Centralized crypto exchanges are useful, provided you want a user-friendly interface and are fine disclosing your identity to the exchanges. For anything else, you can consider decentralized exchanges. ApeX Pro Exchange is one such decentralized player specializing in crypto derivatives. Here, we delve deeper into this permissionless platform with a 360-degree ApeX Exchange review.

By the end of this discussion, you should be able to evaluate ApeX for its strengths and weaknesses. We will unpack everything there is about ApeX Pro, from features to user experience to trading tools and more.

ApeX

– earn BANA

– earn $APEX

- ApeX

- ApeX at a glance: Our overall rating

- What can you expect from the ApeX Exchange review?

- What is ApeX DEX?

- Welcome offer / bonus

- Why is ApeX not like any other DEX?

- ApeX Exchange review: Key offerings

- Is ApeX DEX safe? All aspects explored

- ApeX Exchange review and the fee structure

- ApeX trading: All elements explored

- ApeX Exchange user experience and learning curve

- Customer support system at ApeX Pro Exchange

- How we have tested ApeX Exchange

- ApeX Exchange review: Pros and cons

- Invest responsibly

- How does ApeX Exchange compare against other DEXs?

ApeX at a glance: Our overall rating

While ApeX faces strong competition, it remains a contender in the industry. To be such a new protocol, it certainly has carved out its place in the market — and for good reasons. The DEX’s unique structure allows it to compete with big industry names. However, the platform still has some work to do.

| Criteria | Security | Fees | Assets/ trading pairs | User experience | Features | BeInCrypto score |

| Score | 4/5 | 5/5 | 3/5 | 4/5 | 4/5 | 4 |

What can you expect from the ApeX Exchange review?

Throughout this ApeX Exchange review, we will highlight that the lines between DeFi protocols and DEXs are blurred in the decentralized space. As such, the ApeX Pro Exchange can even be termed the ApeX protocol.

Official website: www.apex.exchange

Also, to evaluate any exchange, we need to factor in its history, driving team, the angle of exclusivity, safety, fee structure, trading experience, and certainly the integrated features.

In discussing all of the above at length, this ApeX review caters to experienced crypto derivatives trades and even newbies who wish to try out perpetual contracts and futures trading without going through the KYC and identity verification hoops.

What is ApeX DEX?

At first glance, ApeX looks like a standard decentralized exchange (DEX). Yet it is much more. It is a decentralized, permissionless protocol featuring a host of utilities. While the ability to trade perpetual contracts seamlessly is one of them, the ApeX protocol even brings forth native tokens — APEX and BANA, which serve different purposes.

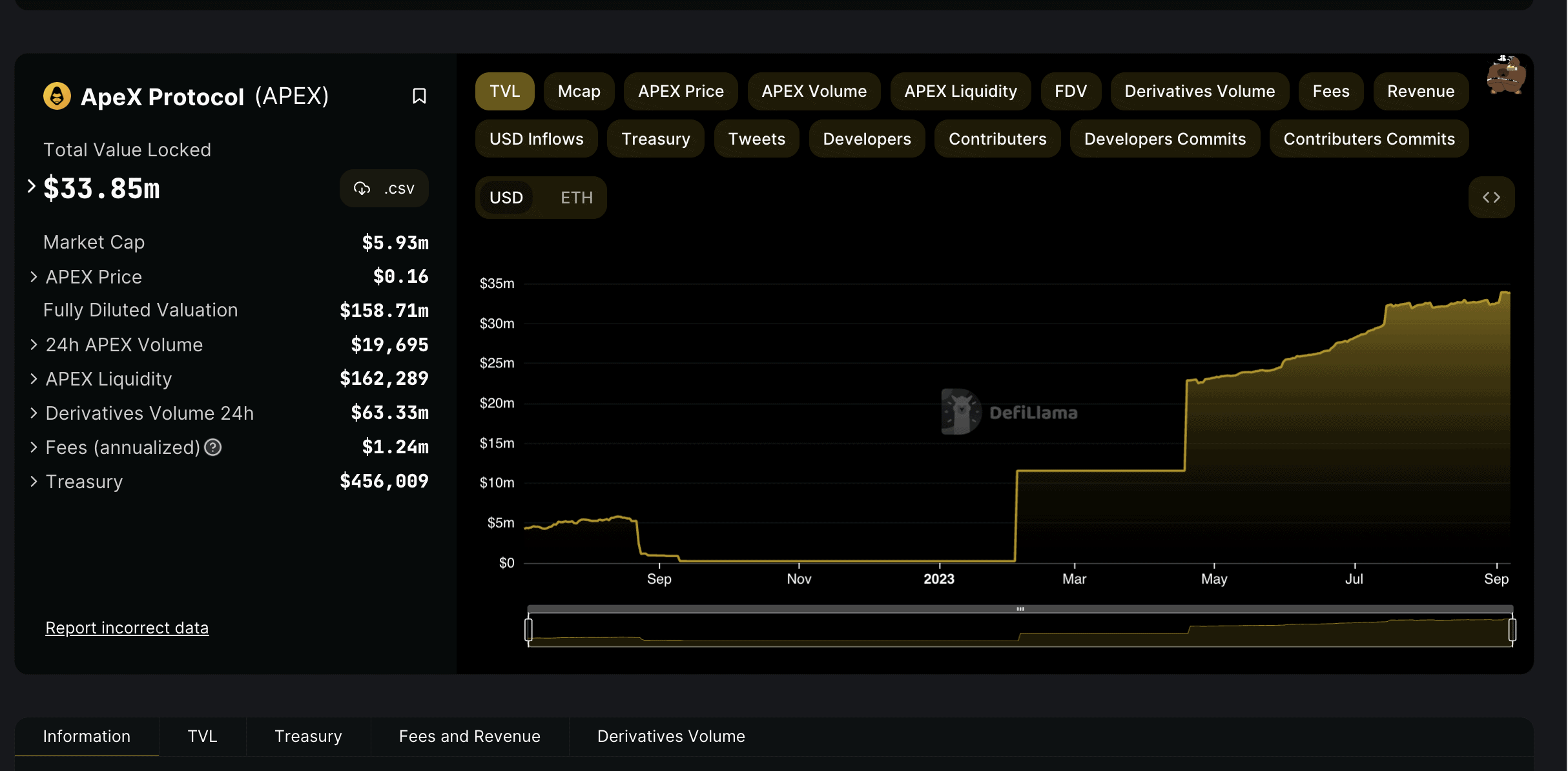

Built on Arbitrum, one of Ethereum’s popular layer-2 solutions, ApeX is a DEX offering with close to $34 million locked in TVL. With StarkWare taking care of trading security courtesy of ZK-Proofs and leading global investors like Tiger Global and Dragon Fly Capital backing the platform, ApeX is making giant strides in the decentralized derivatives space.

ApeX Pro, or the ApeX DEX, is the actual trading platform associated with the ApeX protocol and is one of its products. In this review, we shall focus primarily on the former.

Also, here is a thread if you are interested in other decentralized exchange innovations:

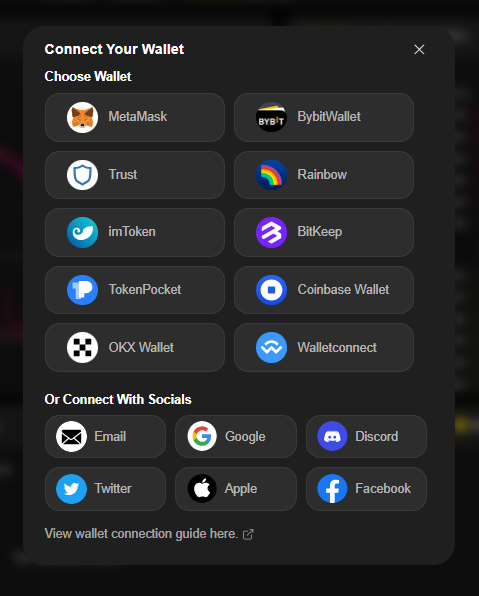

How to sign up

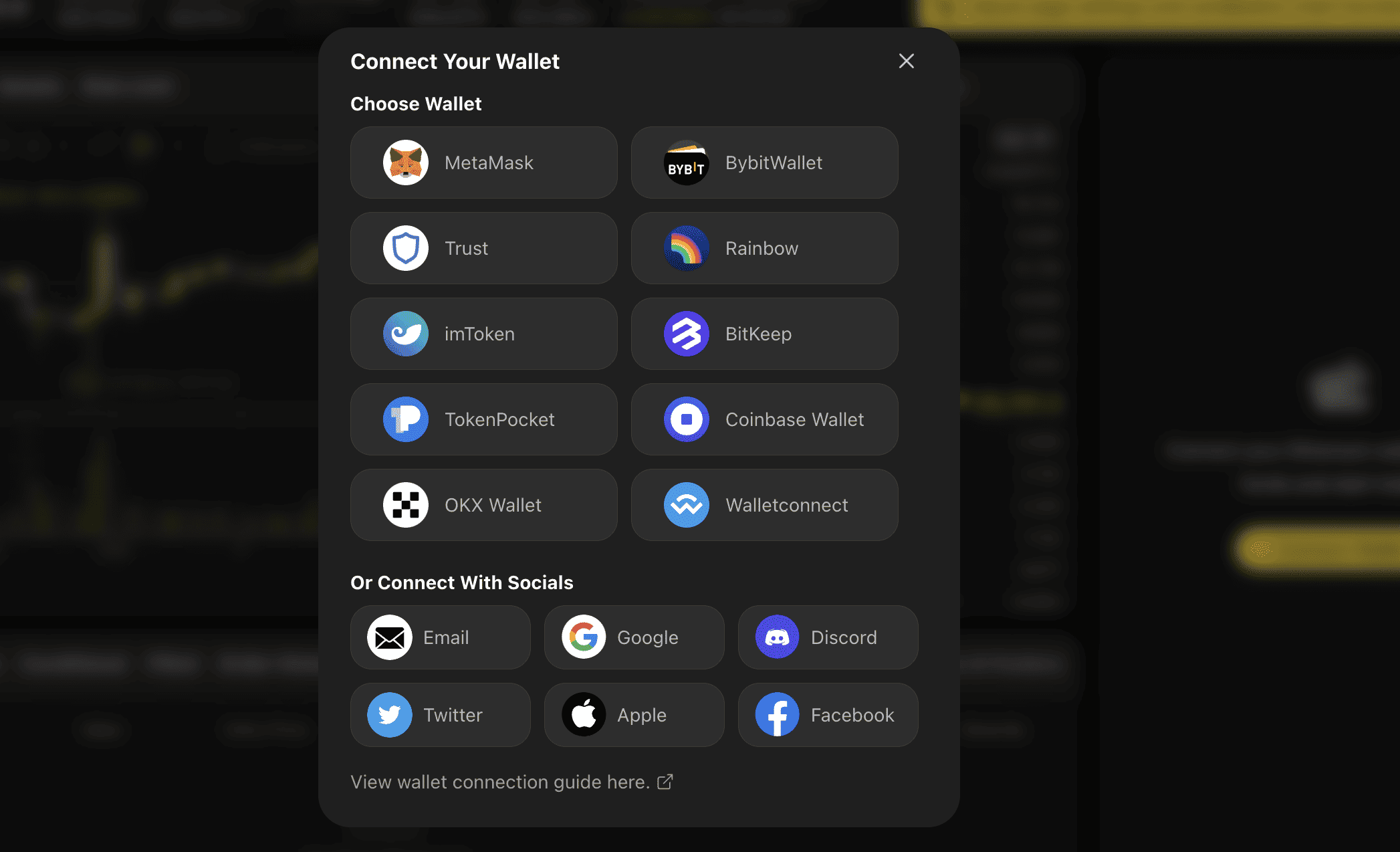

1. Go to the ApeX website and select “Trade.” You will be brought to the following screen. Select “Connect Wallet” to continue.

2. You can either connect through socials, a wallet, or using an email. Since most crypto natives already know how to connect using a wallet, we will use an email.

3. Lastly, choose the email you would like to use. After this step, you have succesfully created an ApeX account.

Welcome offer / bonus

ApeX has a few ongoing promotions and offering. First and foremost, there is the referral program, which allows you to earn from referring friends, family, and followers.

Secondly, you can earn from the “Trade-to-Earn” program. This allows you to multiply your BANA holdings. Lastly, you can earn $APEX from participating in the ApeX NFT game by holding an NFT.

History and the team behind ApeX

The ApeX exchange came to fruition in 2022. Built on Arbitrum, this DEX came about with the aim of making perpetual contract trading easier for everyone. If you aren’t familiar with perpetual contracts, they are a futuristic take on crypto assets or stocks, where users trade bullish or bearish sentiments.

As ApeX itself is a decentralized entity, company communications haven’t been particularly vocal about the founding and the current team. Yet, searching team members on LinkedIn shows that Huajie Zhu — an Operation Manager — could be associated with this platform in some capacity.

Besides a mostly anonymous team, integration with the Dubai-specific Bybit CEX in late 2022 lends additional credibility to ApeX DEX. Plus, the firm has a huge Twitter (X) following, with social sentiments furthering its popularity and trust factor.

Why is ApeX not like any other DEX?

A good DEX is often similar to its competitors. However, a great DEX in the making is one that stands out. ApeX strives to do this same by ditching Automated Market Makers (AMMs). AMMs are standard DEX tools meant to provide liquidity. However, liquidity crunch, pool depletion, and other issues might increase slippage — the difference between asset buying and selling prices.

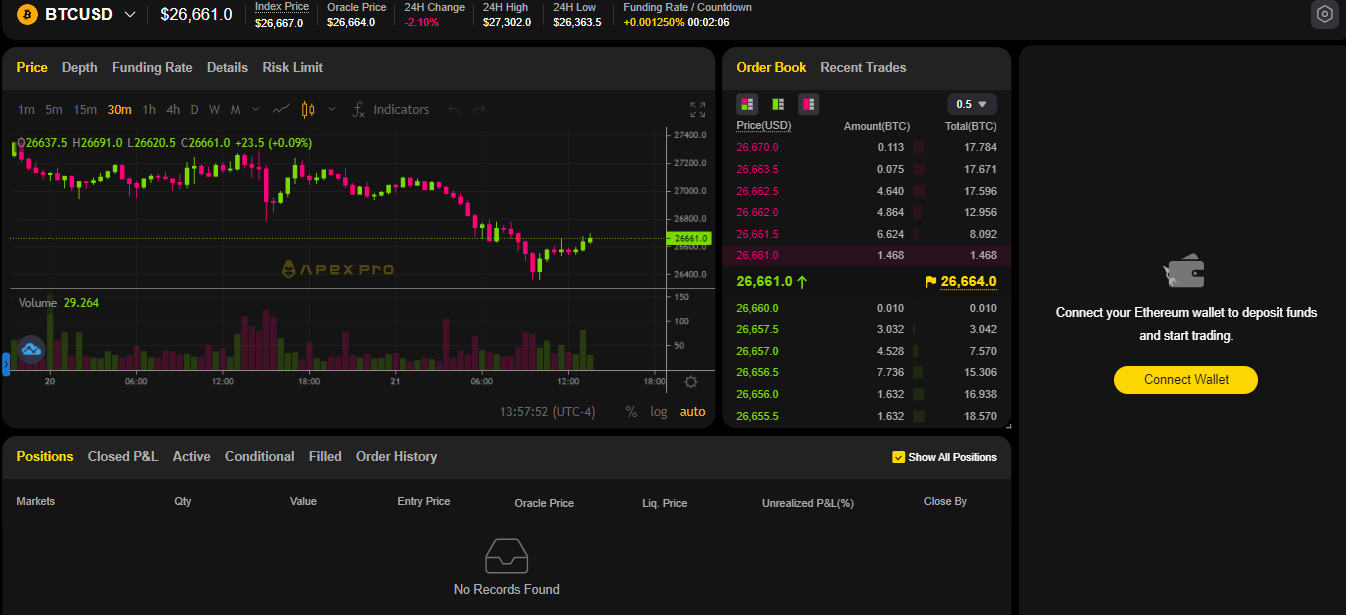

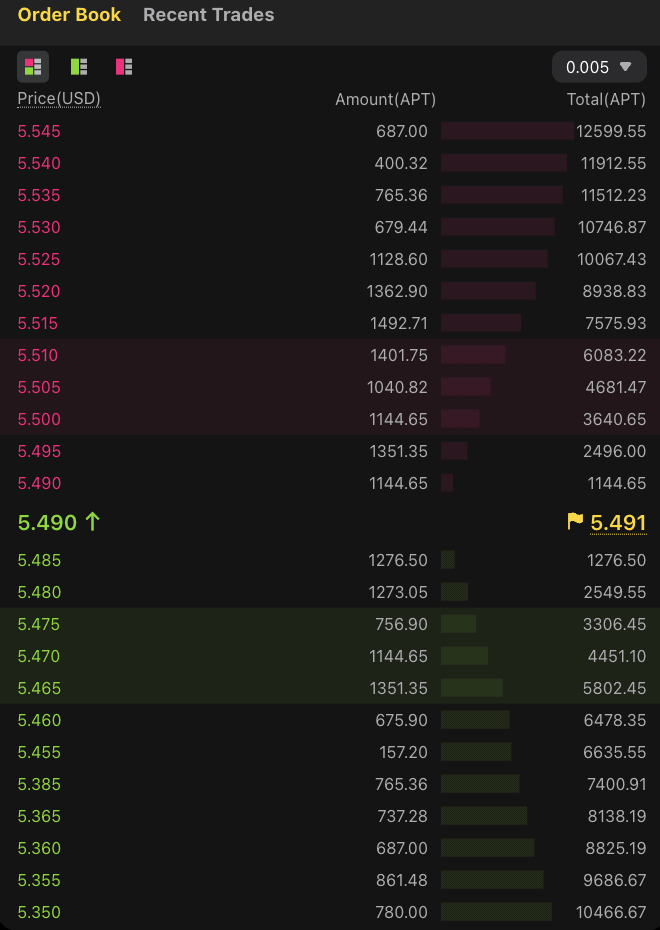

ApeX changes all that by being one of the few DEXs to support an “order book” model. StarkEx, an L2 scalability solution that uses Zero-Knowledge Proofs, further secures this model. All of that means the platform strikes a better balance between novelty, security, and speed than some of its competitors, such as SushiSwap.

ApeX Exchange review: Key offerings

Now we are familiar with the basics surrounding the ApeX Pro, let us focus on the exclusive offerings. These include:

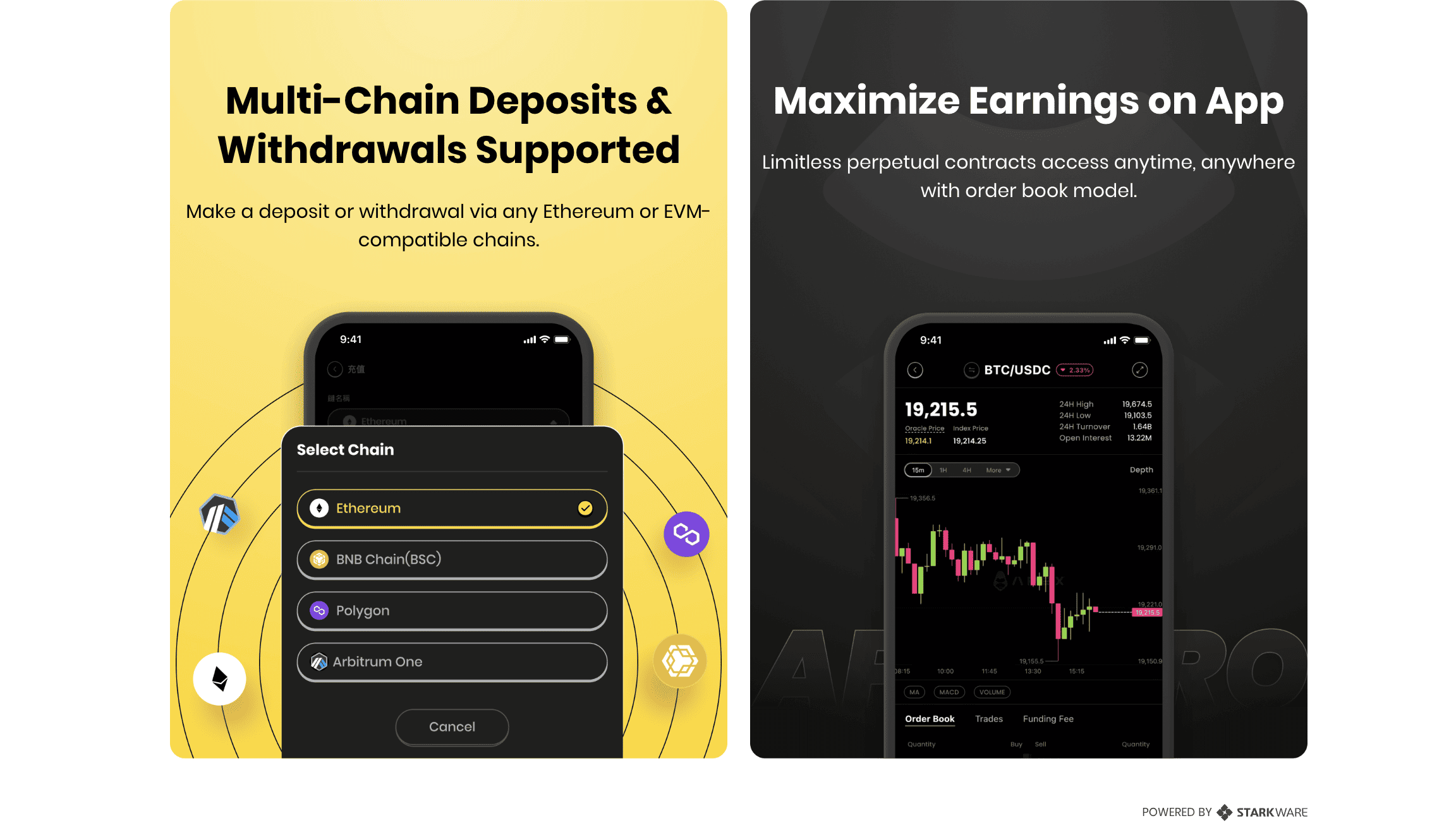

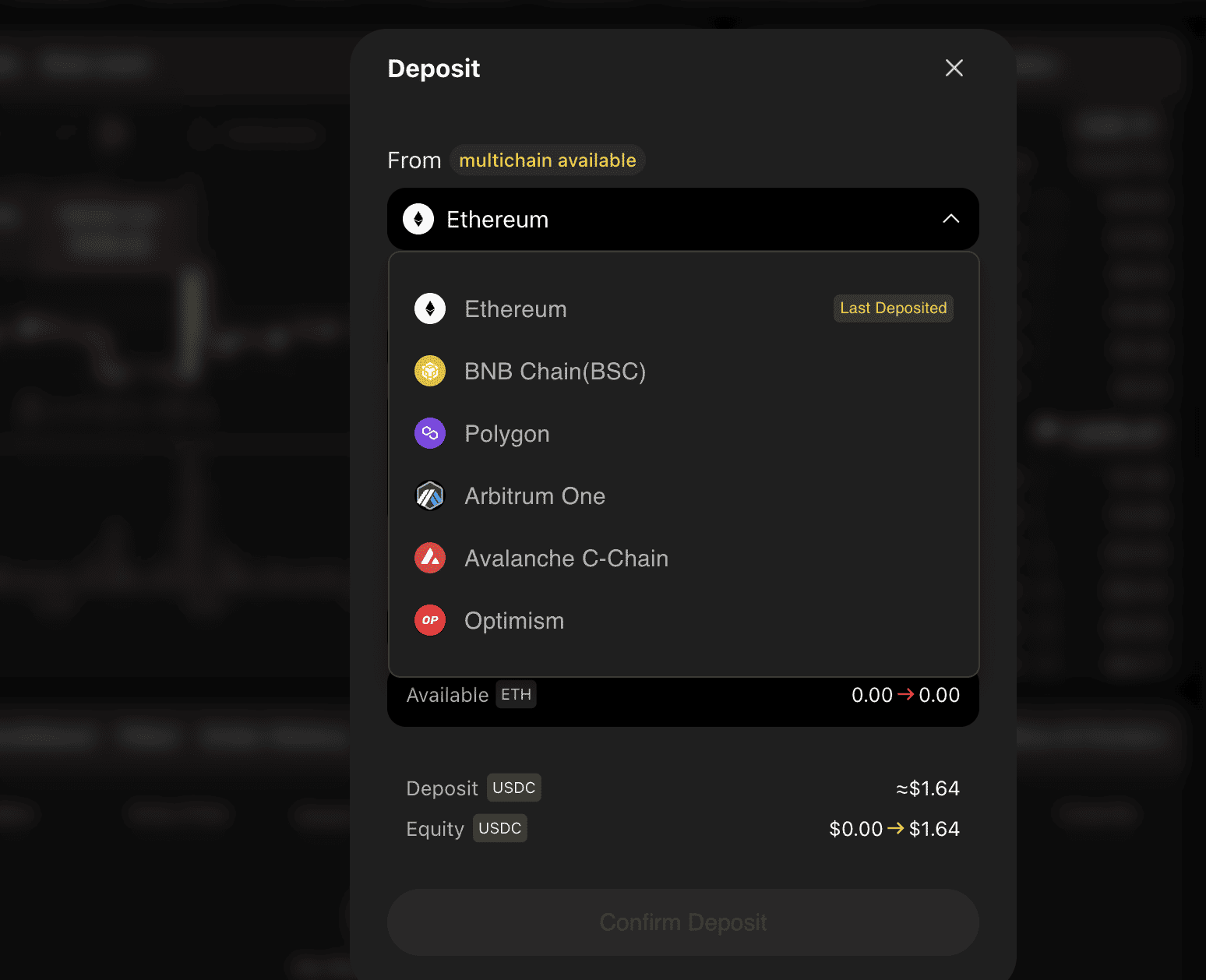

Multi-chain support

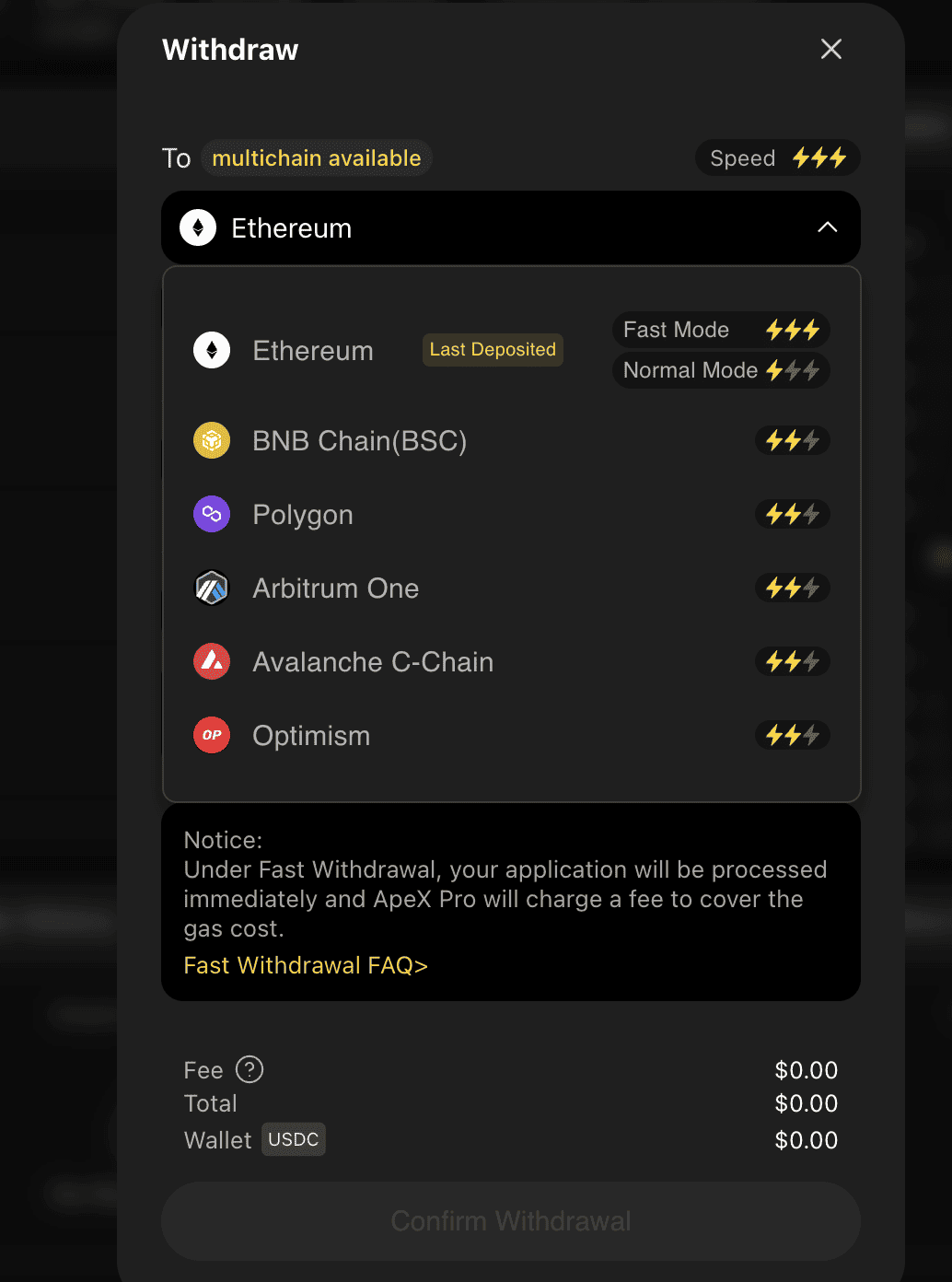

Even though the ApeX Protocol is built on Arbitrum, it can seamlessly interact with other networks, including Polygon, the Binance Chain, and Ethereum. Users from these chains can trade, move funds, and initiate transactions on the ApeX exchange simply by connecting their wallets.

While multichain support lends flexibility, it also brings forth other tangible benefits like cross-chain deposits and withdrawals, additional interoperability, access to a larger user base, lower transaction fees, and minimal network congestion. The multi-chain deposit and withdrawal support has also extended to the Avalanche C-Chain and Optimism.

Trading margin and more

ApeX exchange supports cross-margin perpetual contracts, allowing traders to move around account-specific margins or use collateral across different accounts to initiate trades. Cross-margin perpetual contracts are vital for covering margin requirements on DEXs, preventing liquidations when asset prices fluctuate. Also, cross-margin support helps push forth the idea of shared collateral and utilizes capital more efficiently.

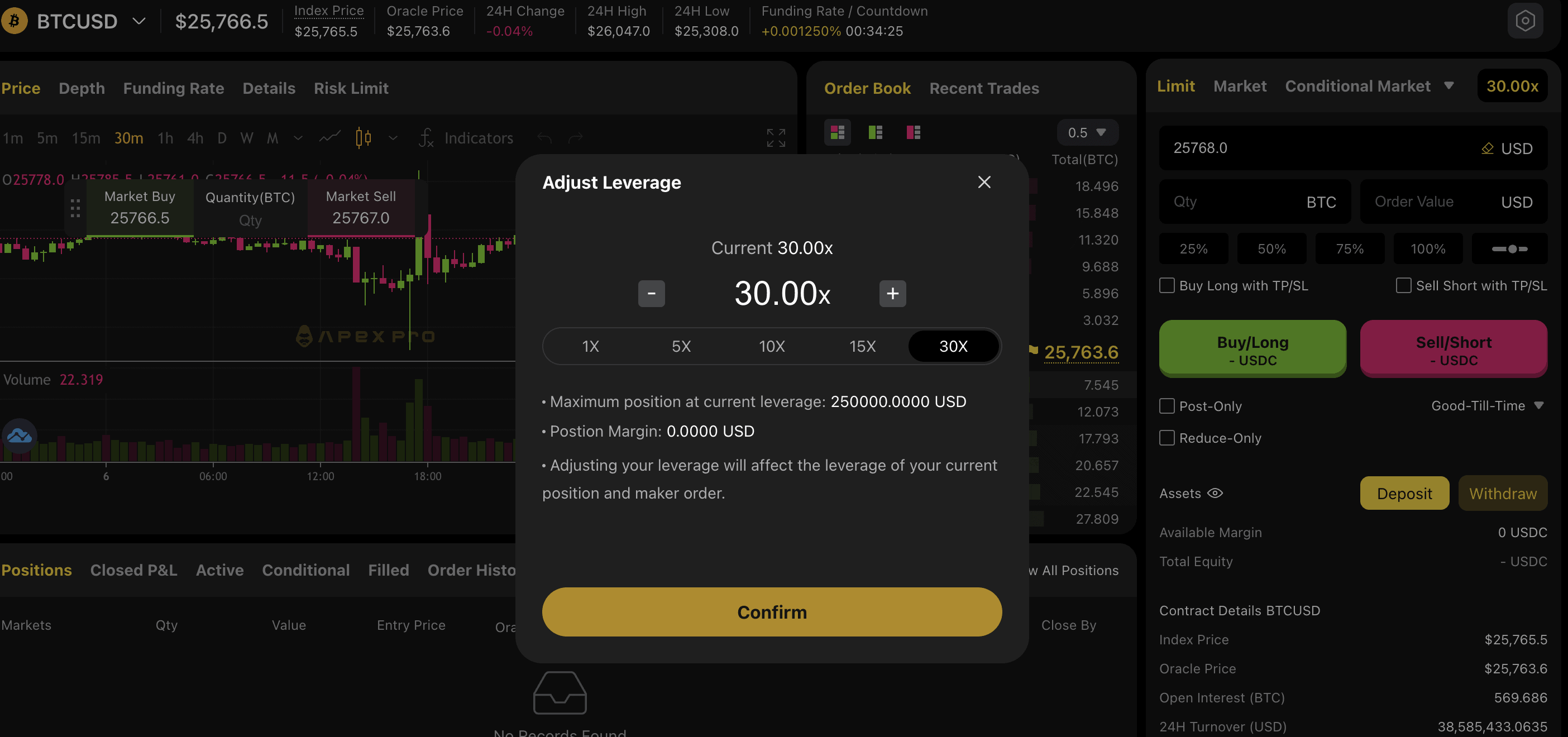

But it is not just the cross-margin functionality that stands out. ApeX Pro also offers leverage, anywhere between 20x to even 30x for specific trades. Traders can use collateral and take leverage up to 20x (even 30x in some cases) to maximize the chances of making profits.

However, new traders should always be careful while using leverage. In a 20x leveraged trade, a dip of 10% in the asset’s value can result in a 200% overall loss. Therefore, a higher leverage isn’t always a safe bet.

Order book design

As mentioned previously, ApeX exchange uses the order book model instead of the DEX-specific AMMs. Having an order book brings the concept of market depth, price discovery, bids, and asks. This allows for lower slippage as there are no surprises when prices are concerned, and traders can place very specific limit orders.

Here is how dYdX approaches the order book model:

Also, traditional traders and even newbies are more accustomed to working with order books than AMMs. Plus, the concept of an order book makes the entire process more transparent, secure, and strategic, opening doors to safer arbitrage trades.

Check this thread to better understand the AMM vs. order book discussions:

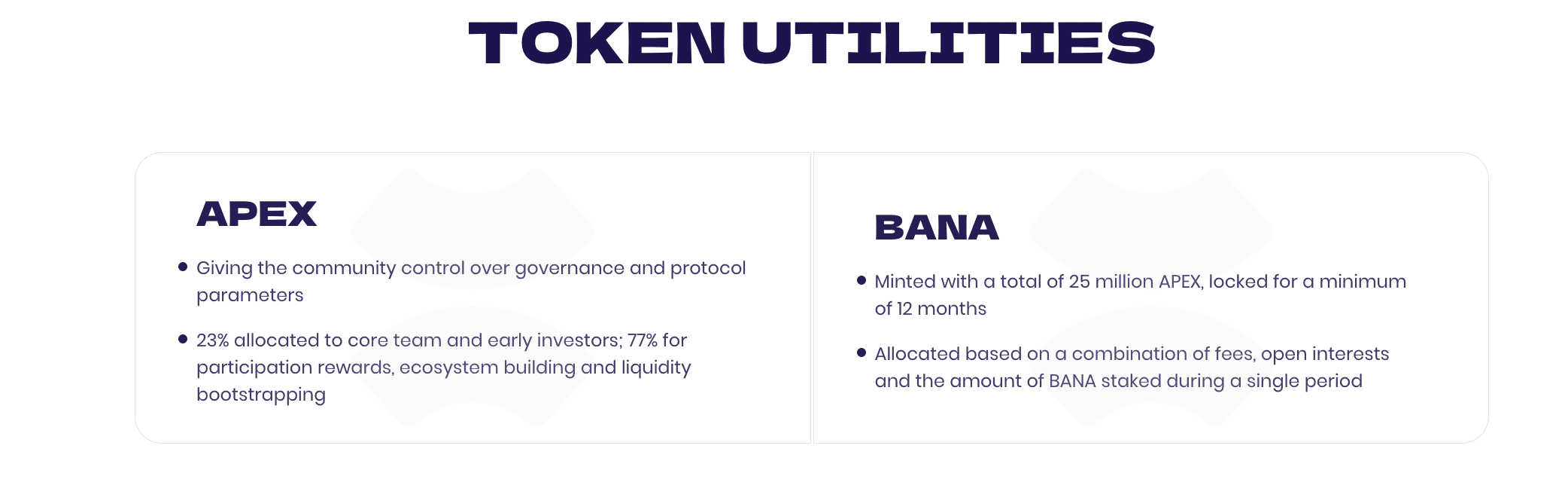

Token-powered ecosystem

The ApeX protocol is powered by two native tokens — APEX, the governance token, and BANA, the rewards token. These tokens offer whole new use cases to this platform, with APEX token holders capable of governance voting and participating in staking. BANA is the utility token of the ApeX ecosystem, accrued as rewards or as airdrops.

Both these tokens facilitate a better economic model, improved flexibility when it comes to trades, and improved user incentivization.

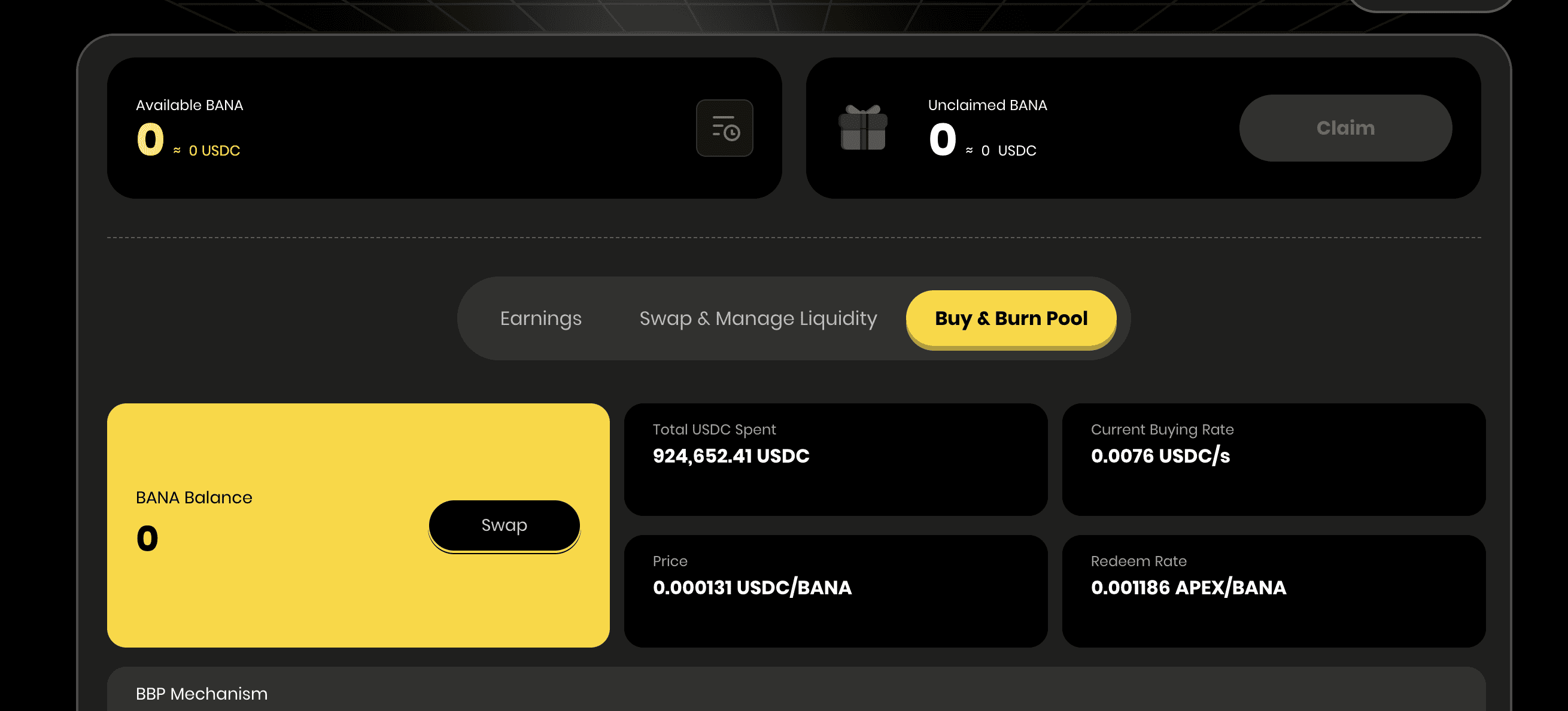

You can swap a BANA token for an APEX token in a given ratio. A Buy and Burn Pool is in place to ensure that the price of BANA stays competitive.

Trade-to-Earn

Exploring the ApeX Pro dashboard reveals the Trade-to-Feature, where BANA tokens are credited to users for placing successful trades. This feature takes ApeX-based earnings beyond the basics of perpetual contract trading profits.

BANA tokens are credited weekly, which can be swapped for USDC, used to add liquidity to the DEX-specific BANA-USDC pool, or exchanged for APEX tokens if held for a full year.

Did you know? ApeX Pro has decided to offer $10 million worth of BANA tokens during the course of the year-long Trade-to-Earn event, with a weekly release of $190,000.

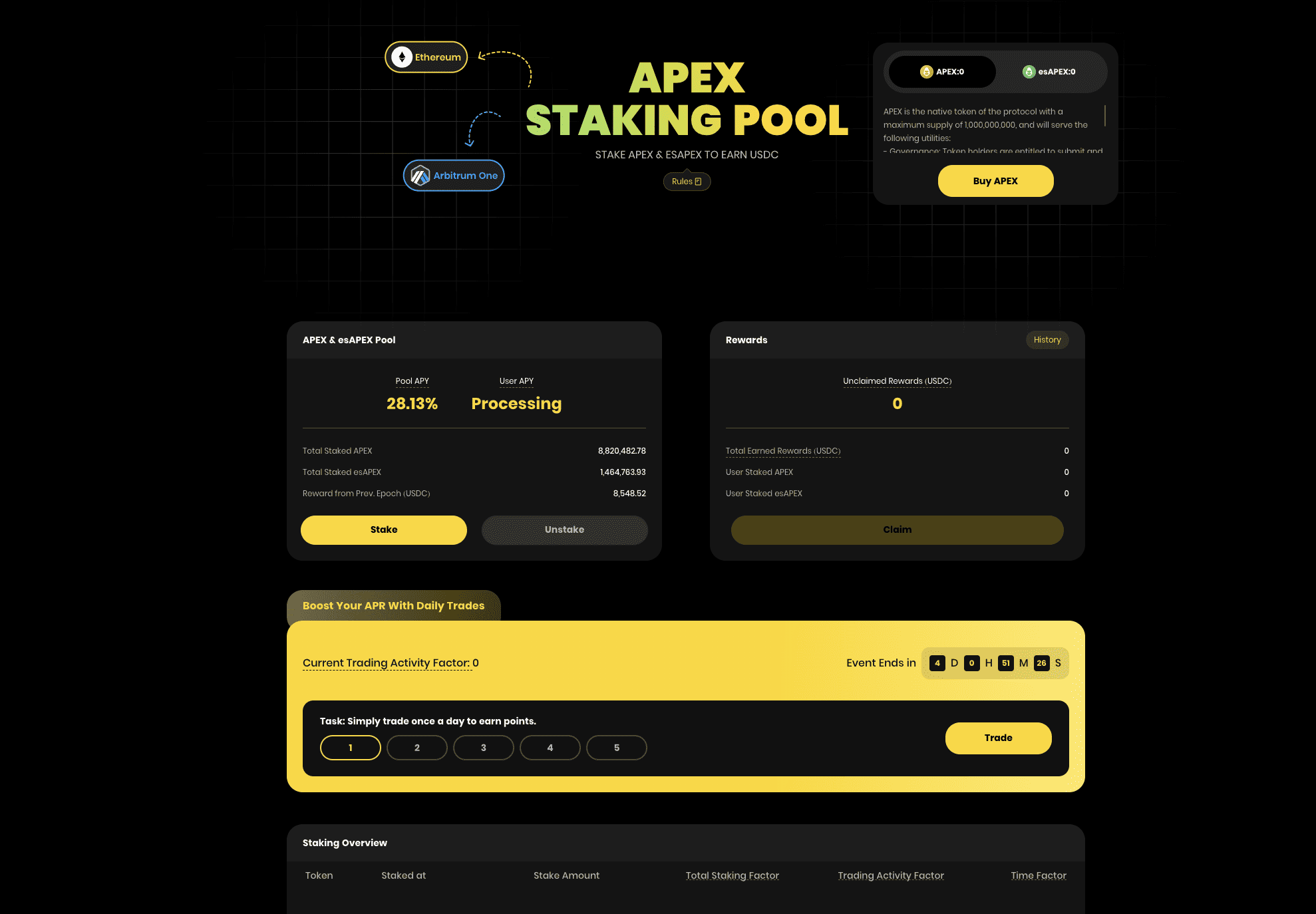

Staking support

ApeX Pro keeps adding new “Earn” based features into the mix. And after Trade-to-Earn, it is staking that we are interested in. In the process, you can stake your redeemed or purchased APEX tokens to get esAPEX liquidity tokens. Also, the APY earned on staking APEX depends on your trading volume. Currently, the APEX staking pools are only active on Arbitrum and Ethereum.

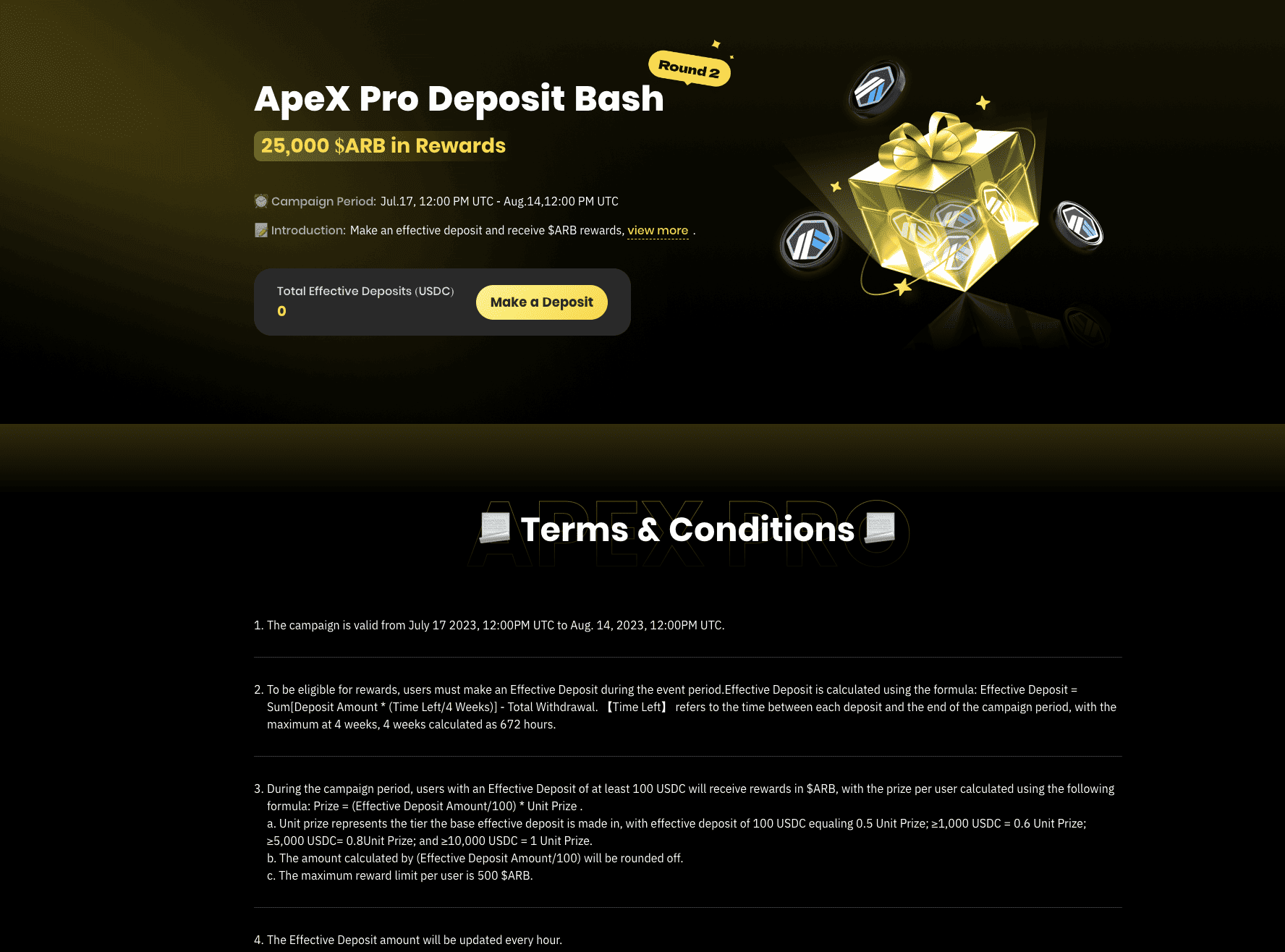

Rewards and referrals

ApeX Pro offers tons of rewards, which you can earned if you participate in events, deposit bashes, and other activities. Apart from Trade-to-Earn, which rewards users in BANA, other activities accrue esAPEX rewards. You can use these to earn APEX — the governance token.

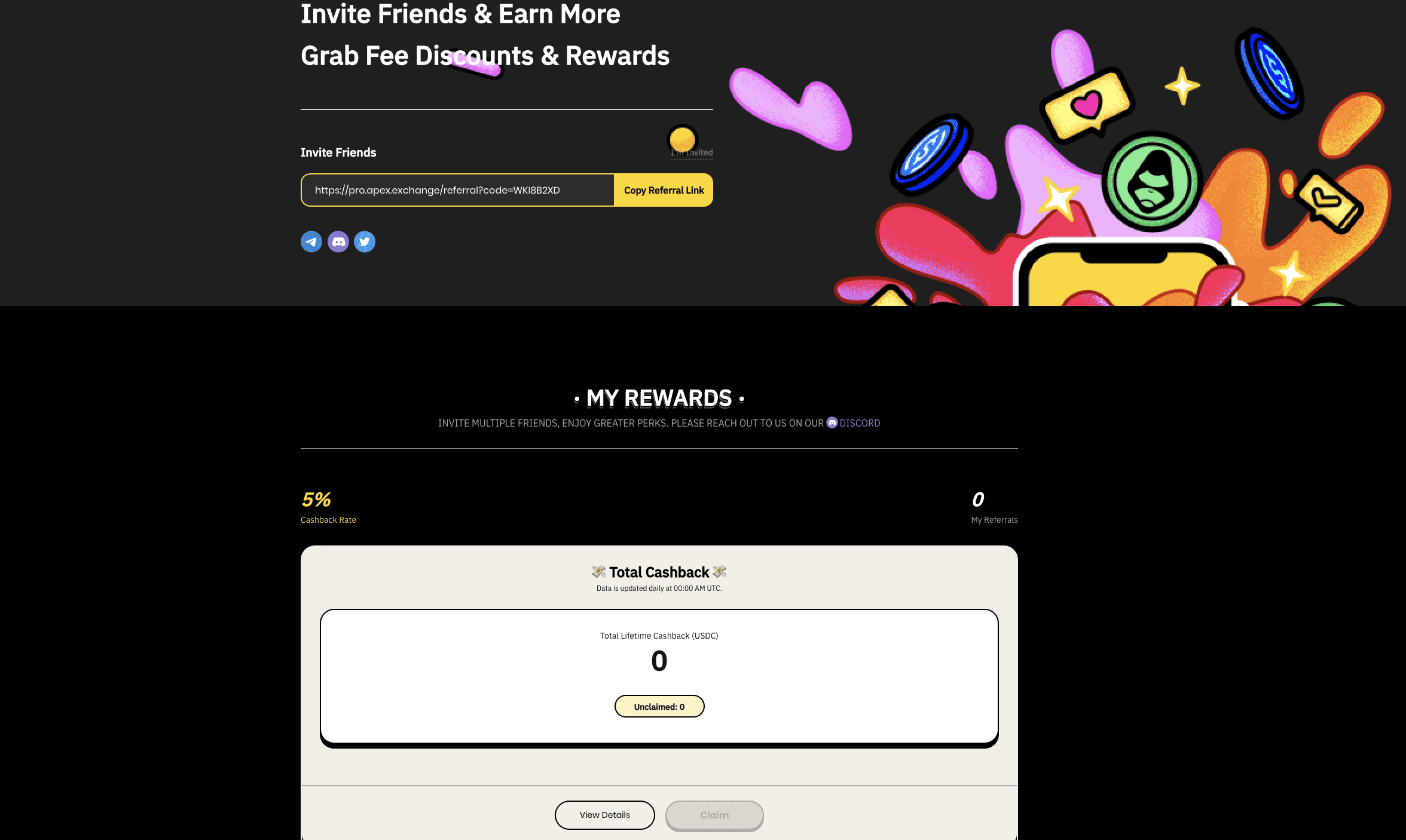

Also, if you aren’t interested in going through these processes, a simple way to amplify your earning chances is via referrals. You can simply make your friends join ApeX Pro using your referral link, all while earning cashback in the process.

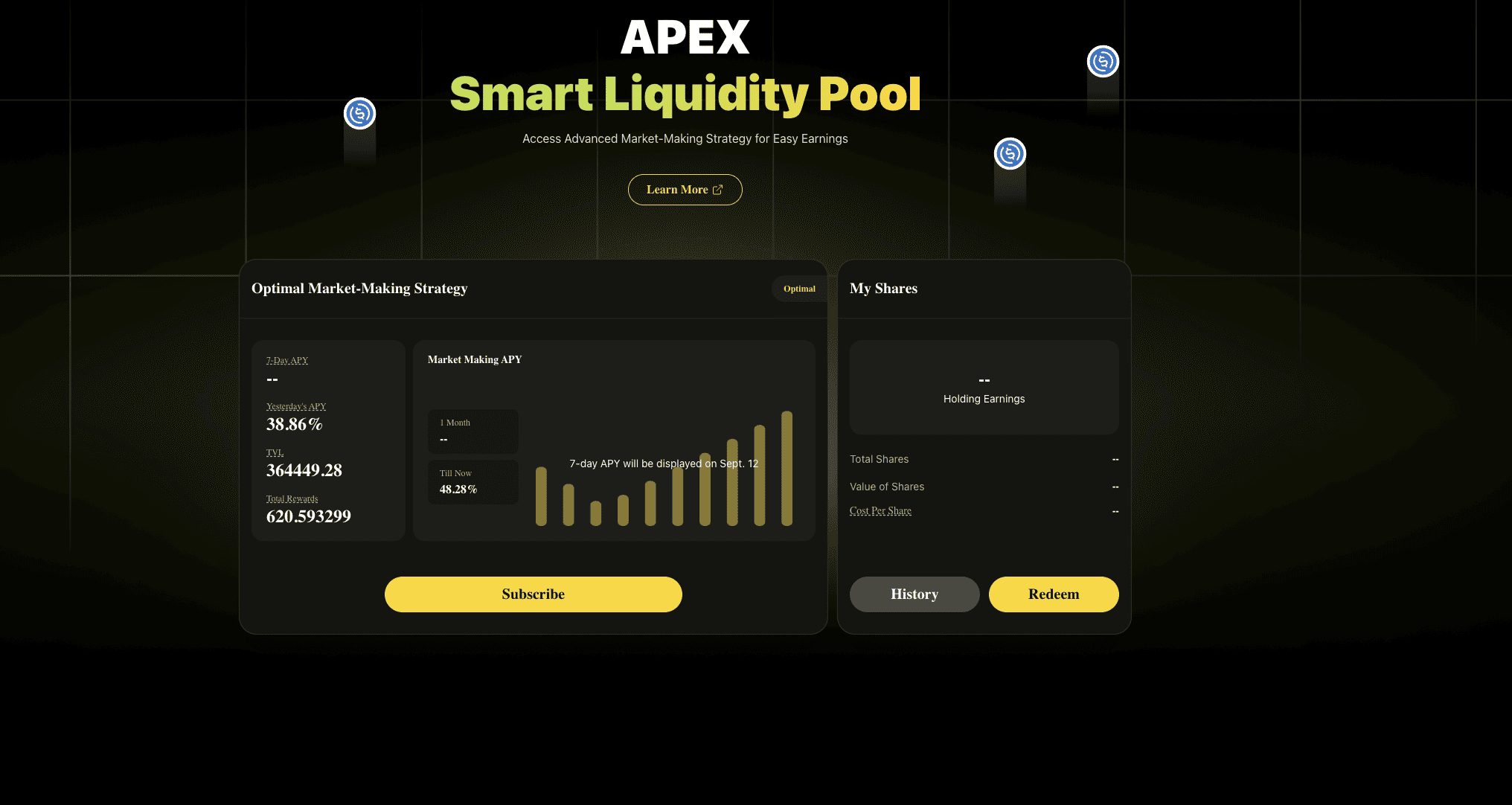

Smart Liquidity Pool

ApeX Pro, or rather the ApeX DEX, boasts a Smart Liquidity Pool or SLP, incentivizing users to pool their earned USDC to earn lip-smacking APYs. Increased liquidity ensures that market-making is also an option at ApeX Pro.

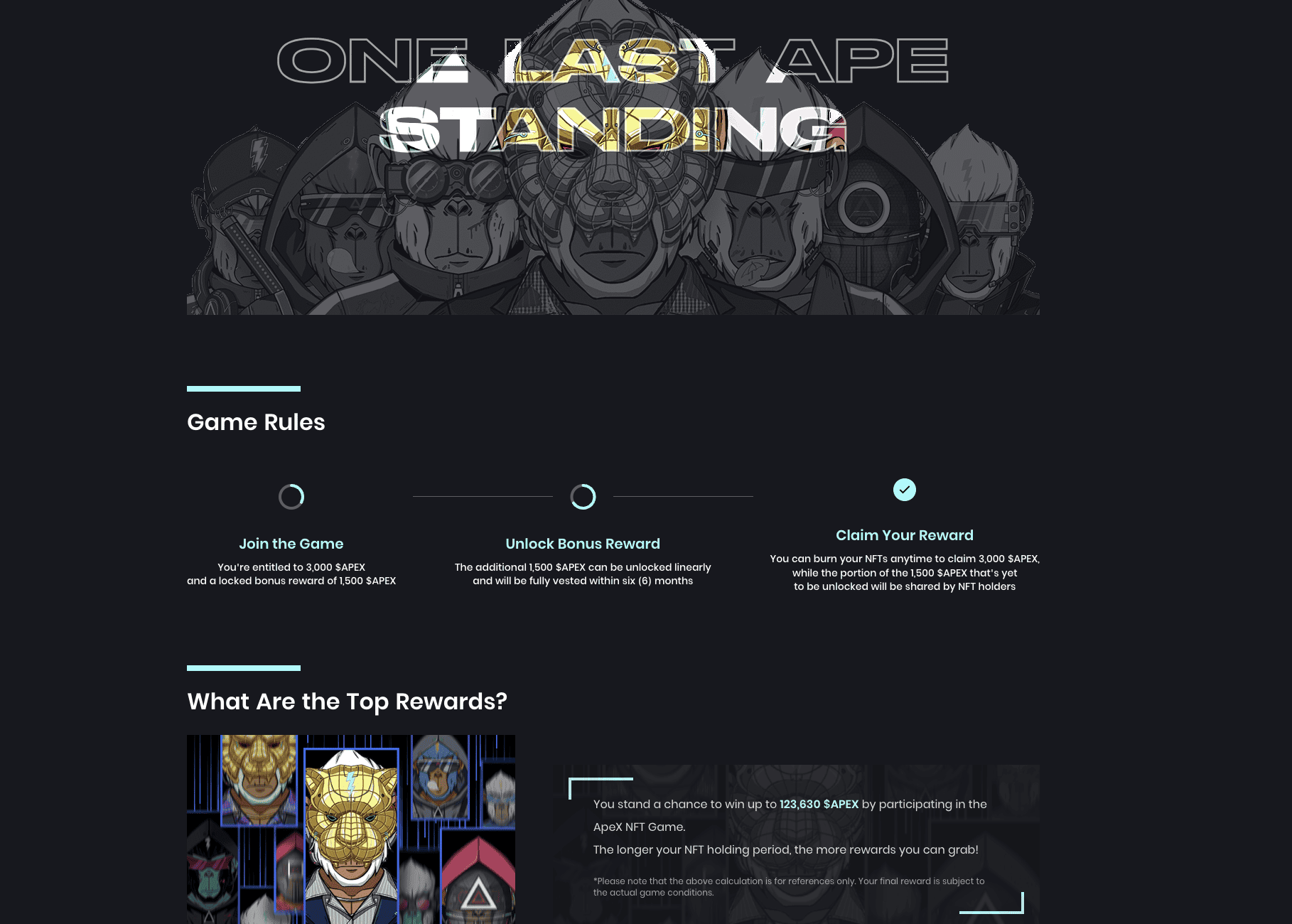

NFT games

The ApeX Protocol is also known for its ApeX NFT game. Playing can help you earn APEX tokens, depending on the holding period. To participate, you must hold APEX Predator NFTs, which are available on marketplaces like OpenSea.

While this is quite the array of offerings, note that the trading platform is still in its infancy, and we can expect new features to show up with time as the web3 arena evolves.

Is ApeX DEX safe? All aspects explored

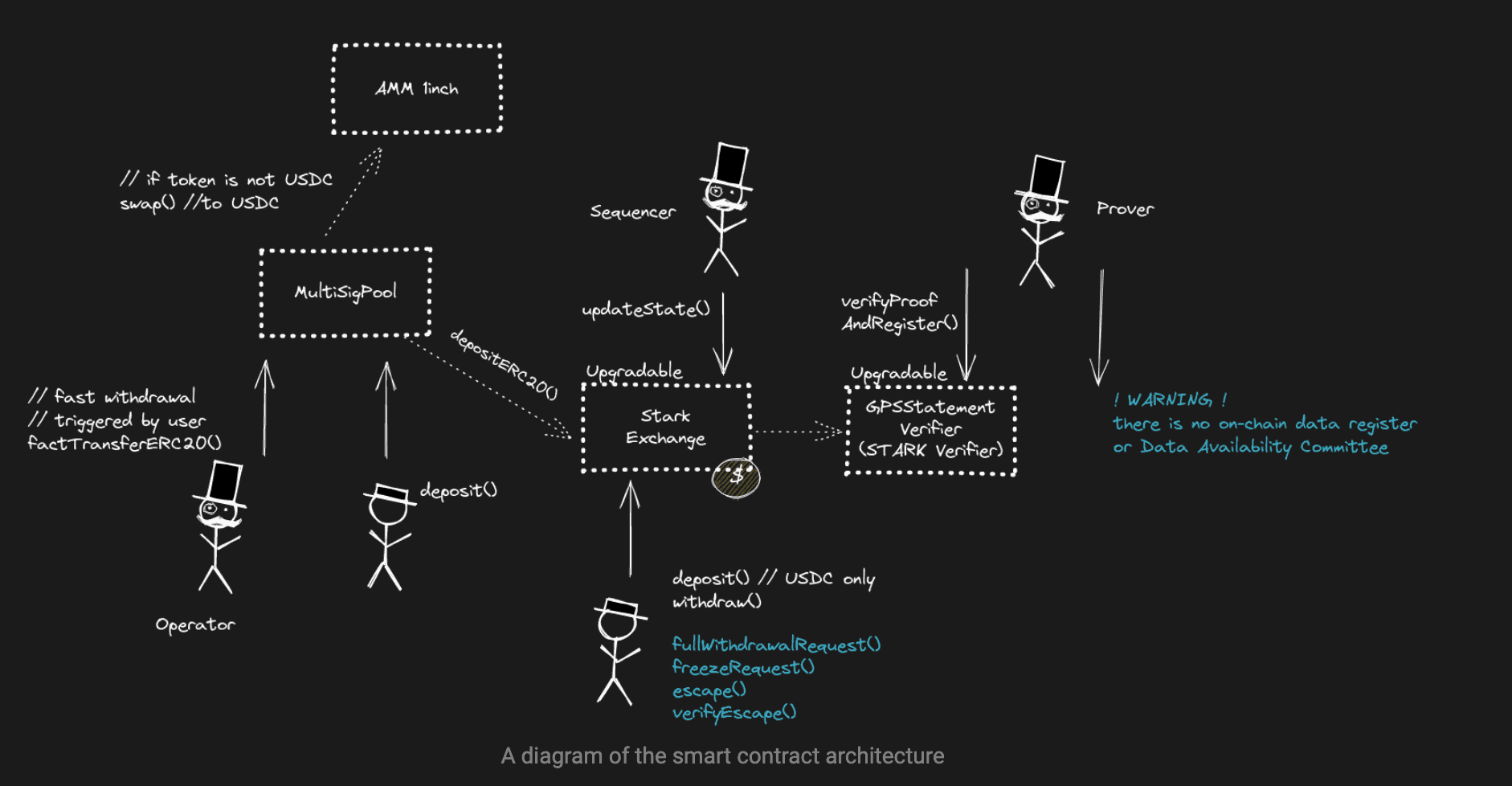

Yes, ApeX DEX is plenty safe. Quelling the security concerns is the StarkWare-developed layer-2 scalability solution, StarkEx. This technology batches transactions and settles them off-chain or on layer-1. While this secures the ApeX Protocol, faster transactions are also possible. It is the layer-1 Ethereum-mainnet that secures the transactions.

Another interesting security trait is the post-quantum resilience of StarkEx, making it nearly immune to the breach threats posed by quantum computers.

The zero-knowledge SNARKs make transaction batching possible and also significantly reduce gas fees. Plus, trade management and executions are handled by audited smart contracts, making the entire process trustless.

Here is a detailed thread on zK-SNARKs:

Other security-specific traits include:

- Reliance on cold wallets for storing funds

- Regular audits

- Fund isolation when users stake or vest their holdings

- Trading via wallets, without depositing funds directly onto the exchange

As of 2025, there hasn’t been any reported security incident concerning ApeX DEX.

Despite the inclusion of StarkEx, there are a few threats that users must be wary of. These include loss of funds if the smart contract doesn’t implement the ZK-SNARK technology correctly. It is, therefore, advisable to withdraw funds whenever you are in profit or done with trading or an earning plan.

ApeX Exchange review and the fee structure

For starters, ApeX DEX charges 0.02% as the maker fees and 0.05% as the taker fees. For the unversed, makers usually place limit orders and add liquidity to the market in the process. According to the order book, takers place market orders and take liquidity from the markets.

As for deposits and withdrawals, standard wallets to order book deposits and vice versa are executed without ApeX DEX charging a fee. However, a minimum fee of five USDC must be paid for quicker withdrawals, regardless of the transaction value. The max fee for faster transactions can go as high as 0.1%.

Therefore, only the expedited withdrawals are charged. Standard withdrawals are free of cost but often take as long as four hours to settle when initiated using the L2.

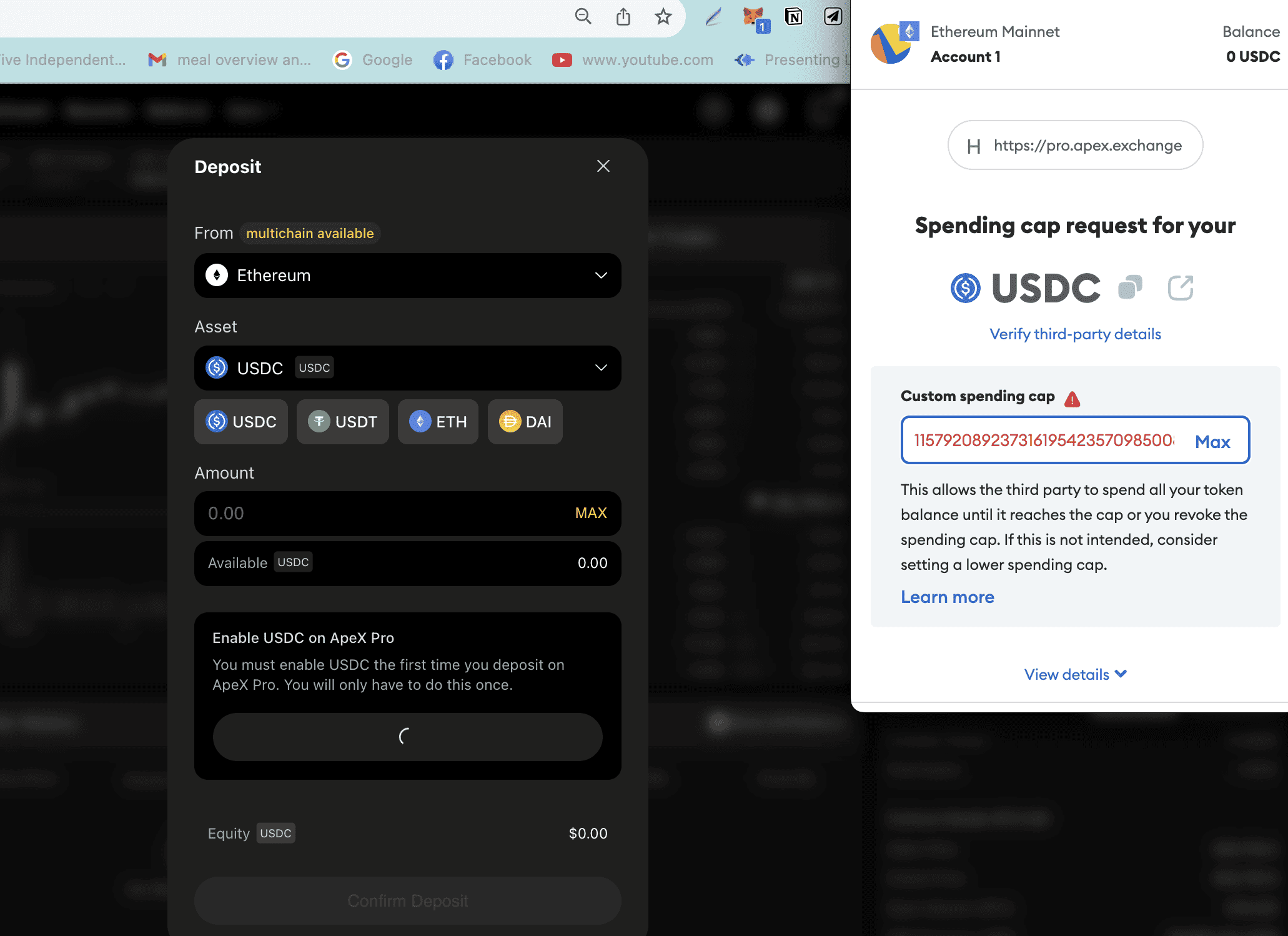

First-time deposits require you to activate USDC as the trading currency and are required to assign the max limit as part of wallet permissions. This is where you would need to pay some gas fees, but these shouldn’t burn a hole in your pocket. Apart from that, no staking fees are involved unless you withdraw the APY-bolstered funds to your wallet and end up paying gas fees.

ApeX trading: All elements explored

Now that we have discussed the security measures and trading fees, let us explore the trading elements. Here are the things you need to consider before delving deeper:

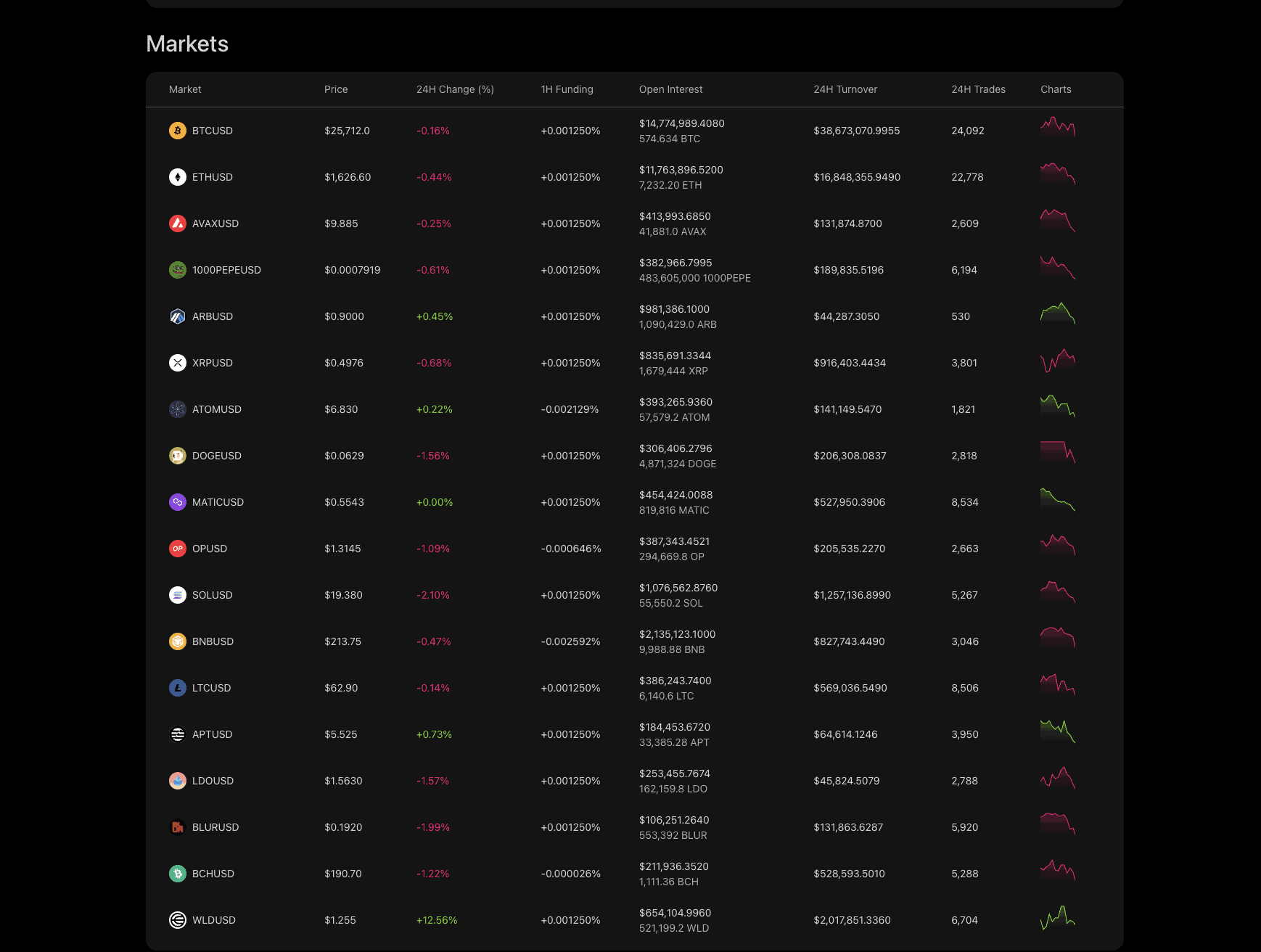

- To trade on ApeX Pro, you have 18 trading pairs or markets to work with.

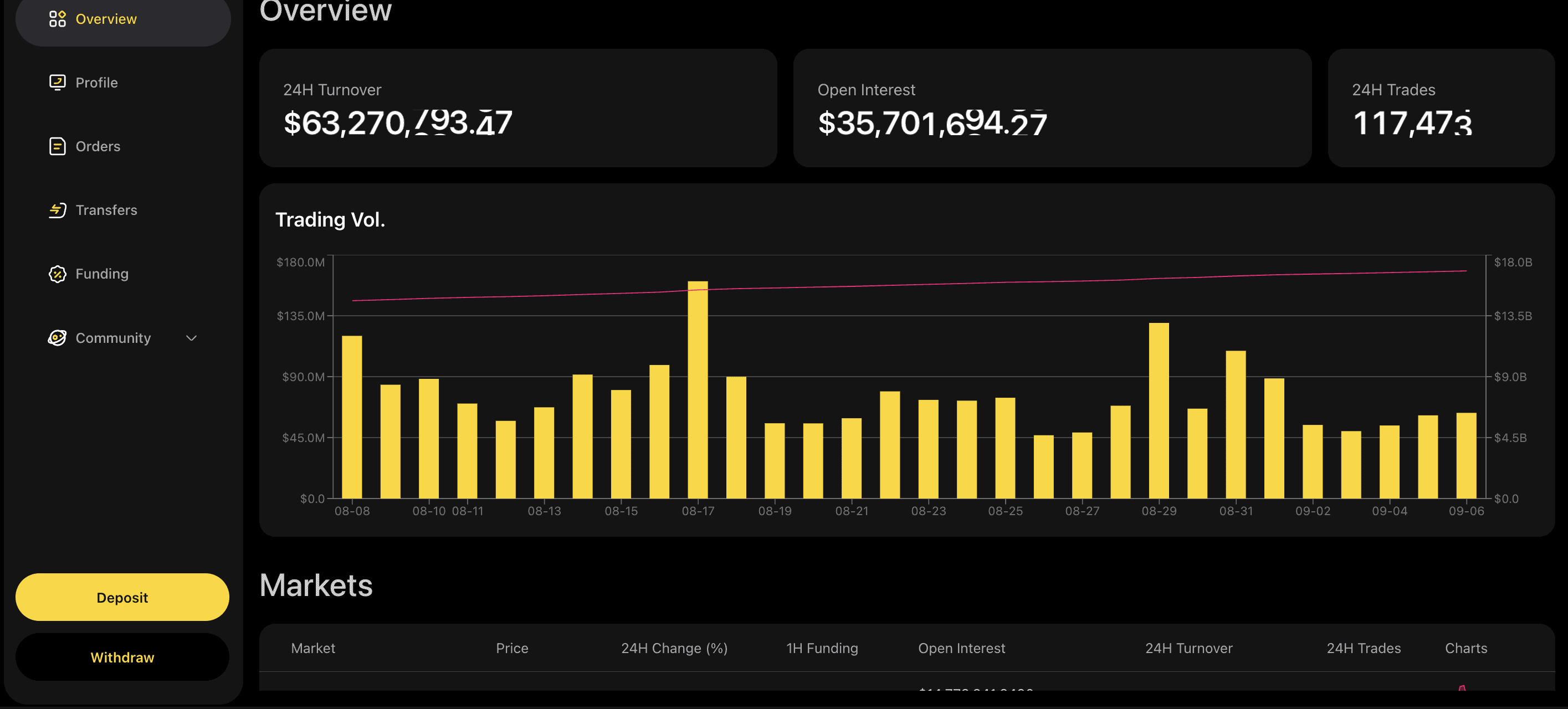

- The “Dashboard” mentions the trading volume, the total number of trades initiated in the last 24 hours, and even the open interest to show the market trends.

Also, here are the top cryptos and the trading pairs associated with this DEX.

As for the leverage, BTC and ETH can go as high as 30X, but for the likes of LTC, BCH, and more, ApeX DEX offers 15x leverage.

ApeX Exchange user experience and learning curve

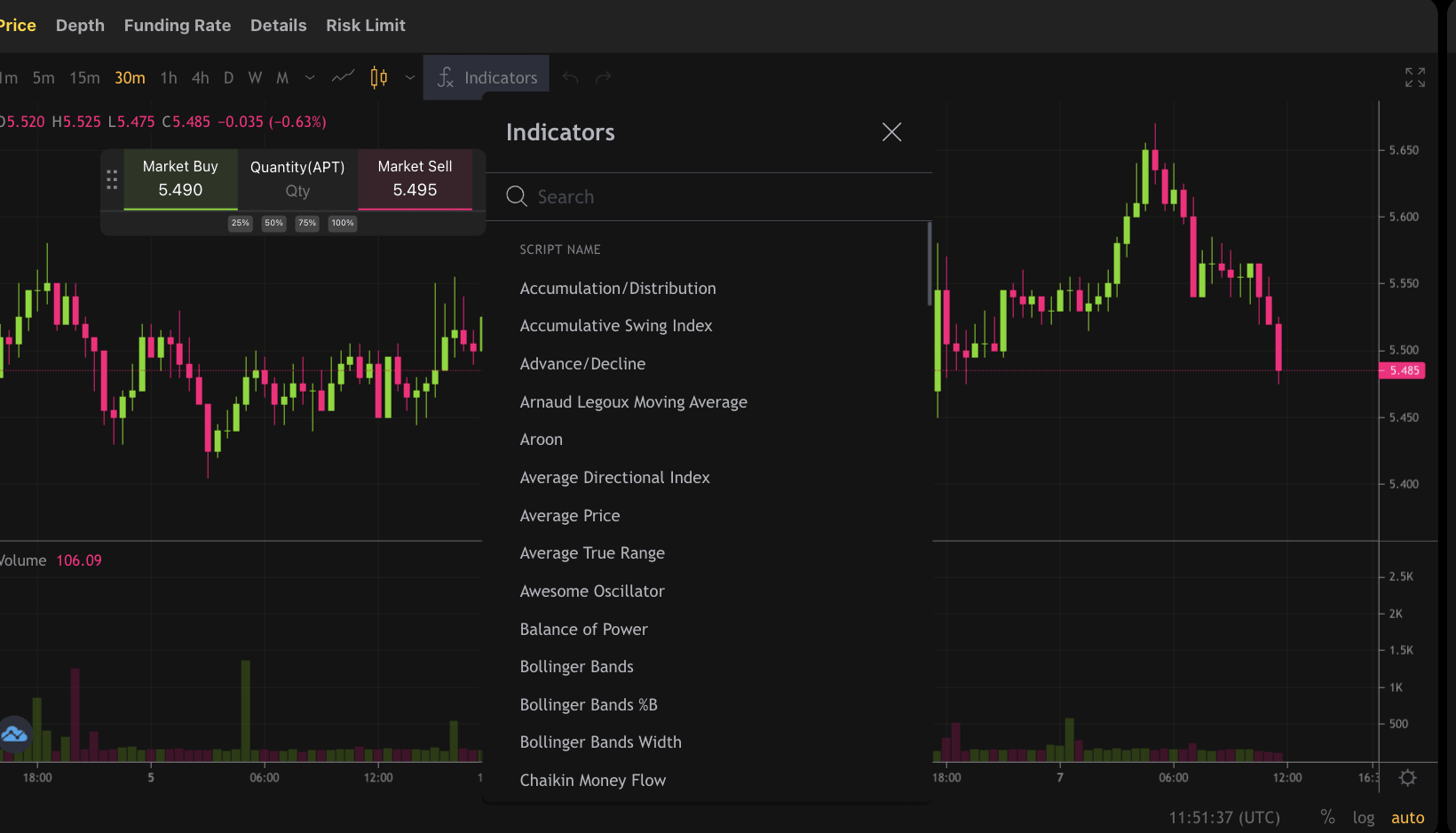

Thanks to the excellent coverage, you can use ApeX Pro as a mobile or a PC app. Once done, you simply need to head over to the “Trade” section, connect your wallet, activate permissions, and get started with the app. The trading interface is loaded with every possible indicator that you usually get on TradingView, allowing you to locate the best price points to enter or exit.

If you want to trade on ApeX Pro, you can place a market or limit order by assigning the target price or the stop loss. Also, depending on the market sentiments, you can either short your position — sell first, buy later — or go long.

Do note that despite being a permissionless platform with several wallet integrations in play, ApeX Pro allows you to access the features by connecting social accounts like Facebook, Discord, and more.

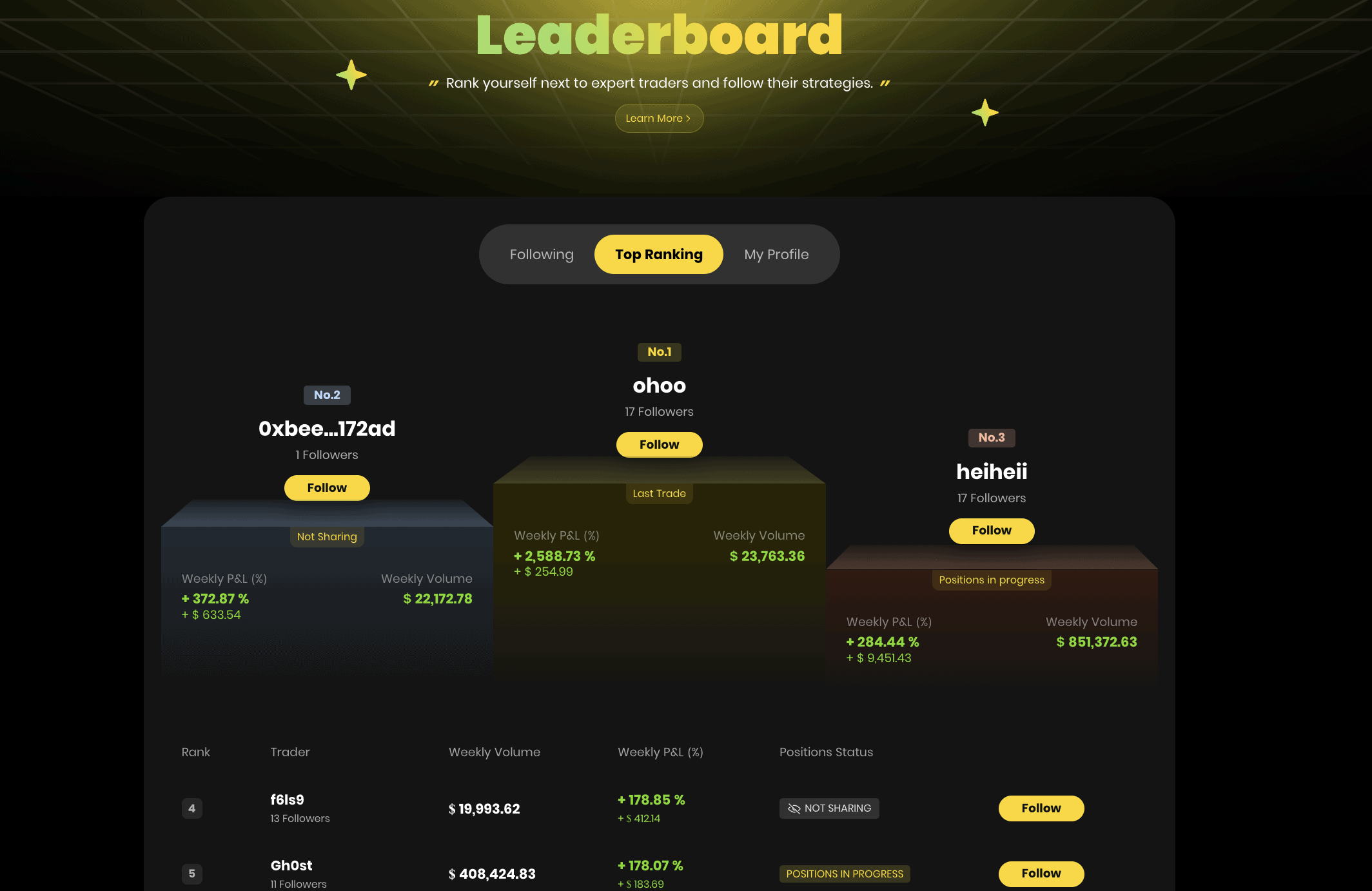

Even though ApeX DEX doesn’t explicitly mention copy trading, you can view the top accounts by checking the “Leaderboard.” This segment also lists the individuals you are following, allowing you to track their trading portfolios.

And finally, it is easy to transition from the trading interface to the “Earn” segment to the “Staking” section or anywhere else. The user interface is easy, quick, and free of complex transitions, making the learning curve shorter and the experience richer.

Transaction speeds and other elements

However, one aspect of the user experience deserves special mention. Courtesy of StarkEx support, ApeX DEX can handle transactions at a clip. The platform can easily handle 10 trades per second, followed by almost 1,000 orders, initiation and cancellation included, per second. However, L2 withdrawals, as mentioned, levy a withdrawal fee of up to 0.1% of the total trade value.

Other elements associated with ApeX Exchange’s user interface include:

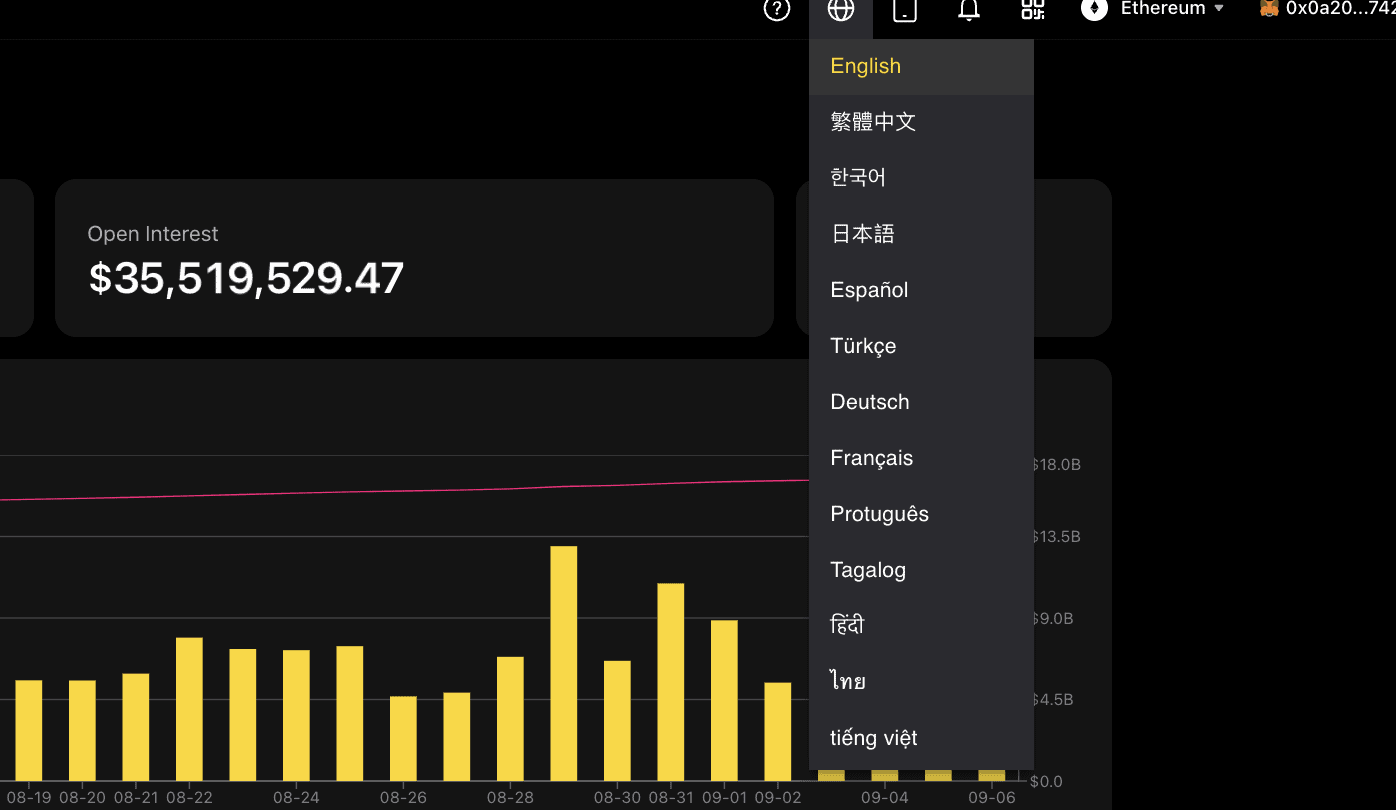

- Multilingual support

- Barcode-based app logins

- An info-rich, exhaustive blog

- Support for push notifications

The only drawback associated with this DEX usage has to be the limited number of trading pairs.

Customer support system at ApeX Pro Exchange

ApeX Pro is decentralized and permissionless. Therefore, you simply cannot call someone to address issues for you. Here is how you can connect to the team with issues:

- Via email support with the address being [email protected].

- A detailed FAQ section, which can be accessed here.

- Via social handles with access to Twitter, Discord, and Telegram available to the users.

The team usually gets back to you in less than 24 hours for emails or even social queries.

How we have tested ApeX Exchange

This in-depth review of ApeX Exchange takes you on a journey into the realm of decentralized crypto derivatives, focusing on ApeX Pro, a prominent player in this space. By the conclusion of our assessment, you’ll gain a comprehensive understanding of ApeX’s strengths, weaknesses, features, user experience, and much more. Here’s an overview of how we conducted this evaluation:

- User-friendly interface and accessibility: We scrutinized the ease of creating an account, the process of identity verification, and explored the accessibility of both the “Lite” and “Pro” modes. We also delved into ApeX’s welcome bonuses.

- Trading limits: We delved into the buy and sell limits on ApeX, analyzing how deposit and withdrawal limits are determined. We also took a detailed look at the impact of the verification process on these limits.

- Fee structure: Our team meticulously examined ApeX’s fee structure, with a particular focus on maker and taker fees for various types of trades.

- Customer support: The effectiveness of ApeX’s customer support system was assessed, taking into consideration various support channels available, including email support, live chat, FAQs, guides, and multilingual support.

- Trustworthiness: We checked factors contributing to its credibility, such as security measures, regulatory compliance, transparent fee structures, and a robust customer support system.

Through this comprehensive testing process, our aim was to equip readers with a clear and informative perspective on ApeX Exchange, empowering them to make informed decisions regarding their cryptocurrency trading endeavors.

ApeX Exchange review: Pros and cons

Still unsure if ApeX DEX is the right platform for you? Here is a quick list of the pros and cons to help you take an informed call:

Pros

- A minimum deposit threshold of $1

- Up to 30x leverage of specific trading pairs

- Comes with APEX staking and esAPEX vesting feature as passive income generators

- A rewarding referral program

- No KYC needed

- Minimal web interface with truckloads of features

- Very secure, courtesy of StarkEx support

- Lacks a fiat gateway for users who want to liquidate holdings and get money in their bank accounts

“The “CEX vs DEX” narrative misses a key issue, that the two are substitutes for some services (cross-crypto trading, custody, sometimes leverage), but CEXes also function as a fiat-crypto gateway and (what we call) DEXes don’t.”

Vitalik Buterin, Co-Founder of Ethereum: Twitter

Cons

- Limited trading pairs

- Trade-to-earn and other passive income generators are time-bound

- No live chat support in case you run into technical concerns

Invest responsibly

It is important to remember that both trading and interacting with decentralized applications carries a certain amount of risk. Users should never risk more than they can comfortably afford to lose.

Furthermore, users should always maintain strong operational security when dealing with smart contracts, wallets, or cryptocurrencies. Lastly, this ApeX review is not an official endorsement of the platform, it is for informational and entertainment purposes only.

Always remember to invest responsibly and do your own research before making any investment decisions.

How does ApeX Exchange compare against other DEXs?

ApeX Pro is one of the rare platforms that give you a flavor of CEXs via the order book model and even a flavor of DEXs for its permissionless nature. Created by Bybit to reduce the trading exposure to controversial and custodial CEXs, ApeX exchange is certainly one of the more innovative DeFi offerings to date. This ApeX Exchange review concludes that the DEX still has much work to do to catch up with the likes of dYdX or GMX — platforms offering 100X and 50X leverage on specific trades. However, the minimalist interface, a decent token spread, and focus on cross-margin perpetual contracts make it one of the bigger and better names in the ever-innovating space.

Frequently asked questions

ApeX Pro is a completely decentralized, permissionless exchange with a layer-2 exposure. This means it is built atop the Ethereum L2 solution, Arbitrum. Plus, it is one of the few exchanges to ditch the AMM model for order book, reducing slippage and ensuring that the trading process remains familiar, even to new traders. And yes, this exchange supports cross-margin perpetual contracts with an option to get leverage up to 30x.

Even though ApeX can be deemed as a DeFi protocol built on top of Arbitrum, it is still a decentralized crypto exchange. However, this exchange only deals in perpetual contracts and offers leverage. Furthermore, unlike traditional exchanges, it doesn’t promote KYC verification and chooses to remain permissionless.

ApeX Pro charges 0.2% as the maker fees. This concerns individuals who place limit orders as, in one way or the other, they are adding to the exchange’s liquidity. The taker fee is higher at 0.05% and focuses on users who place immediate market orders. As these orders get executed instantly, they focus on taking liquidity from the exchange.

Yes, trading on a DEX is safe as you do not need to deposit funds to the platform. Instead, you can simply connect your wallet and start trading. However, while trading on DEXs, you should be wary of smart contract threats.