Digital Currency Group (DCG) founder Barry Silbert is one of the most influential individuals in crypto. He has become a prominent figure in the cryptocurrency industry due to his company’s undeniable impact through investments in various crypto ventures. This guide dives into Silbert’s life, contributions, and role in crypto investments and companies. Here’s what to know.

KEY TAKEAWAYS

► Barry Silbert is a vocal figure in the crypto industry, founding the Digital Currency Group (DCG) and overseeing major subsidiaries like Grayscale and Genesis.

► Silbert’s DCG has faced significant financial challenges, particularly due to Genesis’s bankruptcy and related issues from the 2022 crypto market downturn.

► A dispute with Gemini co-founder Cameron Winklevoss brought DCG under scrutiny, with allegations that Silbert mismanaged funds related to the Gemini Earn program.

► Despite lawsuits and controversy, Silbert remains influential in the crypto space, though his reputation has been impacted by financial and legal troubles.

Who is Barry Silbert?

Barry Silbert is the founder and CEO of Digital Currency Group (DCG), a financial investment and holding company overseeing several subsidiaries specializing in cryptocurrency and blockchain technology. Through DCG, Silbert has built his reputation as a prominent figure in the cryptocurrency industry.

He was born in Maryland in 1976 and demonstrated academic excellence early on. With a clear interest in business, Barry took his General Securities Representative exam in high school, making him a certified stockbroker. Later, he took the Series 7 stockbroker exam.

He joined the Goizueta Business School at Emory University to attain his Bachelor’s in Finance. Afterward, in 1998, he graduated from business school and became an investment banker at the investment bank Houlihan Lokey.

Did you know?

Barry was the youngest person to pass the Series 7 Stockbroker Examination, achieving this at 17.

What does Barry Silbert do?

Unlike many prominent figures in crypto, Barry Silbert is not a programmer but an entrepreneur and investor. Silbert oversees DCG’s strategic direction and daily operations and manages its diverse portfolio. Under his leadership, DCG has invested in over 200 cryptocurrency companies.

Silbert made his bones as an investment banker. He worked at Houlihan Lokey, a global investment bank, until 2004 when he left to create his own company, Restricted Stock Partners. In 2008, the company shifted its ideas for the future, rebranding to SecondMarket.

The mission behind this shift was necessary to understand the company’s vision for the long term. SecondMarket allowed other entities to trade their illiquid assets to raise funds, including from restricted stocks and bankruptcy claims.

In 2009, Barry Silbert was named the Entrepreneur of the Year by Ernst and Young and was featured among the list of 100 Most Influential People in Finance (Treasury and Risk). He was also named a Technology Pioneer by the Davos World Economic Forum in 2010 and made it to Fortune Magazine’s 40 Under 40 in 2011.

Barry’s first encounter with crypto was in 2012 when he recognized the exponential growth the new asset class could achieve. According to his statements, this year also marked his first purchase of BTC at approximately $11. Finding a new passion in crypto made him relinquish his leadership in SecondMarket to explore the possibilities.

Founding the Digital Currency Group (DCG)

Barry Silbert sold SecondMarket to NASDAQ, which rebranded the company to NASDAQ Private Market. The funds he raised from this venture enabled the founding of the Digital Currency Group (DCG) and other firms under it. DCG is now among the biggest asset management companies globally, with over 160 companies under its portfolio.

The company officially launched in 2015 and initially had its headquarters in Manhattan, New York. However, after careful deliberation with the local government, it relocated to Stamford, Connecticut. For Barry to move the headquarters there, he received a $5 million grant from the Connecticut Governor. In return, he needed to create substantial jobs for the local residents.

DCG has investments in major companies, including the crypto exchanges Kraken and Coinbase, Dune Analytics, and Circle Inc. Some of its most famous subsidiaries include Grayscale Investments, Genesis Global Holdings, and CoinDesk.

Grayscale

Grayscale existed before the conception of DCG, making it the first company Barry built to kickstart his crypto journey. Launched in 2013, Grayscale manages digital assets for private companies and investors. It’s among the top digital asset managers in the industry and considered one of the largest.

Like many of Barry’s ventures, Grayscale focuses on a more productive digital investment future. The asset management firm provides the much-needed diversification necessary for investment portfolios to achieve its mission.

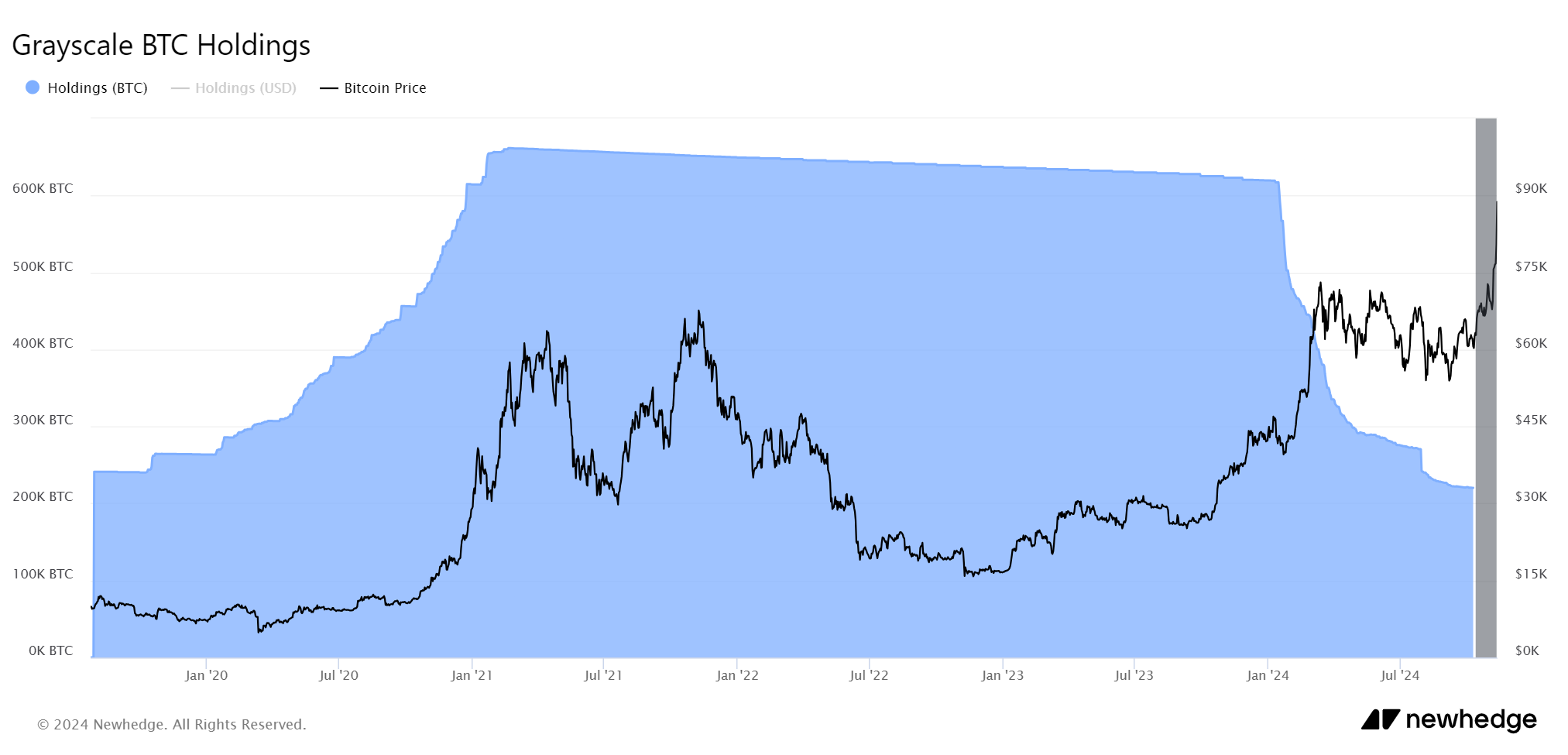

Under the Grayscale Bitcoin Trust (GBTC), the company owned over 600,000 BTC at one point. Following the creation of its spot Bitcoin ETF, the company has seen a massive drop in its reserve due to redemptions.

The subsidiary had been working to turn GBTC into a spot Bitcoin ETF (Exchange Traded Fund) for some time. However, the Securities and Exchange Commission had remained adamant on its disapproval. Still, despite the long wait since 2022, the digital asset manager was finally able to convert GBTC into an ETF.

The company also has an Ethereum Trust, Litecoin Trust, Ethereum Classic Trust, Bitcoin Cash Trust, and the Grayscale Digital Large Cap Fund.

Genesis

Genesis Global Trading also launched as a Bitcoin over-the-counter trading and crypto lending platform in 2013. Previously, this transformed section acted as SecondMarket’s trading branch. However, the platform willingly filed for bankruptcy in January 2023 to prevent further collapse after multiple losses.

The digital finance company is now working toward restructuring its management and services to suit its customers better. Moellis & Co. is the law firm aiding its transition.

The exchange’s issues adversely affect the Digital Currency Group, other subsidiaries, and Barry Silbert. It is currently demanding what DCG owes to enable the revival of its activities.

CoinDesk

CoinDesk was launched in May 2013 under Shakil Khan. DCG did not have control over the news site until 2016, when it purchased and added CoinDesk to its subsidiaries.

Today, it is one of the biggest crypto news outlets. Some of its earliest inceptions include the Bitcoin Price Index (BPI), which is still in use. Others are the State of Bitcoin report and the Consensus Conference.

Barry Silbert

The news site laid off 45% of its workforce in August 2023 as it prepared for its acquisition. The issue leading to this sale was the ongoing problems at DCG. Despite the worrying news, the site ensured the entire CoinDesk staff knew beforehand through emails.

Bullish, run by former NYSE President Tom Farley, purchased Coindesk from DCG in 2023.

Foundry

Foundry is another addition to the DCG family. It has provided miners with crypto-mining equipment and helped with mining-related activity since 2022. Its mission is to provide its customers with tools to help them develop a decentralized infrastructure for the future. Foundry achieves this by providing funds for equipment purchase, advising on mining endeavors, and availing staking and mining opportunities.

Luno

Luno is also a later entrant to the group, debuting as one of DCG’s companies in 2020. With a significant focus on retail investors, the crypto exchange operates in over 40 countries and trades billions in transactions. Its services focus on Southeast Asia and Africa mainly due to the potential of crypto growth and adoption within these regions.

Why is he important?

Barry’s efforts in the crypto industry have helped steer the expansion and adoption of crypto. He has received several awards to recognize his contribution to blockchain’s progress. According to many of his past associates, Barry is focused on the impact left after decades rather than short-term results. He also wants to remain compliant with the law while achieving his mission.

Through Grayscale and other digital asset trusts, Silbert brings virtual assets to every interested investor without forcing them to buy the coins. This step is especially crucial in achieving long-term and mainstream crypto adoption.

As an influential figure and a crypto whale, Barry has the ability to shift the market’s sentiment. His thoughts and activities could positively or negatively affect the crypto markets, seeing as he has a huge following.

Barry vs. Winklevoss

DCG, among other major crypto companies, faced many financial issues during the 2022 crypto winter. Several ended up filing for bankruptcy under Chapter 11. However, the controversies that followed the DCG group were the talk of the town for months. The curious thing is why Gemini’s co-founder Cameron Winklevoss took to Twitter to shun Barry Silbert and the DCG.

DCG’s Genesis and Gemini partnered to give rise to an Earn Program. The aim was to offer lucrative returns on investment for Gemini users, but the program went under after Genesis filed for bankruptcy. Genesis then halted all withdrawals in November 2022 following a lack of funds to settle.

Genesis also issued several loans to venture capital firms 3 Arrows Capital (3AC) and DCG. However, 3AC allegedly liquidated these assets following its bankruptcy claims in Q2 2022, leaving Genesis with over $1.2 billion in deficit out of the $2.6 billion offered.

Meanwhile, GBTC Premium and Genesis seemed okay. Unfortunately, the FTX collapse led to more trouble that shed light on Genesis’ financial state.

Notably, the FTX scandal happened in Q4 2022, but its effects lasted long after. Multiple exchanges and crypto services went ahead to cut costs, including through retrenchments of significant numbers of their workers. Others followed FTX’s lead and filed for bankruptcy. Genesis announced its Chapter 11 filing on Jan. 19, 2023.

Cameron Winklevoss’s open letter

According to the open letter published by Cameron on Jan. 2, 2023, approximately 340,000 users continue to suffer due to these discrepancies. Additionally, Gemini’s co-founder insists that the situation would have been avoidable if Barry and DCG had taken more responsibility beforehand.

The letter highlights alleged lies and coverups by DCG and the health of the group and its subsidiaries after 3AC’s demise. Cameron also suggests that DCG owed over $1.6 billion to Genesis, which should have gone toward the Earn Program. He mentioned that Silbert could have stopped Gemini’s Earn by disclosing crucial financial details about Genesis’ status.

In response, Silbert insisted on DCG’s transparency and dedication to servicing its loans to Genesis. He added that any relationship directly linking DCG to Genesis was 3 Arrow Capital.

On Jan. 10, 2023, Silbert mentioned his pride in being a crypto pioneer through DCG and its subsidiaries. He also highlighted his company’s dedication to eliminating bad actors from the industry who tried to destroy its overall credibility and why it was important to stick together.

“…Now is the time to collaborate, cheer each other’s success, and take our industry to the next level,”

Barry Silbert: DCG Update

Lawsuits

That said, Gemini’s co-founder filed a lawsuit against DCG and Genesis for allegedly defrauding Gemini Earn users. However, it is not yet clear if Barry used DCG and its subsidiaries for fraudulent activity. So far, neither the New York Court nor the Securities and Exchange Commission have acted against Barry and his companies.

On the other hand, Genesis also filed a lawsuit against DCG for unpaid debts, including the loan of 18,000 BTC in 2022. In response, Silbert insisted that DCG was working toward liquidating and distributing assets to Genesis creditors.

However, the SEC sued both crypto exchanges for not registering the Earn Program. According to the commission, the program falls under securities, which the crypto exchanges failed to acknowledge.

What lies ahead?

Barry Silbert is still deemed one of the most fundamental building blocks of the crypto realm. However, the events surrounding his company slowly took a toll on his reputation. Many investors who believe in the Winklevoss narrative have lost faith in Barry.

Meanwhile, there is much left to wonder, especially as the lawsuits continue to unfold. The big question is whether Barry and his accolades will remain significant if it doesn’t work out for him. Additionally, the crypto community is still curious to confirm the truthfulness behind Cameron’s accusations.