Polymarket lets you make predictions on real-world events — from politics and finance to pop culture and sports — using crypto-backed markets. Whether you’re curious about elections or trying to forecast Bitcoin’s next milestone, Polymarket turns your insights into tradable positions.

In this step-by-step guide, you’ll learn how to explore the platform, especially in the United States, interpret market odds, and start trading (where permitted), all while staying informed about the latest regulations and best practices.

If you buy “Yes” shares at $0.65 and the market resolves in your favor, each share becomes worth $1 — giving you a $0.35 profit per share.

- How to use Polymarket in the U.S.

- Getting started with Polymarket in the U.S.

- What do you need to know about global regulations?

- Why is Polymarket unique?

- How to make money on Polymarket

- What can go wrong with Polymarket?

- Why Polymarket stands out among prediction platforms

- How to trade safely on Polymarket

- Frequently asked questions

How to use Polymarket in the U.S.

Due to U.S. regulatory laws, residents are restricted from making trades on the platform, but they can still access Polymarket to view markets and data. This means that while you can explore political predictions and current odds, active participation — like buying or selling shares — isn’t available in the U.S.

In short, to use Polymarket to predict anything in the U.S., you have to:

- Set up your crypto wallet and fund it with USDC.

- Navigate to the prediction market

- Select a chosen outcome

- Buy shares related to the outcome.

- Sell shares before the outcome.

If you buy “Yes” shares at $0.65 and the market resolves in your favor, each share becomes worth $1 — giving you a $0.35 profit per share.

1. Setting up your wallet for Polymarket

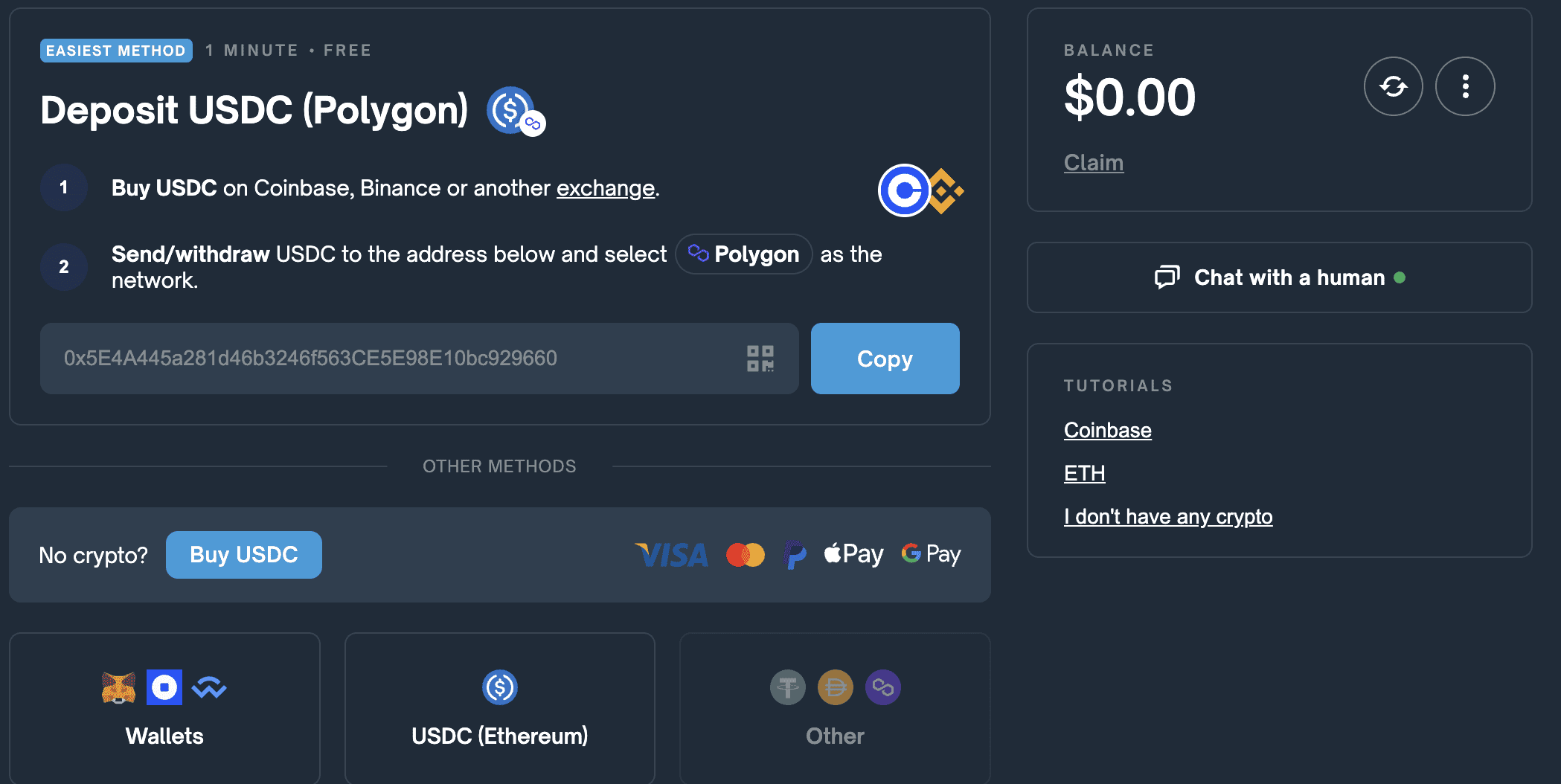

Before placing any prediction, you need a crypto wallet and some USDC in it. Here’s how to get started:

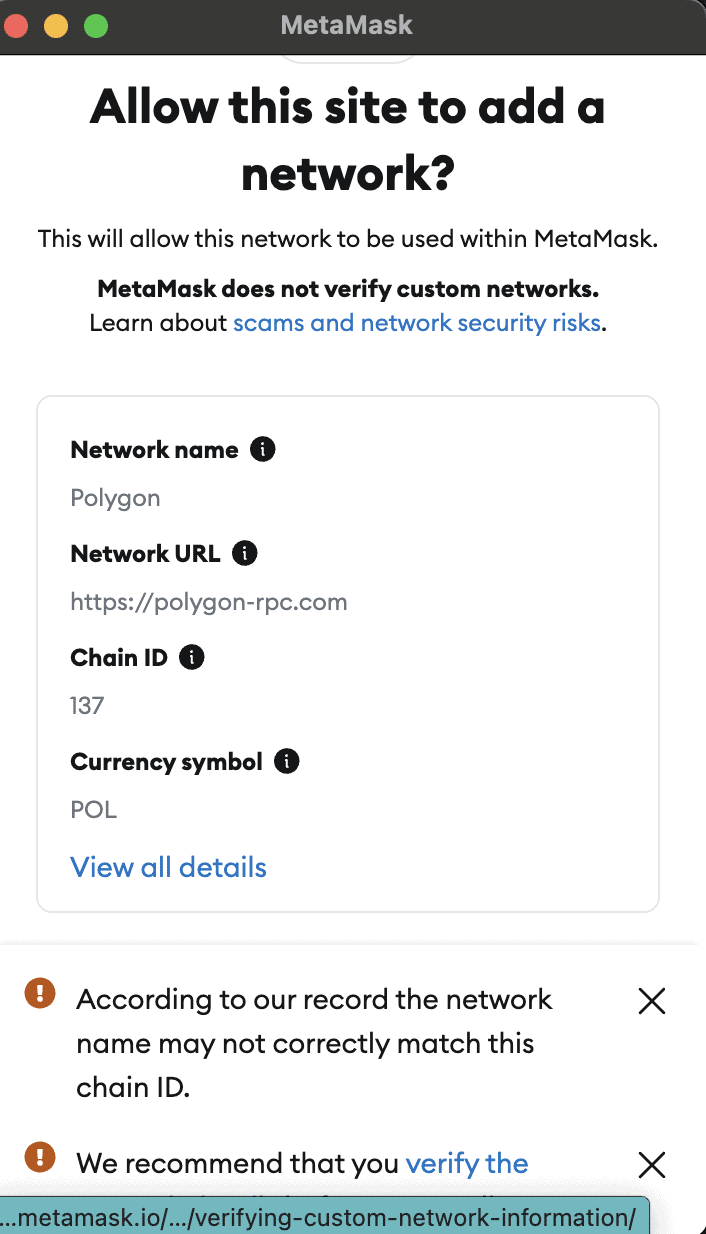

- Choose your wallet: Many users prefer MetaMask, a reliable Ethereum-compatible wallet that works well with Polymarket’s Polygon integration for low transaction fees.

- Fund with USDC and MATIC: USDC is used to buy shares, while MATIC (Polygon’s currency) covers transaction fees. Even a small amount of MATIC, around 0.1, usually covers initial trades.

- Buy USDC if not already holding: Besides wallet transfers, you can purchase USDC using traditional tools like debit and credit cards.

If you buy “Yes” shares at $0.65 and the market resolves in your favor, each share becomes worth $1 — giving you a $0.35 profit per share.

2. Choose the preferred prediction market

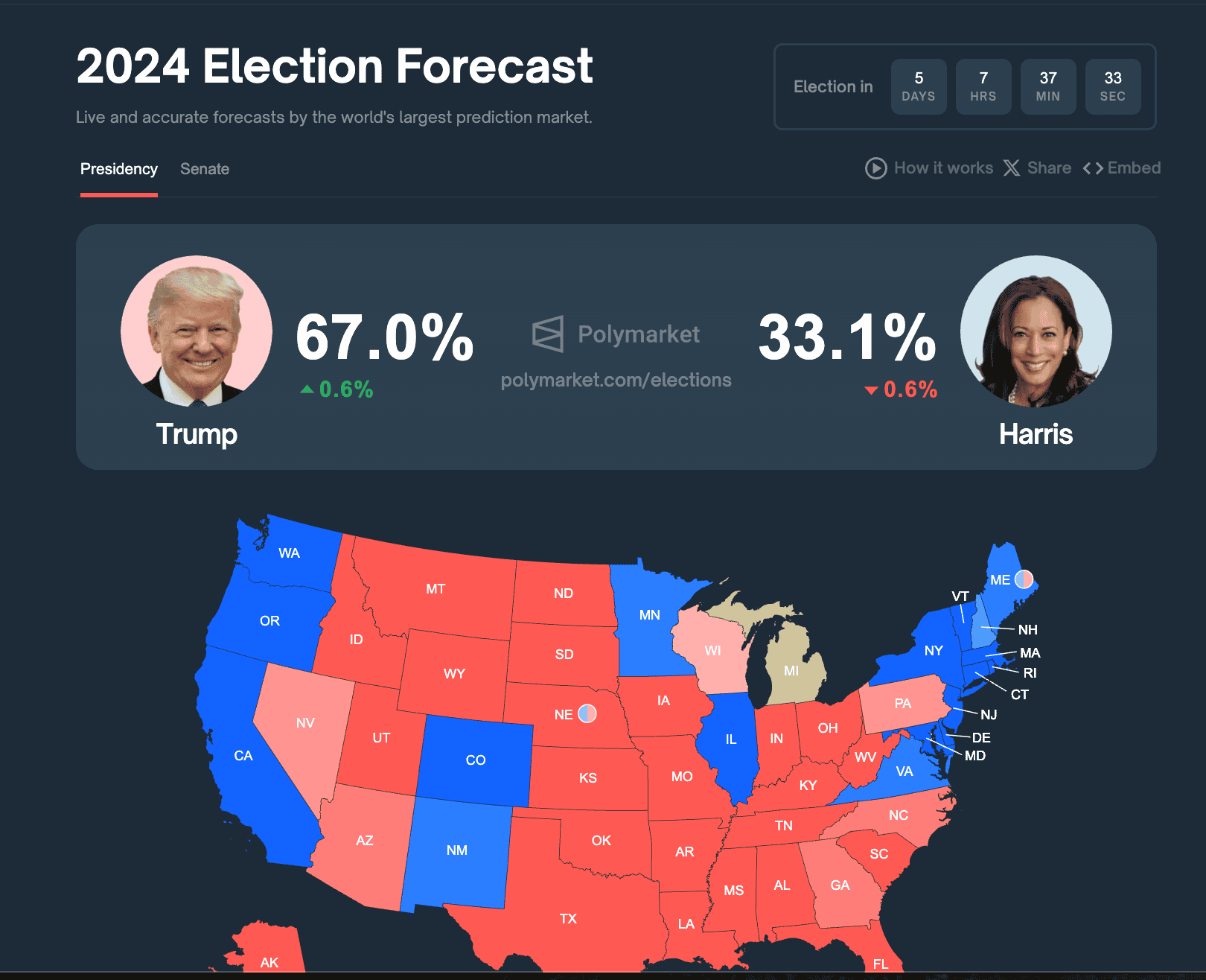

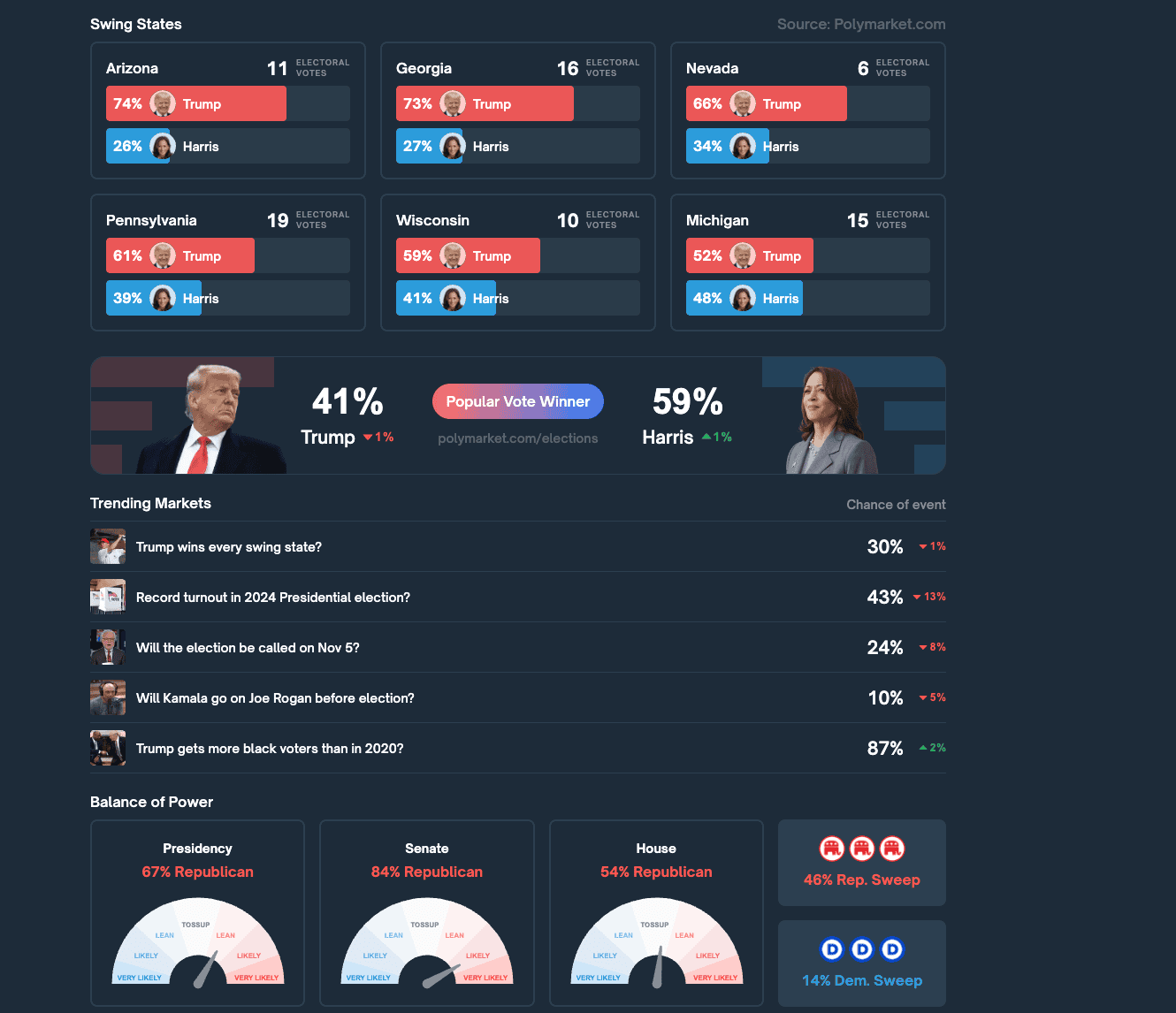

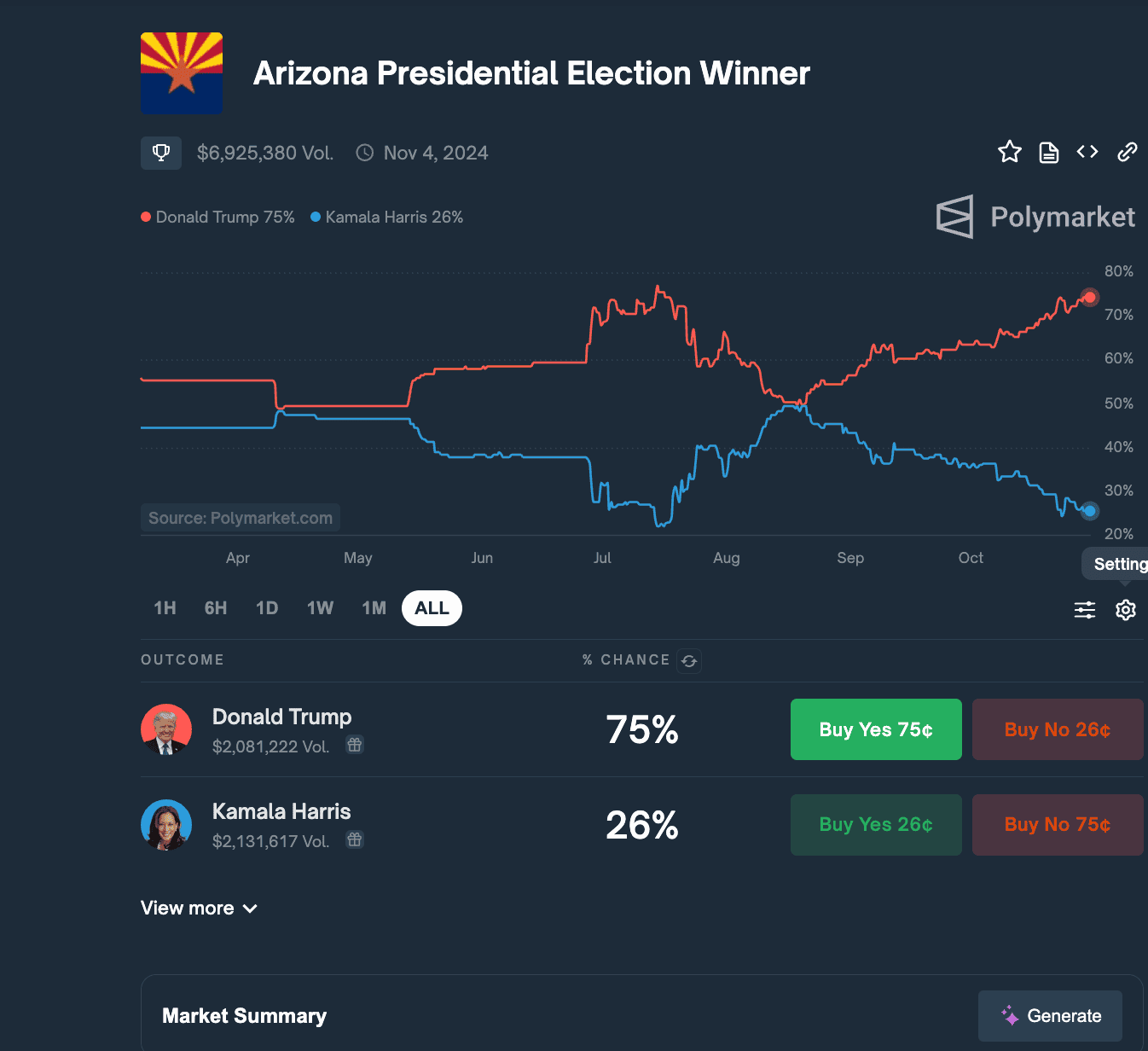

Even though we have listed an example of the recently concluded U.S. election forecast market, here is a more generic way of locating your Polymarket market.

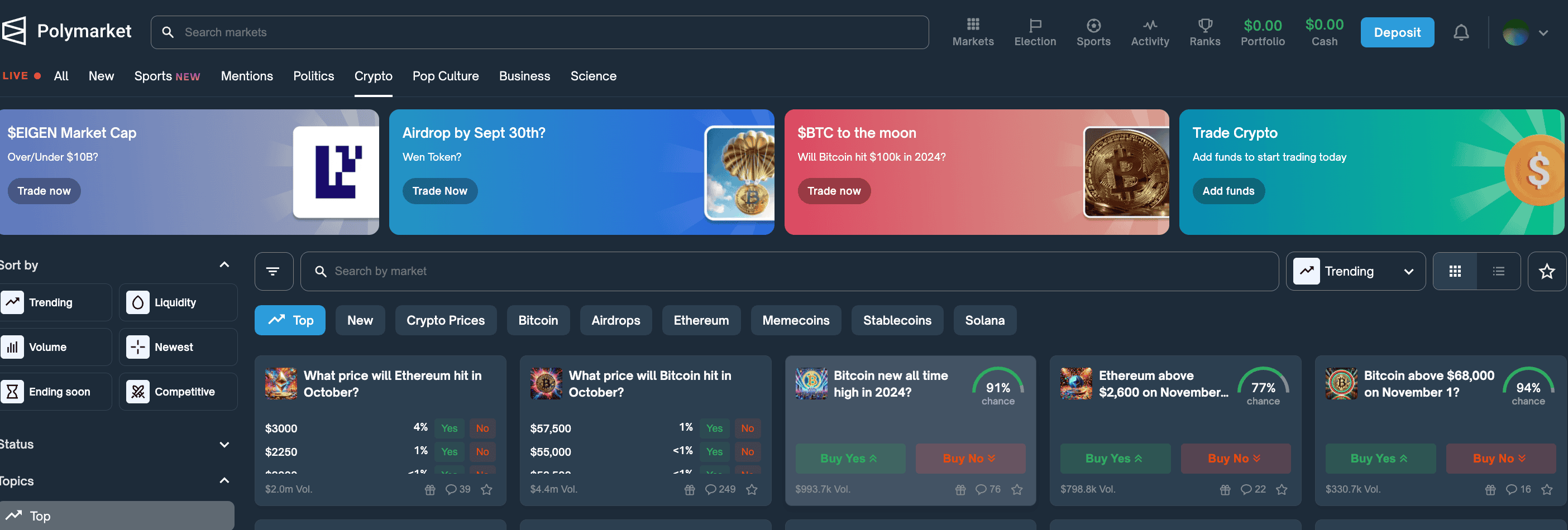

- Head to the Polymarket homepage or use the search bar to explore trending markets — topics range from presidential approval ratings to Bitcoin milestones or even celebrity events.

- Each market displays the share price for “Yes” or “No,” reflecting real-time sentiment from thousands of users.

For example, to view the odds for Trump vs. Harris, you had to head to Polymarket’s U.S. elections section or type “Trump vs. Harris” in the search bar. Each market’s interface displayed share prices for “Yes” or “No,” letting you see where other users stand on the outcome.

In fact, due the the global and momentous nature of the event, simply heading to the Elections tab revealed all Trump vs. Harris prediction markets.

3. Buy shares in preferred market

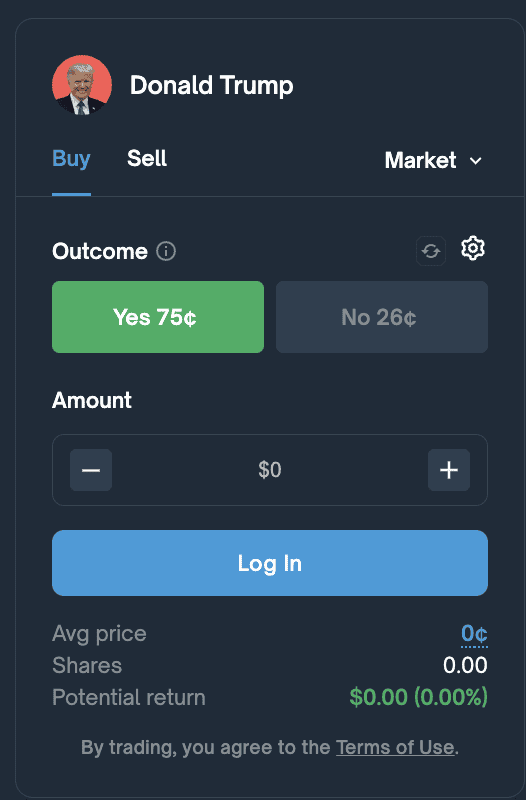

Once you’ve picked a market, follow these steps:

- Select your outcome: Choose between “Yes” or “No” based on your prediction.

- Buy shares: Prices change based on market activity — the earlier you buy in, the more you could gain if your prediction plays out.

- Understand share value: If your prediction is correct, each “Yes” share is worth $1 when the market resolves. If incorrect, it’s worth $0.

Here is a quick mathematical scenario to help you out:

If you buy “Yes” shares at $0.65 and the market resolves in your favor, each share becomes worth $1 — giving you a $0.35 profit per share.

This buy-sell concept allows you to enter the market based on what you believe will happen, with the potential to profit if your prediction aligns with the final outcome.

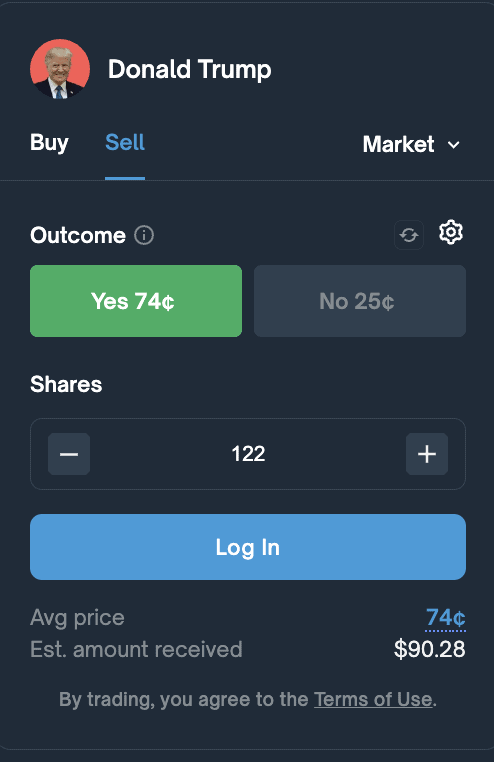

4. Sell shares before the outcome is final

Polymarket allows you to sell shares at any time before the final outcome, giving you flexibility to adjust your position as election odds shift:

- Lock in profits if the outcome is leaning toward your prediction.

- Limit losses by selling if the odds turn against you.

Here is an example from a recently concluded event that explains it better:

Imagine you bought Trump “Yes” shares at $0.75. As time passed, new developments (like a poll favoring Trump) caused his “Yes” share price to rise to $0.90. Here’s where selling comes into play:

- Selling early for profit: At $0.90, you could sell your shares even before the election results are known. Selling now locks in a $0.15 profit per share (the difference between the current price of $0.90 and your original buy price of $0.75).

- Cutting losses: Alternatively, if circumstances were to turn against your prediction (e.g., Kamala gained popularity), the price could drop to $0.65. In this circumstance, you could sell at this lower price to recover part of your investment and cut your losses rather than risk a total loss if Trump lost.

It is worth noting that at any point before the outcome, both “Yes” and “No” shares hold value. This is relevant to every prediction market on Polymarket.

Getting started with Polymarket in the U.S.

Do note that even though bypassing restrictions using a VPN can be a possibility, we usually advise against it. As for usage, U.S. citizens can view the Polymarket markets and place the predictions elsewhere on seeing and identifying trends.

It is worth noting that in late March 2025, U.S. regulators reaffirmed restrictions on retail participation in prediction markets via platforms like Polymarket. The Commodity Futures Trading Commission (CFTC) issued a follow-up advisory reiterating that platforms offering event-based binary options — especially those tied to political outcomes — fall under their jurisdiction and are subject to enforcement if not registered.

This was prompted by increased scrutiny during the lead-up to the 2024 U.S. presidential primaries and ongoing investigations into offshore platforms bypassing compliance norms.

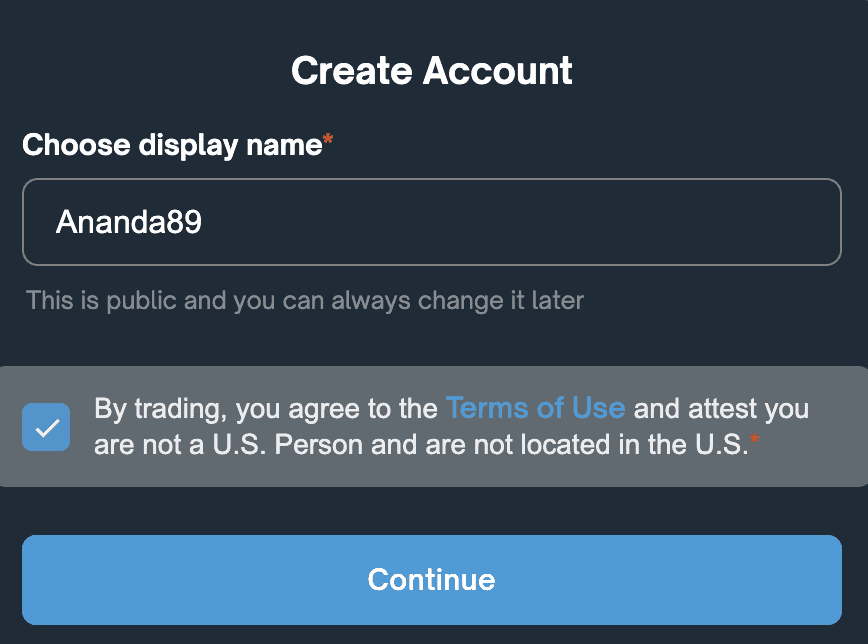

For non-U.S. users, the process of getting started involves a few steps:

- Create an account: Register using an Ethereum-compatible wallet, like MetaMask.

- Fund your account: Add USDC for trading and a small amount of MATIC to cover transaction fees.

This setup lets international users easily access prediction markets, while U.S. residents can explore the site to stay informed about real-time event probabilities.

What do you need to know about global regulations?

So you’ve been exploring Polymarket in the U.S., but what about users in other parts of the world? While Polymarket is a fantastic tool for making predictions and tracking real-time sentiment, it’s crucial to understand how regulations differ across countries.

As prediction markets continue to grow, so does the scrutiny they face from governments worldwide. Here’s a look at how Polymarket operates globally and the challenges it faces in different regions.

Singapore and Thailand crack down on Polymarket

Singapore: In December 2024, the Gambling Regulatory Authority classified Polymarket as an unlicensed gambling service and restricted access to the platform. This decision highlights Singapore’s strict regulatory framework for online platforms offering speculative services.

Thailand: In January 2025, Thai authorities announced plans to block Polymarket, citing concerns about illegal gambling and potential misuse. The move reflects Thailand’s cautious approach to blockchain-based platforms that operate without clear local oversight.

United States: Limited use for residents

While Polymarket allows U.S. residents to view markets and trends, direct participation — such as buying and selling shares — remains restricted due to regulatory concerns.

Polymarket settled with the Commodity Futures Trading Commission (CFTC) in 2022, but scrutiny continues. In late 2024, the FBI seized the phone of Polymarket founder Shayne Coplan as part of an investigation into its operations.

U.S. users can still leverage Polymarket for data insights and trends but must explore alternatives for active participation.

Other countries: Mixed reactions

Australia: Polymarket is under scrutiny from the Interactive Gambling Act, with regulators closely monitoring its operations. Future restrictions or outright bans may be possible.

India: While Polymarket operates in a legal gray area, regulators are increasingly looking to bring crypto-based platforms under stricter control. The government has hinted at potential oversight for blockchain prediction markets as part of broader crypto regulation.

European Union: The E.U. is yet to issue specific guidance on prediction markets. However, platforms like Polymarket will need to comply with the upcoming Markets in Crypto-Assets (MiCA) framework, set to be fully implemented in 2025. This will determine Polymarket’s accessibility across member states and its ability to meet compliance requirements.

Some notable EU developments include:

Belgium: Platform ban enforced

In February 2025, Belgium’s Gambling Commission (Commission des Jeux de Hasard) officially banned Polymarket, declaring the platform illegal under national gambling laws. Users attempting to access the site from within Belgium now receive warnings that its use is prohibited.

Following the 2024 U.S. presidential election, France’s National Gaming Authority initiated an investigation into Polymarket’s operations. This move came after reports surfaced of a French investor profiting approximately $85 million by betting on the election outcome through the platform.

Why is Polymarket unique?

Polymarket isn’t just for traditional market predictions — it lets you predict outcomes in crypto, sports, pop culture, and business events. Here’s what makes it unique:

- Predict without timing the market: Unlike typical crypto predictions, Polymarket allows you to predict if a price will reach a specific level (like Bitcoin hitting $100,000) without needing to worry about timing your entry and exit. This feature keeps things simple for those who don’t want to track minute-to-minute price changes.

- Tap into events beyond finance: Polymarket users can speculate on sports games, movie box office hits, political outcomes, and even trending topics. This diversity means there are always new opportunities based on current events and pop culture.

How to make money on Polymarket

Did you know? Polymarket set a record with $100 million in predictions made in June 2024 alone, boosted by intense speculation during major political events like the U.S. presidential debate. On the debate day itself, Jun. 29, 2024, Polymarket saw an impressive $8.2 million in trading volume as users quickly reacted to shifting odds in real-time.

While profits are never guaranteed, there are a number of things you can do to increase your chances of success when using Polymarket.

- Stay informed for better odds: Staying up-to-date with news around your prediction market increases your chances of profiting. For instance, if you’re following a sports game, knowing the teams’ stats or current form gives you an edge.

- Use real-time odds to adjust your position: Since Polymarket odds fluctuate with public sentiment, you can track share prices to know where the crowd stands. If you sense a market shift, you can sell early to lock in profits or minimize losses.

- Diversify predictions: Spread your predictions across different markets — crypto, pop culture, and sports — to manage risks and increase potential returns. A diversified approach means you aren’t fully reliant on a single outcome, and it can give you steady gains over time.

- Follow market sentiment: Prices on Polymarket are determined by supply and demand, reflecting other users’ overall sentiment. By watching price movements, you can get a sense of the broader market view and make more informed decisions.

Recent data indicates shifts in Polymarket’s activity:

• Trading Volume Fluctuations: After a surge in late 2024, Polymarket’s trading volume decreased to $515 million in January 2025, down from $1.9 billion in December 2024.

• Popular Markets: As of early 2025, sports-related markets have gained prominence, with over $1 billion wagered on sports predictions.

• Economic Indicators: Polymarket users are actively betting on economic events, such as the likelihood of a U.S. recession in 2025, which saw a 64% probability following new trade tariffs.

What can go wrong with Polymarket?

While Polymarket can be profitable, it’s important to be aware of potential pitfalls. Here’s a quick breakdown of what can go wrong and how to mitigate risks:

- Market volatility: Prices on Polymarket change based on real-time sentiment. Rapid shifts in demand can cause significant price swings, potentially leading to losses.

Solution: Regularly monitor share prices and exit positions early if market sentiment turns. - Liquidity issues: If a market has low participation, it can be trickier to buy or sell shares at your desired price.

Solution: Stick to popular markets with high trading volumes for smoother transactions. - Limited U.S. access: U.S. residents face restrictions and can’t participate directly, limiting accessibility.

Solution: Use Polymarket primarily for data insights if based in the U.S. - Outcome disputes: Some markets may face disputes over outcomes, especially in less clear-cut events.

Solution: Stick to markets with objective outcomes to avoid disputes over results. - Dependence on wallet security: If your crypto wallet is compromised, funds can be at risk.

Solution: Use secure wallets, activate two-factor authentication, and avoid phishing scams to protect your assets.

Why Polymarket stands out among prediction platforms

Polymarket has created a name for itself within the prediction market space by focusing on transparency, user control, and a wide range of event categories.

While it’s not the only platform out there, it has several unique advantages and trade-offs that set it apart from others like PredictIt, Augur, and Kalshi.

| Platform | Blockchain technology–powered | Market resolution | Focus area |

| Polymarket | Yes (Polygon) | Decentralized Oracle (UMA) | Politics, crypto, sports, pop culture |

| PredictIt | No | Centralized | U.S. politics, global events |

| Augur | Yes (Ethereum) | Decentralized | Open market creation, sports |

| Kalshi | No | CFTC-regulated | Politics, finance, weather |

Did you know? Polymarket’s interface is designed to show the “real-time odds” for each event directly through share prices. Unlike typical betting platforms, Polymarket doesn’t have a “house” — you’re trading with other users. This means that the odds (or share prices) reflect actual demand and sentiment from users like you rather than being set by the platform itself. Plus, you can trade out of your position at any time before the market resolves, giving you the flexibility to act on new information as it happens.

How to trade safely on Polymarket

To use Polymarket safely, start small with diverse predictions across crypto markets or the political arena. Secure your USDC wallet, monitor real-time price changes, and stay informed on events. Set limits on trades and consider exiting early to lock in gains or minimize losses. By following these steps, you can ensure you use Polymarket effectively and confidently manage risks.

Disclaimer: This information is for informational purposes only and should not be considered investment advice. Making money on Polymarket is possible. However, using prediction platforms to anticipate the election outcome or any other event carries risk. Never spend more than you can comfortably afford to lose.