Copy trading has transformed how beginners and seasoned traders engage with cryptocurrency. Understanding how to copy trade is key to navigating the financial markets successfully. This article delves into futures copy trading and crypto futures, offering insights into how copy trading works and its benefits.

We’ll explore the mechanisms of a copy trading system and highlight the importance of using regulated brokers to ensure security and legality. Here’s our top selection of cryptocurrency exchanges for futures copy trading.

- 8 best crypto futures copy trading platforms

- 1. OKX

- 2. Margex

- 3. Bybit

- 4. Bitget

- 5. BYDFi

- 6. MEXC

- 7. Binance

- 8. BingX

- Understanding crypto futures copy trading

- How to get started with copy trading

- What are the risks of crypto copy trading?

- Ways to become a smarter copy trader

- Maximizing success in futures copy trading

- Frequently asked questions

8 best crypto futures copy trading platforms

1. OKX

OKX’s copy trading offering benefits from a network of more than 8,000 experienced “lead traders.” It is is renowned for copy trading, especially for futures. The platform has a massive selection of trading options, such as spot, derivatives, and margin trading. What’s more, OKX extends services users from more than 100 countries and offers a selection of over 300 cryptocurrencies.

- Global reach

- Wide range of services (spot, derivatives, and margin trading)

- Extensive cryptocurrency support

- Web3 and DeFi focus

- High trading volumes

- Not available for the U.S. audience

- Complex for beginners

- Regulatory challenges

– Derivatives trading, including futures, options, and perpetual swaps for advanced trading.

– Staking and mining pools

– DeFi trading strategies

– Integrated web wallet

– Global accessibility

– Web3 features

2. Margex

Margex enables users to trade crypto at some of the lowest costs, thanks to its low minimum deposit requirement and high leverage options. This setup allows traders to increase their trading capacity while starting with minimal initial capital.

Copy trading on Margex is easy with its user-friendly interface, which guides users through the process. Whether you’re new to trading or have been in the game for a while, Margex’s platform is designed to provide a user-friendly trading experience.

- Low minimum deposit

- Access leverage of up to 100x

- Easy-to-use interface

- MP Shield AI system enhances platform security by preventing price manipulation, unfair liquidations, slippage, and wicks.

- Referral program

- Multilingual customer support

- Not available in the United States

- Margex operates from Seychelles and is unregulated

- Limited cryptocurrency pairs

– Purchase Bitcoin with Visa and Mastercard directly on the platform

– Margex provides an optional account verification process, catering to users who prefer to maintain anonymity

– Two-factor authentication (2FA), email notifications, and cold storage for user assets.

– Educational resources

– Transparent statistics and daily commission payments in Bitcoin

3. Bybit

We like Bybit’s broad array of copy trading options, including both derivatives and spot trading. The exchange is known for its high-performance transaction engine, which ensures trades are executed swiftly and efficiently, handling a large volume of transactions without a hitch.

- Offers a wide range of derivatives for trading

- Quick order matching

- Over 10 million users

- Stringent security protocols for user protection

- Complex for beginners

- Limited availability in certain regions

- Inefficient customer support

– Futures and perpetual contracts with high-leverage options

– Altcoin trading with built-in leverage

– Copy trading

– Advanced trading interface

– Fast transaction processing

– Bybit wallet

– Multiple deposit and withdrawal options

4. Bitget

Bitget implements a range of security protocols to protect traders and user wallets, ensuring the safety of investments. It’s future copy trading offerings are extensive and easy to use.

The platform’s legitimacy is further enhanced by its licenses in multiple countries, including Lithuania, Italy, Canada, and Australia, showcasing Bitget’s commitment to meeting stringent regulatory standards.

- Diverse trading options, including spot and futures trading

- Bitget Earn

- Web3-focused wallet

- Competitive fee structure

- Solid security measures

- Copy trading feature

- Limited fiat support

- Complexity for beginners

- Withdrawal limits for unverified users

– Spot and futures trading

– Offers leverage up to 125x on certain trading pairs

– Copy trading

– Bitget Wallet

– Bitget Earn

– Extensive cryptocurrency support

– Trading bots

5. BYDFi

BYDFi was selected offers copy traders a wide range of options, including futures, plus spot and perpetual contracts with leverage.

The platform has implemented security measures to ensure a safe trading environment, giving users peace of mind while they trade. Unlike other platforms that may spread their focus thin over multiple areas, BYDFi concentrates solely on trading, avoiding the complexity of features like staking or web3 products.

- Low trading fees

- Accepts over 50 fiat currencies

- Offers both an online wallet and cold storage

- Available in 150+ countries

- Doesn’t offer staking and lending

- Deposited funds are not insured

– Good market liquidity with $250 million 24-hour trading volume

– Offers tiered spot trading options from classical to advanced interfaces

– Perpetual futures with up to 100x leverage for both USDT and coin-margined contracts

– Features leveraged tokens for spot trading

– Copy trading

– Advanced security

6. MEXC

MEXC boasts an automated copy trading feature with a low entry barrier: users only have to transfer funds to their copy trade account and fill in their details to start copying futures trades.

This platform also shines with its user-friendly P2P (peer-to-peer) marketplace, simplifying direct cryptocurrency transactions between users. Catering to a vast user base, MEXC serves over 200 regions, making it highly accessible and inclusive.

- Zero fees for spot trading

- 24/7 help center

- Educational tutorials

- Global availability

- Very limited range of fiat currencies

– User-friendly P2P marketplace

– Supports over 7 million traders globally

– Available in multiple languages

– Offers a variety of payment methods

– Real-time user communication chat

– 24/7 help center

– Zero fees for spot trading

– Encryption for user safety

– Compatible across all devices

7. Binance

Binance supports a wide array of cryptocurrencies and altcoin trading pairs, catering to various interests and trading strategies. The CEX’s automated trading feature is easy to use, with users able to search for specific traders and either use the “copy” or “mock copy” functionality for futures trades.

- Offers high liquidity

- Extensive crypto asset range and over 1400 cryptocurrency pairs

- Advanced trading features, including leveraged trading

- Cheapest crypto trading fees

- Fast and effective P2P trading options

- Customer service might be slow

- Geographic restrictions may impact fiat deposit and withdrawal options

- Limited selection of cryptocurrencies available for trading in the U.S.

– Spot and derivatives trading

– Peer-to-peer (P2P) trading

– Binance Earn (staking)

– Binance Academy (educational resources on cryptocurrency and trading)

– API support

– NFT marketplace

– 2FA and advanced encryption

– Mobile app

– Multiple payment options

8. BingX

BingX boasts a competitive fee structure, which is lower than many other platforms. Alongside its quick and efficient withdrawal processes and intuitive user interface, BingX also allows users to copy “Trending Traders”, “Conservative Traders” (targeting low risk, long-term growth) and “Rising Stars”, filtering between futures and spot trading. The CEX also offers a handy social trading guide and a useful FAQ section.

- Over 400 payment methods

- No fees for buying and selling

- Supports more than 40 fiat currencies

- Slow transaction time

– Spot trading

– Convert and trade crypto

– Standard & perpetual futures

– Automatic trading bot for spot or futures trading

– BingX’s social trading network

– Social trading

– New user rewards, trading gifts and bonuses.

Understanding crypto futures copy trading

Crypto futures copy trading lets you copy the futures trades of expert traders. This way, you can make similar investments without needing a deep market analysis.

Here’s how copy trading works:

- You pick a skilled trader on a platform that offers this service.

- When they trade, your account does the same automatically. It’s like following a recipe from a top chef.

Perpetual futures contracts are popular in copy trading. They don’t expire, so you can hold a trade as long as you like. This adds flexibility to your trading strategy. Learning how to trade Bitcoin options can also help. These options allow you to buy or sell Bitcoin at a set price in the future. They’re different from futures but can be part of your trading mix.

Copy trading is great for beginners — it’s a way to start trading crypto without starting from scratch. You can see how trading works and learn by doing. Some demo trading platforms allow you to practice copying trades without using real funds.

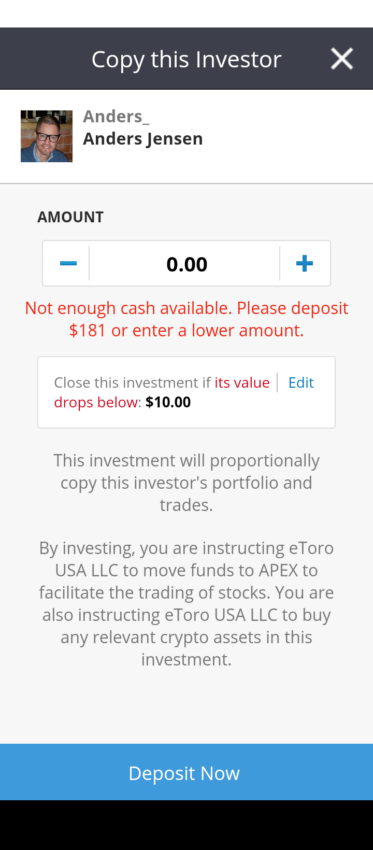

How to get started with copy trading

Copy trading allows you to mirror the trades of experienced investors in real-time. Here’s how to start copy trading in crypto, including futures and other assets:

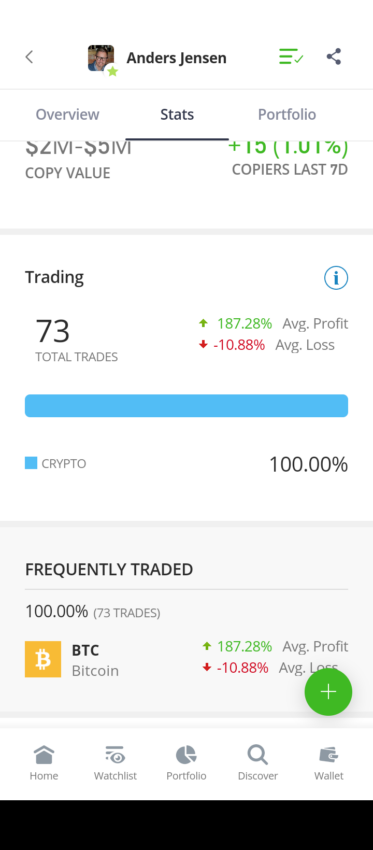

1. Open an account: Choose a regulated broker or trading platform. Compare platforms based on the services and assets they offer.

2. Select a trader to copy: Research and select an experienced trader to copy. Look for someone with a proven track record in areas you’re interested in, such as crypto futures or specific altcoins. Ensure their trading style aligns with your risk tolerance and investment goals.

3. Set your budget: Decide how much money you want to allocate to copy trading. It’s important to only invest what you can afford to lose.

4. Monitor your performance: Once you’ve chosen a trader, start copy trading by linking your account to theirs. This will automatically replicate their trades in your account in real-time. Keep track of your chosen trader’s trading signals and performance. Make adjustments as needed based on your investment goals and market conditions.

Use copy trading as a learning tool. Analyze why the copied trades are successful, and use this information to improve your trading strategies. The market is always changing; being informed will help you make better decisions. Employ risk management strategies include setting stop-loss orders and taking profits at appropriate times.

What are the risks of crypto copy trading?

Crypto copy trading comes with risk. From market volatility to dependence on the trader you’re copying, it’s not always going to go to plan. It’s also worth considering what you are learning while copy trading.

Are you blindly following a trader, and thus losing the opportunity to learn important market analysis skills? If so, slow down and try to understand why the trader you copy is making specific choices. Also, it’s important that copy trading doesn’t lead to overconfidence. While risky strategies may sometimes pay off, this will not always be the case.

Ways to become a smarter copy trader

Becoming a smarter copy trader involves strategic choices and continuous learning. Here are some key ways you can improve your copy trading:

- Choose the right platform: Opt for the best copy trading platform that is user-friendly and matches your country of residence. Ensure it’s among regulated brokers for security.

- Start with a minimum deposit: Begin with an amount you can afford to lose. This minimizes risk as you learn.

- Select experienced traders: Choose professionals with a track record of profitable trades in areas like crypto futures and currency pairs.

- Use trading signals: Leverage real-time trading signals to understand market movements and the actions of the trader you’re copying.

- Diversify your trades: Engage in futures copy trading, forex pairs, and other financial markets to spread risk.

- Monitor in real-time: Utilize a mobile app to keep track of your copy trading activities and market conditions anytime, anywhere.

- Utilize trading bots: Incorporate trading bots within your copy trading system, if applicable, for enhanced efficiency and strategy.

- Stay updated: Keep abreast of changes in the crypto futures and financial markets to adapt your strategies accordingly.

- Review and adjust: Regularly review the performance of your copy trades and make adjustments as needed for improved outcomes.

Maximizing success in futures copy trading

Futures copy trading provides a strategic and accessible approach for both novices and seasoned traders to improve their performance against the market. Remember, success in copy trading hinges on ongoing education and diligent risk management.

With a well-defined plan, real-time monitoring of investments, and the flexibility to tweak strategies as necessary, futures copy trading can help you effectively maneuver through the decentralized asset market and trade derivatives like a pro.

Frequently asked questions

Is copy trading a future?

How profitable is copy trading?

Is copy trading legal in the U.S.?

Is copy trading risk-free?

How do you copy trade futures?

Is copy trading good for beginners?

What is the minimum amount for copy trading?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.