The New York Attorney General (AG) has sued Gemini Exchange and the Digital Currency Group (DCG) for an alleged $1.1 billion fraud. The AG said the Gemini and DCG-owned Genesis Global Capital (Genesis) offered a lending program in 2021 without adequate disclosure of risks.

Gemini reportedly misled investors about the risks of loans it extended to third parties like Alameda Research. The loans caused significant losses, which Genesis and Gemini allegedly tried to cover up, according to the AG.

Genesis and Gemini Didn’t Disclose Risks

Letitia James, the AG office’s top cop, said the companies exploited the “under-regulated” crypto industry to cause harm to investors. She said these practices deceived customers through false promises and promised more crackdowns.

“My office will continue our efforts to stop deceptive cryptocurrency companies and to push for stronger regulations to protect all investors.”

James accuses Genesis of lying to Gemini that it regularly audited the health of its borrowers. The state found no records of audits over a period of two years.

Read more: 11 Best Crypto Exchanges for Beginners

Genesis also allegedly covered up its true financial situation with a $1.1 billion promissory note, the prosecutor said. Gemini failed to warn customers about Genesis’ financial difficulties despite mulling the potential closure of the Earn program.

The lawsuit wants to ban Gemini, Genesis, and DCG from offering investment services in the state. In addition, James is asking for investor restitution and disgorgement of the companies’ alleged illegal profits.

Gemini May Shift Focus to Non-US Markets

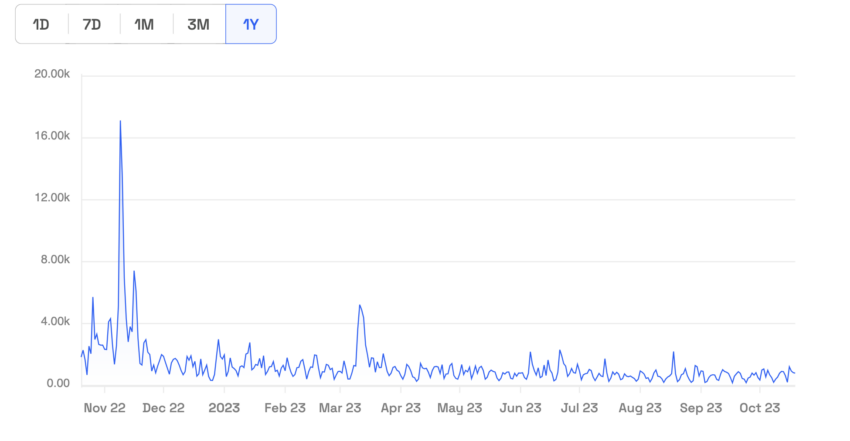

The lawsuit comes at an awkward time for all parties, with Gemini facing allegations by the US Securities and Exchange Commission (SEC) for offering Gemini Earn as an alleged unregistered security. Gemini’s Earn customers deposited money into Gemini that Genesis loaned to third parties to deliver the promised 8% annual yield.

Earlier this year, Genesis filed for bankruptcy after the collapse of several crypto firms, including Three Arrows Capital and Voyager Digital, saw it scrambling to recover loans. Genesis also lost over $100 million from Babel Finance.

Read more: Gemini vs Coinbase: Which is the better platform in 2023?

Gemini, while a relatively small US exchange compared to Coinbase, brought gravitas to an industry that had largely been the Wild West since the launch of the Bitcoin paper in 2008. If successful, the lawsuit could see Gemini focus on overseas markets like India and Singapore and hasten efforts to establish healthy businesses in the UK and Hong Kong.

Do you have something to say about the lawsuit filed by the New York Attorney General against Gemini and Genesis, Genesis’ connection to Three Arrows Capital, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.