With crypto gaining mainstream adoption, traditional financial bodies are increasingly welcoming digital assets with open arms. This guide explores everything there is about crypto hedge funds, including operations, fund management strategies, capital management, investment strategies, and the regulatory space. Here’s what you need to know in 2024.

KEY TAKEAWAYS

• Crypto hedge funds offer a unique way for investors to gain exposure to digital assets while aiming for higher returns through strategic capital allocation.

• Despite the risks and recent setbacks like the FTX collapse, crypto hedge funds continue to attract interest, especially from those looking to diversify beyond traditional markets.

• Changing regulation is a challenge, but clearer rules could help solidify crypto hedge funds as a mainstream investment option.

- What is a hedge fund?

- Is there a crypto hedge fund?

- How does a crypto-specific hedge fund work?

- Capital allocation: How to get the ball rolling?

- What are the strategies employed by hedge funds?

- Types of crypto hedge fund

- Other fund types: crypto-focused

- How crypto hedge funds have matured

- How are crypto hedge funds regulated?

- Pros and cons of these hedge funds

- The way forward for crypto-backed hedge funds

- Frequently asked questions

What is a hedge fund?

Think of a hedge fund as a private club where investors pool finances to achieve financial goals. A more specific definition would be a body of pooled investments that function with fewer regulations than traditional funds like ETFs, Mutual Funds, and more.

With fewer regulations in place, hedge funds are better poised for alpha generation — generating higher returns. In TradFi (traditional finance), a hedge fund aims to help investors maximize returns with a proper risk management strategy in place. And with risk management, we mean strategies to hedge the risks.

But are traditional hedge funds as relevant as they once were? Marcel Kalinovic, the CEO of Lit XChange, thinks not.

“Hedge funds returns are collapsing due to their poor positioning in meme stocks and financial markets.”

Marcel Kalinovic, CEO of Lit Xchange: Twitter

Is there a crypto hedge fund?

In short, yes! With finance changing and investors showing interest in diverse asset classes, crypto hedge funds are becoming increasingly common. While they do exist, they do not have major diversifications from the traditional ones.

Crypto hedge funds leverage the unique opportunities presented by crypto investments. They offer strategic and crypto-relevant portfolio management and risk management strategies.

Over time, these funds carved an identity with fund managers using traditional investment strategies to foray into the digital asset domain. And with institutional investors like Grayscale, MicroStrategy, and Tesla showing interest in cryptos, the crypto hedge fund space has only grown since its inception.

Here is a list of the top crypto hedge funds, per the AUM standings:

How does a crypto-specific hedge fund work?

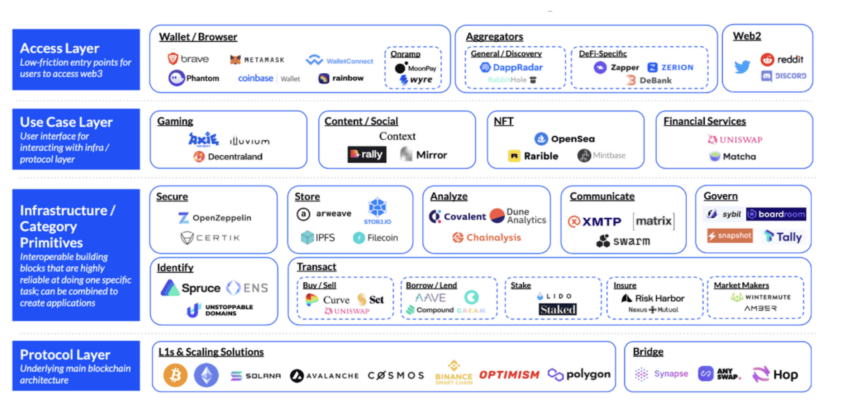

Crypto hedge funds serve as bridges to connect these esteemed firms and individuals to the crypto space.

Institutional investors do not usually take positions in crypto assets using centralized and decentralized exchanges, and the same goes for high-net-worth investors (HNWI).

Did you know? A pension fund named Virginia’s Police Officer’s Retirement System has exposure to a crypto-focused fund — the Morgan Vreek Blockchain Opportunities Fund. This is one instance of institutional investing.

Note that hedge funds are often good at making predictions. Here is how:

Portfolio management

Portfolio management involves ideating the right set of assets for your funds. Consider this the process of choosing the right ingredients for the dish (which is the hedge fund). And guess what? The chef here is the fund manager.

A hedge fund is an investment instrument that pools investor assets, prepping them for financial gains. Portfolio allocation is the process that determines where the investor’s assets will go.

Maybe the player has just BTC and ETH in their portfolio. Or there might be a decent mix of altcoins. For instance, DCG or the Digital Currency Group, the firm behind Grayscale Investments, has BTC, Decentraland (MANA), ETC, and several other crypto holdings.

That’s not it. DCG brings forth a sizable crypto corpus comprising Brave (the web browser), an investment in Chainalysis — the blockchain analysis firm, and other broad market positions as part of its portfolio.

Pantera Capital, the first crypto hedge fund, has its capital allocated to early-stage crypto tokens, liquid tokens, Bitcoin funds, and more.

Capital allocation

This aspect of fund ideation involves planning the amount of funds that go into each asset. Consider this the amount of each ingredient that a chef plans to use. A fund manager needs to be very careful in this regard. Allocating too much to a highly volatile cryptocurrency might comprise the fund’s structure and stability.

Capital allocation is a type of science that requires experience. We cover this important aspect of hedge fund management in more detail later in this discussion.

Alpha generation

In regards to an investment instrument, alpha signifies the performance. A hedge fund is aimed to generate alpha and outperform even some of the most rewarding TradFi hedge funds.

The concept of alpha generation relative to a hedge fund is all about beating the average performance of the index, asset, or fund against which it is measured.

For instance, if you plan on investing in a Bitcoin fund, a 15% yearly return would be considered positive alpha if BTC, the asset, has given anything between 10% to 14.9% as returns. The idea is simple. Positive alpha means beating the average or beating the underlying asset or index.

Risk management

Alphas are lip-smacking. However, they come with risks that crypto hedge funds aim to manage. Risk management is like an anchor that a fund manager can drop if things go south. But then, risk management strategies can differ depending on the alpha generation strategies a given fund employs.

For instance, if an arbitrage-focused hedge fund is in sight, the fund manager must account for exchange risks, including downtime concerns.

A good risk management strategy could be to diversify across diverse exchanges to lower platform-specific dependency.

Market analysis

Market analysis aims to analyze the breeze flowing through the crypto space. From setting up arbitrage positions to indulging in simple crypto trading, the fund manager should gauge the possibilities and act accordingly.

This might involve reading about key events, doing a broader market sentiment analysis, and evaluating the investment and capital flow.

Capital allocation: How to get the ball rolling?

Fund managers often work closely with capital allocators to prepare the most rewarding crypto hedge fund. As mentioned previously, capital allocation is a science defined by logic.

Here are the factors fund managers focus on:

- The idea is always to generate the most positive alpha, all while keeping the risk within acceptable levels.

- Most funds hinge on asset diversification, and therefore, a due-diligence structure is necessary to look at. The allocator should know everything about the crypto before going all in. And this even involves checking the derivatives space to see the nature of the funds.

- Hedge fund portfolio management isn’t random and is only token-specific. Examples of DGB have shown us that analysis platforms, web3 browsers, and other broader players are also worth investing in.

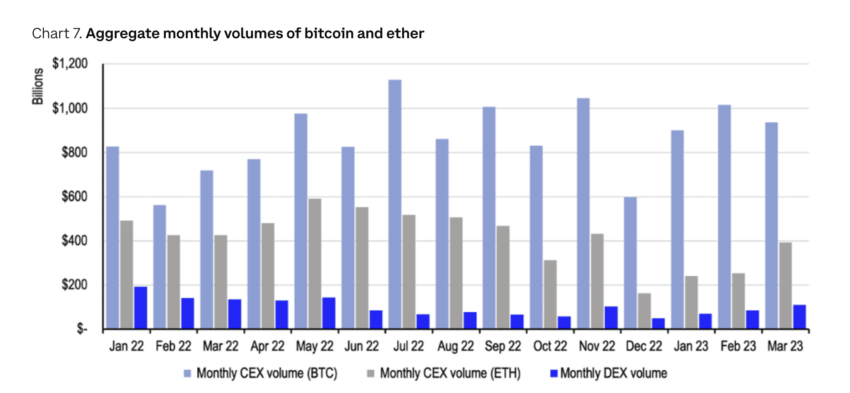

- The market depth and liquidity of the assets in the portfolio. Alpha generation might be followed by exits. For the funds to be accessible, the asset has to be liquid. Checking the CEX and DEX quarters can help in this regard.

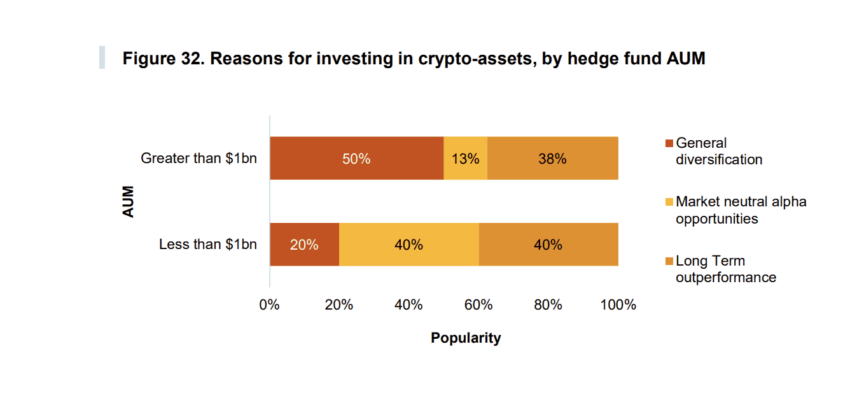

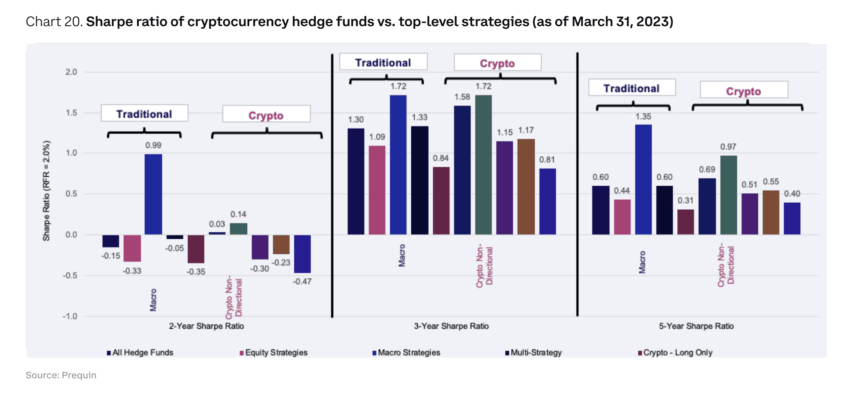

- Key ratios like Sharpe, comparing the risk-adjusted alphas associated with TradFi and crypto. This should help neutral allocators identify if crypto is as rewarding as claimed.

In addition to the mentioned aspects, the allocator must check the historical performances of similar hedge funds, different categories of funds based on the assets they control, and different hedge fund indices.

However, another important aspect of capital allocation is the hedge fund’s strategy. And by strategy, we mean the way it aims to generate alpha.

Understanding the process

There is a lot more to a crypto hedge fund than the mentioned terminologies. When it comes to working, the pooled investments are used to take positions in diverse crypto-specific elements. These can be tokens, the ETF space, crypto firms, or almost anything else. Usually, a crypto hedge fund has a minimum investment threshold.

While all that seems basic enough, it all comes down to how the hedge fund levies fees. Like a traditional hedge fund, a crypto hedge fund attracts performance and management fees. While performance fees are levied based on the fund’s performance — given which benchmarking standard it follows — management fees are primarily the fund maintenance cost.

Did you know? Every crypto hedge fund has something called the “hurdle rate” in place. Based on the benchmarking standards, the hurdle rate is the minimum level of outperformance that a fund must show before it can levy performance fees. Typically, the performance fee is anywhere between 10% to 20%, whereas the management fee is often fixed at 2% or less.

What are the strategies employed by hedge funds?

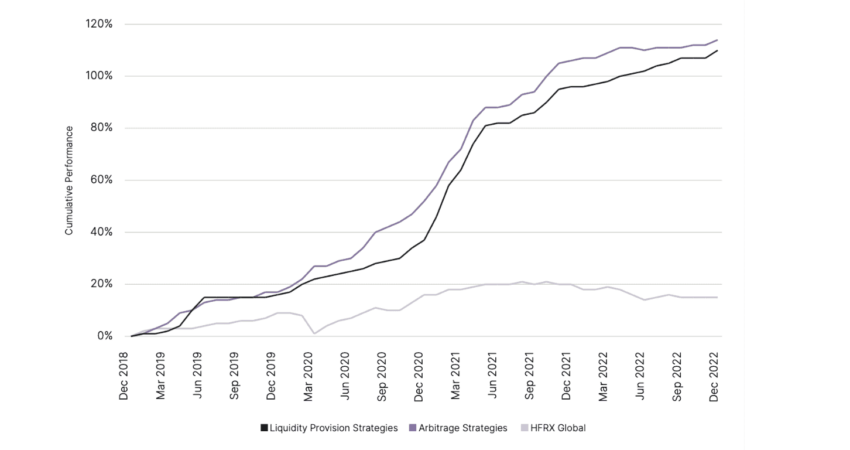

Active funds, or hedge funds, usually generate alpha through cryptocurrency trading, fundamental-focused liquidity provisioning, and arbitrage strategies.

It doesn’t tell that other strategies can also be employed, provided you plan on piggybacking this space for success. These strategies include:

- Quantitative trading using mathematical models

- Event-based strategies by giving importance to sentimental analysis

- Yield farming, staking, and other active DeFi activities.

- Leveraged trading

- Macro strategies that bank on geopolitical indicators

- Short-selling strategies to ride a dipping market

Fund managers assign portfolio players and allocate capital based on the strategy the hedge funds aim to follow.

A thread on what event-based trading entails:

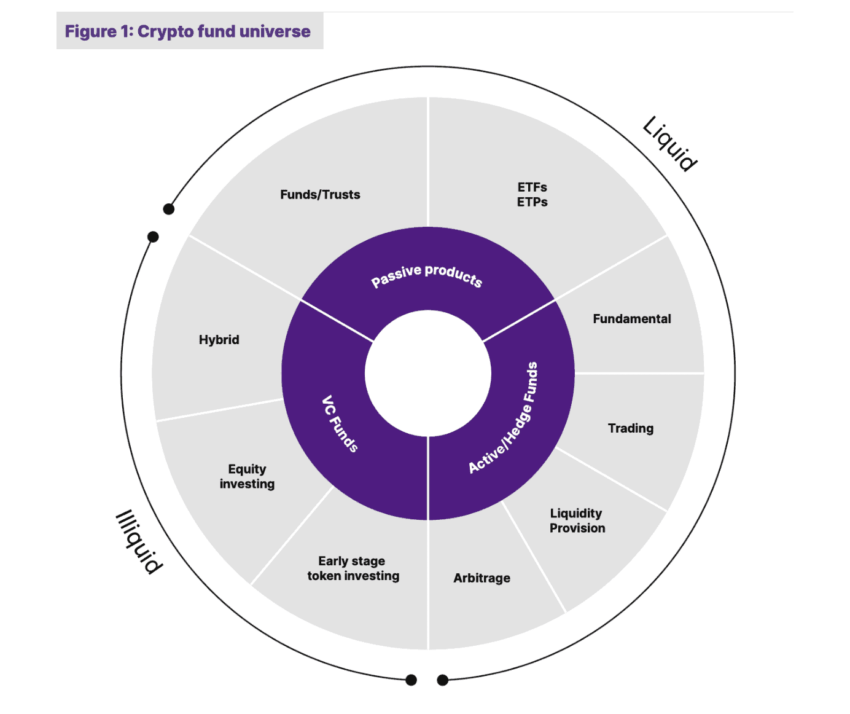

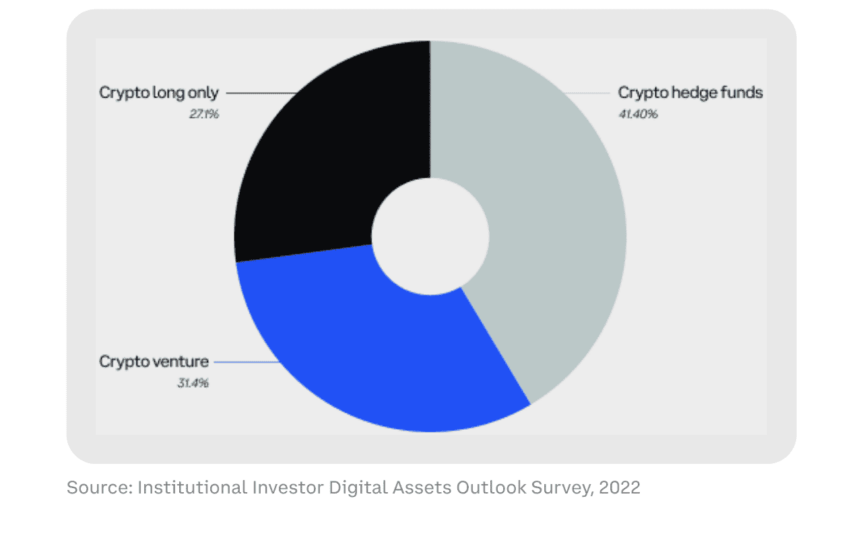

Types of crypto hedge fund

While crypto hedge fund strategies make sense, it is better to use them as parameters and focus on enlisting the types of crypto hedge funds. A generic diversification would only include two fund types — active funds and passive funds.

In crypto, active funds hinge a lot on market analysis. This allows fund managers to focus on cryptocurrency trading as a primary strategy. Other strategies relevant to active funds include arbitrage and event-based alpha generation. They usually have higher overheads as the focus is always on higher returns.

Passive hedge funds in crypto are usually index-driven. For instance, there might be hedge funds that would only allocate capital to metaverse and DeFi indices.

The portfolio management strategy relevant to passive crypto hedge funds often mirrors indices and not the underlying cryptos. They usually attract lower fees and are less prone to outperforming the market compared to active funds.

Other fund types: crypto-focused

In addition to being active and passive, there are other hedge fund types to consider. These include the following:

- Quantitative funds: They employ systematic, algorithmic, and mathematical strategies.

- Long-only: These are bullish-only funds that look to maintain long positions without short-selling.

- Long/short funds: Depending on market trends, these funds can quickly switch between long-holding and short-selling. The only focus remains on generating alpha.

- VC style funds: Unlike active portfolio management and capital allocation, which focus on picking liquid assets, these funds usually invest in crypto startups — like venture capitalists.

- Multi-strategy: These funds, per the name, employ multiple strategies to generate alpha for high net-worth investors and others.

- Fund of funds: Some funds are invested in other crypto hedge funds, especially as a method to diversify risks.

- Yield-focused funds: Some funds only focus on DEX and DeFi-based fund management. Their focus is primarily on using funds to generate yields through liquidity provisioning, staking, or other strategies.

- Global macro: Also termed Managed Futures or Systematic funds, the idea here is to trade future and forward contracts — liquid only — based on trends.

- Market-neutral funds: These are risk-mitigating funds where the focus is on profiting from relative price action.

Apart from the mentioned types, you can see fund managers also focussing on the following underrated fund types:

- Crypto mining funds

- Convertible arbitrage funds (asset to its future price contracts)

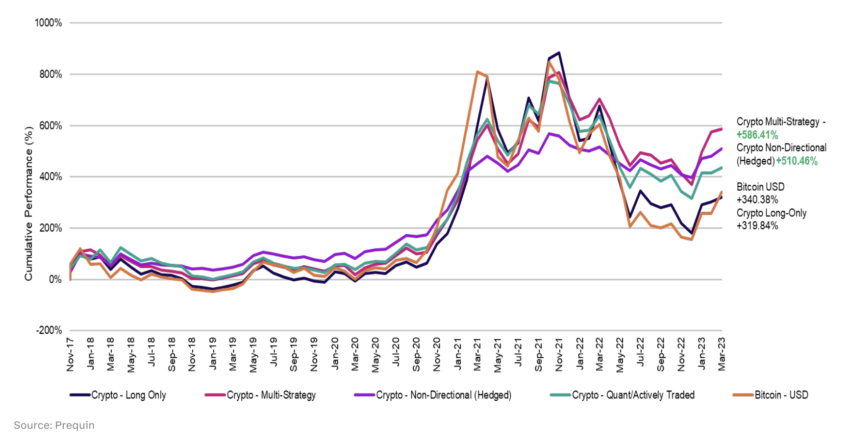

How crypto hedge funds have matured

The crypto hedge fund space is dynamic yet nascent. However, the growth curve seems similar to what traditional funds experienced in the late 1990s before they blew up in the early 2000s.

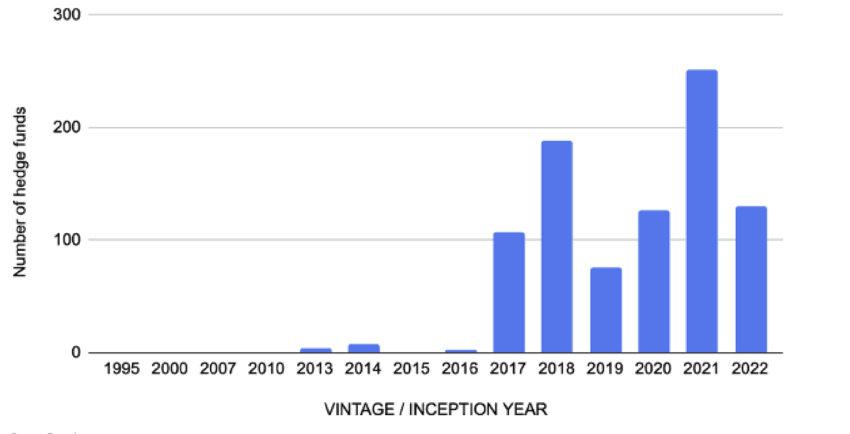

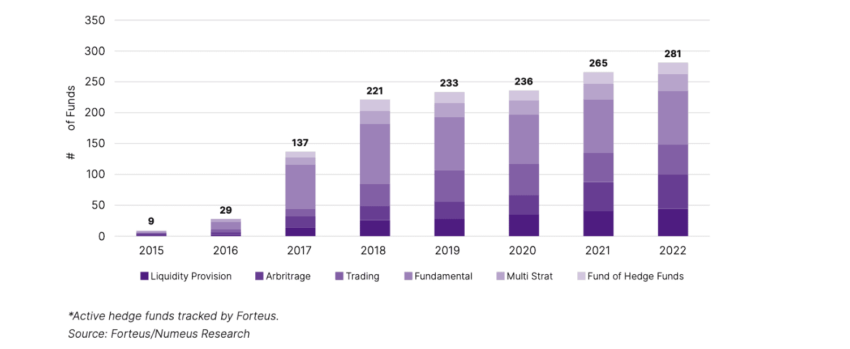

The growth since 2013 — the year Pantera came into existence — has been solid. Here are a few insights that can help trace the growth of these funds over the past few years.

Rise of the Assets Under Management (AUM) value

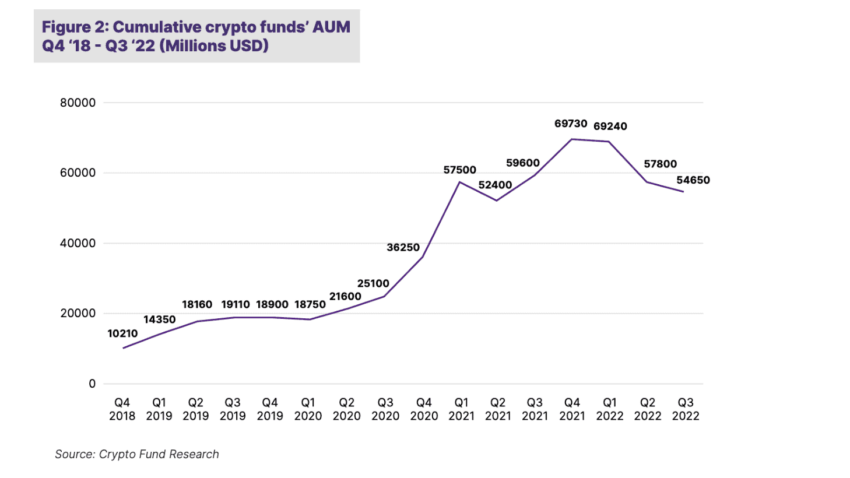

The data from 2018 to 2022 is available for analysis, and we can see a steady rise in the AUM value of the crypto hedge funds. A surge in AUM figures shows that hedge funds have been adding to their wallets over these past few years.

The crypto hedge fund space: How are things post FTX contagion?

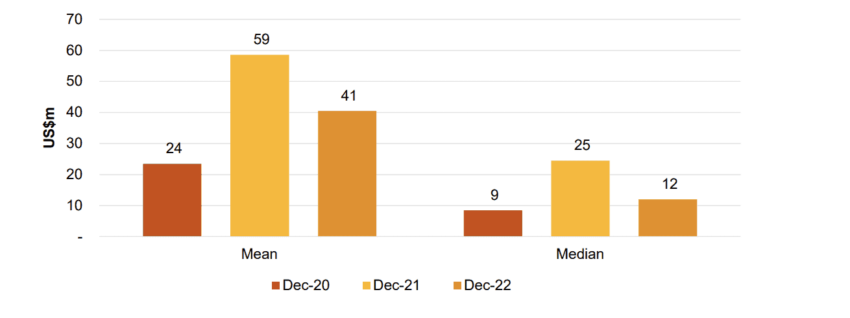

However, this chart doesn’t consider the FTX crisis, after which the AUM dropped rather significantly. Data from 2021 to 2023 shows a more granular picture. As you can see, in December 2022 — post the FTX contagion — the AUM levels have come close to the 2020-2021 levels, dropping significantly from the 2021-2022 highs.

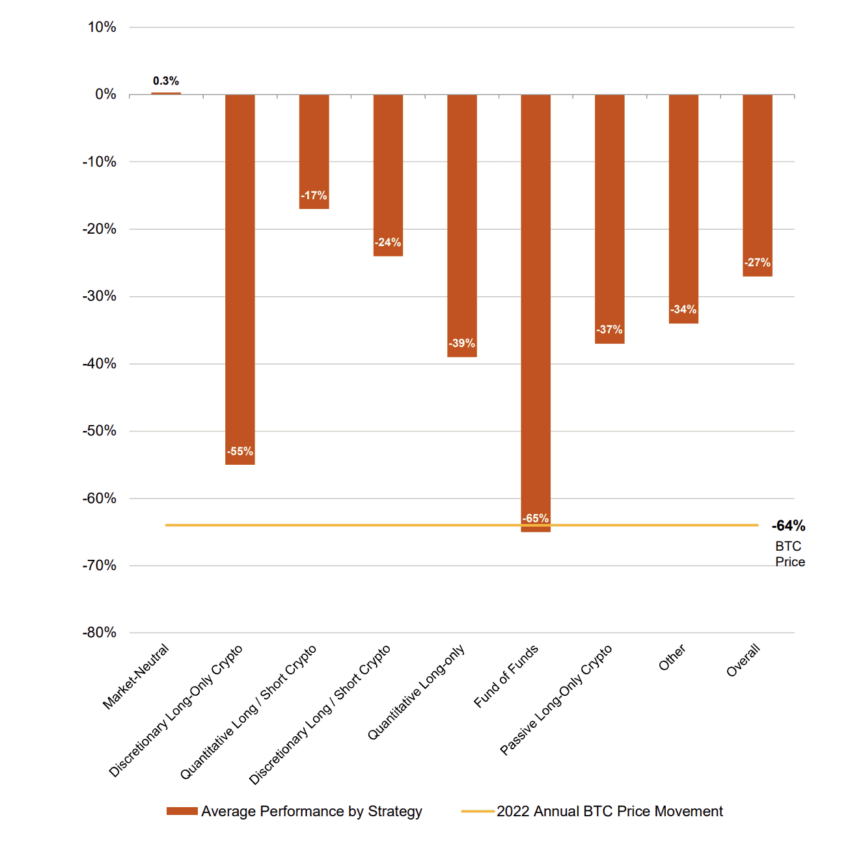

Post-FTX, hedge fund performance has dropped sharply, regardless of strategy or fund type.

Evolution in fund strategies and types

Crypto hedge funds have existed since 2013. However, we only got a clear view of the strategies and types in 2015. Here is how the active hedge fund space evolved over the years, with the focus shifting from liquidity provisioning to trading.

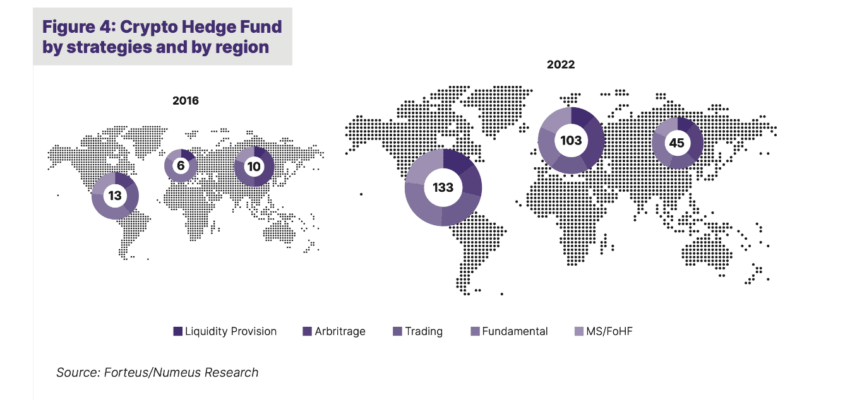

Localization of crypto hedge funds

Another novel aspect of the current state of crypto hedge funds is their geographical spread. According to the latest reports, the U.S. has taken the lead in the number of hedge fund setups.

Also, while the Asian and European fund setups and managers prefer active strategies like trading and arbitrage, the U.S. counterparts are more aligned towards Fundamental strategies, Fund of Funds, and other passive options.

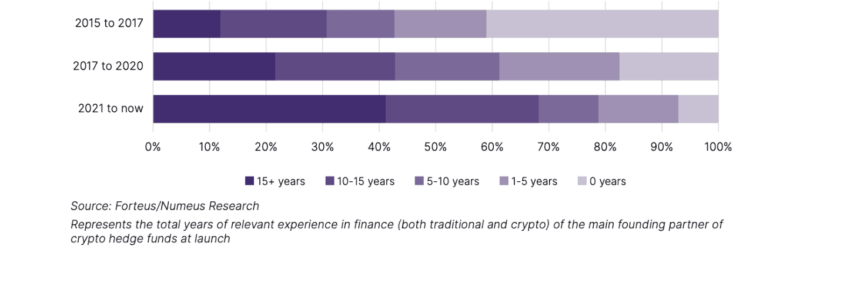

Talent shift to the hedge fund space

As the crypto hedge fund space heats up, new and experienced players are ditching TradFi institutions to jump onto the alpha-generating bandwagon.

Between 2015 and 2017, when the fund space was in its infancy, mostly inexperienced players were around. Things have changed now. From 2021 onwards, we have seen many experienced individuals helming key positions.

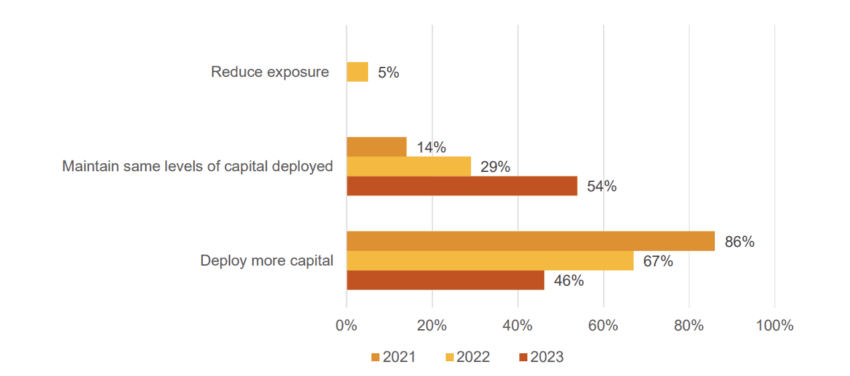

Asset segregation and other focus areas

Another interesting take on the state of crypto hedge funds is the type of assets and platforms the managers rely on. We can term this the general investment plan. In 2023, the focus was primarily on sticking with the same amount of already invested capital. If you look at 2021, hedge fund managers were too eager to infuse more at every turn—all thanks to the ongoing bull market.

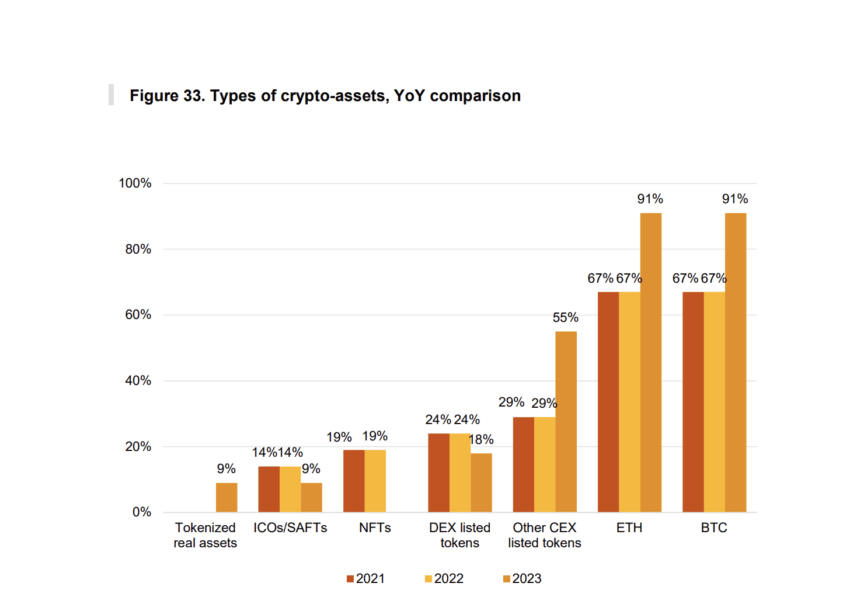

Also, here is how the token and asset-specific cryptocurrency investments looked in 2023.

It isn’t surprising that BTC takes center stage whenever the respondents are unsure about other cryptocurrencies and crypto assets.

The state of crypto funds in 2024: Many hedge funds are now diversifying their portfolios by increasing their exposure to altcoins rather than focusing solely on Bitcoin and Ether. Funds like Pantera Capital and Stoka Global LLP have reported significant gains by betting on altcoins, which often outperform Bitcoin in the later stages of a market rally.

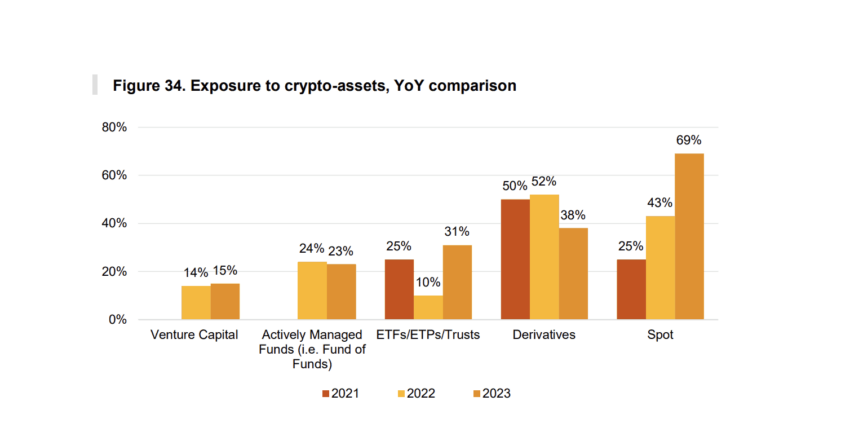

Another interesting thing to look at is the ETF space. With BTC ETFs being talked about in plenty, 2023 saw an uptick in the ETF-powered exposure to crypto assets. The derivative space simmered down a little due to the extended spells of market volatility.

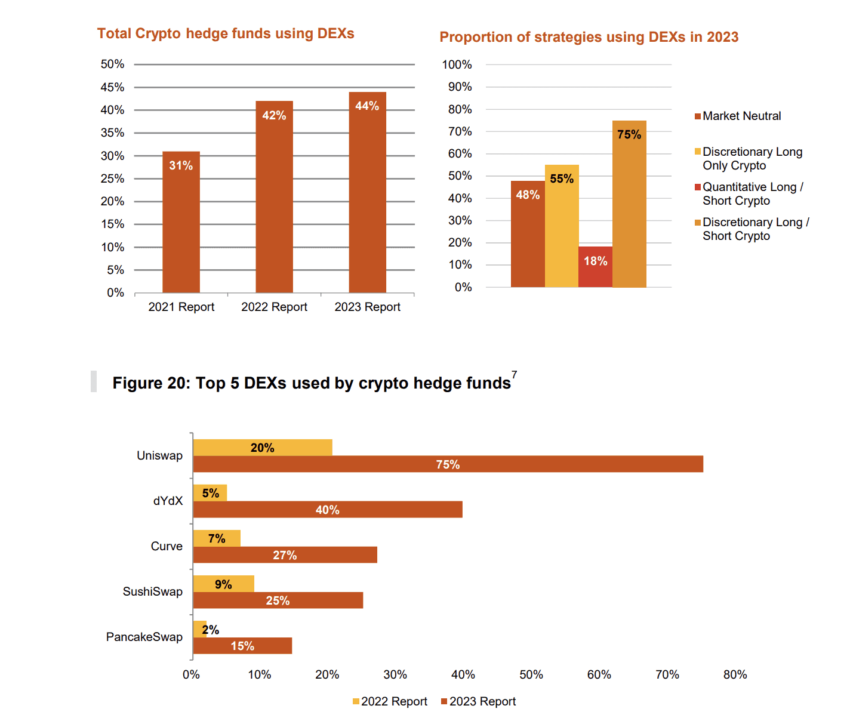

Also, in 2023, fund managers started prioritizing decentralized exchanges (DEXs) for alpha generation, with Uniswap and dYdX being the leading platforms.

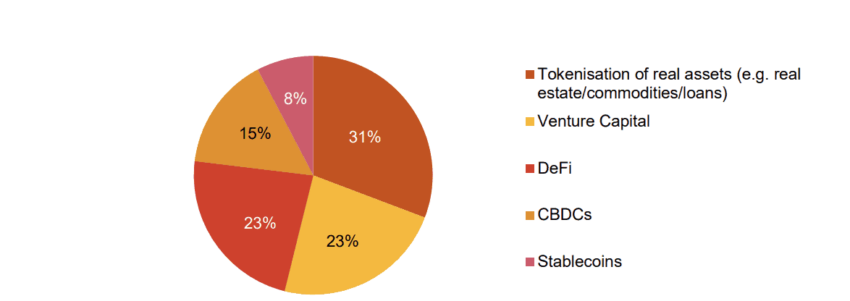

Finally, the tokenization of real-world assets emerged as a force in the hedge fund space.

How are crypto hedge funds regulated?

2023 was not the best year for hedge funds. The U.S. banking crisis was a contagion that ensured 13% of the hedge funds shut shop. The currently functional ones are awaiting regulatory clarity to become commonplace across the crypto space.

https://x.com/crypto/status/1693805257657057501

As for the current regulatory implementations, the crypto hedge funds in the U.S. are scrutinized at two levels — the issuer and the adviser. At the issuer level, the state and SEC regulate the investment, whereas, at the adviser level, the onus is on the CFTC, SEC, or neither, depending on the type of assets the fund is invested in.

Even though the SEC has an active role to play in the regulation of crypto hedge funds, the standards aren’t as stringent as those of other funds like ETFs.

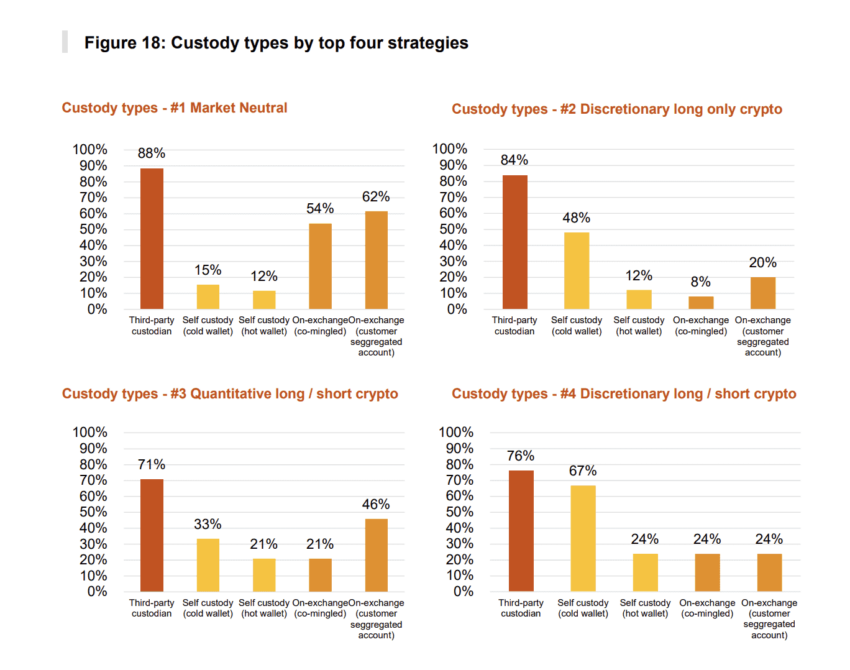

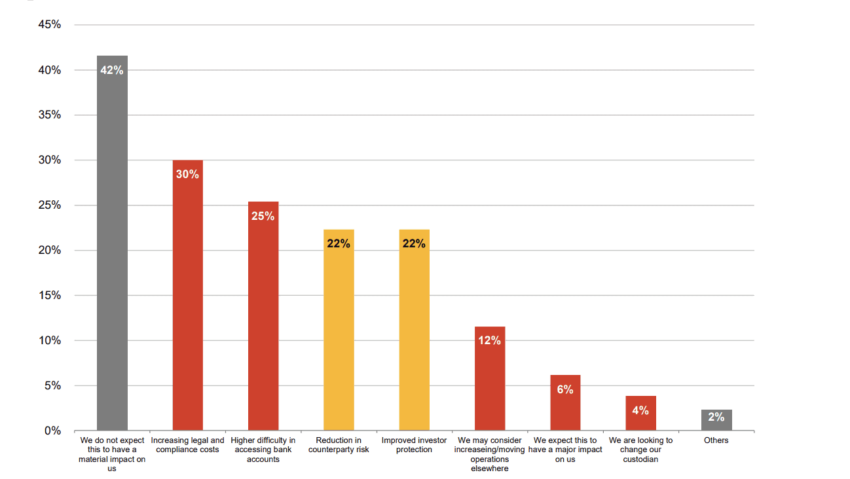

Per PWC’s detailed report on the state of crypto hedge funds in 2023, only 4% of respondents feel that the new wave of regulations, if and when it arrives, will require them to change the existing custodians — bodies associated with loss prevention.

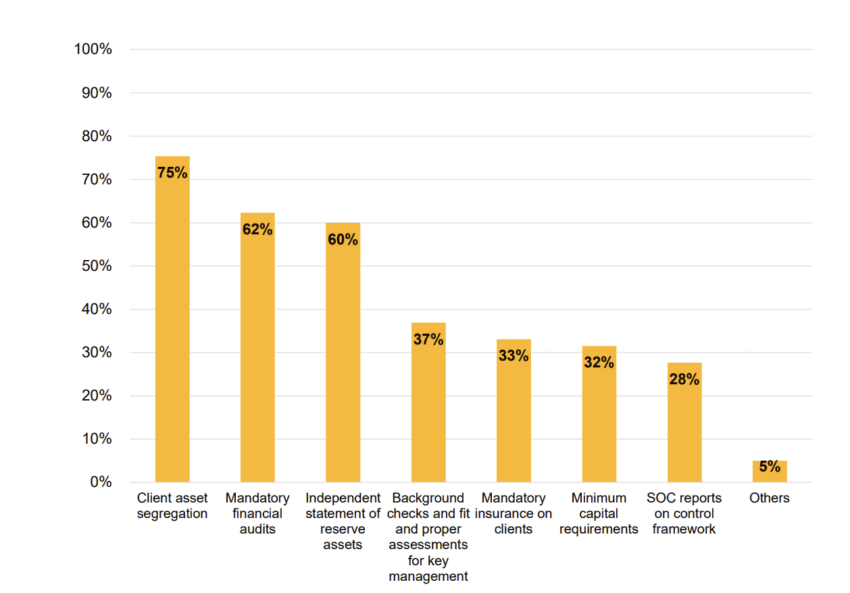

Even the hedge fund handlers are asking for regulations to make the process even more transparent. A majority of these handlers are concerned about regulations relevant to asset segregation followed by financial audits and statements of reserves.

Pros and cons of these hedge funds

Crypto-specific hedge funds came about due to capital erosion in the TradFi space. People started realizing that legacy markets weren’t as easy to extract alphas from. And thus, crypto hedge funds became popular. Here are the pros and cons associated with these funds.

| Pros | Cons |

| Globally distributed funds with diversified exposure | Cryptocurrency market volatility and reputational risks |

| Bolstered by large retail-specific trading volume | High fees and complex learning curves |

| Rapid innovations, despite increasing complexity | Low entry barriers and uncertainties around regulatory compliance |

| Managed by highly experienced fund managers | Counterparty threats and operational issues |

| Offer opportunities for wealth creation in the changing crypto space | Unreliable data and potential inaccuracies |

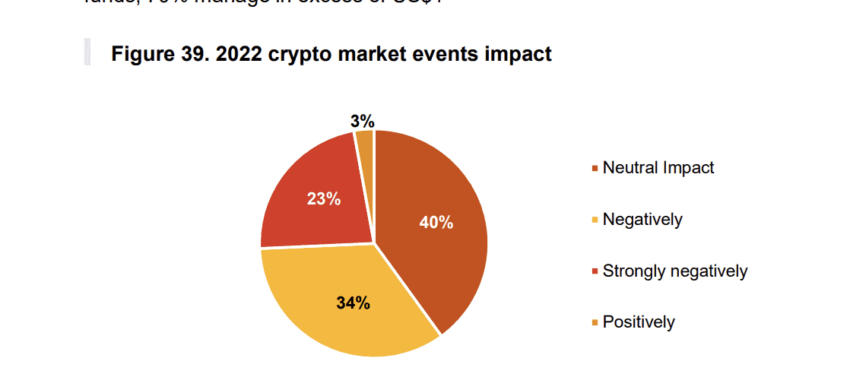

Note: Catastrophic events like the Terra-Luna crash and the FTX collapse did push several willing hedge funds away from crypto in 2022. As you can see, the negative impact outweighed other emotions.

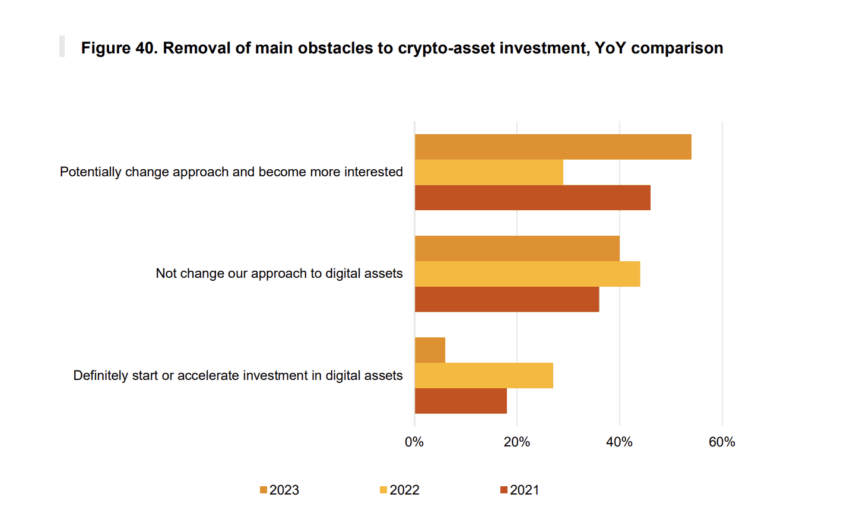

Despite these barriers hindering global adoption, traditional hedge funds in 2023 showed optimism and interest in exploring the space if the challenges get less threatening.

The way forward for crypto-backed hedge funds

A lot is happening in the crypto hedge fund space. While the percentage of traditional hedge funds moving to crypto has dipped, the AUM has increased since 2022. Also, tokenization has charmed many fund managers as a new theme. Still, these developments pale in comparison to the potential of this space to emerge as the next big thing in web3 provided the industry receives further regulatory clarity.

Frequently asked questions

Which are the biggest crypto hedge funds?

What is the first crypto hedge fund?

Is there a fund that invests in crypto?

Does Warren Buffett own a hedge fund?

How do crypto hedge funds manage market volatility?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.