Even though bulls have arrived in 2026, bear phases are expected in every cycle. How do Wall Street traders hang on, and what are some of the simple things that you can do to earn some money? Do you buy the dip? How can one make money in a bear market? Are there any bear market investment strategies to implement? What digital assets do you hold? In this article, we will give you the top six ways to make money in a bear market.

What is a bear market?

A bear market is when the stock market or broad market index drops by 20%, or more, over a period of time, which is usually around two months. This broad definition is offered by the SEC (Securities and Exchange Commission) from the U.S.

Generally, during a bear market, every asset is trending downward, except for occasional relief rallies. Investors eventually find stocks that are attractively priced and begin buying them, thus officially ending the bear markets.

The low confidence of investors and pessimism are hallmarks of bear markets. Investors often ignore good news during a bear market and sell quickly to push prices lower.

However, predicting a bear market is nearly impossible, and most investors don’t expect a bear market until they start to lose at least 5% of their asset’s value.

Investors can feel overwhelmed by the combination of market volatility, uncertainty about the future, and losses that have already been suffered. They may not be able to make the right decisions and take the necessary actions while their portfolio is suffering long-term damage. When the market becomes bearish, nearly all stocks within it start to fall, even if they report good news or growing earnings.

Although every bear market has ended in higher prices, many portfolios that were damaged by bear markets can take longer to recover. But some never recover. A bear market is an excellent example of how capital preservation is essential in investing.

However, as Warren Buffett put it, you have to be “greedy when others are fearful” of winning in the long run. So, there are benefits to the bear market. There are platforms such as, Nexo, or AvaTrade that will help you earn a passive income.

Benefits of a bear market

- Low price entry point for investors: Every past bear market was eventually followed by higher prices. All potential future bull markets will bring great rewards for those who took the opportunity to invest in stocks during a bear market, when prices are lower.

- Investors learn to control their emotions: You can be more in control of your emotions when you realize that business sectors generally return. The length of the bear markets and the severity of the decay will determine how long it takes for the recovery to take, but there has never been an era in history where the business sectors haven’t recovered.

- Investors can become more consistent with their investments: Allow your investments time to grow. Trying to time the market is a losing strategy. Although you might be able to do it well a few times, it will not benefit you in the long term. Constantly contributing to a down market will not only make you more stable, but could also help your overall returns.

- Investors can evaluate their risk resistance: A bear market will give you a good idea of your risk tolerance. Once you have sorted your nerves and decided what you can handle, you can also adjust your investments and your strategy. This will help you to have a more positive outlook on market volatility.

How to make money in a bear market

A bear market does not necessarily mean you can’t make profits if you’re an active investor. Actually, bear markets can actually be a source of long-term wealth creation for investors.

Also, bear markets can be challenging, but they also present opportunities for profit. Investing in the bear market can churn out profits for long-term holders. Key bear market strategies include dollar-cost averaging to manage investment risks, following experienced traders for insights, and leveraging stablecoins to protect assets. Staying informed through reliable news sources and analyzing trading signals can also help you make better decisions. Remember to choose your investments wisely and prioritize safety to navigate through tough times successfully.

Here are the top six ways you can make money as an investor in a bear market, explained in detail:

Top 6 ways to make money in a bear market

1. Dollar-cost average

One of the ways to profit from a bitcoin bear market is to regularly invest in the cryptocurrency market. Nobody knows how long the crypto winter will last, but dollar-cost averaging investments are suitable for long-term investments. Dollar-cost averaging is one of the most reliable bear market opportunities for hardcore crypto traders.

Dollar-cost averaging (DCA) refers to the strategy of investing money in equal amounts over time. This allows you to smoothen out your purchase price over time and ensures that you don’t invest all of your money in a stock or crypto when it is at its highest. By dollar cost averaging, you will be able to buy more cryptocurrencies as prices fall and less as they rise. But in the long term, the average price of your digital asset will even out, and you stand a high chance of making a profit when the bull market comes.

Dollar-cost averaging offers additional benefits to regular contributions to tax-advantaged savings plans. Contributions and employer matches account for approximately two-thirds, while investment gains account for one-third. This suggests that many 401(k), contributors can quickly rebuild their account balances after bear markets.

The best (and safest) way to hold your funds would be cold-storage wallets, such as Trust Wallet, YouHodler, Argent Wallet, or MetaMask. The absolute best option would be to use a hardware wallet, such as Trezor or Ledger. However, even if you choose to use a hot wallet for long-term crypto holding, you can do it as long as you use reputable wallets such as Nexo or Zengo, which also offer great earning programs.

To apply DCA, you can either manually select a day of the month (or any given period) to buy the same cryptocurrency or stock for the same amount of dollars, or use services that automate this feature for you. The amount you spend each time remains the same, while the amount of digital assets you receive changes over time.

When it comes to making money in a bear market, nothing matters more than applying a dollar-cost average strategy, as it is the easiest and most convenient way to go.

2. Do not reinvent the wheel

How to go about investing in a bear market when you have no prior experience? Just follow what other traders are doing.

You don’t have to be an expert investor or stock trader to make money during market downturns. If you don’t have experience trading the S&P 500 or digital currencies, then you can follow more experienced traders and observe what they do.

The way to follow other crypto investors is to join a Telegram Community, such as the free BeInCrypto Trading Community on Telegram. This is an open group where traders can discuss their market analysis and forecasts. The community also benefits from regular updates on market trends, and they even share tech analyses of coins.

The BIC Telegram channel also offers video tutorials on how to read trading signals and how to use them on trading platforms. Participants can also participate in occasional contests. Channels like this one are meant to help newcomers to start trading, but also to provide daily market analysis for educational purposes.

On the Premium BIC Telegram group, users will receive daily premium crypto signals and market analyses. To join the premium group, you will have to follow the steps listed in the pinned message.

Another popular way to follow what other traders are doing is copy-trading. Copy trading allows individuals to copy positions that have been opened and managed by others in the financial market.

Some of the most popular trading platforms that offer copy-trading features are AvaTrade.

Other platforms, offer in-built signals, which are AI-powered trading signals for traders. Following what other experienced traders are doing can be a valuable strategy during market downturns.

Keep in mind that none of these are financial advice, and you should always do your own research (DYOR) before making any financial decisions.

3. Be a good learner

Nobody knows when the crypto winter will end or when the next market correction will come, but you can always learn more about how to improve your investment strategy.

When trading on the cryptocurrency market or the stock market, you can find platforms that allow you to first learn, where you can test your strategies, use trading signals, or follow your own intuition. And then, only when you feel comfortable, you should start trading with real money.

Some of the most popular trading platforms that offer a learning module are AvaTrade.

4. Stablecoins are your friend

Not all traders are ready to start active trading. But you can still learn how to make money during a bear market by reducing inflation for your assets. The best choice would be to invest in stablecoins that are pegged to a fiat currency, such as the USDT or USDC. Beware of algorithmic stablecoins, which are not backed by anything. This kind of stabecoin led to the Terra Luna collapse in May 2022.

Investing in bitcoin (BTC) is also a good idea, as many use it for long-term investment, and even big institutional hedge funds are now into BTC.

Sure, simply holding stablecoins or BTC will not give you much of a return on investment, especially during a bear market. But some platforms, such as Nexo or Binance, offer nice APY interest rates for your stables. However, most are limited to small amounts, and you should always check the conditions for each program. For instance, Binance offers a good APY for smaller deposits, but everything over this will get a much lower APY.

While Earn programs are not going to generate massive returns, they are still a way to make money during a bear market. By doing this, you are not risking anything, as it doesn’t matter how the cryptocurrency prices move.

5. Analyze news and trading signals

Everything you need to know about the cryptocurrency market is freely available over the internet. For instance, the BeInCrypto Trading Community receives daily news and trading signals for the crypto market. This is one of the easiest and best ways to stay on top of the currency market conditions. In addition to the Telegram group, the BeInCrypto YouTube channel and website are the best places to learn about the latest crypto news.

You don’t have to be a trader to benefit from trading signals. You can track top news bits and market analysis, and can even rely on Twitter or X-based discussions.

As a general tip, you can always consult the Learn section on our website (this section where this piece is published) to find detailed research on the latest technologies used in the world of cryptocurrencies and blockchain.

Having a good understanding of the market conditions and knowing the opinion of market analysts is always a good start to finding out how to make money during a bear market. How do you use all this info? It’s up to you. But you can always join discussions on our Telegram.

6. Choose wisely

Please remember that you are in control, and you should always make safety a priority. Choose wisely who you trust with your money.

Big exchanges such as Binance and Kraken are safe and can be trusted, as millions of other people have already. But you want to check all the available security information whenever you want to use a new exchange. Always check whether they have audits of funds or what financial institutes support them.

Some security checks you can do are:

- Risk management policies of the exchange

- Partnerships with financial institutions (here’s an example for AvaTrade documents)

- Financial certificates from regulatory institutions to prove their activity

- Read risk disclosures before trading Forex, CFD’s, Spread-betting, or FX Options. For instance, CFDs are extremely risky investments, and approximately 70% of retail investor accounts lose money when trading CFDs with most providers.

- Real-time audit of funds supporting the platform

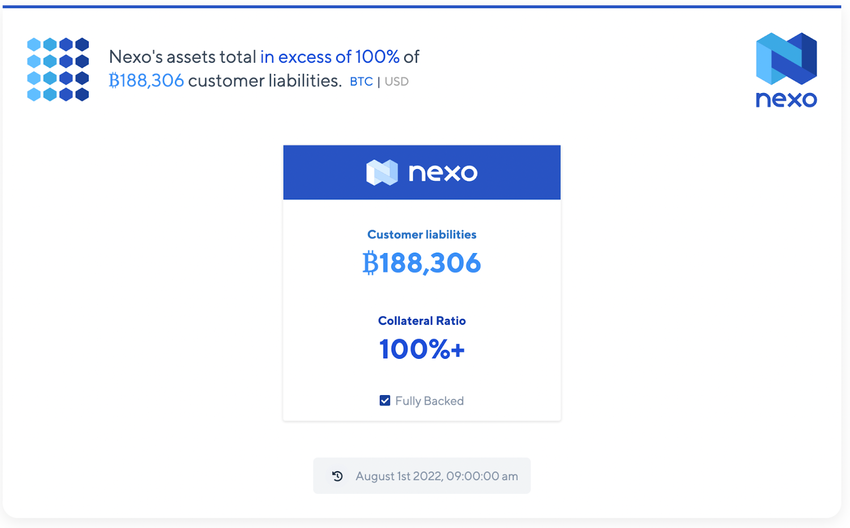

This is a real-time Nexo audit by Armanino.

To make money in a bear market, be simple

As you can see, there is no shortcut or magical method to make money during the bitcoin bear market, but with the right investment strategy, you can see long-term returns for investments.

Regardless if you invest in the stock market or the cryptocurrency market, buying the dip is the best way to profit from market downturns. Remember that the crypto winter will not last forever and that you can always profit from decentralized finance platforms that offer interest rates for digital currencies.

Diversification and trading volumes are key factors in making a profit, but over the long run, dollar cost averaging may be a safe strategy when cryptocurrency prices increase.

Financial planning and defensive investments are crucial during market downturns. Consider exploring alternative investments to mitigate risks and take advantage of bear market opportunities. Also, trading volumes are a key factor in making a profit, but over the long run, dollar cost averaging may be a safe strategy when cryptocurrency prices increase.