Gemini is a US-based, multinational cryptocurrency exchange popular among professional traders and beginners alike. However, with the competition between exchanges now stronger than ever, can the United States’ first fully regulated Bitcoin exchange keep up?

Update: Read our latest comparative in our article: 11 Best Cryptocurrency Exchanges for Trading Bitcoins

In our honest Gemini review, we will be scrutinizing its relevance, features, safety, and reputation. We will dig down to the roots of the company, looking at the driving force behind its creation before summarizing who Gemini serves best in today’s market.

Exchange Basics

What is Gemini?

Announced in 2013, Gemini was dubbed the ‘next-generation Bitcoin exchange’ by its co-founders Cameron and Tyler Winklevoss. Initially, Gemini claimed to be the first exchange in the world that would facilitate Bitcoin trading as an Exchange Traded Fund (ETF), however, this has yet to be proven. Currently, the Gemini founders are striving to increase data confidentiality for its users by becoming the world’s first SOC-2 compliant crypto exchange and custodian. At its core, Gemini is a Math-based Asset Service that was initially designed to allow individual and institutional investors to trade with Bitcoin, just like regular stocks. Since then, they have added other cryptocurrency pairs to the platform, allowing them to be traded against each other and the US dollar (USD). Gemini is regulated by the New York State Department of Financial Services under the name of its parent company, Gemini Trust Company, LLC. The decision to form the trust was a conscious decision made by the founders in an effort to bolster the mass adoption of Bitcoin.“The trust brings bitcoin to Main Street and mainstream investors to bitcoin, It eliminates the friction of buying and reduces the risks associated with storing bitcoin while offering similar investment attributes to direct ownership.” — Said Tyler Winklevoss in an interview with the New York Times.With a headquarters based in New York, Gemini is a multinational company that has expanded its business beyond the US, now operating in Canada, the UK, South Korea, and Puerto Rico.

| Mobile Options | Yes |

| Exchange Type | Centralized |

| Company Country | US |

| Exchange Launch | 2014 |

| Deposit Methods | Cryptocurrency/Fiat |

| Withdrawal Methods | Cryptocurrency/Fiat |

| Withdrawal Limits | None |

| KYC | Required |

| Number of Assets | <10 |

| Areas of Operation | Canada, Hong Kong, Singapore, South Korea, The United Kingdom, The United States (exc. Hawaii). |

| Security | High |

| Reputation | Excellent |

| Fiat Payments | Yes |

| Website | gemini.com |

Gemini Trading Features

When it comes to its trading features, Gemini can be considered a relatively lightweight cryptocurrency exchange. It features many of the basic order types and options but lacks the advanced trading tools and graphing features offered on other modern cryptocurrency trading platforms. Trading on the platform is simple, as far as cryptocurrency exchanges go, with the trading options separated into ‘buy’ and ‘sell’ categories, unlike most exchanges that offer both of these order types within the same page. Although this is much more intuitive for new users, it can bottleneck fast-paced traders who will be required to open two separate tabs to buy and sell quickly. Currently, six different order types can be placed on the platform, these are:- Market

- Limit

- Limit: Immediate-or-Cancel (IOC)

- Limit: Maker-or-Cancel* (MOC)

- Limit: Auction-Only Limit (AO)

- Limit: Indication of Interest (IOI)

Gemini Fees

Being one of the newer entries to the market, Gemini has had time to find out what works, and what does not when it comes to which fees to charge and when. Because of this, Gemini has a competitive fee schedule, particularly for higher volume traders, but also makes some concessions for light traders when it comes to withdrawal fees. Gemini separates its trading fees into two models, one for market takers, and one for market makers. Market takers are essentially orders that reduce market liquidity by being filled instantly, while market makers are orders that add liquidity, resting on the order book until it is potentially filled at a later date. This maker-taker fee model is further divided into different rates, based on your previous 30-day trade volume at Gemini. Low volume traders with under $25,000 equivalent in trade volume are charged a 1 percent market maker or market taker fee, but this can be reduced to as low as 0.10 percent and 0.00 percent respectively for those trading in excess of $15 million within the 30-calendar-day trailing window. Besides this, there is an additional fee charged if the order is placed via the Gemini mobile app, this is known as a ‘convenience’ fee. The amount charged relates to the size of the order, with the mobile convenience fee schedule as follows:- Less than or equal to $10.00 – $0.99

- Greater than $10.00 but less than or equal to $25.00 – $1.49

- Greater than $25.00 but less than or equal to $50.00 – $1.99

- Greater than $50.00 but less than or equal to $200.00 – $2.99

- Greater than $200.00 – 1.49 percent of your mobile order value

Gemini Transfer Limits

Like many modern cryptocurrency exchanges, Gemini requires full identity verification before any trading features can be used on the exchange. Because Gemini complies with both Know Your Customer (KYC) and Anti-money laundering (AML) regulations, all verification steps will need to be completed before deposits and withdrawals are enabled on your account. Despite verification being mandatory, Gemini is relatively relaxed when it comes to the documentation you need to provide. For US customers, all that is required is a scan of your state issued ID or driver’s license, whereas international customers will need to provide this, plus proof of address in the form of a full-page scan of either a bank statement or utility bill. The exchange claims that a verification time of between 2-5 days applies for all accounts, but there have been reports that verification can take significantly longer, particularly during busy periods. This is roughly in line with the industry standard. After passing verification, all individual accounts have the same deposit and withdrawal limits. This is definitely something quite uncommon, since most other exchanges have a tiered transfer limit system, requiring additional verification to deposit and withdraw large sums. At Gemini, there is no limit to the amount of cryptocurrency that can be deposited or withdrawn by either individual or institutional accounts. For deposits and withdrawals by Bank Transfer (ACH), individual accounts are limited to depositing $500 per day, or $15,000 per month, while withdrawals are capped at $100,000 per day. For institutional account holders, Bank Transfer (ACH) deposits increase to a maximum of $10,000 per day, and $300,000 per month, with a $100,000 daily withdrawal limit. For wire transfers, Gemini has removed all transfer limits but does set a minimum withdrawal amount at $100 for both individual and institutional accounts. All-in-all, Gemini sets itself apart from most exchanges in the transfer limit department, leaving very little to complain about.

Asset Selection

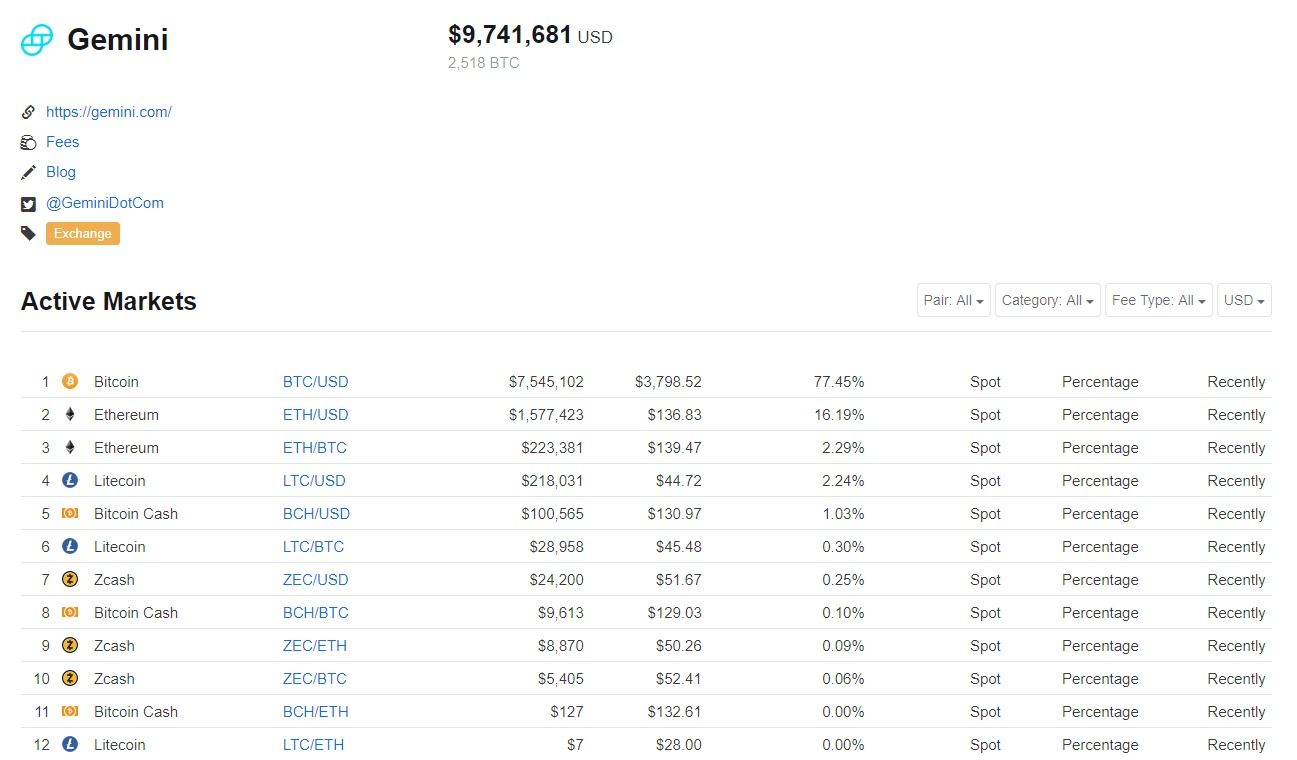

When it comes to asset selection, Gemini can easily be described as one of the more limited cryptocurrency exchanges. Featuring just five digital assets and one fiat currency, Gemini has just six total assets tradeable on the platform. The five digital assets available are Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC) and Zcash (ZEC), whereas the only fiat currency available is the US dollar (USD). Despite the unashamedly small asset selection, Gemini does somewhat make up for this by ensuring each asset is tradeable against all others on the exchange, resulting in a total of 12 different trade pairs. Gemini appears to be a firm believer in quality over quantity, with each of the digital assets offered on the platform being in the top 25 by market capitalization. This ensures that all assets available on Gemini are likely to be around for the long term, and should maintain excellent liquidity even when the market is down.

Gemini Trading Volume

Since Gemini has so few digital assets and offers its services in only a small selection of countries, it has not enjoyed the same success that some other, less selective exchanges have. Despite this fact, Gemini still manages to rack up a respectable $10-$15 million per day in trade volume, placing it well within the top 100 cryptocurrency exchanges by daily volume. Looking at its 30-day trading volume, Gemini regularly tops $300 million—the vast majority of which can be attributed to its BTC/USD trading pair, which drives over 80 percent of all trading activity on the exchange. Besides this, the ETH/USD and LTC/USD trading pairs also have excellent liquidity, achieving around $1.5 million and $400,000 per day in volume respectively. That being said, the remainder of trade pairs on Gemini do not demonstrate such impressive volume, as 9 out of 12 trading pairs achieve less than $100,000 in daily trade volume, including ZEC/USD and ETH/BTC. Because of this, Gemini likely is not the best bet for traders who require high liquidity for Zcash (ZEC) or Bitcoin Cash (BCH).

Gemini’s Reputation

It goes without saying that the reputation of the exchange is directly tied with that of the Winklevoss twins. They have been a major influencing force in the industry ever since they publicly announced their interest in Bitcoin back in 2012, and subsequently filed to launch the first ever Bitcoin ETF. Ever since its inception, the founders and the team have strived to ensure Gemini stands apart from similar ventures by pushing for absolute legal compliance, even in the face of an often uncertain regulatory environment. As a result of this, Gemini became the first US exchange to be licensed for both Bitcoin and Ether trading and also became the world’s first licensed Zcash exchange back in May 2018. They also work with multiple crypto exchanges in an effort to form a self-regulatory working group through its partnership with the Caspian Trading Group, and also became the first exchange to partner with Nasdaq in a move against market manipulation in the crypto markets. Unlike other bootstrapped startups, Gemini has enjoyed the support of its billionaire founders and the federal government of the United States just like any other traditional financial corporation. Despite the initial lack of user interest in its early years owing to local regulations, Gemini has since been able to expand its business to several other countries while at the same time pushing small businesses, e-commerce stores, and local vendors to begin accepting digital assets for their goods and services. Despite the strong support of its current users, Gemini has always faced issues of slow growth and user retention. Its users frequently complain about the lack of variety on the platform, while its mobile ‘convenience’ fee, has drawn significant flack from the media and users alike. In summary, Gemini has become known as somewhat of a ‘premium’ exchange, owing to its popularity among institutional investors and its higher trading fees compared to many mainstream exchanges. However, with a near flawless reputation in the space, Gemini leaves nothing to chance, a trait that is rarer than we would like to see in the industry.

Is Gemini Safe?

Unlike some cryptocurrency exchanges, Gemini stores only a small fraction of users’ funds in hot wallets, with the remainder stored in an ‘air-gapped’ cold storage vault. The platform itself, including any hot wallets for digital assets, are hosted by Amazon Web Services (AWS) who are renowned for their security checks. One of the major advantages of Gemini is that it is completely compliant with consumer protection laws, as well as digital assets and securities regulations. They are the world’s first crypto exchange and custodian that has achieved SOC-2 Type-1 certification and are looking to be audited for further security credentials down the line. This commitment to customer data protection is rivaled by few other cryptocurrency exchanges. Another major feature of the exchange is that customers’ funds deposited in USD at Gemini are held with a New York state-chartered bank, meaning they are covered under FDIC insurance. Besides this, Gemini also offers insurance for any cryptocurrency funds stored in its hot wallet, protecting its users against loss from almost any situation. As discussed above, Gemini does not feature a large list of virtual currencies and sticks to only a very select group of assets that have held up to the intense internal scrutiny of the founders. This helps them avoid low quality and over-hyped projects that may jeopardize the available liquidity in the market, and be vulnerable to pump-and-dump manipulation. Since its advent in 2014, Gemini is one of the first leading cryptocurrency exchanges to have never been breached, mostly due to its uncompromising approach to security. Beyond this, Gemini’s enforced two-factor authentication for all user accounts, rate limiting login system, and global encryption make it one of the most secure cryptocurrency exchanges available.

Gemini Withdrawal Time and Options

Looking to keep things as simple as possible, Gemini offers just a few different withdrawal options. For USD balances, the only withdrawal option is Wire Transfer, whereas cryptocurrency balances cannot be automatically withdrawn as USD, and will instead need to be exchanged first. Besides this, there are also Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), and Zcash (ZEC) withdrawal options. Interestingly, Gemini does not provide a guideline on how long either cryptocurrency or fiat withdrawals take to process or complete. After reaching out to Gemini, we were informed that fiat withdrawals can take up to five business days to be processed, whereas cryptocurrency withdrawals are typically completed the same day. Overall, the exchange has a small number of withdrawal options to match its small asset selection, and withdrawal times longer than many of its competitors. It seems as though Gemini has a lot of catching up to do in the withdrawal time and options department.

Who Does Gemini Report To?

According to its Help Center, Gemini considers itself to be a Third Party Settlement Organization (TPSO) under Section 6050W of the Internal Revenue Code, meaning it is legally required to issue 1099-K forms to those who meet the following two conditions:- Have performed more than 200 transactions exchanging digital assets to USD during the calendar year

- Have total sales proceeds exceeding $20,000 associated with trades where digital assets were exchanged for USD.

Gemini Customer Support

One of the reasons Gemini is so popular with institutional users and large-scale investors is its excellent customer support, which could be argued as being the best in the business. Gemini has several different support methods available to its users, covering a wide range of platforms and ensuring that help is never too far away should it be needed. As with most cryptocurrency exchanges, the first line of support is a comprehensive Help Center containing answers to the most commonly asked questions, as well as basic details on how to use the platform and perform trades. Beyond this, Gemini also offers free telephone support via a toll-free number in the US. Gemini is one of the few exchanges to offer this support option, which can be considered the hallmark of a higher quality exchange. According to Gemini, the primary support channel for the exchange is through its internal ticket system, which allows users to raise issues from within their account to be handled by a support representative. You can also write to Gemini at their office address in New York, though this method will almost certainly yield the slowest response time. Gemini also has a dedicated security support team, who can be reached at [email protected], allowing you to report any suspicious activity on the exchange, though it does not seem that this method is appropriate for personal security issues. Overall, the support options offered by Gemini are among the best we have seen, and with excellent response times, there is little not to like about the way Gemini deals with customer issues.Our Review

As one of the few regulated cryptocurrency exchanges, Gemini offers a secure and simple on-ramp for those first getting to grips with cryptocurrencies. Featuring a clean, easy-to-use interface and a rather limited selection of trading tools, Gemini is well-suited for the casual investor, whereas career traders may feel overly restricted with the tools available. With a spotless security record and insurance on funds, Gemini is able to offer something that very few other exchanges can—peace of mind. However, its very limited range of digital assets available to trade, relatively few supported countries, and sometimes disproportionately high fees make Gemini most attractive to high-volume traders specializing in Bitcoin (BTC) trades.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored