The total net assets under management (AUM) of crypto investment firm Grayscale fell back to $38.7 billion on Feb. 24.

In its asset update from Feb. 22, Grayscale had tweeted that its AUM amounted to $42 billion. This makes up a $3.3 billion downturn in trust value in less than a week — nearly an 8% loss.

Grayscale Hit Hard

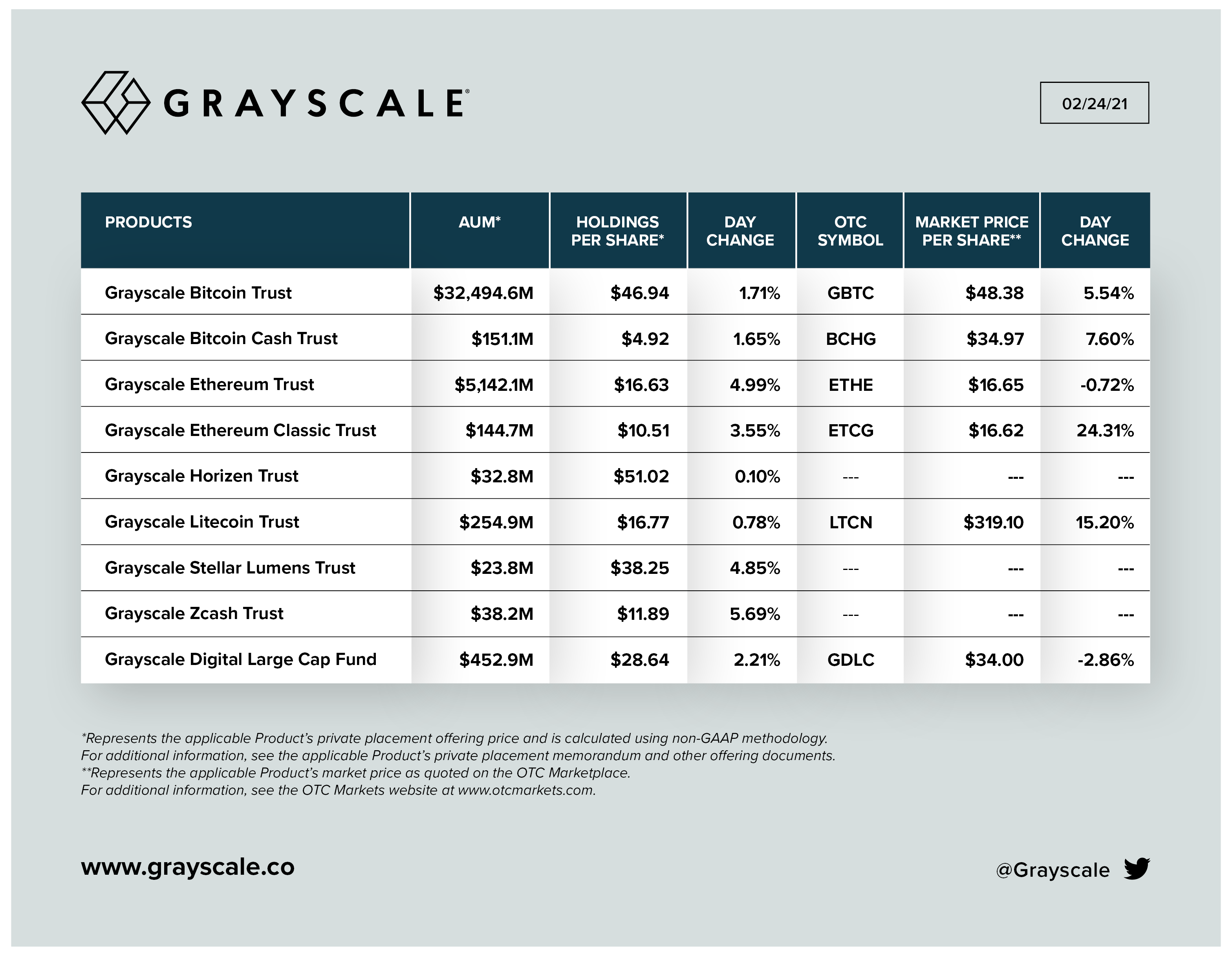

The value of Grayscale’s largest trust, the Grayscale Bitcoin Trust, fell from $35.2 billion to $32.5 billion, a drop of almost 8%.

Grayscale’s Ethereum Trust dropped from $5.58 billion to $5.14 billion, a loss of around $440 million. After the damage had been done, the firm’s Ethereum Classic Trust was the biggest loser. It saw its holdings per share drop nearly 20%, and its market price per share fall over 25% on Feb. 22.

Bloody Monday

Grayscale’s current losses are representative of many crypto investments over the past few days. According to data from Bybt, $5.64 billion in crypto across 645,278 positions on exchanges were liquidated between Feb. 22 and Feb. 23. The event has come to be known as ‘Bloody Monday.’

Some $2.41 billion worth of BTC was liquidated along with $1.35 billion worth of Ethereum (ETH) as well as nearly $200 million of Litecoin (LTC) and Ripple (XRP) each. Other crypto-assets such as Binance Coin (BNB), Bitcoin Cash (BCH), EOS, Polkadot (DOT), and Cardano (ADA) added up to a total of $663 million in liquidated positions.

Grayscaling Up

Despite these losses, Grayscale is unlikely to be deterred. Recently, it has aggressively picked up almost any crypto assets it could get its hands on. Even since the beginning of the year it has made several prominent acquisitions.

In January, Grayscale accumulated 150% more BTC than was mined across the entire network. On Feb. 4, it bought 12,684 ETH, adding nearly $40 billion to its portfolio, which put its AUM over $30 billion for the first time. It also began dabbling in DeFi, filing trusts for Aave and Polkadot in January, as well as Yearn, and SushiSwap in February.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.