Institutional asset manager Grayscale Investments has plans to expand its crypto asset trusts with more decentralized finance-based tokens according to its recent filings.

Grayscale is the world’s largest crypto asset trust for institutional investors. The firm is now planning to expand its offerings beyond Bitcoin, Ethereum, and a handful of other cryptocurrencies, by adding on DeFi token trusts.

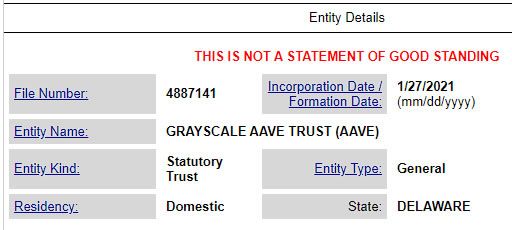

The firm has filed to register five more digital asset trusts — two of them related to DeFi. The Delaware corporate registry, Grayscale’s statutory trustee for the state, received the filings on Jan. 27.

It does not necessarily mean they will be launched but shows that the investment giant has been eyeing the DeFi sector for future gains.

DeFi Token Trusts Coming

Among the five trusts are Aave, Polkadot, and Cosmos. Aave is the world’s second-largest DeFi lending platform in terms of total value locked according to DeFi Pulse, which currently reports it as $3.9 billion.

Polkadot is an Ethereum-rivaling high-throughput blockchain network that works with sidechains or ‘parachains’ in its own terminology. Cosmos is a decentralized ecosystem of independent blockchains designed to create the next generation of the internet.

The other two filings are privacy-centric coin Monero and decentralized application platform Cardano. Grayscale has recently registered trusts for Chainlink (LINK), Basic Attention Token (BAT), Decentraland (MANA), Tezos (XTZ), Filecoin (FIL), and Livepeer.

Its current trusts are dominated by Bitcoin which represents about 80% of the total with $20.4 billion. The Ethereum trust has around 15% with $3.8 billion and the rest is distributed between a number of smaller crypto trusts including Litecoin, Bitcoin Cash, Stellar Lumens, Ethereum Classic, and Zcash.

The firm recently dissolved its XRP trust following Ripple’s losing battle with the Securities and Exchange Commission.

Grayscale AUM Back at $25B

The latest tweet from the asset manager reports that total assets under management is back at $25 billion.

Grayscale is constantly adding Bitcoin to its trust with its latest reported purchase being on Jan. 28, for 890 BTC. On Jan. 18, the fund scooped up a record largest single-day Bitcoin purchase of 16,244 BTC.

It was also reported on Jan. 28 that the Rothschild Investment Corporation bought 6,000 shares of Grayscale’s Bitcoin Trust between October and December of 2020, increasing the Chicago investment bank’s exposure to the trust by 24% in Q4.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.