Gemini, the New York-based digital asset exchange led by Cameron and Tyler Winklevoss, has introduced Ethereum staking services for United Kingdom customers.

The Winklevoss-owned exchange has expanded its proprietary product, Gemini Staking Pro, to the UK, enabling institutions and affluent individuals to stake their Ethereum holdings.

Gemini Launches Ethereum Staking in the UK

Gemini Staking Pro now permits customers to become Ethereum validators. To do so, customers must stake at least 32 Ether (ETH), valued at around $60,000.

This strategic move places Gemini in a unique position as the sole provider of staking services in the UK. It also expands Gemini’s global reach, with the staking product already active in the United States, Singapore, Hong Kong, Australia, Brazil, and more than 30 other countries.

Gemini’s staking services are not regulated by the UK’s Financial Conduct Authority (FCA). Therefore, suggesting a degree of autonomy in its operations.

As part of its service, Gemini offers to reimburse stakers for specific penalties associated with staking. About the potential risks of running a validator node, the company cited “small mistakes” that could lead to network penalties or “slashing” — losing staked tokens.

Gemini seeks to alleviate these concerns, stating:

“At Gemini, we simplify the staking process for you. With Gemini operating the validator nodes, users can stake their assets with more confidence and without the technical know-hows.”

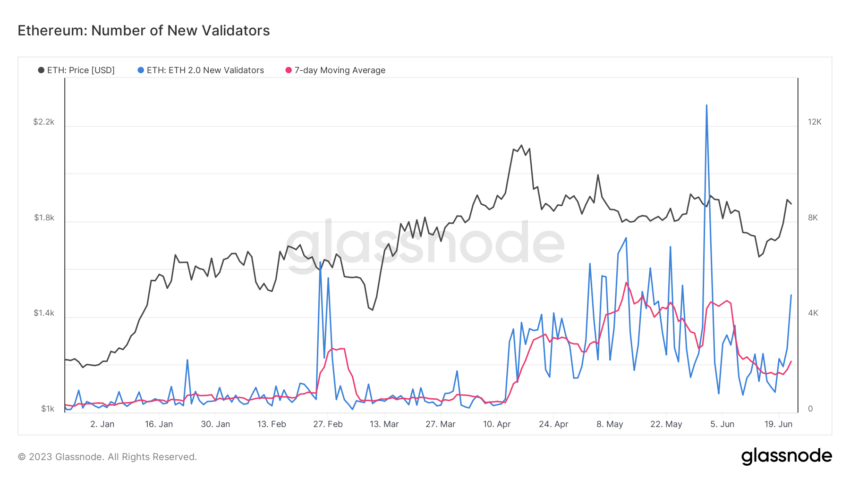

This move comes amid discussions among Ethereum’s core developers to raise the maximum amount of Ether required to become a validator. Developers plan to to go from 32 ETH to a whopping 2,048 ETH, equivalent to roughly $3.9 million. Still, the minimum staking threshold will remain at 32 ETH.

Gemini’s expansion into the UK comes as the company faces scrutiny in the US. The Securities and Exchange Commission (SEC) claims violations of securities regulations related to lending platform, Gemini Earn.

Despite this legal challenge, Gemini remains undeterred, recently announcing plans for further expansion into Asia-Pacific.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.