Dogecoin (DOGE) price retested $0.09 on Friday morning, bringing its monthly gains above 20%. On-chain analysis pinpoints key indicators that could impact DOGE price action in the days ahead.

DOGE price entered a bullish breakout on November 17, as crypto investors piled into DOGE in both the spot and futures markets. As investors lean towards high-risk trading, here’s how the DOGE price could react.

Crypto Whales Have Invested $230M in Dogecoin in November so Far

On November 2, Beincrypto reported how Dogecoin price often rallies in the aftermath of the annual Doge Day celebrations. Barely two weeks later, DOGE price entered another rally from $0.067 to retest $0.09.

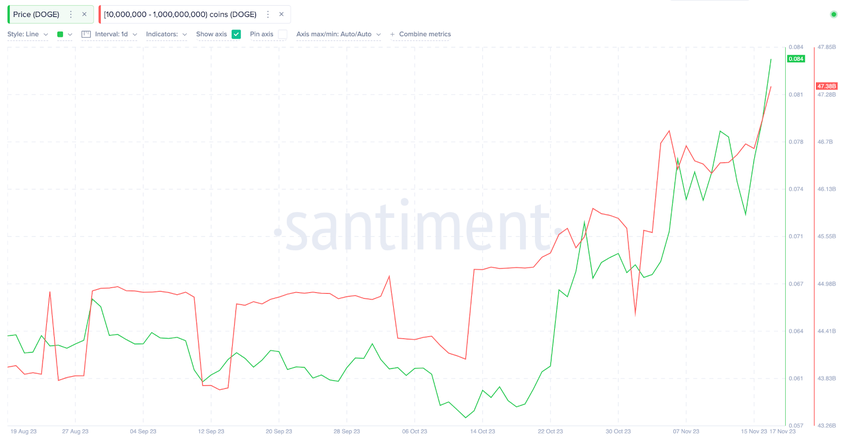

On-chain data reveals that a group of bullish whales buying large amounts of DOGE have been pivotal to the rally. As depicted in the Santiment chart below, the whales (wallets holding 10 million to 1 billion DOGE) had a cumulative balance of 44.63 billion coins as on November 1.

But remarkably, they acquired an additional 2.75 billion DOGE between November 2 (Doge Day) to bring their balances to 47.38 billion on November 17.

With the current market price of $0.084, the newly-acquired 2.75 billion DOGE is worth approximately $230 million. When whale investors make such large purchases within a space of two weeks, it often impacts prices positively. If the whales keep buying DOGE, the bulls could capitalize to stretch the rally further.

Dogecoin is Attracting New Money Despite Rising Prices

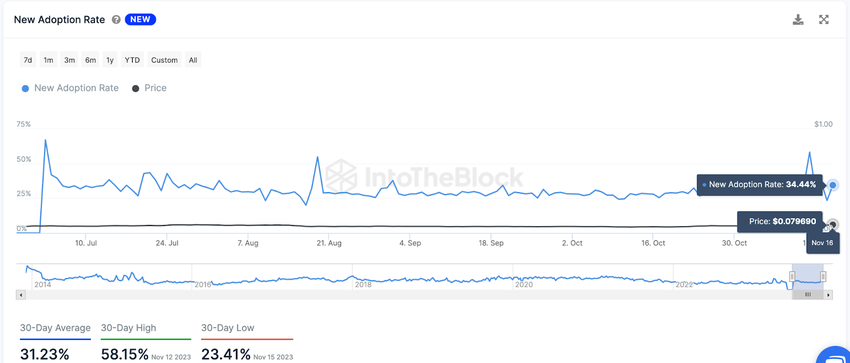

The rising number of transactions from new users appears to be another critical factor driving up the Dogecoin price. According to IntoTheBlock, Dogecoin has experienced a significant increase in “New User” transactions this month.

Pointedly, Dogecoin’s New Adoption Rate recently reached a 4-month peak of 58.16 on November 12. Notably, the latest reading of 34.44% is still well above the 30-day average of 23.41%. This signals that DOGE is still currently attracting a high number of new joiners despite high prices.

The New Adoption Rate metric measures the percentage of total active addresses that conducted their first transaction on a given day. This provides clear insights into the rate at which investors bring new money into the market.

When new user adoption increases during a price rally, it means that a significant number of new investors are FOMO-ing in.

Is FOMO Driving High-Risk Behaviour Among Futures Traders?

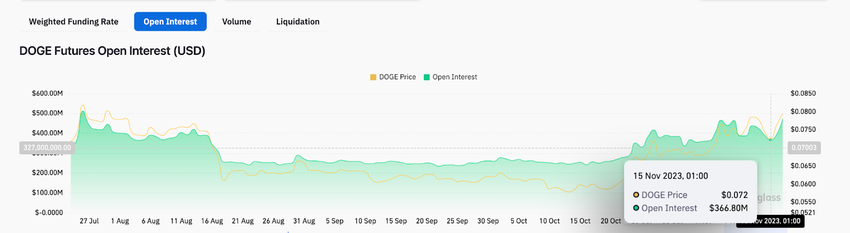

Amid the positive Dogecoin price performance in the spot markets, recent shifts in the derivatives markets flashed early warning signals. According to the crypto derivatives data tracker, Coinglass, DOGE Open Interest jumped about 30% in the past 24 hours.

As depicted below, it increased from $366 million to a 4-month peak of $474 million between November 16 and November 17.

Open Interest quantifies the total capital invested in active or outstanding Dogecoin perpetual futures contracts. Typically, an increase in Open Interest is a bullish signal indicating that more investors are bringing capital into the markets than those exiting their positions.

However, a 30% increase in Open Interest during a price rally indicates higher risk-taking behaviors among traders. It implies that many investors are doubling down on their positions to amplify their gains as the Dogecoin price rally advances.

Historically, this phenomenon has often marked local price tops in crypto markets. If this pattern re-occurs, DOGE prices could enter a correction phase in the days ahead.

DOGE Price Prediction: Can the Rally Reach $0.20?

From an on-chain perspective, the rising whale accumulation and increased demand from new users could further propel the DOGE rally. However, for the positive momentum to enter second gear, the Dogecoin price must first scale the initial resistance around $0.10.

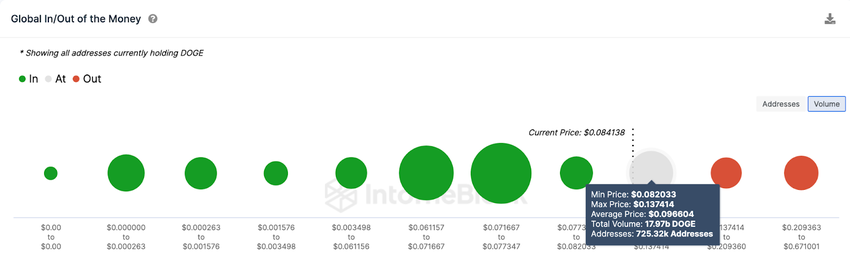

The Global In/Out of the Money (GIOM) data, which groups the current DOGE holders according to their entry prices, also confirms this prediction.

It shows that 725,320 addresses had bought 17.97 billion DOGE at the average price of $0.10. If those investors exit early, they could trigger an instant Dogecoin price correction. However, scaling that initial sell-wall could open the door to a possible $0.20 reclaim.

Still, the bears could invalidate that positive prediction if the Dogecoin price dips below $0.06. But, in that case, the 405,850 addresses that bought 42.20 billion DOGE at the maximum price of $0.071 could offer initial support. If those investors HODL firmly, the Dogecoin price will likely avoid a major reversal.

However, considering the high-risk behavior of futures traders, a reversal toward $0.07 could trigger massive liquidations. If this happens, a long squeeze could send the DOGE price spiraling toward $0.06.