Unexpected financial events in 2022 and 2023 have made us question our understanding of conventional uncertainty and risk. These events with far-reaching consequences and minimal predictability are termed black swans.

This comprehensive guide makes sense of the Black Swan theory, focusing on its meaning, financial implications on traditional and crypto markets, previous instances, and characteristics. Plus, we cover some underrated yet mathematically-powered ideas to identify and prepare for them.

BeInCrypto Trading Community in Telegram: read the hottest news on crypto, discuss the market trends & get technical analysis on coins from PRO traders & experts!

- Unpacking the Black Swan theory

- The Black Swan origins

- Black Swan events: distinguishable traits

- Perspective-changing Black Swan events

- Black Swan events and crypto

- The sectoral impact of Black Swan events

- The need for Black Swan preparedness

- Predicting the Black Swan events: it’s in the meaning

- Black Swan events and psychological biases

- Reflecting on the true meaning of Black Swan

- Frequently asked questions

Unpacking the Black Swan theory

Simply put, the Black Swan theory stands for a high-impact, rare, and highly unpredictable event boasting significant consequences for economies and financial markets. Any event adhering to this theory is a black swan event and has a widespread, mostly detrimental impact.

Note that, for instance, a market correction after a bull run isn’t a black swan event. Experienced investors can prepare for such an occurrence with tools and analysis. Instead, a black swan event is something that hardly anyone can prepare for.

What‘s at the heart of the Black Swan theory?

The theory hinges on the idea that the conventional concept of risk forecasting and management usually fails in case of extreme events, like the financial crash of 2008. The underestimation of a cataclysmic event leads to unpreparedness, even from the likes of policymakers and market participants.

It is important to consider the possibility of these unexpected events by looking at as many indications as possible while taking finance-specific calls. A black swan event thrives on panic — an emotion that follows something unexpected.

The Black Swan origins

Time for some history lessons! The Black Swan parlance dates back to when Dutch explorers arrived in Australia in 1670 and ended up encountering a rare bird, the black swan. Till then, people only knew about the white swan. Soon, the term black swan was associated with impossible and improbable events. Over time, the thought of pairing the rare bird name with unexpected happenings in the financial realm made sense.

However, the metaphor didn’t come to fruition on its own or via the Dutch explorers.

Nassim Nicholas Taleb and coining the “Black Swan Theory.”

It was Nassim Nicholas Taleb that coined the Black Swan theory. Notably, Taleb is an options trader and a former hedge fund manager.

Taleb used his experience of the markets to identify the limitations of traditional financial models in predicting and addressing improbable events. His theory was instrumental in the field of financial risk management.

Taleb’s seminal work to further the meaning of the Black Swan

Taleb published his groundbreaking book — The Black Swan: The Impact of the Highly Improbable — in 2007. While this book explains the true meaning of a black swan, it throws ample light on the behavioral patterns of the financial markets —including human nature, especially in regard to trading and investing. Here are some areas and pointers that the book explores:

1. Forecasting and predictions have their limitations

Traditional market prediction and forecasting strategies fail during these black swan events. And most importantly, people overestimate their capabilities to predict the same.

“We are explanation-seeking animals who tend to think that everything has an identifiable cause and grab the most apparent one as the explanation.”

From The Black Swan: The Impact of the Highly Improbable: Nassim Nicholas Taleb

2. Luck and randomness have roles to play

According to Taleb, luck can have a role to play in helping you identify such events. Imagine those who cashed out their BTC positions before the market crashed in 2020. There was no way to predict the pandemic. Cashing out was random.

3. Antifragility wins every time.

Yes, it is virtually impossible to predict the black swan events. However, the focus should be on building systems that are robust enough. This makes it easier to withstand shocks.

4. The narrative fallacy

Once a black swan scours the sector, vanquishing everything in its wake, people tend to create backdated explanations and narratives. This hardly makes sense, as the black swan events are inherently random. Yet, piecing stories is human nature as we often tend to justify and make sense of unpredictable events after their conclusion.

Black Swan events: distinguishable traits

Not every hiccup along the way is a black swan event. Here are some of the key hallmarks that should help you better understand the meaning:

Rarity

Black Swan events are highly infrequent. And it is the rarity that makes it hard to predict them with standard forecasting tools. For instance, take the Black Monday crash from 1987. The global markets suddenly started melting, with Dow Jones leading the crash with a 22.6% dip in less than 24 hours. Nothing alike was experienced before that in terms of such a massive single-day drop.

The rarity factor is a reason why Black Swan events get the outlier status, as they are far off from any regular expectations.

Unpredictability

You might argue that every bad thing that happens is unpredictable. Well, we disagree. Black Swan events are inherently unpredictable, so there are almost zero chances that you could predict them, even with the best forecasting tools. The Covid-19 pandemic was such an event. Even though experts highlighted the possibility of a global pandemic, the timing, spread, and severity were random. And that lead to a global economic disruption.

Extreme impact

The impact of a black swan event is outrageously high. And do note that a crash isn’t an event. It is mostly a high-impact after-effect of a black swan. The 2008 crisis is one such example: the collapse of the subprime (mortgage) market snowballed and derailed the global economic train.

Retrospective predictability

Once the black swan event concludes, it is a common right to see people drawing parallels, rationalizing the event, and creating explanations. This form of hindsight bias furthers a sense of false belief that black swans can be identified easily. The 2000 dot-com bubble burst is one example of this black swan trait, with people even considering it obvious in hindsight.

Norm disruption

In most cases, once concluded, a black swan event challenges traditional norms and nudges the financial world toward a more progressive direction. The most recent example has to be the implosion of FTX — one of the more popular centralized exchanges. Post FTX’s bankruptcy, people started focusing more on self-custodial and decentralized options to store and trade their crypto.

Perspective-changing Black Swan events

By now, you should be aware of how a black swan event unfolds, festers, and concludes. Now let’s look at some real examples that can help us better decipher the meaning of the black swan theory (we will cover the impact of these examples in more detail later in the article).

The financial crisis of 2008

In 2008, the housing market collapsed, targeting the financial products tied to the U.S. subprime mortgages. Over time, the defaults increased, housing prices dipped, and the entire global financial machinery broke courtesy of a massive credit crunch. And yes, major banks collapsed in the wake of a recession, as bank runs became the norm.

Lessons learned

- The value of transparency in financial markets.

- Global financial tracks are connected.

- Central banks and the government help stabilize such scenarios, often by providing liquidity (printing more money) and drawing specific fiscal policies. Interest rate drops are common during such scenarios to encourage lending.

COVID-19 pandemic

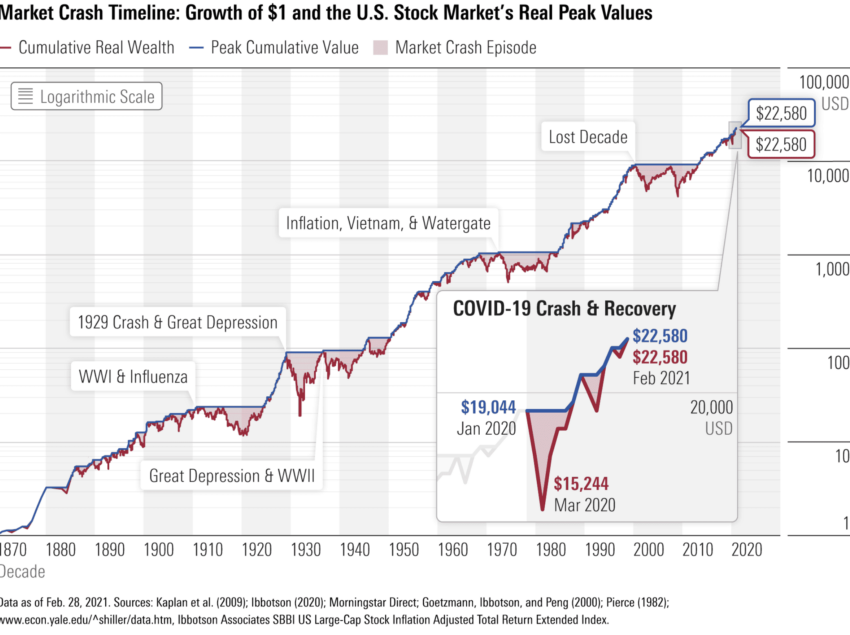

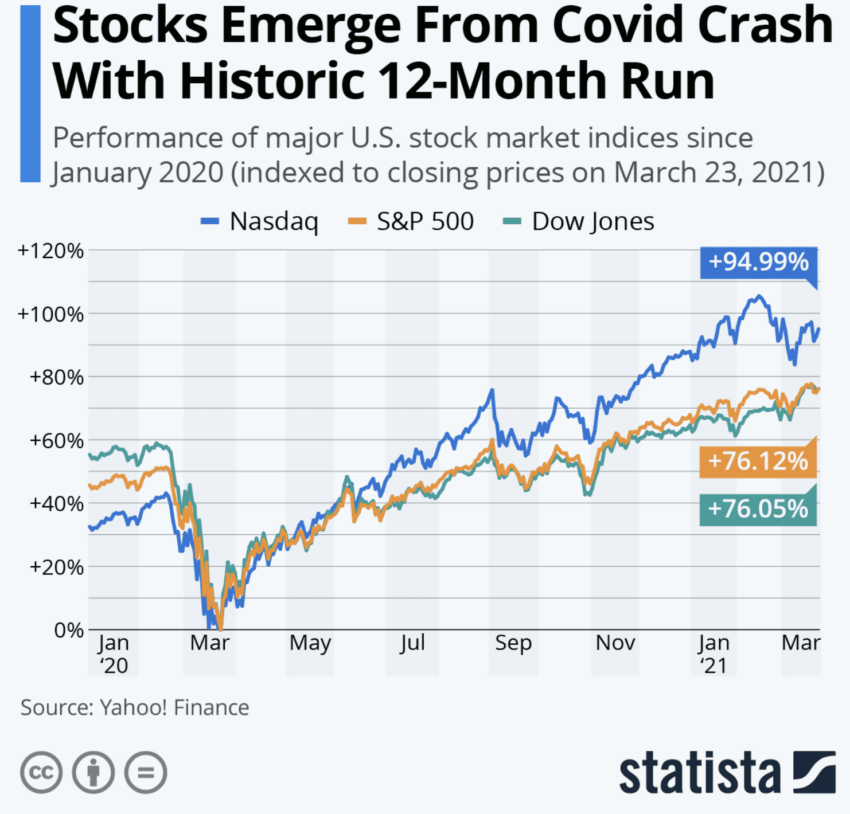

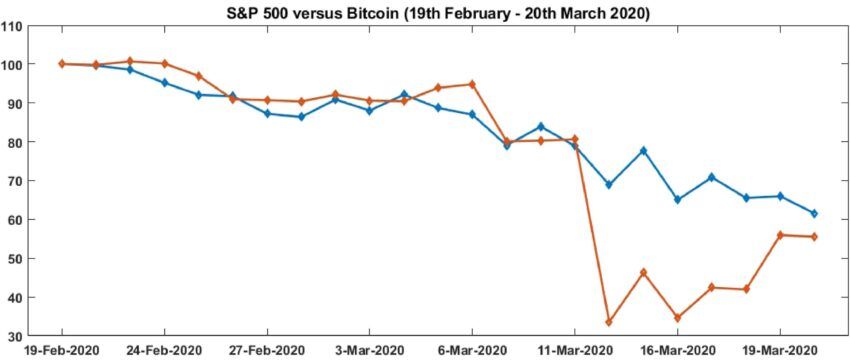

The pandemic was one of the most hard-hitting Black Swan events that emerged in early 2020. The world was caught off-guard and virtually destroyed the global financial markets. Global governments started implementing lockdowns, which led to business closures, market volatility, and economic drawdowns.

However, like any other attempt at a recovery, even the stock market had bounced back by March 2021, registering new highs.

Lessons learned

- There will always be a need for preparedness.

- A good way to combat a black swan event is by utilizing the power of innovation and adaptability, like how companies moved to remote work, digital technology, and whatnot.

- Black Swan events require global cooperation.

- A widespread Black Swan event like the pandemic doesn’t only impact the stock market or the crypto market once. The effects can continue over the years.

While there have been several other Black Swan events, these two have been the most obvious reminders of how unforeseen events can wreak havoc across global economics.

Black Swan events and crypto

Black Swan events are known to ramp up market volatility, regardless of the trading space. But how do these events unpack in a realm as volatile as crypto? Here are some of the crypto-centric Black Swan events that jolted the crypto space:

Terra (LUNA) Crash

In May 2022, Terra — one of the more promising crypto projects — went belly up in a $1 trillion implosion. The dual-token economics of the Terra (LUNA) ecosystem, involving LUNA and UST (a stablecoin), was hit hard when UST depegged from its $1 peg. As it started dipping, an effect multiplied by the panic all around, even LUNA started suffering. Eventually, the entire ecosystem folded like a losing hand, questioning everything we knew or believed about algorithmic stablecoins.

Lessons learned

- Crypto markets move quickly and can be highly unpredictable.

- Big projects can also fail, and even due diligence might not work in case of a Black Swan event.

- All stablecoins aren’t equal, especially the algorithmic ones.

- Projects that promise unrealistic yields (Terra’s Anchor Protocol) need to be looked at with a discerning eye.

FTX crash

The Terra (LUNA) collapse wasn’t the only tremor that shook the crypto world in 2022. In November 2022, FTX — one of the largest centralized exchanges — collapsed in less than 24 hours. Here is how things unfolded.

Binance, the largest crypto exchange, mentioned selling their FTT holdings due to transparency issues. And FTT was the native crypto of the now-defunct FTX crypto exchange. Such a statement made by Binance started a series of events that steamrolled FTX to bankruptcy. The exchange went from a valuation of $16 billion to ground due to debt and liquidity crunch.

Lessons learned

- A greater focus on self-custody wallets is necessary, as several users found their funds locked in FTX during the collapse.

- Decentralized exchanges powered by smart contracts are trustless and, therefore, less susceptible to the likes of corruption.

The sectoral impact of Black Swan events

Honestly speaking, the event doesn’t tend to be as disconcerting as the sectoral impact. Let us explore the key examples.

Financial markets and the turmoil

Events like the ones discussed can cause dramatic shifts in the financial markets. For instance, the 2008 financial crisis saw the S&P Index drop close to 57% from its 2007 peak to a new low made in March 2009.

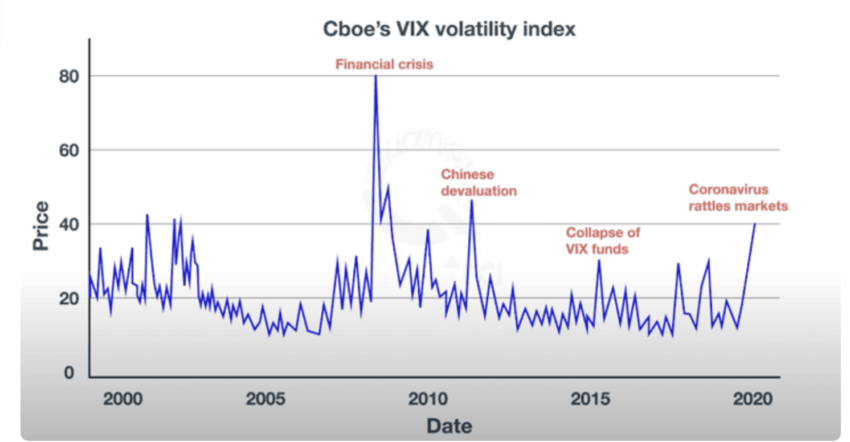

Another instance is when the CBOE volatility index or VIX surged to 82.69 in 2008.

A shaken global economy

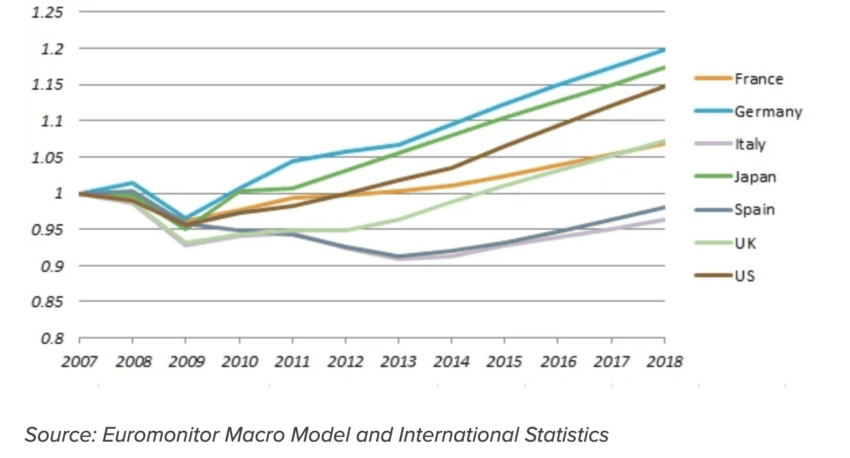

Index and volatility movements are expected with Black Swan events, but the repercussions often extend to global markets. For instance, the crisis of 2008 saw many countries reporting negative GDP growth due to the recession. Also, fixing the recession with money printing and similar liquidity-infusing moves can later lead to inflation and an eventual hike in interest rates. This might end up leading to another Black Swan event, something the corp of central banks shutting down (such as Silicon Valley Bank, Silvergate, and Signature all in early 2023) may be an indicator of.

Risk management: the art and science of it

As mentioned previously, a Black Swan event has the ability to change the set norms and take the financial train to a more innovative space. Post the 2008 crisis, experts started focusing more on stress testing financial products and checking capital adequacy.

Over the years, risk management strategies like tail-risk hedging, adaptive management, and more have also come to the fore. Even crypto has started to see top-of-the-line risk management implementations, like the latest DeFi-centric IntoTheBlock Risk Radar from the blockchain analytics firm IntoTheBlock.

“Decentralized finance has tremendous potential, but the institutional adoption of DeFi hinges on effective risk management. Technical, governance and economic risks are all significant, but it’s the economic risks that are often overlooked. Economic risks may not make headlines, but they account for the majority of losses in DeFi protocols.

As we move forward, it’s essential that we prioritize economic risk management to ensure the long-term success and sustainability of the DeFi ecosystem.”

Jesus Rodriguez, IntoTheBlock CEO: BeInCrypto

The need for Black Swan preparedness

Preparing oneself for something as rare as a Black Swan event is difficult. Yet, here are a few strategies that might help:

- Diversify across assets, geographics, and sectors.

- Focus immensely on risk assessment and management strategies by conducting regular stress tests, risk-reward profiling, and scenario analysis.

- Develop contingency plans that focus on cybersecurity measures, data backup, and everything else that covers you in case of an imminent threat.

- Focus on having adequate liquidity in hand, especially by keeping your assets in self-custody. Even if your crypto or assets are on centralized exchanges and custodial wallets, do not get in more than 10% of your entire portfolio as a risk management strategy≥

In addition to these strategies, staying updated with global trends is necessary. Focus on the historical impact of other Black Swan events, and never give in to panic while making investing decisions.

Did you know? Risk management focusing on Black Swan events is getting recognized in crypto as “Black Swan smart contracts.” These contracts use complex models to help users hedge and even protect their asset-specific investments from catastrophic events and massive price fluctuations. Insurance as a Digital Service is one of the rising potential applications of these Black Swan smart contracts.

Predicting the Black Swan events: it’s in the meaning

Wait, didn’t we say that Black Swan events cannot be predicted? Well, that’s the usual scenario courtesy of their outlier status. However, a few strategies can help you locate the potential risks and enhance preparedness.

Before that, we need to understand one thing. These events are more like extreme deviations from any average outcome. Standard financial models follow the insights associated with normal distribution or the Gaussian. Also, in the case of a normal distribution, three standard deviations usually encompass 99.7% of all the probable data sets. Therefore, any event that falls outside these three standard deviations is rare.

A black swan event falls beyond six standard deviations and not six. Therefore, the probability of occurrence is 0.0000001%. This is the reason why we consider them as super rare.

Heavy-tailed distributions

This strategy focuses on the big and rare events, looks at the past data, and locates the patterns associated with these events (mostly some time ahead) to determine an upcoming black swan event. Unlike a normal distribution that can be read for standard models, black swan events need heavy-tailed distributions like the Cauchy or Pareto distributions, where a higher probability is assigned to these extreme impact events.

Bayesian analysis

Consider this strategy as working like a detective who believes in the trial and error method. With Bayesian analysis, you consider that a black swan event — like a large-scale exchange implosion, something similar to the FTX meltdown — might occur. And you keep updating the findings and analysis based on new evidence.

Scenario analysis

This happens to be a non-mathematical approach where the focus is on creating hypothetical scenarios to understand and evaluate potential outcomes. This form of analysis tracks multiple scenarios and helps amplify preparedness.

Stress testing

This method is all about simulating Black Swan events from the past and checking the existing resilience of a financial system against it. This helps identify vulnerabilities and enhance preparedness.

In addition to these predictive and preventing strategies, experts even gather insights from subject matter experts as part of Expert Eliciation. While predicting a Black Swan event accurately is impossible, these mathematical and non-mathematical strategies, if used correctly, can give you an edge.

Black Swan events and psychological biases

Psychological biases and Black Swan events are inherently connected. Processing the likelihood of such a highly improbable event isn’t easy and bound to attract fallacies. Here are a handful:

- Confirmation bias: we start believing things that align with our expectations. This way, we end up looking at the right analysis and end up succumbing to a black swan event.

- Availability bias: A reason for not being able to predict a Black Swan event is the bias that makes our mind focus on instances that are readily available and do not require a lot of recalls.

- Overconfidence bias: Some experts might be overconfident about their analysis of the market that follows a normal or Gaussian distribution. This way, they end up overlooking the rare signs.

- Normalcy bias: Individuals believe that things will keep progressing per the set path. This form of bias doesn’t easily accept anything that’s out of the ordinary.

- Hindsight bias: This kind of “knew-it-all-along” tendency is a way of backtracking and rationalizing a black swan event. While this is more of a lagging bias, it can cloud our understanding of rare and cataclysmic events.

Scaling beyond these interplaying biases can help us better understand Black Swan events and their repercussions. Also, considering these biases exist, it is necessary to master trading emotions while dealing in crypto or any other asset class.

Reflecting on the true meaning of Black Swan

We do not know when the next lack swan might appear, impacting the global financial markets or the crypto space. We do know that certain predictive tools can help close in on the possibilities of such a highly improbable event. But in order to make use of these tools, we must take care of the psychological biases. This means believing that anything and everything is possible in the financial realm.

Frequently asked questions

What is the meaning of a black swan event?

Is FTX a black swan event?

How does the black swan theory apply to investing?

Can black swan events be predicted?

How do black swan events affect the economy?

Why are black swan events important in risk management?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.