European Central Bank executive Fabio Panetta has criticized PayPal and its PYUSD stablecoin for exploiting the loosely regulated private stablecoin market. He said tech companies could threaten the adoption of the digital euro if they monopolize stablecoins like they dominate the tech sector.

Rather than cowering, Panetta argues the ECB should ride the momentum of PayPal’s launch to speed up efforts to develop a digital euro. He said the central bank’s digital currency (CBDC) should be built on local infrastructure to lower “dependence on a handful of non-European providers.”

Euro Commissioner Tries to Pacify Surveillance Fears

European Commissioner for Financial Services, Financial Stability and Capital Markets Union, Mairead McGuinness, agrees.

“Europe’s current payment systems are national or international – we don’t have truly European options and are overly reliant on companies such as Visa, Mastercard, or PayPal.”

But the ECB’s push has been slowed by protests the region doesn’t need a new digital currency. Citizens feel it will lead to greater surveillance and is not a solution to any existing problem.

Find out more about stablecoins and the link they offer between the traditional and digital worlds of finance here.

McGuinness says the CBDC will have the same privacy measures as current digital payment options. Offline exchanges of the digital euro would require the same disclosures as an ATM withdrawal.

On Sep. 15, the ECB will announce its next interest rate hike decision. Around 75% of experts predict it will pause rates.

Experts Remain Bullish Despite PayPal PYUSD Data

Many industry experts considered the launch of PYUSD as important in onboarding more crypto users. After the launch, former Acting Comptroller of the Currency Brian P. Brooks said stablecoins could help preserve dollar dominance.

Miles Fuller, Head of Government Solutions at Taxbit, said efforts like PayPal’s to simplify complicated crypto products with user-friendly interfaces will promote widespread adoption. He said the launch of PYUSD is itself a sign of generally broader crypto adoption and that the trust people place in established fintech companies like PayPal will further boost adoption.

But recent data from Nansen suggests the optimism may have been premature.

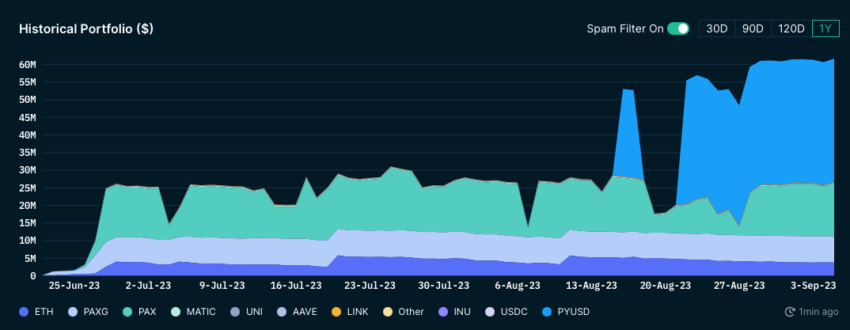

According to the latest data, 79% of the supply of PYUSD is held in issuer wallets. Placed in the context of PayPal’s 350 million-strong customer base, it appears PayPal may not have been the adoption catalyst the crypto community hoped for. Not yet, at least.

Nevertheless, Fuller thinks stablecoins will appeal to people looking to escape the heightened surveillance a CBDC may introduce. Eventually, he thinks, it will be possible for stablecoins and CBDCs to coexist.

Learn more about the state of stablecoin regulation here.

Got something to say about the ECB criticizing PayPal and its PYUSD stablecoin, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.