Zilliqa (ZIL) staking is a practical way for you to contribute to the network’s security and stability in exchange for returns on your staked investments. This guide will walk you through how to get started with staking ZIL, so you are well-prepared to make the most of the Zilliqa ecosystem.

KEY TAKEAWAYS

• Zilliqa is a high-performance blockchain platform designed to address scalability issues in other blockchains.

• ZIL, the native asset on the platform, can be staked for rewards using a centralized exchange or a wallet.

• Direct staking via a wallet offers greater control, while exchange staking provides a more convenient experience.

• Carefully consider key risks like market volatility and lock-up periods before staking your ZIL tokens.

- How to stake Zilliqa

- Benefits of Zilliqa staking

- Risks of Zilliqa staking

- Tips for safe and effective Zilliqa staking

- What is the Zilliqa (ZIL) blockchain?

- Zilliqa staking rewards

- Best platforms to stake ZIL in 2024

- Binance

- Atomic Wallet

- CEX.IO

- Is Zilliqa staking still worth it in 2024?

- Frequently asked questions

How to stake Zilliqa

Staking Zilliqa is straightforward if you are familiar with the basics of cryptocurrencies and staking. There are a couple of ways you can go about it:

- Staking via an exchange

- Staking via a wallet (direct staking)

Disclaimer: This Zilliqa staking guide is for informational purposes only and does not constitute financial advice. You should carefully weigh the pros and cons before deciding to stake. Consider consulting a financial expert if you need personalized advice.

Now, let’s explore each method.

Staking via an exchange

Before we explore the step-by-step procedures, here’s a quick overview of the steps for staking ZIL using an exchange. This is the easier choice between the two options.

- Create an account on your preferred exchange and complete KYC.

- Deposit ZIL tokens by purchasing or transferring them to your exchange account.

- Locate the staking section and find ZIL options.

- Select a staking product that matches your preferences.

- Stake your ZIL by entering the amount and confirming to begin earning rewards.

Now we’ve covered the basics, let’s take a closer look at each step. Note that we are using Binance for this demonstration, but you can use any other exchange of your choice.

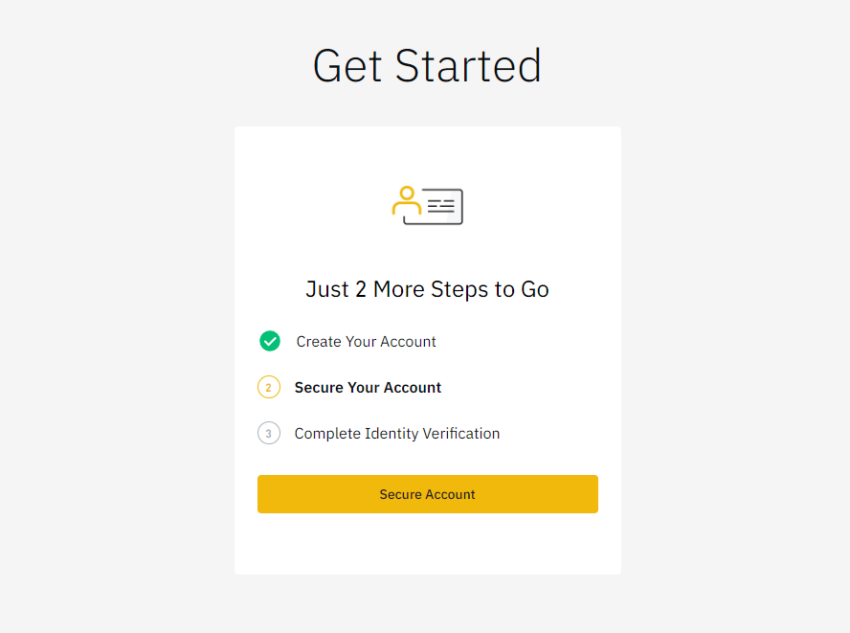

1. Create an account

Create a Binance account if you don’t already have one. You will have to undergo the mandatory KYC process before being able to access Binance’s staking services.

2. Deposit ZIL tokens

You have to purchase or deposit some ZIL tokens in your Binance account. You can either buy ZIL directly on Binance using fiat or other cryptocurrencies or transfer ZIL from an external wallet.

If you are buying, then simply go to the “Buy Crypto” section, select ZIL from the options, and choose your preferred method (credit card, bank transfer, etc.). If you want to deposit ZIL from an external wallet, then go to the “Wallet” section and click on “Fiat and Spot,” search for ZIL and click on “Deposit.”

After that, copy your ZIL deposit address and use it to transfer ZIL from your external wallet to your Binance account.

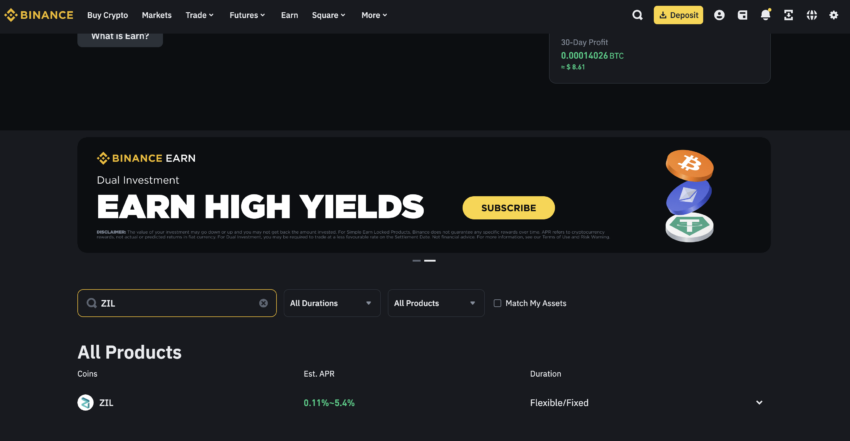

3. Find ZIL staking

Once you have ZIL in your Binance account, go to the “Earn” section on the Binance homepage. From the dropdown menu, select “Staking.” You’ll see a list of available staking products in the staking section.

Look for ZIL in the list. You can also use the search bar to find Zilliqa staking options quickly.

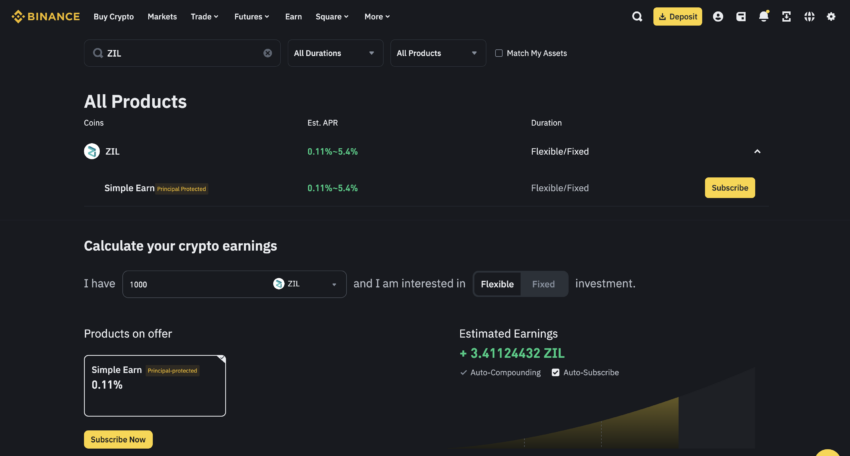

4. Choose a staking product

Depending on when (or where) you are reading this, Binance may offer different ZIL staking products with varying durations and reward rates. Review the available options and choose the one that suits your preferences.

Longer staking periods usually offer higher rewards, but they may lock your assets for the entire duration.

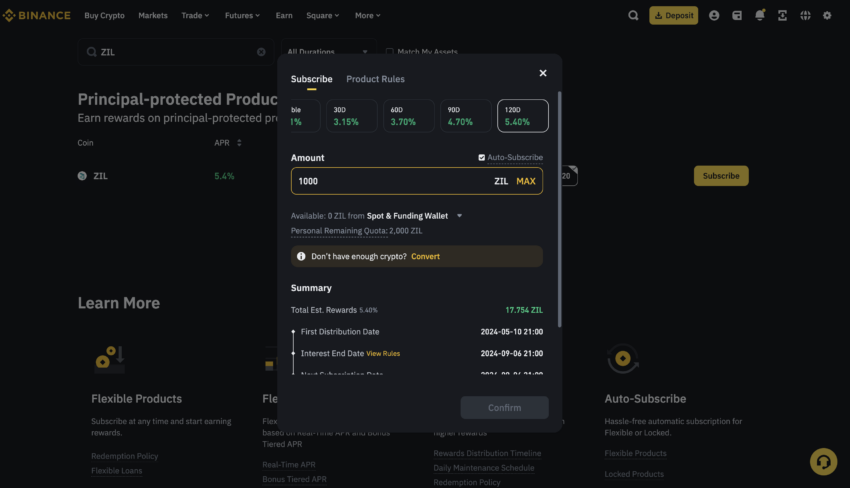

5. Stake Your ZIL

Click on the “Stake” button next to the ZIL staking product you’ve chosen. Enter the amount of ZIL you want to stake and confirm the transaction. Your ZIL tokens will be locked for the duration of the staking period, and you’ll start earning rewards.

Staking via a wallet

Here’s a quick summary of how to stake ZIL using a wallet:

- Get a ZIL wallet that supports Zilliqa staking and set it up.

- Buy ZIL tokens if you don’t have any.

- Choose a staking provider by researching and selecting a reliable option.

- Delegate your ZIL tokens by entering the amount and starting to earn rewards.

- Monitor your staking by tracking earnings and validator performance.

The steps in a little more detail are as follows.

1. Get a ZIL wallet

First, you need a wallet that supports Zilliqa staking. Some popular options include Zillet, Moonlet, and Atomic Wallet. Download and set up one of these wallets if you don’t already have one.

You should also secure your wallet with a strong password and back up your recovery phrases.

2. Purchase ZIL tokens

At the risk of stating the obvious, if you don’t have any ZIL tokens yet, you’ll need to buy some in order to stake. We have already outlined some of the best exchanges where you can buy ZIL earlier in this guide.

3. Choose a staking provider

Next, you need to choose a staking provider. This could be a staking pool or a validator. Ideally, you should research different providers to find one that suits your needs.

Look for providers with good reputations, high uptime, and favorable reward rates. Some popular options are Binance, Zillacracy, and CEX.IO, among others.

4. Delegate your ZIL tokens

Open your wallet and find the staking section. Select your chosen staking provider from the list of available options. Enter the amount of ZIL you want to stake and confirm the transaction.

Your ZIL will be delegated to the staking provider, and you’ll start earning rewards.

Note that it’s important to monitor your staking status and rewards after delegating your ZIL. Most wallets and staking platforms provide dashboards where you can track your earnings and the performance of your chosen validator.

Which option is a better fit for you?

Staking Zilliqa directly through a wallet gives you more control and could earn you higher rewards, but it’s a little more hands-on since you have to manage your own private keys.

It becomes a lot easier and more convenient if you go through an exchange like Binance because it handles all the technical elements and security. On the flip side, you might get slightly lower rewards.

If you like having full control, go for direct staking. But if you prefer something straightforward, staking through an exchange is the more convenient option.

Benefits of Zilliqa staking

| Benefits | Details |

|---|---|

| Earn rewards | Receive more ZIL tokens over time, growing your holdings without purchasing additional tokens. |

| Support the network | Help secure the Zilliqa network by validating transactions and contributing to decentralization and security. |

| Participation in governance | Gain a voice in network decisions by voting on important proposals, influencing Zilliqa’s future. |

| Passive income | Earn passive income over time simply by staking and holding ZIL tokens, ideal for long-term holders. |

Risks of Zilliqa staking

| Risks | Details |

|---|---|

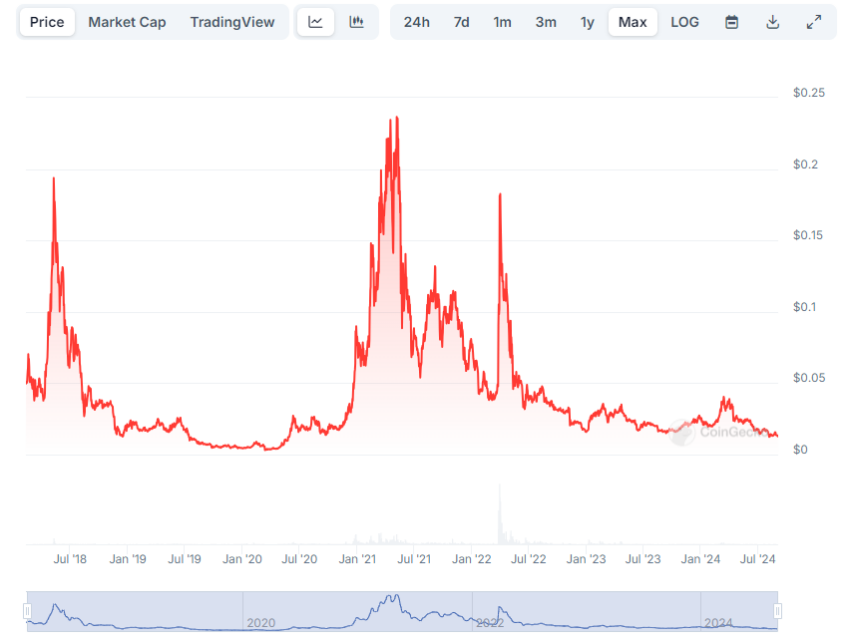

| Market volatility | The Zilliqa price can fluctuate, affecting your staked tokens’ value and rewards. |

| Lock-up periods | Staked tokens may be locked, limiting access to your funds during the staking period. |

| Technical risks | Potential bugs or vulnerabilities in the staking mechanism could put your staked tokens at risk. |

| Network risks | Zilliqa’s network health is crucial; technical issues or reduced interest could impact staking benefits. |

| Slashing risks | Some protocols may penalize misconduct by taking a portion of your staked tokens. Understanding these rules is essential. |

Tips for safe and effective Zilliqa staking

So, now that you are aware of some of the potential risks associated with Zilliqa staking, here are a few quick tips to avoid common staking mistakes and steer clear of any danger:

Do your research

- Get to know how Zilliqa staking works, including the process and potential rewards.

- Keep up with the latest news and updates from the Zilliqa team.

Choose a reputable staking platform

- Stick to well-reviewed and trusted staking platforms or wallets.

- Steer clear of platforms with bad security records or unclear terms.

Understand the risks

- Remember that the value of ZIL can go up and down significantly. Be prepared for occasional wild swings.

- Learn about the lock-up period and make sure you won’t need those tokens right away.

Diversify your investments

- Don’t put all your eggs in one basket. Spread your investments to manage risk.

- Consider staking only a part of your ZIL stash to keep some liquidity.

Stay updated

- Keep an eye on Zilliqa network updates, governance proposals, and community news.

- Join community discussions to learn from others and stay informed.

Use strong security practices

- Turn on two-factor authentication (2FA) for your staking platform or wallet.

- Keep your private keys and recovery phrases safe, and never share them.

Monitor your staking

- Regularly check on your staked tokens and rewards.

- Watch out for any unusual activity in your account.

Be prepared for slashing

- Learn about the slashing conditions and how to avoid them.

- Choose validators with a good track record to reduce slashing risks.

Plan for taxes

- Understand the tax implications of staking rewards in your country.

- Keep detailed records of your staking transactions for tax reporting.

Engage with the community

- Join Zilliqa’s community forums and social media groups.

- Share your experiences and pick up tips from other stakers.

What is the Zilliqa (ZIL) blockchain?

As a blockchain platform, Zilliqa (ZIL) promises high performance and security. It was created to tackle the pestering issue of scalability that many other blockchains face.

A team of researchers and developers from the National University of Singapore launched Zilliqa in 2017 to enable innovative applications that need a lot of transactions and data.

Key components of Zilliqa

Here’s a quick rundown of the under-the-hood components that power the Zilliqa blockchain and the surrounding ecosystem:

Sharding technology

Zilliqa uses sharding, which breaks the network into smaller groups of nodes called shards. Each shard processes transactions at the same time, which ultimately boosts the network’s overall speed. More nodes mean a higher number of transactions per second.

With sharding, each node has less work to do, making the whole system run faster and more efficiently. The more shards there are, the more transactions the network can handle.

The sharded architecture is ideal for running large-scale computations that can be easily parallelized. Examples include simple computations such as search, sort, and linear algebra computations, to more complex computations such as training a neural net, data mining, financial modeling, scientific computing and in general, any MapReduce task, among others

— Zilliqa whitepaper

Consensus mechanism

Zilliqa combines Practical Byzantine Fault Tolerance (PBFT) with proof-of-work (PoW). PoW helps establish node identities and prevent fake nodes, while PBFT ensures transactions are confirmed by the majority of nodes in a shard. This mix enhances security and efficiency.

PBFT ensures that once a transaction is confirmed, it’s final and can not be changed. This guarantees the integrity of the blockchain.

Smart contracts

Zilliqa created Scilla (Smart Contract Intermediate-Level Language), a functional programming language designed for safety. Scilla helps avoid common smart contract bugs and makes them more secure.

Scilla also supports formal verification, which allows developers to prove that their smart contracts work correctly. This reduces the risk of bugs and vulnerabilities in the code.

Decentralized applications (DApps)

Zilliqa supports a growing range of Dapps, from finance (DeFi) to gaming and digital advertising. Its high speed and low fees make it an attractive platform for developers.

Zilliqa has also established Zilliqa Capital to drive innovation. This fund supports projects and startups that build products/services on the Zilliqa blockchain.

Use cases and applications

- Decentralized finance (DeFi): Zilliqa’s speed and low fees make it perfect for DeFi apps. Projects like ZilSwap, a decentralized exchange (DEX), use Zilliqa for efficient and cost-effective trading.

- Digital advertising: Backed by partners like Aqilliz, Zilliqa aims to improve digital advertising by making ad verification transparent while reducing fraud.

- Gaming: Zilliqa’s scalability benefits gaming apps that need fast and secure transactions. Games like Battlemechs are already using Zilliqa for their blockchain-based gaming.

- NFTs: Zilliqa supports non-fungible tokens (NFTs), allowing artists to mint, trade, and showcase their digital assets on a secure blockchain.

Governance and community

- Decentralized governance: Zilliqa involves the community in its governance model. With Zilliqa Improvement Proposals (ZIPs), the community can propose and vote on network changes.

- Zilliqa staking: Zilliqa offers staking, where ZIL holders can participate in network security and governance while earning rewards. This helps improve security and decentralization of the network.

To sum it up, Zilliqa is a growing ecosystem that promises cross-chain compatibility, better privacy features, and improved sharding technology.

It aims to establish itself as a top platform for next-gen decentralized applications by addressing scalability and security issues.

Zilliqa staking rewards

Here’s a quick look at when you will get your rewards and what to keep in mind about taxes:

Reward calculation

The main thing to know about earning rewards is that it depends on how much ZIL you stake. Put simply, the more ZIL you stake, the more rewards you can get. This is because the rewards are divided up based on how much each person has staked. So, if you stake a lot, you get a bigger slice of the pie.

Keep in mind that validators that perform well and have high uptime usually provide more consistent rewards. To maximize your earnings, pick a validator with a strong track record.

Staking platforms usually provide an estimated Annual Percentage Yield (APY), showing the annual return you can expect. This percentage can change based on network conditions and the factors mentioned above.

Frequency of payouts

The frequency of your staking payouts can vary depending on the staking platform and the network’s rules. Some platforms offer daily payouts, which means you get a portion of your rewards every day. This can be great if you like to see regular, small amounts of ZIL coming in.

Meanwhile, other platforms might offer weekly payouts. In this case, your rewards accumulate over a week and are then distributed. This approach balances frequent payouts with manageable transaction processing for the network.

It’s important to check with your staking platform to see when and how you’ll get your rewards.

Tax considerations

The way staking rewards are taxed can vary a lot depending on where you live. In many places, staking rewards are seen as taxable income when you receive them. This means you might need to report the value of the ZIL tokens you earn as income on the day you get them.

If you decide to sell your staked ZIL tokens later, you might have to pay capital gains tax. This tax depends on how much the value has changed from when you received the rewards to when you sold them.

To keep everything in line, it’s important to track all your staking transactions and note the dates and values of your rewards.

You could also consider consulting with a tax professional who knows the ins and outs of cryptocurrency taxes in your area to be on the safer side with the tax authorities.

They can provide specific advice and help you follow local tax laws, ensuring you correctly report your staking income and any gains or losses.

Keen to learn more about crypto tax? Check our ultimate U.S. crypto tax guide for 2024 or our U.K. tax guide for those residing in Britain.

Best platforms to stake ZIL in 2024

Binance

Binance offers a user-friendly platform for staking ZIL, which makes it suitable for beginners. It provides flexible staking options (locked or flexible terms) and benefits from high liquidity for buying and selling ZIL.

However, Binance offers lower staking rewards compared to some dedicated staking platforms, and it functions as a custodial service, meaning the platform holds your ZIL.

- User-friendly platform, easy to set up for beginners

- Flexible staking options (locked or flexible terms)

- High liquidity for buying/selling ZIL

- Secure and reputable exchange

- Lower staking rewards compared to dedicated platforms

- Custodial service (Binance holds your ZIL)

Atomic Wallet

Atomic Wallet is a non-custodial wallet that allows you to stake ZIL directly within its mobile or desktop app. This grants you control over your private keys. It also flaunts a user-friendly interface and supports various cryptocurrencies.

Additionally, staking returns on Atomic Wallet are usually on the (relatively) higher side. However, some technical knowledge is necessary for managing your own wallet.

- Non-custodial wallet (you control your ZIL keys)

- Secure mobile and desktop app for staking on the go

- User-friendly interface

- Supports various cryptocurrencies

- APY on the relatively higher side

- Requires some technical knowledge for managing your wallet. So, less ideal for absolute beginners.

CEX.IO

CEX.io is a well-established exchange offering competitive ZIL staking rewards. It prioritizes security and transparency. The platform supports multiple cryptocurrencies and offers good customer service.

However, CEX.io has a slightly more complex user interface compared to beginner-friendly platforms, and just like Binance, it requires account verification (KYC). The APY, on the other hand, is on the higher side.

- Competitive ZIL staking rewards

- Transparent and secure platform

- Supports multiple cryptocurrencies

- Good customer service

- Slightly more complex user interface

- Custodial service (CEX.io holds your ZIL)

Is Zilliqa staking still worth it in 2024?

Staking your ZIL can be a great way to generate passive income. Zilliqa offers a secure and reliable mechanism for staking, even though the returns might be marginally lower than some other high-paying options. However, what Zilliqa lacks in headline rates, it makes up for in relative stability and future potential of the Zilliqa ecosystem.

That said, remember that staking any crypto — not just ZIL — comes with certain inherent risks. For instance, the value of your ZIL can fluctuate wildly with the market, so it’s important to stay informed and consider these factors before you give a shot at Zilliqua staking.

Frequently asked questions

Can I stake Zilliqa?

How do I start staking Zilliqa?

Is staking Zilliqa secure?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.