The DOGE price risks breaking down from a long-term descending triangle pattern. This could trigger a 50% price decrease.

While the weekly timeframe readings are decisively bearish, the daily timeframe offers hope for a potential bullish trend reversal.

Will DOGE Break Down From Long-Term Bearish Pattern?

The weekly technical analysis for DOGE’s price movement indicates that it has been hovering slightly above the $0.059 support level since June 2022. This support has been confirmed multiple times, bolstering its significance. Notably, the most recent confirmations, marked with green icons, featured long lower wicks, suggesting increased buying activity.

Despite this apparent bullish behavior, DOGE has also been constrained by a descending resistance trendline since November 2022. This, in combination with the $0.059 support, forms a descending triangle pattern, typically viewed as bearish. Over this period, DOGE has established several lower highs, signaling a loss of upward momentum. Furthermore, the DOGE price has nearly returned to the $0.059 horizontal area, negating the gains from its most recent bounce.

A breakdown that travels the pattern’s entire height (white) would potentially lead DOGE’s price down to $0.030. To validate this breakdown, DOGE must close below the $0.059 horizontal support level.

The weekly Relative Strength Index (RSI), which gauges momentum, supports the notion of a potential breakdown. Traders often use the RSI to assess whether an asset is overbought or oversold, guiding their buying or selling decisions. The RSI is below the 50 mark (red circle) and declining, both indicative of a bearish trend.

The upcoming FTX liquidation could negatively impact the meme coins price since the exchange has reported $42 million worth of assets in Dogecoin. These Dogecoin FTX holdings could potentially catalyze the breakdown if the liquidation occurs.

DOGE Price Prediction: Will Double Bottom Save Breakdown?

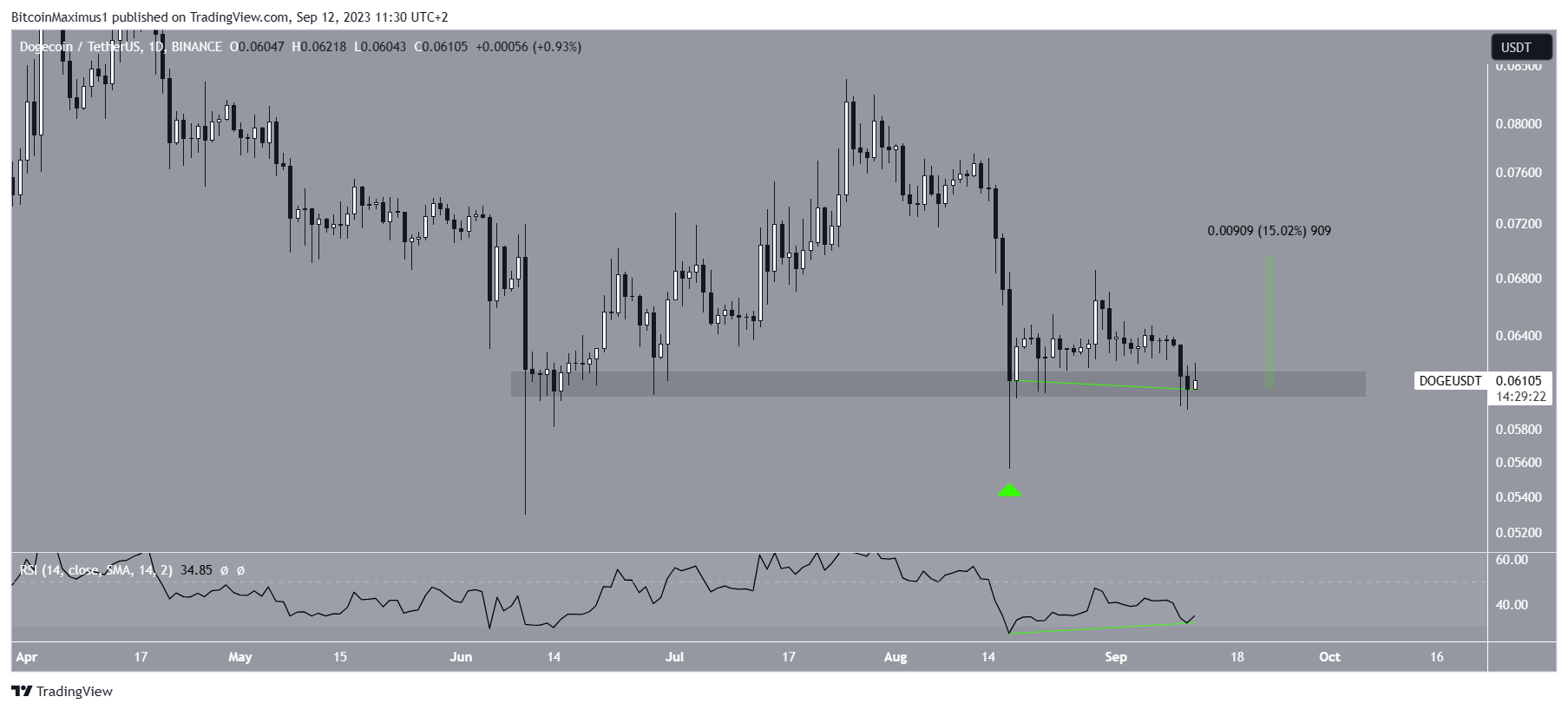

Unlike the weekly timeframe, the daily one offers hope for a bullish trend reversal. The main reason for this is the creation of a double-bottom pattern. The double bottom often leads to bullish trend reversals.

Moreover, the first bottom had a long lower wick (green icon), and the second one has been combined with bullish divergence in the RSI (green line). Finally, the pattern exists inside a horizontal support area.

All these signs point to the possibility of an upward movement transpiring.

Check Out the Best Upcoming Airdrops in 2023

However, since these bullish signs are only present in the daily timeframe, it is possible that they will only initiate a short-term bullish trend reversal. The price could increase to only the long-term resistance line at $0.070 before another downward movement.

Also, a close below the minor $0.061 area will invalidate the double bottom pattern, likely causing the aforementioned long-term breakdown.

Moreover, the DOGE price prediction will be bearish, with a close below $0.059. A 50% decrease to the next support at $0.030 will be expected in that case.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.