Decentraland is a revolutionary virtual world accessible from any standard web browser or mobile device. It is one of the better-known metaverse platforms out there, thanks to its immersive gameplay built around purchasable 3D land plots. Individuals can procure these plots using the platform’s native digital currency, MANA. In this guide, we’ll explore the ecosystem, including how to buy decentraland (MANA), how it works, and much more.

Do you want to buy MANA? Use and test these exchanges

Best for beginners and advanced crypto traders

Secure exchange with high deposit & withdrawal limits

Best for demo and spot trading

Methodology for selecting the platforms to buy MANA

In order to recommend the top platforms to purchase MANA, multiple exchanges were tested over a rigorous six month period to ensure that only the best options made the final cut. Many considerations were taken into account, such as availability, liquidity, trading fees, security, and user experience.

YouHodler

YouHodler is a Swiss and EU regulated centralized exchange that allows you to spot trade, take out loans in crypto and fiat, and earn interest on your idle cryptocurrency. It is a top choice, largely due to availability and compliance to regulations in relevant jurisdictions, which provides safety to customers.

• Supports over 100 countries

• 60 cryptocurrencies, including stablecoins

• Supports USD, GBP, EUR, and CHF

Kraken

Kraken is a U.S. based exchange that allows users to trade with advanced tools for experienced traders. It regularly publishes a proof of reserves to assure customers of solvency, and has more advanced financial products, such as crypto futures.

• Supports more than 220 coins and tokens

• Accepts USD, EUR, CAD, AUD, GBP, and CHF

• Crypto futures

OKX

OKX is an exchange that accepts most global users. It is considered an all-in-one exchange that, as it offers a suite of products that caters to nearly every type of user. The exchange also publishes a proof of reserve and has two funds to ensure customers of safety on the platform.

• Supports over 100 countries

• Allows you to trade over 300 cryptocurrencies

• Uses crypto third-party payment providers for account funding

Binance

As the world’s largest exchange by trading volume and assets under management, Binance is naturally a top choice for buying MANA. It is also considered an all-in-one exchange because it has a large suite of products that cover most crypto related activities that you can think of.

• Supports more than 100 countries

• Offers more than 500 cryptocurrencies

• Derivatives trading, trading bots, NFTs,

KuCoin is renowned for catering to crypto traders that value derivatives. The exchange caters to a global set of users by offering products such as peer-to-peer trading, NFTs, and a proprietary wallet. It uses a tiered fee system so customers can take advantage of trading discounts by increasing their trading volume.

• Supports over 700 cryptocurrencies

• Caters to more than 200 countries

• Futures and margin trading

Data analysis was conducted by aggregating and analyzing the data from each particular exchange. Before finalizing, the article underwent a rigorous review process that included fact-checking to verify all the claims made. To learn more about BeInCrypto’s verification method, visit this link.

- Methodology for selecting the platforms to buy MANA

- What is Decentraland?

- Decentraland tokens: LAND, MANA, and ESTATE

- How to buy decentraland (MANA)

- How to buy decentraland with a credit card

- Where to buy decentraland (MANA)

- Decentraland wallets for 2023

- Decentraland vs. The Sandbox

- Is it worth investing in MANA in 2023?

- Frequently asked questions

What is Decentraland?

Put simply, Decentraland is a virtual world rooted in the Ethereum blockchain. It is a user-owned and operated platform where users can create, own, and monetize their experiences.

In essence, the metaverse redefines traditional ownership norms, creating a space where MANA token holders have democratic ownership.

– an excerpt from the Decentraland whitepaper

Decentraland has 90,601 land parcels, with an NFT representing each individual parcel. Users can purchase land with MANA, the platform’s native cryptocurrency.

It is already a popular platform for gaming, social networking, and e-commerce. Some of the most popular experiences in Decentraland include:

- Casinos

- Music venues

- Art galleries

- Museums

- Educational games

- Virtual marketplaces

The vitality of the MANA token, reminiscent of a nation’s currency, is invigorated by the transactional dynamism on the platform. Every transaction and asset ownership in Decentraland is governed by smart contracts.

Not just a metaverse game

At its core, Decentraland isn’t merely a virtual playground. Its Ethereum underpinnings mean the platform boasts a familiar and proven degree of security, transparency, and genuine digital ownership. As we already mentioned, users have complete control over their virtual assets, which safeguards against potential malpractices or misuse.

Venturing into Decentraland’s creative space is fairly easy. Budding architects can purchase a land parcel and use Decentraland’s Builder tool to create 3D scenes or interactive experiences. They can also import their own 3D assets or purchase them from the Decentraland Marketplace.

There are many ways to monetize experiences in Decentraland, such as charging entry fees, selling virtual commodities, or hosting MANA-based casino games. Yet, Decentraland still has a long way to go. If the team behind it manages to do justice to the roadmap promised, Decentraland could find use cases in various sectors. For instance, in education, digital workspaces, e-commerce, and immersive social networking, just to name a few.

Decentraland tokens: LAND, MANA, and ESTATE

The Decentraland metaverse has three native assets: LAND, MANA, and Estate tokens. They each play distinct roles, driven by their unique attributes per ERC-20 and ERC-721 token standards.

MANA, an ERC-20 token, is fungible, meaning each token is identical and can be swapped with any other. It serves as a universal currency within Decentraland.

On the other hand, LAND and Estate tokens adhere to the ERC-721 standard. They are non-fungible tokens (NFTs), meaning each LAND or Estate token possesses unique attributes and, therefore, is not directly interchangeable with one another. Rather than acting as a currency, these tokens facilitate exclusive, individualized items within the Decentraland metaverse, such as distinctive avatars, apparel, and singular land parcels.

How Decentraland works under the hood

Decentraland operates the Ethereum network to facilitate the management and trading of LAND tokens, which represent ownership of virtual parcels of land within the platform.

The virtual world is divided into parcels, each identified by Cartesian coordinates (x, y). Ownership, content, and usage rules of each parcel are determined by the owner and are stored on the Ethereum blockchain, providing immutability and transparency. The content, such as 3D scenes and interactive applications, is hosted on a decentralized distribution system, enhancing platform security and reducing single points of failure.

The Decentraland platform deploys a three-layer stack:

- Consensus layer

- Land content layer

- Real-time layer

The Consensus layer employs Ethereum smart contracts for LAND management, handling ownership, and transaction details. The Land Content layer uses a decentralized protocol for content distribution and a positioning system to retrieve and set three-dimensional positions and files for rendering scenes.

Finally, the real-time layer is responsible for enabling user interactions in a decentralized manner without a global clock. It determines the outcome of users’ interactions based on a set of reproducible rules.

Users can create, develop, and monetize applications on their parcels. These applications are rendered using a decentralized protocol for content distribution. The Decentraland SDK enables developers to build on top of the Decentraland platform, leveraging its capabilities to create immersive virtual experiences.

Decentraland also supports the use of decentralized identities and uses a native cryptocurrency (MANA) for transactions. This allows users to buy and sell virtual goods and services within Decentraland.

LAND is purchased by burning MANA. This means that to buy LAND in the metaverse, you must send a specific amount of MANA to a specific address. This MANA is then permanently removed from circulation.

Why is Decentraland popular?

Decentraland’s objective is to mesh blockchain, decentralized storage, and VR to create an exciting virtual world. And not just any virtual world, but one in which users have true ownership and control over their digital assets and creations. It aspires to establish a sizable user-governed virtual economy and social space.

Some of the reasons behind its popularity may include:

- Its reputation as one of the pioneering and most recognized virtual worlds.

- Because it is rooted in the Ethereum network, it has several advantages, such as security, transparency, and ownership of digital assets.

- The platform is governed and “owned” by its users, which empowers them to influence its evolution and forthcoming developments.

- It presents a rich tapestry of experiences, spanning from gaming and social interactions to e-commerce, offering a multifaceted virtual universe.

- The dynamic nature of Decentraland ensures that it is perpetually unfolding, with fresh features and experiences consistently rolling out.

How to buy decentraland (MANA)

As of mid-October 2023, MANA has a market cap of over $525 million with more than $17 million daily trading volume. As of this writing, it is the 61st-ranked cryptocurrency (by market cap), and there is no shortage of crypto exchanges supporting Decentraland (MANA).

Due to the sizable liquidity, buying or selling decentraland (MANA) is a relatively straightforward process. You just have to follow the same generic steps you would while buying any other cryptocurrency.

Step-by-step procedure

Here’s how you do it:

Get yourself an account on a crypto exchange

Begin by setting up an account on a cryptocurrency exchange that facilitates MANA trading. Most major exchanges support MANA. We will be using Binance here as an example to demonstrate the steps. Make sure that the exchange you choose has listed MANA.

Deposit fund

Transfer the cryptocurrency you intend to exchange for MANA into your newly created exchange account. This can typically be done through various means, such as a transfer from a crypto wallet. Some exchanges may also support fiat-MANA pairs. In such cases, you can deposit fiat currency into your exchange account using various methods, such as bank transfer, credit card, or debit card. Note that depending on the exchange you choose, you may have to undergo a KYC verification process before being able to deposit funds. In most cases, the process requires you to submit an ID proof and/or proof of residence.

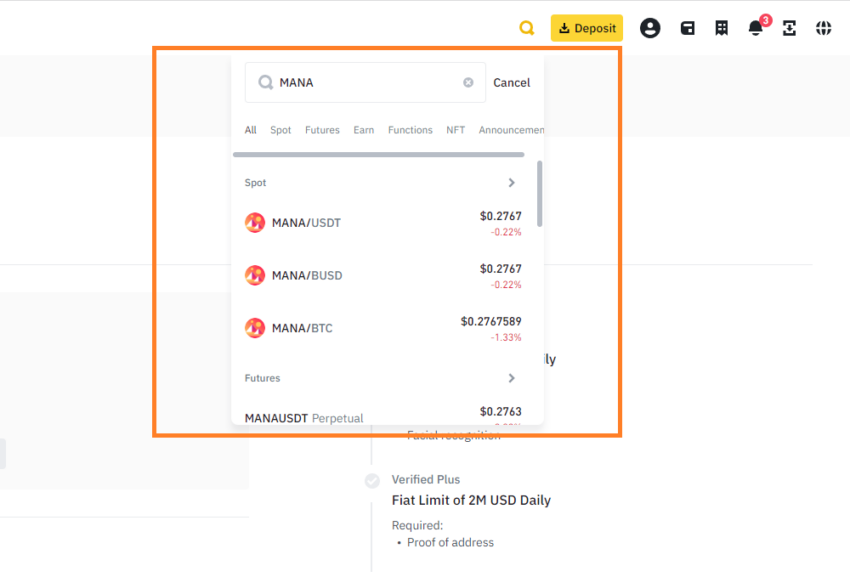

Locate the right trading pair

Identify the trading pair for the cryptocurrency you want to exchange for MANA. For example, if you want to buy MANA with USDT, look for the MANA/USDT trading pair. If you are buying MANA with fiat currency, you can proceed directly to purchase MANA once your fiat currency deposit has been processed.

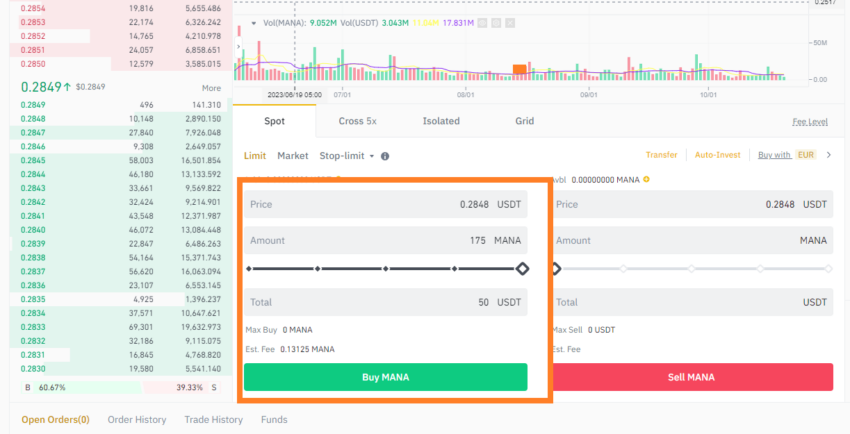

Place your buy order

After identifying the desired trading pair, proceed to place a buy order for MANA. This involves specifying the quantity of MANA you wish to purchase and your preferred price point. After placing your buy order, wait for it to be matched with a corresponding sell order; at this point, it will be executed, and the MANA will be deposited into your exchange account.

How to buy decentraland with a credit card

To buy decentraland with a credit card, start by selecting a cryptocurrency exchange that supports MANA and credit card transactions. Create an account on this exchange and verify your identity by providing personal information and identification documents. Once verified, link your credit card by entering its details and completing any security verifications.

Deposit funds using your credit card, then head to the trading section to purchase MANA. Enter the desired amount and confirm the transaction. For enhanced security, transfer your MANA tokens to a private wallet, particularly if you intend to hold them long-term.

Manage your MANA

Following the purchase, you can opt to keep your MANA in the exchange account or transfer it to a cryptocurrency wallet for added security.

Additional tips for buying MANA:

- Evaluate exchange fees: Be mindful of the varying trading fees across different exchanges. Make sure to compare them to select the most cost-effective option available.

- Mind the price fluctuations: Cryptocurrencies, including MANA, can experience rapid price fluctuations. Be cognizant of this volatility and plan your purchase accordingly.

- Secure your MANA: After buying MANA, prioritize its security by storing it in a secure wallet, saving it from potential theft or loss. It’s pretty easy, considering you have a range of MANA wallet options to choose from.

- Review a decentraland price prediction: Predictions can provide investors with insights into potential future price movements. However, it’s crucial to remember that these predictions are not guarantees and should not be the sole basis for investment decisions.

Where to buy decentraland (MANA)

Now that you have a general idea of investing in decentraland, let’s explore some of the most popular exchanges listing MANA.

Coinbase

As one of the largest crypto exchanges globally, Coinbase hardly needs an introduction. Using Coinbase to buy MANA is a great option thanks to the platform’s easy-to-use interface and intuitive design. To buy MANA from Coinbase, follow these simple steps:

- Download the Coinbase app and set up an account by filling out the registration form.

- Keep your ID and proof of address ready, as you will need these during the verification process.

- Tap into the payment method box to connect your preferred payment method, be it a bank account, debit card, or wire transfer (or a crypto wallet).

- Use the search bar to navigate to decentraland and select “Buy.” A tap on it will lead you to the purchase page.

- Enter the amount you’re willing to invest in, which the app will promptly convert to MANA.

- Hit “Preview buy” to review your purchase details. Once everything looks shipshape, finalize your order, and that’s it — MANA now graces your portfolio!

Decentraland wallets for 2023

Here are a few decentraland wallets to safely store your MANA tokens and access them conveniently.

- YouHodler wallet: Supports direct purchase of MANA, offering an easy-to-use interface for trading and managing crypto assets.

- Wirex wallet: Allows buying MANA with traditional currencies or other cryptocurrencies, featuring integrated seamless exchange capabilities.

- Coinbase Wallet: Users can buy MANA on the Coinbase platform and easily transfer it to this secure and user-friendly wallet.

- Zengo Wallet: Facilitates MANA purchases with credit cards or other cryptocurrencies, boasting a unique keyless security feature.

- OKX Wallet: Enables buying MANA and various cryptocurrencies, catering to users with its advanced trading tools.

Kraken

Kraken is another top-of-the-line crypto exchange that lists several MANA trading pairs. The steps to buy decentraland (MANA) on Kraken are more or less the same as that on Coinbase:

- Start by creating an account, providing an email, creating a username, and setting up a strong password to secure your account.

- To buy MANA with cryptocurrencies like Bitcoin or USDT, you’ll need to go through the KYC verification process. Here, you will need to provide essential details like name, date of birth, country, and phone number. For fiat transactions, additional documentation will be required.

- Next, depending on your locale and preferences, choose a suitable method to deposit funds into your Kraken account.

- With funds in your account, you’re set to purchase MANA. Kraken also offers you a range of charting tools, round-the-clock global customer support, and the option to engage in margin trading, enhancing your trading adventure.

KuCoin

KuCoin is another popular crypto exchange supporting MANA. Just like Kraken, it lets you buy MANA using fiat and crypto, including stablecoins such as USDT.

To buy MANA on KuCoin, you must create an account and deposit funds. Once you have deposited funds, you can use various payment methods, such as credit/debit cards, bank transfers, and third-party payment processors, to buy MANA.

Here are the steps to buy MANA on KuCoin:

- Create a KuCoin account

- Verify your KuCoin account

- Deposit funds into your KuCoin account

- Go to the KuCoin Spot Market

- Find the MANA/USDT or any other trading pair(including both fiat and crypto)

- Place a buy order for MANA

All of the above platforms come recommended thanks to their strong reputations in the crypto market, decent liquidity, and solid security offerings. For beginners, Coinbase is best. For a security-first CEX, choose Kraken. Many advanced traders choose KuCoin for its huge range of features, low fees, and wide range of coins.

MANA staking

MANA operates on a proof-of-work mechanism and doesn’t support on-chain staking. Nonetheless, depositing MANA into a specific type of account, often labeled as “staking” by certain individuals and platforms, is possible. For instance, Binance utilizes the term “staking” to describe this process.

You stake MANA for a set period of time to earn rewards, which are paid out in MANA tokens. The amount of rewards you earn depends on how much MANA you stake and how long you stake it for.

Different ways of MANA Staking:

Centralized exchange (CEX) staking:

- Platforms like Binance or Coinbase offer a straightforward staking process but tend to skim off a portion of the staking rewards.

- Create an account, deposit MANA, navigate to the staking page, select the MANA staking program, and define your staking parameters.

- When you confirm the transaction, the system will lock your MANA, and you will start earning rewards.

Decentralized exchange (DEX) staking:

- Opting for platforms like Uniswap or SushiSwap might present a more rewarding yet intricate and riskier staking path.

- Set up a wallet, deposit MANA, select the MANA staking pool on the DEX staking page, and set your staking parameters.

- Approve the transaction, lock your MANA, and daily rewards commence.

Staking via Decentraland DAO:

- While potentially offering the highest rewards, this method comes with complexity and associated risks.

- Create a Decentraland wallet, deposit MANA, connect your wallet via the Decentraland DAO website, and establish your staking parameters.

- Confirm the transaction, lock in your MANA, and start receiving daily rewards.

Your optimal staking route hinges on your individual preferences and requirements. If simplicity appeals to you, CEX staking might be your go-to. However, if maximizing rewards is paramount, consider the Decentraland DAO.

Decentraland vs. The Sandbox

Both Decentraland and The Sandbox are prominent virtual worlds in the metaverse, each offering unique opportunities and experiences. Both platforms facilitate the creation and monetization of virtual experiences yet diverge in their governance, development, and user engagement approach.

Launched in 2017, Decentraland allows users to purchase, develop, and sell parcels of virtual land using its native cryptocurrency, MANA. It emphasizes decentralized ownership and applications.

On the other hand, The Sandbox, introduced in 2011, also enables users to own virtual real estate but places a significant focus on gaming and player-created experiences through its SAND token.

Here’s a quick comparison between the two:

| Features | Decentraland | The Sandbox |

| Launch Year | 2017 | 2011 |

| Native token | MANA, LAND, ESTATE | SAND, GAME, ASSET, LAND |

| Primary focus | Decentralized ownership and applications | Gaming and player-created experiences |

| Virtual land | Yes, can be bought, developed, and sold | Yes, with a focus on gaming experiences |

| User engagement and activities | Virtual businesses, applications, and social interactions | Interactive gaming, experiences, and asset creation |

| Monetization scope | Through virtual businesses and applications | Primarily through gaming and asset creation |

Is it worth investing in MANA in 2023?

The surge in popularity of “alternative life” games cast a very promising light when they first emerged, leading many people to buy decentraland. However, the trajectory from 2D to 3D and blockchain-integrated platforms has been shrouded in speculative mist in 2022 and 2023. Decentraland not only aims to amplify its technological offerings to a broader audience but also seeks to weave its capabilities into the fabric of everyday life, positioning it as a noteworthy investment asset.

Due to the crypto market’s inherent volatility, marked by its frequent surges and sharp declines, it is essential to adopt a deliberate and prudent strategy when deciding to buy investments in MANA or virtual LAND within Decentraland.

Frequently asked questions

Where can I buy decentraland?

Is MANA a good investment?

Can you buy and sell on decentraland?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.