The number of automated market makers (AMM) and food-related yield farms has exploded in the past six months or so propelling the total value locked (TVL) across all platforms to a record $57 billion.

Following the major successes that decentralized exchange (DEX) Uniswap had in 2020, mirrored by its clone SushiSwap, it was only a matter of time before a DEX cloned them again and emerged on a rival chain.

Ethereum (ETH) has been struggling under the weight of its own success, which has driven up transaction fees to unsustainable proportions. This has made smaller DeFi operations, such as token swaps, totally unviable for those without very deep pockets.

The food-themed PancakeSwap (CAKE) AMM and liquidity farm promised a solution to the gas crisis by launching on a faster blockchain, namely Binance Smart Chain (BSC).

Around six months after its debut, the DEX had attracted over $4 billion in liquidity.

A very brief history

PancakeSwap is a relatively new platform, so it does not have much to speak of in the way of history. It was launched in mid-September 2020 on BSC as a clone of SushiSwap but offering swaps for BEP-20 tokens instead of the ERC-20 standard.

As with most platforms launched with a lot of promotion from Binance, it touted fast and cheap transactions at a time when ETH gas fees were at their highest levels.

In essence, PancakeSwap does exactly the same thing as SushiSwap, but with the advantage of being supported by a huge centralized exchange. There is a DEX, AMM, farms/pools, or kitchens as it calls them, and a native token called CAKE.

It had a lot of surreptitious shilling from Binance and its enigmatic CEO around the time of launch, but little liquidity and few tokens that people wanted to trade – Uniswap was still king.

Yield farming went live on Sept. 22, 2020, and after the first twelve hours the total value locked peaked at $35 million. By comparison, Uniswap’s TVL, at the time, was $1.8 billion.

PancakeSwap was not the only food-themed DeFi farm to be launched on BSC, as BurgerSwap and BakerySwap had also arrived on the scene the week earlier.

As ETH gas fees continued to skyrocket into 2021, reaching a peak of over $40 for an average transaction in late February, the popularity of AMM on faster chains also increased especially for newcomers to the DeFi scene.

Have your CAKE and eat it

Just like its predecessor SushiSwap, PancakeSwap derives its liquidity from farmers who stake tokens in return for a cut of the trading fees for the specific pool they have provided into.

Whenever someone trades on PancakeSwap, the trader pays a 0.2% fee, of which 0.17% is added to the liquidity pool of the swap pair they traded on.

Like most DeFi protocols, PancakeSwap has a governance token called CAKE. It can be obtained by staking liquidity pool (LP) tokens in a number of farms on the platform.

LP tokens, called FLIP on the exchange, are obtained when liquidity is provided through token pairs such as BUSD/BNB. As an example, users that deposited CAKE and BNB into a liquidity pool would receive CAKE-BNB FLIP tokens.

The provider, or farmer, gets an equivalent amount of tokens to their stake and these can then be deposited into other pools to earn CAKE. These CAKE tokens can also be staked in Syrup pools, which offer staking for a whole range of obscure BEP-20 tokens such as DITTO, DUSK, DEXE, WATCH, BUX, ALICE, and so on.

Syrup Pools allow BSC projects to bootstrap adoption by distributing a portion of their tokens to CAKE token holders. The pools are split into two sections:

- “Core,” which will be initially selected by the PancakeSwap team;

- “Community,” which will be projects that pass a community vote on the governance portal.

Syrup Pool projects allow new DeFi protocols to receive market attention by issuing tokens to the largest and most active BSC community. This is through an initial farm offering (IFO), in addition to the occasional plug from the Binance exchange itself.

There are a number of different farms on PancakeSwap with varying yields. The top one, at the time of writing, was the CAKE/BNB farm offering almost 100% annual percentage yield and a 40x multiplier for the amount of CAKE per block that gets issued. It had $480 million in liquidity, at press time.

APYs on some of the other farms are even better though there is less liquidity on some of the lesser known ones. A farm for TXL/BUSD was offering 570% APY and the BELT/BNB one – 490%.

Tokenomics

According to the official documentation, there is currently no hard cap on the supply of CAKE tokens, making it an inflationary token. Its primary function, and that of the numerous offshoot tokens, is to incentivize providing liquidity to the exchange, which elaborates:

“The chefs aim to making deflation higher than emission by building deflationary mechanisms into PancakeSwap’s products. The goal is for more CAKE to leave circulation than the amount of CAKE that’s produced.”

By reducing the amount of CAKE made per block, inflation is decelerated. This has already been done once, with the first reduction in block emissions, effectively reducing the number of CAKE produced from 40 per block to 25.

There are also burning mechanisms built into some of the exchange’s products, such as the 10% spent on lottery tickets.

At the time of writing, CoinGecko was reporting a circulating supply of 136 million CAKE, with a market capitalization of $1.4 billion.

Wait… There’s more

PancakeSwap doesn’t just end with an automated market maker and a bunch of yield farms. It also has a lottery system and supports non-fungible tokens (NFTs).

The CAKE Lottery system runs for six hours every twelve hours and costs 1 CAKE for a ticket which gives the holder a random four-digit combination of numbers between 1 and 14.

To win the jackpot, which is 50% of the entire lottery pool, the numbers in the ticket need to match all four numbers in the same position as the winning ticket. Prizes are also awarded if two or more of the numbers are in the same position as the numbers in the winning ticket.

PancakeSwap also offers digital collectibles that can be kept of swapped for CAKE tokens. Registration for competition entry is all that is required and winners are chosen at random.

What about the bunny?

If farms, cakes, lotteries, and NTFs weren’t enough, PancakeSwap has also introduced something called the Pancake Bunny as a new Syrup pool. The blog post explains why the DEX needed yet another farming incentive:

“Pancake Bunny was built to support the underlying DeFi ecosystem by providing users with an easy way to automatically compound their yields through the Binance Smart Chain.”

BUNNY distribution started on March 15 and runs until May 14, when 5,000 tokens will be distributed to liquidity providers. In essence it is just another carrot, pun intended, to attract collateral and liquidity to the platform.

CAKE price outlook

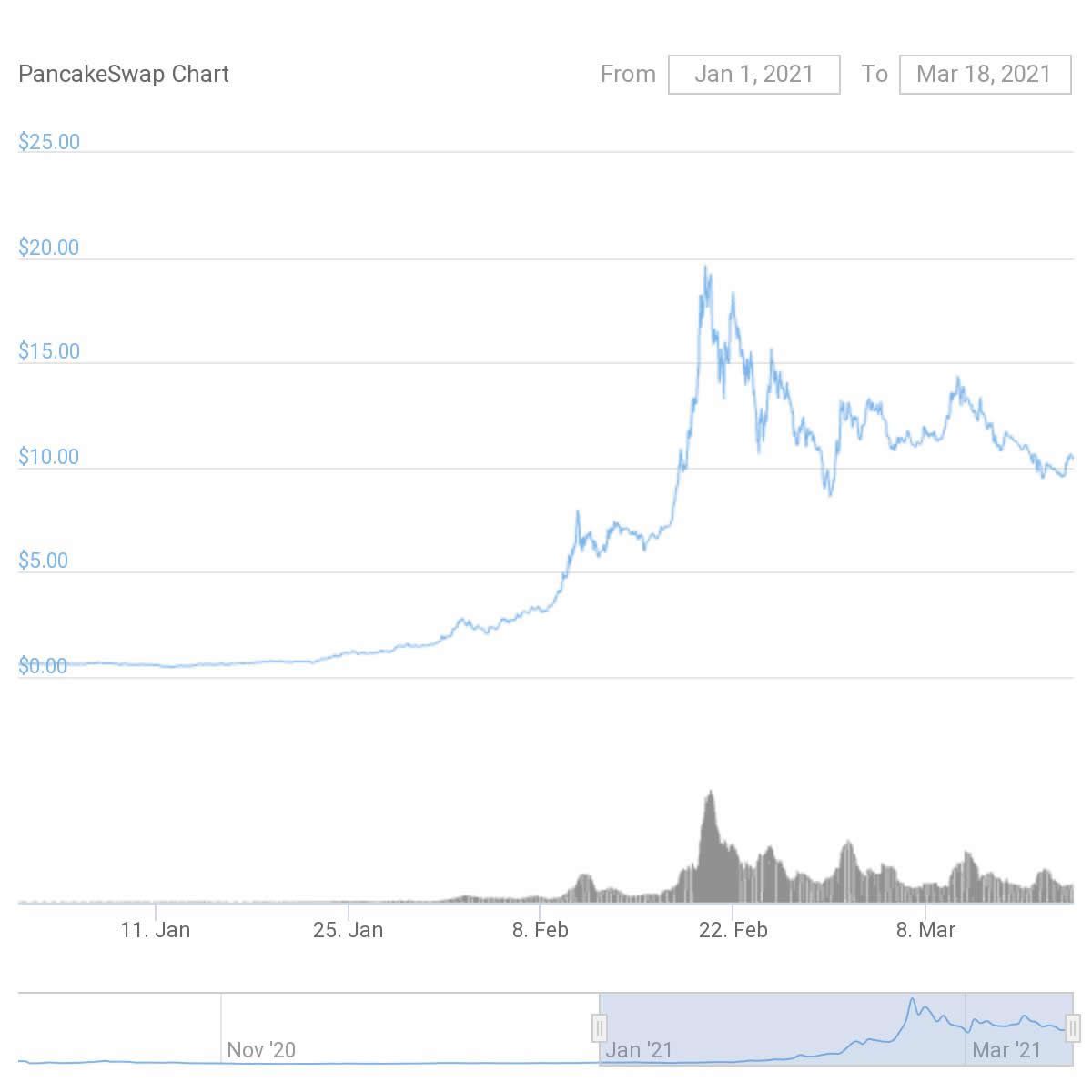

The DEX’s native token launched at about a dollar with the protocol at the end of September. It did very little in terms of price action until February 2021 when things really started to heat up in the DEX’s DeFi kitchen.

CAKE prices skyrocketed to reach an all-time high of $19.50 on Feb. 19. Since then, the token has cooled a little and was trading at around half that, at the time of writing. But still up over 1,500%, since the beginning of the year.

In terms of total value locked, PancakeSwap collateral has exploded to around $4 billion in BNB terms, according to DappRadar.

The analytics platform also reported a daily user number of around 47,000 and a daily volume of $426 million. There have been some accusations of fake volume figures for BSC projects, but they have been disputed by in depth research.

Flipping pancakes into the future

It would be fair to say that PancakeSwap has derived its popularity from the downfalls with Ethereum. Gas prices in early 2021 were unsustainable for anyone without a serious stash of ETH, which eliminates most newcomers to the DeFi scene.

Critics will argue that it is powered by a centralized exchange, but that does not seem to bother the growing number of users that are more interested in saving on transaction fees when doing DeFi.

There is clearly room for more than one DEX in the ever expanding realm of decentralized finance, even if many of the tokens listed on it are totally obscure and serve little real world purpose.