The Dogecoin (DOGE) price fell sharply on June 5, breaking down from a crucial long-term support level in the process.

While the price bounced afterward, it faced diagonal and horizontal resistance, which could lead to the continuation of the downward movement.

Dogecoin Price Breaks Down From 360-Day Pattern

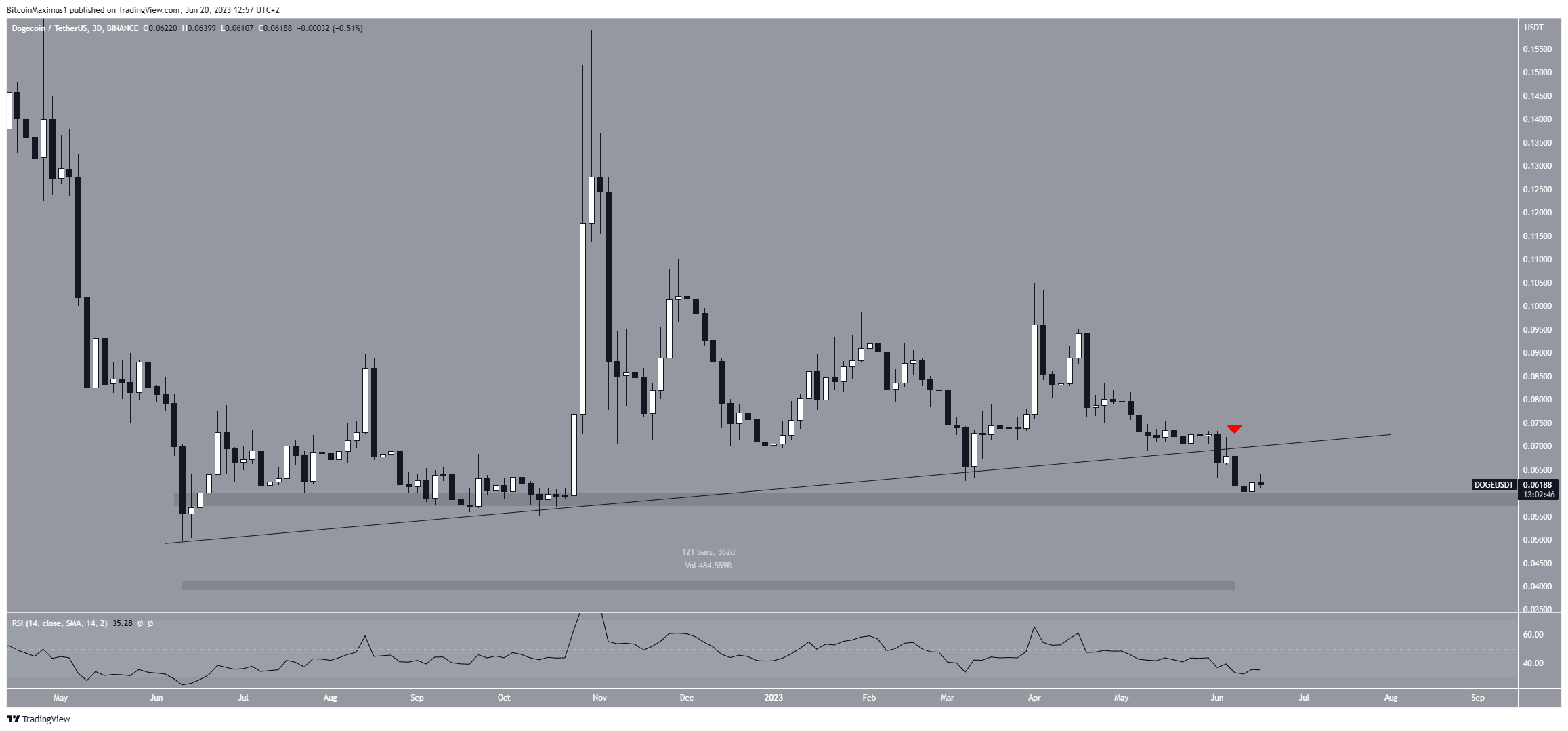

The technical analysis from the 3-day time frame shows that the DOGE price broke out from a 360-day ascending support line at the beginning of June.

Breakdowns from such long-term structures indicate that the previous trend has ended and a new one has begun in the other direction. In the case of DOGE, this means that the price might have begun a new, long-term downward movement.

After the breakdown, the meme coin bounced at the $0.060 horizontal support area.

Despite the bounce, the RSI provides a bearish reading. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite. The indicator is below 50 and falling, a sign of a bearish trend.

It is also worth mentioning that Elon Musk, one of the biggest Dogecoin proponents, was hit with an insider trading lawsuit. Moreover, one of his key litigators has filed a motion to withdraw from the case.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

DOGE Price Prediction: How Long Will Bounce Continue?

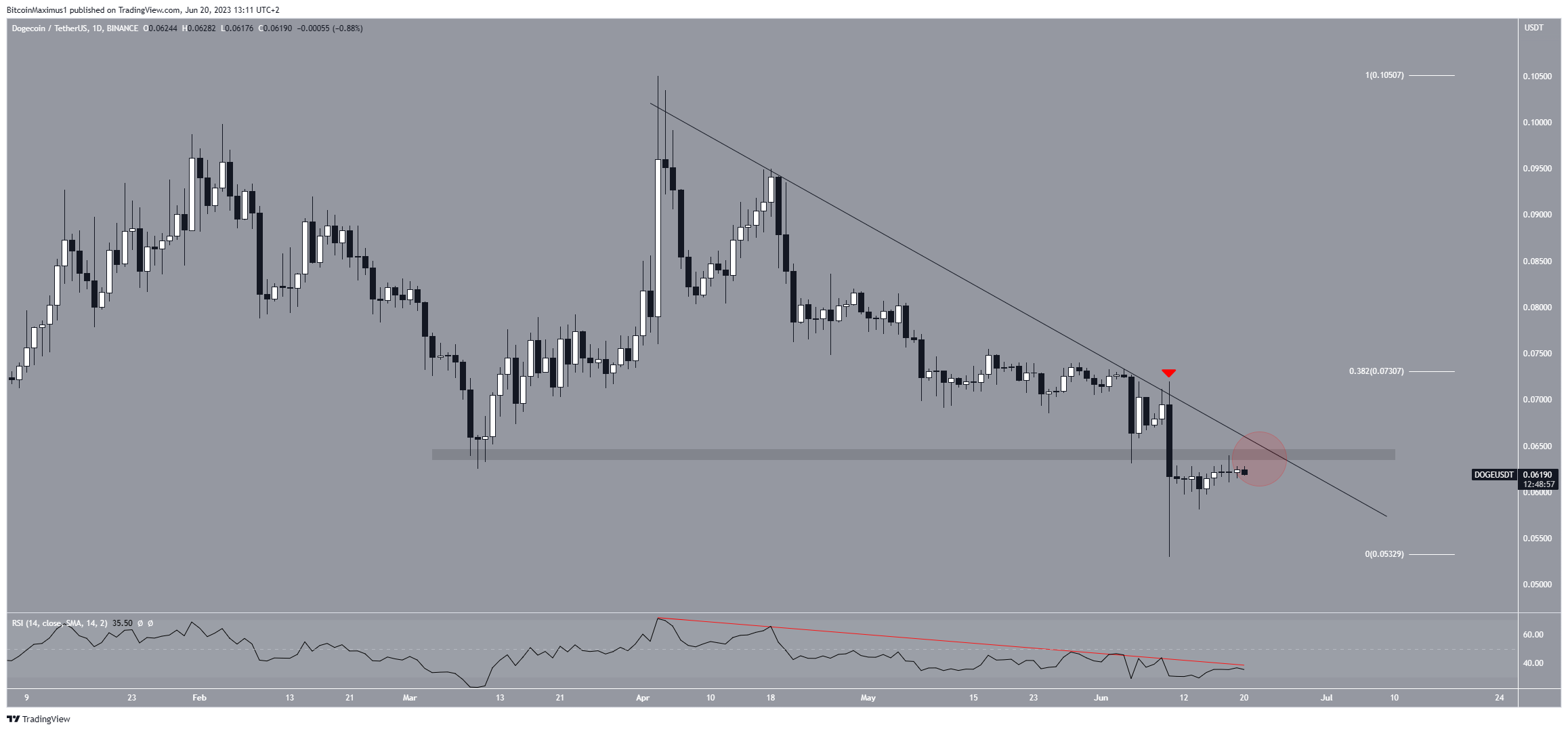

A closer look at the daily time frame reiterates the bearishness of the 3-day time frame. The main reasons for this relate to the Dogecoin price action and the RSI.

Since April 3, the DOGE price has fallen under a descending resistance line. More recently, the line caused a rejection on June 10.

Even though the DOGE price bounced afterward, it still trades below a confluence of resistance levels created by the $0.065 resistance area and the resistance line (red circle). So, the trend is considered bearish until the price breaks out.

Alongside the descending resistance line, the RSI also follows a descending trendline (red line). So, the trend is considered bearish until the price breaks out. If another rejection occurs, the DOGE price could drop to $0.050.

Despite this bearish DOGE price prediction, a breakout above the resistance line will mean that at least the short-term trend is bullish. The price can increase to the next resistance at $0.073 in that case.

For BeInCrypto’s latest crypto market analysis, click here.