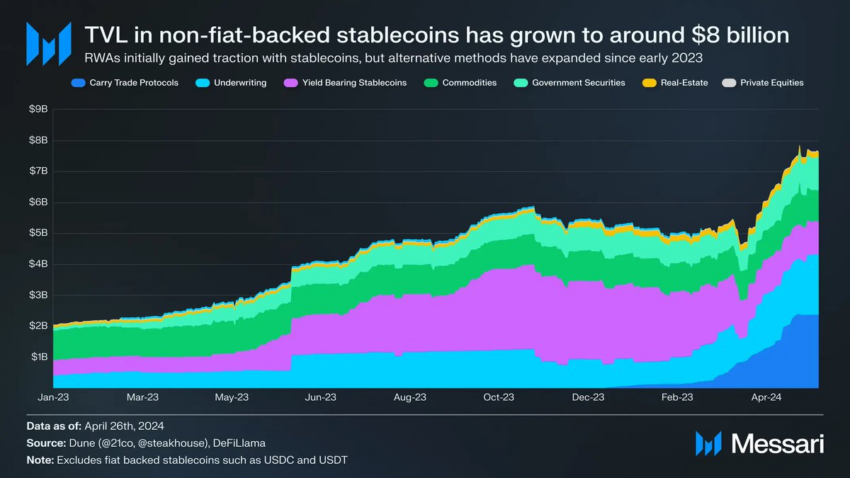

According to Messari’s latest report, the total value locked (TVL) in real-world assets (RWA) tokenization protocols has soared to a record $8 billion as of April 26. This represents an almost 60% increase since February.

The finance ecosystem is undergoing a significant transformation with the integration of blockchain technology. This is evident from the recent milestone in the tokenization of real-world assets.

Adoption Increases For Real-World Assets Tokenization

This surge in TVL highlights a marked preference in the market for debt-based, high-yield investments. Notably, these figures exclude fiat-backed stablecoins and include a variety of assets like commodities, securities, and real estate tokenization protocols.

Moreover, platforms focusing on carbon markets and real estate have seen significant increases in both TVL and active user numbers. This indicates a growing interest among retail investors.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Notably, El Salvador is taking bold steps in this sector by launching a tokenized debt issue to fund a new hotel project near El Salvador International Airport. This initiative aims to raise $6.25 million through the HILSV tokens.

The tokens offer a 10% coupon over five years with a minimum investment of $1,000. Investors can also enjoy perks like free hotel accommodations based on the size of their investment. Industry leaders such as Paolo Ardoino, the CEO of Tether have emphasized the importance of tokenization of real-world assets.

“For the first time, investors who do not usually have the opportunity to invest in such assets have the opportunity to do so, while issuers in markets which have less access to capital, are able to tap into a new asset class to raise finance,” Ardoino said.

Tokenized US treasuries and bonds are also on the rise, with a current total of $1.29 billion locked in, an 80% increase since the beginning of 2024. The growth is primarily driven by entities such as Securitize and Ondo. Moreover, BlackRock’s Ethereum-based Institutional Digital Liquidity Fund (BUIDL) has recently become the world’s largest tokenized treasury fund.

Read more: RWA Tokenization: A Look at Security and Trust

Launched just six weeks ago, BUIDL has quickly caught the market’s attention. It now boasts a market cap of $375 million, surpassing Franklin Templeton’s Franklin OnChain US Government Money Fund. This rapid growth highlights the increasing adoption of blockchain in traditional financial systems.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.