Crypto ETN and crypto ETF are both types of exchange-traded products (ETPs). While they share some similarities, these financial instruments have distinct characteristics that make them quite different. In this extensive crypto ETN vs. crypto ETF guide, we explore the key differences between these two options, including how they hold the underlying assets, their risk profiles, and regulatory considerations.

Understanding crypto ETNs

Some call them a game changer, while others see them as just “soft” ETFs. Crypto Exchange-Traded Notes (ETNs) are financial instruments developed by banks or other financial institutions to allow investors to invest in the crypto market without directly owning the underlying asset.

In simpler terms, crypto ETNs are IOUs or documents acknowledging the existence of a debt. But, instead of cash, they’re tied to the value of cryptocurrencies.

ETNs are tracking tools for crypto prices. They follow a specific index, a single crypto such as Bitcoin, or a whole basket. So, if the cost of the crypto the index is tied to goes up, the ETN goes up, too, and vice versa.

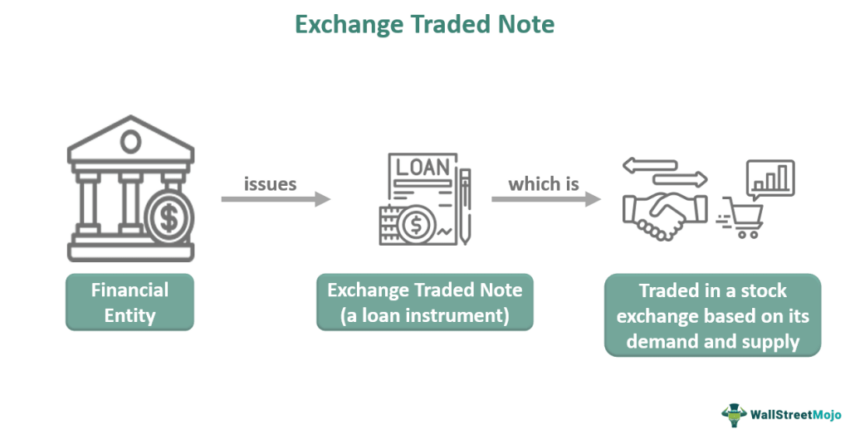

Crypto ETNs let you invest in the market by lending money to the bank (or any other financial entity) issuing them. In return, you get a piece of the pie based on the underlying cryptocurrency’s performance. These ETNs trade on regular stock exchanges, so you can buy and sell them all day, just like any stock.

Always examine the fine print

A cautionary note: crypto ETNs function as a type of loan, making your investment dependent on the issuer’s financial stability. If the issuer fails, your investment risks substantial loss. Therefore, you must thoroughly research and verify the issuer’s stability before committing your funds.

Also, crypto ETNs come with fees that can eat into your returns. There are fees for setting them up, keeping them running, and even for the folks managing them (management fees). Make sure you factor these costs in before you invest.

Despite all the complexities and risks, crypto ETNs are an innovative way to get into crypto. They let you tap into the crypto market using the familiar tools of the stock market — this way, you get exposure to the asset class without having to deal with the risks associated with crypto exchanges and digital crypto wallets.

Decoding crypto ETFs: What you need to know

Like crypto ETNs, crypto ETFs offer exposure to cryptocurrencies without requiring you to hold the asset directly. A crypto ETF is a financial instrument that allows you to purchase and sell shares of the ETF on traditional stock exchanges.

These financial products function similarly to traditional ETFs that track indices’ performance, like the S&P 500. The only difference, as the name suggests, is that instead of conventional assets, crypto ETFs track the performance of a basket of cryptocurrencies or a single cryptocurrency — for example, a Bitcoin ETF or an Ethereum ETF. This allows investors to gain exposure to the cryptocurrency market without the burden of directly owning or managing the underlying digital assets.

The key difference between crypto ETFs and their cousin, crypto ETNs, lies in their basic structure. Unlike ETNs, essentially debt instruments, crypto ETFs usually hold the underlying cryptocurrencies in custody. This distinction is crucial if you are the kind of investor who wants a more direct connection to the underlying assets.

“It [crypto ETF] allows the biggest money holders in the world to actively invest in a way that is comfortable n easy for them. Again no 65 year old with a 10 mil portfolio is gonna self custody 500k in bitcoin. Their manager is not gonna self custody it either, especially not across 20-100 clients each. With an ETF…they will…. Making bitcoin a routine asset in most funds/portfolios.”

— Alex Becker, tech entrepreneur and CEO of Hyros

The inner workings of a crypto ETF

The typical crypto ETF has several key parts. First, an ETF sponsor, which is the main entity behind the fund, creates it and ensures it meets regulatory approval.

Then, they join forces with authorized participants — usually big financial institutions — to handle the creation and redemption of ETF shares. These institutions acquire the underlying crypto (Bitcoin, Ethereum, etc.) and deposit them with the ETF in exchange for shares. This ensures that the ETF holds the crypto it tracks.

Following the launch, these ETFs trade on regulated exchanges like stocks. Investors can buy and sell shares throughout the day at market prices. The price itself reflects the combined value of the underlying crypto assets minus fees.

One of the biggest draws of crypto ETFs is their ability to help you diversify your crypto portfolio. For instance, if you invest in an ETF consisting of Bitcoin and a dozen other major altcoins, you give yourself a better shot at mitigating the risks associated with individual coins. Additionally, some ETFs target specific sectors within the crypto market, such as DeFi or NFTs. This enables investors to capitalize on emerging trends within the broader market.

Of course, like any other financial product, crypto ETFs come with their share of risks and challenges. Regulatory approval, for instance, remains a big hurdle as these ETFs are legally required to comply with the local regulations in each market. Any changes in rules can potentially significantly impact the viability of crypto ETFs.

Besides that, keep an eye on additional charges such as management fees, operation costs, and custodial fees. It’s crucial to factor these fees into your investment decisions, as they can impact your overall returns.

Crypto ETN vs. crypto ETF: Key differences

Despite similar sounding names and some similarities, crypto ETFs and ETNs are distinct investment vehicles, each with advantages and drawbacks. Understanding these differences is crucial to invest in either or both.

Crypto ETN vs. crypto ETF: Legal structure

Here are some of the differences between both financial products:

- Crypto ETNs operate like unsecured loans. Financial institutions issue them, and investors become creditors by lending money to the issuer in exchange for a note that tracks specific cryptocurrencies. This means your investment hinges on the issuer’s creditworthiness — an extra layer of risk.

- Crypto ETFs, on the other hand, cut out the middleman. They’re structured as investment funds that directly hold the underlying cryptocurrencies they track. When you invest in a crypto ETF, you’re buying shares of the fund itself. These shares represent a proportional ownership stake in the ETF’s cryptocurrencies. This way, the average crypto ETF promises more control and potentially less risk.

Crypto ETN vs. crypto ETF: Risk profile

Another significant difference between the two lies in the balance of risk versus transparency, which can have substantial implications for you as an investor.

Crypto ETNs might seem straightforward when playing the crypto market, but a hidden danger lurks beneath the surface: issuer risk. Since they’re essentially unsecured loans to the issuing institution, your investment largely depends on their financial health. Worst case scenario — if the issuer stumbles, your ETN could become worthless, and you will lose money. And that’s not all; market fluctuations can also bite. While the ETN tracks a crypto index, its performance might not perfectly mirror it.

Liquidity issues or market disruptions can cause the ETN’s price to deviate from the underlying crypto, adding another risk layer. Meanwhile, crypto ETFs offer a different kind of risk profile. Here, you’re not lending money but directly owning a piece of the underlying crypto.

In other words, the ETF holds the underlying cryptocurrencies, exposing you to market volatility. Crypto prices can swing wildly, and your investment value can fluctuate significantly. Unlike ETNs, you don’t have to worry about the issuer going bankrupt. Your investment is tied to the cryptocurrencies’ value, not the bank’s creditworthiness.

Crypto ETN vs. crypto ETF: Tax implications

How the taxman treats your ETN or ETF investment can significantly differ and will most likely impact your bottom line. The tax implications of crypto ETNs can vary depending on where you live and the specific structure of the ETN.

Crypto ETN vs. crypto ETF: Market access and liquidity

Both crypto ETNs and crypto ETFs trade in the same field, but their respective liquidity can make a big difference.

- Crypto ETNs: These financial products are traded on regulated exchanges, giving investors liquidity and ease of trading. However, liquidity can vary based on the ETN’s popularity and demand, with less popular ETNs potentially making it harder to trade at desired prices.

- Crypto ETFs: These are traded on exchanges and offer similar liquidity benefits, allowing for ongoing buying and selling. Typically, ETFs experience better liquidity than ETNs because they are backed by the underlying crypto assets, attracting more investor interest.

Crypto ETN vs. crypto ETF: Regulatory considerations

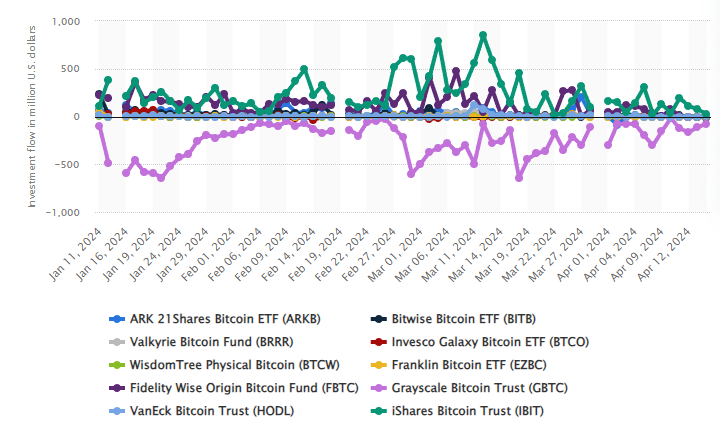

On April 15, 2024, regulators in Hong Kong shone a green light on spot Bitcoin and Ethereum ETFs, signifying a significant shift in the country’s regulations. Although regulatory authorities closely monitor both ETNs and ETFs, there are important differences between them, such as:

- Crypto ETNs: Operate in a regulatory gray area with variable oversight depending on local rules for debt instruments and financial products. Issuers must comply with some regulations and make disclosures, but the framework is generally less rigorous than for ETFs.

- Crypto ETFs: These are under stricter regulatory control, facing uniform scrutiny from securities regulators in the jurisdictions they are offered. ETF sponsors must adhere to higher standards in fund management, investor protection, and disclosure, enhancing transparency and security for investors.

| Factors | Crypto ETNs | Crypto ETFs |

| Legal structure | Exposed to issuer credit risk, performance may deviate from the underlying index. | Structured as investment funds, directly hold underlying cryptocurrencies, investors own shares of the fund. |

| Risk profile | Exposed to issuer credit risk, performance may deviate from the underlying index under some circumstances. | Exposed to market risk of underlying cryptocurrencies, fluctuations in investment value. |

| Tax implications | Tax treatment may vary; gains are taxed as ordinary income. | Taxed as capital gains, potentially benefit from long-term capital gains tax rates. |

| Market access and liquidity | Traded on regulated exchanges, liquidity may vary. | Traded on exchanges, liquidity influenced by market demand is generally smoother than ETNs. |

| Regulatory considerations | Oversight varies, subject to regulations but less standardized. | Subject to securities regulators, stricter standards regarding fund management, investor protection, and disclosure. |

Pros and cons of investing in crypto ETNs

Pros

- Simplified investment: Forget dealing with the complexities of crypto exchanges, wallets, and private keys. ETNs let you invest in crypto through your existing brokerage account — almost similar to how you would invest in stocks.

- Easy access and diversification: Crypto ETNs can be an ideal choice if you want exposure to a basket of digital assets without picking and monitoring individual coins. Some ETNs track crypto indexes, thus offering instant diversification in a single purchase.

- Potentially lower taxes: ETNs might be taxed as capital gains depending on your location, potentially offering a tax benefit compared to directly owning crypto.

- Reduced tracking error: Unlike some ETFs that can deviate from their target index, ETNs aim to mirror the underlying crypto’s performance directly. This minimizes the difference between the ETN’s price and the crypto it tracks.

Cons

- Issuer risk: Unlike directly owning crypto, ETNs are essentially unsecured loans to the issuing institution. If the issuer defaults, your investment could vanish.

- No direct ownership: Owning an ETN is not the same as owning the underlying crypto. You don’t hold any digital assets, and your investment largely depends on the issuer’s repayability.

- Limited liquidity: Some ETNs have low trading volumes while trading on exchanges. In such cases, selling your ETN quickly during market downturns or unexpected events might be difficult.

Pros and cons of investing in crypto ETFs

Pros

- Exposure without the hassle: Forget the complexities of managing individual cryptocurrencies; crypto ETFs provide a streamlined way to gain exposure to crypto without the burden of custody charges, transaction fees, and secure storage concerns. The ETF takes care of all those details.

- Learning curve: The crypto space sometimes feels alien to new investors. It is filled with all kinds of technical jargon. Crypto ETFs eliminate the need to familiarize yourself with all the nitty-gritty surrounding the asset class. You can invest without understanding the intricacies of blockchain technology or the technicalities of managing a crypto wallet.

- Security made simple: Security breaches have unfortunately plagued the crypto world for a long time. Crypto ETFs help you eliminate the resulting insecurity and vulnerability by taking on the responsibility of securing the underlying assets. You can invest with the confidence that professionals are handling the security side of things.

- Cost-effective diversification: Crypto ETFs allow you to diversify your holdings into a basket of crypto assets, all within a single ETF. This eliminates the need to manage assets on multiple exchanges and wallets. It also helps you avoid the fees associated with buying (and selling) individual coins or tokens.

Cons

- Regulatory uncertainty: Crypto ETFs are a relatively new financial product, and regulations to oversee them are still evolving. As the market and the rules it is governed by evolve, crypto ETFs’ functionality might also adapt. In the meantime, you should constantly be on your toes regarding all looming regulatory concerns.

- Tracking error: Not all Crypto ETFs are created equal. Some, particularly those that rely on futures contracts, might not perfectly mirror the price movements of the underlying cryptocurrencies. That’s why you should always be mindful of this potential tracking error when choosing a Crypto ETF.

- ETF fees: Since they are often actively managed, the expense ratios of crypto ETFs can be higher than those of traditional ETFs. You should invest only after carefully comparing expense ratios.

Crypto ETN vs. crypto ETF: Which one suits you more?

You may have heard the adage, “Don’t invest in what you don’t understand.” Crypto ETFs are notably less complicated than ETNs and, thus, might be a more suitable option for the majority. Crypto ETNs are newcomers and admittedly complex, making them potentially less accessible.

Experts generally view ETNs as riskier than ETFs in the crypto sector because they combine default and market risks. While an ETF’s value can drop if the market plummets, it typically remains unless extreme events occur. Conversely, if an ETN’s issuer fails, investors could lose their entire investment. This doesn’t mean that you should avoid crypto ETNs. Instead, ensure to carefully assess your risk tolerance and conduct thorough research before investing.

Frequently asked questions

Crypto ETNs and taxes can get tricky. The exact tax hit depends on your location and the ETN itself. Some governments treat ETN gains like regular income, meaning higher taxes than capital gains on long-term investments. So, you might want to consider these factors before going all in with ETNs.

Ultimately, it depends on your preference and risk appetite. Objectively speaking, crypto ETNs are the proverbial new kid on the block and are relatively complex. Compared to ETNs, crypto ETFs face a more standardized regulatory environment. They’re subject to the scrutiny of securities regulators in the areas where they’re offered. ETF sponsors are held to stricter standards regarding fund management, investor protection, and disclosure.

Between ETNs and ETFs, the former tends to be riskier because it combines both default risk and market risk. An ETF might take a tumble if the market crashes, but it wouldn’t vanish unless something truly disastrous happened. But if an ETN’s issuer folds, you might as well bid farewell to the money you invested.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.