.

BYDFi (formerly known as Bityard) is a crypto trading platform that offers a wide range of services, including spot trading, derivatives trading, and copy trading. It provides a user-friendly interface and stringent security measures, catering to beginners and more advanced traders. Founded in 2019, BYDFi has gained global recognition for its low trading fees and comprehensive suite of trading tools.

• Access derivatives trading with a range of futures contracts for speculative and hedging opportunities.

• Practice trading strategies and familiarize yourself with the platform using a risk-free demo trading account.

• Trade leveraged tokens to gain exposure to cryptocurrency price movements without the complexities of margin trading.

• Utilize automated trading bots to execute trades based on predefined strategies and algorithms.

Kraken

Kraken is a prominent crypto exchange known for its extensive security measures and range of digital assets. Founded in 2011, Kraken offers services including spot trading, futures trading, staking, and margin trading. The platform is known best for its comprehensive regulatory compliance and advanced features, making it a trusted choice for users worldwide.

• Trade a wide variety of crypto with competitive fees and deep liquidity.

• Engage in futures and options trading to hedge or speculate on cryptocurrency prices.

• Earn rewards by staking directly on the Kraken platform.

• Trade on a platform known for its strong regulatory compliance and transparent operations.

• Deposit and withdraw multiple fiat currencies, including USD, EUR, CAD, JPY, and GBP.

• Access a wealth of educational content, including tutorials, guides, and market insights, to enhance your trading knowledge.

Bitget

Bitget is another top centralized exchange that offers a wide range of trading services, including spot trading, futures trading, and copy trading, allowing users to mimic the trades of successful traders. It aims to provide a secure, user-friendly interface with advanced features like leveraged trading and risk management tools. Founded in 2018, Bitget counts over 20 million user worldwide.

• Engage in spot trading, leverage your positions with margin trading, and access various futures contracts with different leverage options to capitalize on market movements.

• Mimic the trades of successful traders and utilize automated trading bots to execute trades based on predefined strategies.

• Securely store, manage, and transfer your digital assets with Bitget’s integrated wallet.

• Explore, buy, and sell non-fungible tokens (NFTs) in Bitget’s dedicated NFT marketplace.

• Earn rewards by staking your assets via various staking programs or access crypto-backed loans to leverage your assets without needing to sell them.

What is Litecoin?

Litecoin is a first-generation altchain designed to support peer-to-peer transactions. As opposed to other blockchains like Ethereum and Solana, Litecoin has limited state and scripting capabilities. Therefore, it cannot support decentralized applications (DApps) and is solely used to process simple transactions.

History of Litecoin (LTC)

Litecoin (LTC) was created by Charlie Lee, a former Google engineer, and launched on Oct. 13, 2011. As one of the earliest altcoins, Litecoin was designed to improve upon Bitcoin’s model.

The network accomplishes this by addressing perceived shortcomings and offering a more efficient alternative for everyday transactions. Lee’s vision was to create a crypto that was the “silver to Bitcoin’s gold,” emphasizing speed and cost-effectiveness.

Litecoin emerged from a modified version of Bitcoin’s open-source code. It introduced a few key differences. Some of these included a reduced block generation time of 2.5 minutes and a different hashing algorithm called Scrypt. This approach aimed to decentralize mining by making it more accessible, as Scrypt was initially resistant to ASIC mining rigs dominating the network.

Over the years, Litecoin has undergone various updates and improvements. These include the adoption of Segregated Witness (SegWit) in May 2017, which enhanced scalability and transaction speed.

Litecoin has also become a testing ground for new technologies, such as the Lightning Network, which offers instant transactions and reduced fees.

Litecoin Guide: How does Litecoin (LTC) work?

Litecoin operates on a decentralized, peer-to-peer (P2P) network that facilitates the transfer of value without the need for intermediaries like banks or payment processors. It has a fixed supply of 84 million LTC.

Litecoin uses the UTXO (Unspent Transaction Output) model, which tracks the ownership of coins through individual transaction outputs, ensuring efficient and accurate accounting of user balances. This approach can enhance privacy and reduce the risk of double-spending, as each UTXO is uniquely identifiable and traceable.

Inputs always have two equal outputs. When a transaction is validated, one of the validation methods is to make sure that the lock time has actually happened, that you’ve passed the lock time. Another validation point is that inputs are greater than or equal to outputs. If outputs are greater than inputs, the transaction will not be validated. The digital signatures have to be validated…

Gary Gensler, Chairperson of Securities and Exchange Commission (SEC), on UTXOs

The UTXO (Unspent Transaction Output) model is often compared to cash transactions. In the UTXO model, each transaction output can be thought of as a discrete piece of digital cash that can either be spent in its entirety or used to create new transaction outputs.

Litecoin guide: Mining and transactions

The blockchain is maintained by a network of nodes (computers) that validate and propagate transactions. Miners, who are crucial to this process, compete to solve complex cryptographic puzzles using the Scrypt hashing algorithm.

This proof-of-work (PoW) mechanism ensures the network’s security and integrity. Once a miner successfully solves a puzzle, a new block is added to the blockchain, and the miner is rewarded with newly minted Litecoins, along with transaction fees.

Litecoin transactions are relatively quick and cost-effective due to its shorter block generation time. When a user initiates a transaction, it is broadcast to the network, where nodes verify its validity. Verified transactions are grouped into blocks by miners and added to the blockchain, ensuring a transparent and irreversible record.

The use of Scrypt as the hashing algorithm helps maintain a level playing field by reducing the dominance of specialized mining hardware, promoting greater decentralization.

What makes Litecoin (LTC) unique?

Several features distinguish Litecoin from other cryptocurrencies, particularly Bitcoin. Here are a few of the most obvious:

- Faster transaction times: Litecoin’s block generation time is 2.5 minutes, compared to Bitcoin’s 10 minutes. This allows for quicker confirmation of transactions, making Litecoin more suitable for everyday use.

- Scrypt algorithm: Unlike Bitcoin’s SHA-256, Litecoin uses the Scrypt hashing algorithm, which was designed to be more memory-intensive. This characteristic initially kept mining more accessible to a wider audience. However, over time, ASIC miners for Scrypt have emerged.

- Lower transaction fees: Litecoin typically offers lower transaction fees compared to Bitcoin, which can make it more appealing for smaller transactions and frequent use.

- A bought-in and passionate community: As one of the oldest cryptocurrencies, Litecoin has built a strong and active community. Its longevity and track record contribute to its enduring credibility. However, Litecoin’s community pales in comparison to that surrounding BTC.

LTC price potential

As of June 6, 2024, Litecoin (LTC) is priced at $85.19 (LTC/USD), with a live market capitalization of approximately $6.35 billion. The 24-hour trading volume is $281.3 million, showing a 10.46% decrease. The crypto’s circulating supply is 74.6 million LTC.

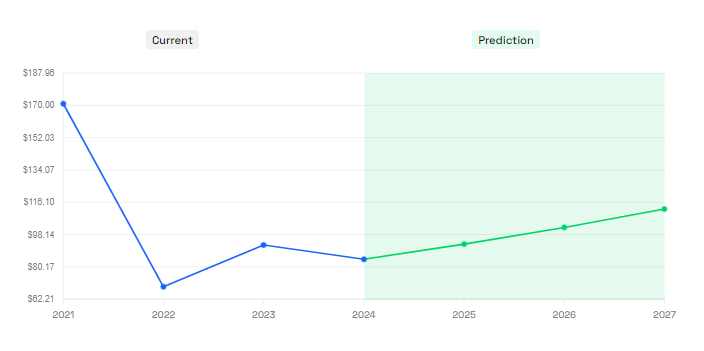

According to BeInCrypto’s expert Litecoin price prediction, the asset’s price is expected to show moderate growth in the coming years.

In 2024, the price is projected to range between $90.04 and $106.75, with an average price of $92.83. In 2025, our experts anticipate that the price of LTC will hover within the range of $99.05 to $117.43, averaging at $102.11.

These projections are based on a number of factors, including market trends, historical data and performance, and technical and fundamental analysis. They also hinge signficantly on potential further adoption of the Litecoin network.

So should you buy Litecoin? In summary, while in the short-term, our predictions indicate some volatility, the long-term prospects for the asset are positive, with steady growth anticipated in the years ahead. Remember to assess your own personal situation and risk tolerance before parting with your cash. Crypto is volatile, and you should never invest more than you can afford to lose.

Litecoin’s lasting impact

In 2025, the Litecoin network remains a significant player within the decentralized ecosystem, offering a blend of speed, cost-efficiency, and innovation — despite being one of the oldest blockchains around. The native LTC crypto continues to hold a prominent position as one of the top assets in terms of market cap. While Litecoin faces challenges such as ASIC mining dominance and market competition, its faster transaction times, lower fees, and reputation for security make it a valuable asset for everyday transactions and long-term investment.

Frequently asked questions

Litecoin is a decentralized peer-to-peer payment network. Unlike its counterparts, it has limited scripting capabilities. This means that it can not support the development of decentralized applications.

Litecoin’s source code is heavily based on Bitcoin’s. However, Litecoin does make several improvements. It has faster block times, lower transaction fees, and uses the Scrypt hashing algorithm to make mining more equitable.

While Litecoin is not as popular as its predecessor, Bitcoin, the protocol continues to innovate and update. As of June 2024, the last upgrade to Litecoin was Litecoin Core v0. 21.3rc3. Before this, the Mimblewimble update was added in 2022.

Litecoin and similar protocols are what’s known as pseudonymous. This means that transactions, while technically anonymous, are traceable. However, there are ways to remain safe while transacting in transparent and open protocols like Litecoin.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.