Bitcoin fell more than 16% since the daily open and is trading around the $46,000 mark at the time of press.

This price crash is picking up on the downwards price momentum that was initiated in the market on Monday with a 13% 4-hour red Bitcoin candle.

Feb. 22 was also a record day for the daily Bitcoin trading range. At one point BTC had strayed $10,877 from its opening price. In contrast, this figure has seen an average range of $3,765 year to date.

Crypto Liquidations Galore as Bitcoin Shudders

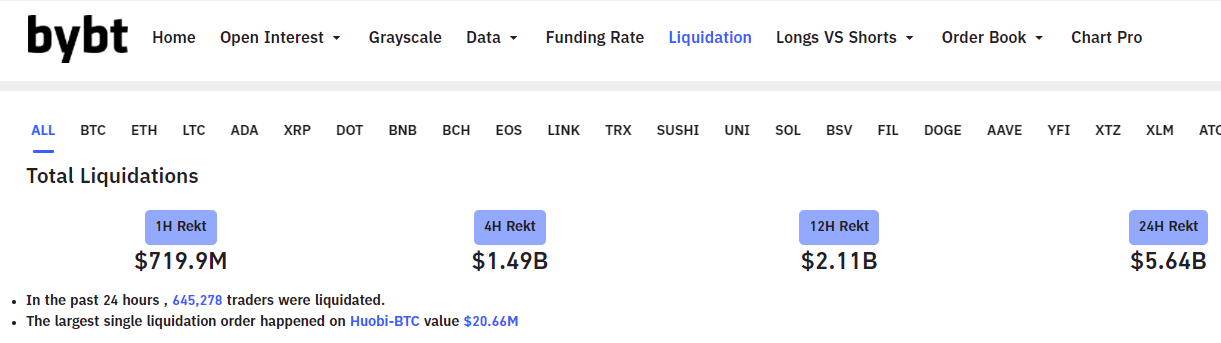

Data from Bybt shows that a massive $5.64 billion in crypto across 645,278 positions on exchanges were liquidated.

Bitcoin made up the lion’s share of these liquidations. $2.41 billion worth of BTC was liquidated along with $1.35 billion worth of ETH and nearly $200 million of Litecoin (LTC) and Ripple (XRP) each.

In addition to these four, other crypto-assets like Binance Coin (BNB), Bitcoin Cash (BCH), EOS, Polkadot (DOT), and Cardano (ADA) added up to a total of $663 million in liquidated positions.

The price rout that began on Feb. 22, now being referred to as “Bloody Monday,” had a huge effect on the DeFi sector as well.

According to data from DeBank, the total value locked in decentralized finance (DeFi) protocols dropped from $44 billion to $36 billion. This equates to an 18% fall in the value of the DeFi market in just a single day.

Could This Be the ‘Musk Effect’?

On Feb. 20, Tesla CEO Elon Musk took to Twitter to say that the prices of BTC and ETH “do seem high.”

Musk’s influence over the crypto market has been labeled as the ‘Musk Effect.’ Historically, his tweets about Bitcoin and Dogecoin have garnered huge engagements and can be correlated with some recent price shifts.

Whether this price crash is just a healthy price correction or a late market reaction to Musk’s comments, remains to be seen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.